15Apr2024

Industry Reviews / Latest News & Report

Comments: No Comments.

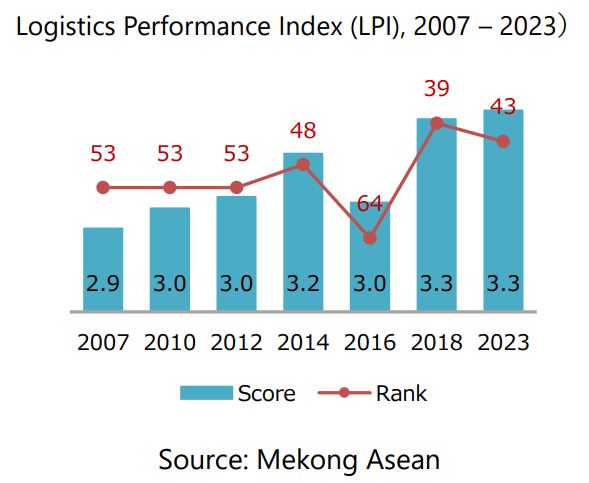

The logistics sector in Vietnam has seen growth and improvement in recent years. According to a report by the World Bank in April 2023, Vietnam ranked 43rd out of 139 countries in the Logistics Performance Index (LPI), ranking among the top 5 ASEAN countries, following Singapore, Malaysia, Thailand, and the same position as the Philippines. Compared to 2016 (64th position), Vietnam has climbed 21 levels, but compared to 2018 (39th out of 160 countries), Vietnam has dropped 4 levels[1]. Despite the drop, the LPI score has increased to 3.3 points compared to 3.27 points in 2018[2]. This may indicate an improvement in the quality of logistics services in Vietnam, but other countries are also focusing on this sector.

Besides infrastructure difficulties, the capacity of service providers is reflected in logistics service quality indices, timeliness, and cargo tracking capabilities[6]. In 2019, the number of Vietnamese enterprises accounted for 88%, joint venture enterprises accounted for 10% and foreign enterprises accounted for 2%. However, the market share of FDI enterprises accounted for 70-80%. Most Vietnamese logistics businesses provide basic services and often subcontracting or acting as agents for foreign-invested enterprises. The workforce in the logistics industry is lacking in both quantity and quality. For domestic enterprises, 93-95% of employees are not trained in logistics, mainly working in small supply chains. such as delivery, warehousing, and handling of shipments[7].

National digital transformation program to 2025, orientation to 2030 (Decision No. 749/QD-TTg of the Prime Minister issued on June 3, 2020) clearly stated 8 priority areas for digital transformation , including the logistics industry[8]. Although up to 50 – 60% of businesses in most services are applying many different types of technology[9], according to VLA’s 2018 survey, the level of science and technology application in Vietnam is still not high, Most are single solutions. About 40% of information technology applications currently used in logistics enterprises are basic applications such as international forwarding management, warehouse management, transportation management, and data exchange. In addition, there are financial difficulties to develop technology and human resources when only 6.7% of businesses are satisfied with the expertise of their employees[10].

The legal system regulating logistics activities is not yet complete. Although the legal framework for this industry has been established in numerous documents, specific policies and detailed implementations of these policies have not been fully realized. Regulations on the subject of logistics are scattered in many legal documents, so when applied, they cause difficulties and even overlap[11]. The logistics industry is still facing a number of difficulties and needs to overcome these problems so that the logistics sector can improve its competitiveness and support the development of the economy.

B&Company

This article has been published in the column “Read Vietnamese trends” of ASEAN Economic News. Please see below for more information

|

B&Company, Inc. The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles

- All

- E-Commerce

- Economic

- Food & Beverage

- Healthcare

- Human Resources

- Investment

- IT & Technology

- Logistics & Transportation

- Regulation

- Retail & Distribution

- Seminar

- Temporarily closed

- Tourism & Hospitality

- White Book