23Jan2026

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s Tet 2026 holiday market reflects a shift toward more value-conscious consumption, as consumers prioritize practicality over extravagance while preserving traditional gifting practices. Despite Tet remaining the most important commercial period of the year, shoppers are increasingly selective, balancing spending with concerns over affordability and value. This article explores evolving consumption patterns, channel preferences, and key implications for businesses seeking to engage consumers during Vietnam’s most critical festive season.

Tet Holiday and Consumer Spending Context

Tet is the most important trading season in Vietnam’s consumer economy, especially for FMCG, when demand and promotional intensity peak. Although it spans only about eight weeks (including pre- and post-Tet), Tet typically accounts for around 18-20% of annual FMCG value sales. In 2025, the Tet market recorded 5% FMCG value growth year-on-year and 16% growth versus the pre-Tet period, reaffirming Tet’s commercial relevance[1].

For Tet 2026, demand is expected to rise by more than 72% compared with the annual average, prompting early and large-scale supply preparation[2]. Ho Chi Minh City reported goods worth over VND 26 trillion prepared for the season, including more than VND 9 trillion under price-stabilization programs, the highest inventory level on record. Price-stabilized goods are projected to cover 23-42% of Tet demand, supporting local price control. Hanoi has also implemented measures to secure supply and food safety; participating firms increased inventories by 5-30% versus Tet 2025, with Vietnamese goods accounting for over 80% of supply[3]. Major modern retailers (e.g., WinMart, MM Mega Market, Aeon Mall) have raised inventories by 10-30%, diversified channels, and extended promotional periods[4].

On the demand side, consumer spending remains cautious. A 2025 survey of 1,200 respondents found 42% described themselves as “cautious” shoppers, up 6 percentage points from 2024, driven by inflation concerns and rising household expenses[5]. B&Company also notes that while Tet 2026 inventories are building faster and higher than in 2025, the domestic market remains stable and has not yet entered a strong growth phase; post-New Year demand has stayed steady without a clear surge so far.

Consumer behavior in Tet 2026

Timing and Planning behaviors

A survey of 481 respondents in 2025 shows that 68% of Tet shoppers started their shopping 20+ days in advance and 36% planned their shopping 40+ days in advance[6], showing a decline compared to the previous years when more people started shopping early. This indicates that early, long-distance stockpiling is gradually giving way to more concentrated purchasing closer to the time of use. From a consumer perspective, the shift reflects a more practical approach to Tet, as households increasingly assess actual needs, manage budgets carefully, and spend only when the purpose of the purchase is clearly defined.

Value-driven Decision making

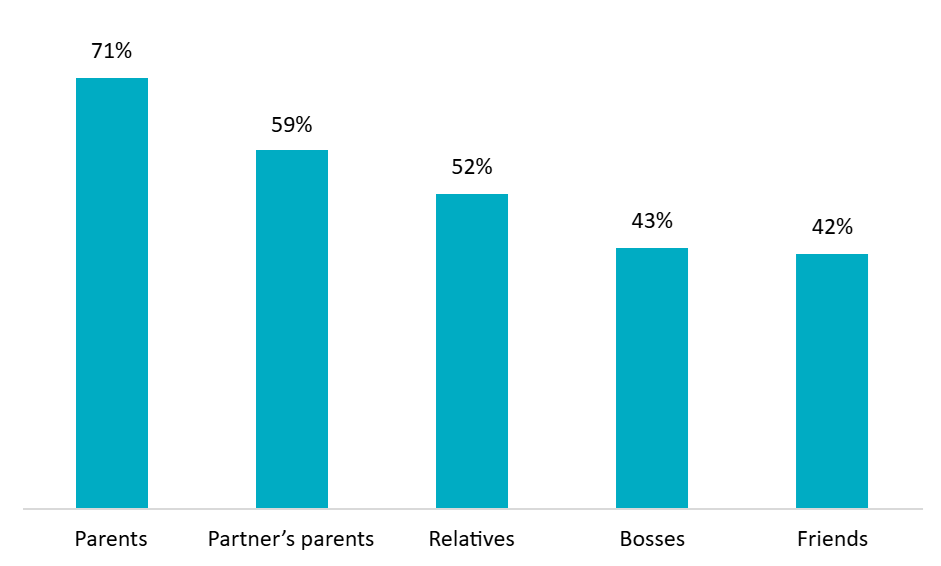

A survey of 1000 respondents shows that Tet gifting is most commonly directed toward parents (71%) and partners’ parents (59%). Another survey from Kantar reveals that 52% of consumers are shopping more for their families, but prioritizing actual needs over appearances represents the biggest change this Tet season[7]. This shift is illustrated in purchasing that favors functional utility over social display, with consumers allocating budgets to close relationships rather than obligatory social gifting. Vietnamese consumers in 2026 exhibit sophisticated purchasing behaviors characterized by intentional planning and value optimization. Consumers no longer spend impulsively but calculate, compare prices, and make rational choices focused on practicality and convenience while preserving traditional Tet cultural values.

Top Tet gift recipients

100% = 1,000 respondents

Source: Cimigo

Channel contribution

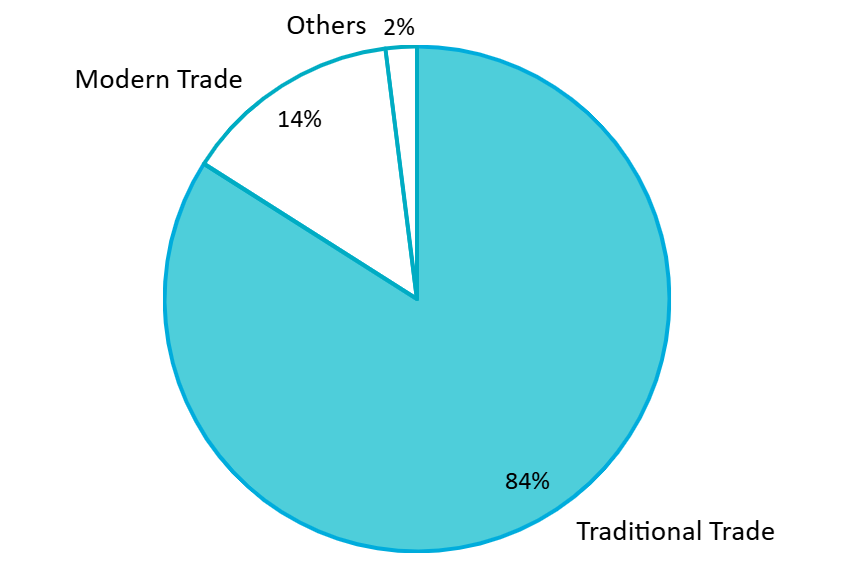

The Vietnamese retail landscape exhibits distinct multi-channel characteristics during Tet 2025. Traditional trade remains the top choice for 84 percent of Tet shoppers, while modern trade accounts for 14 percent of total value, reflecting deeply entrenched local shopping habits. Looking ahead to 2026, although traditional trade is expected to remain the primary channel, B&Company expects a gradual shift as modern trade and e-commerce continue to gain traction, becoming a major driver of Tet shopping, driven by entertainment, emotion, and trust rather than active search. With 74% of TikTok Shop users discovering products via the “For You” feed, livestreams, short videos, and flash sales are emerging as a new digital Tet marketplace[8].

Channel contribution in Tet 2025

Unit: %

Source: NIQ

Popular product category for Tet 2026

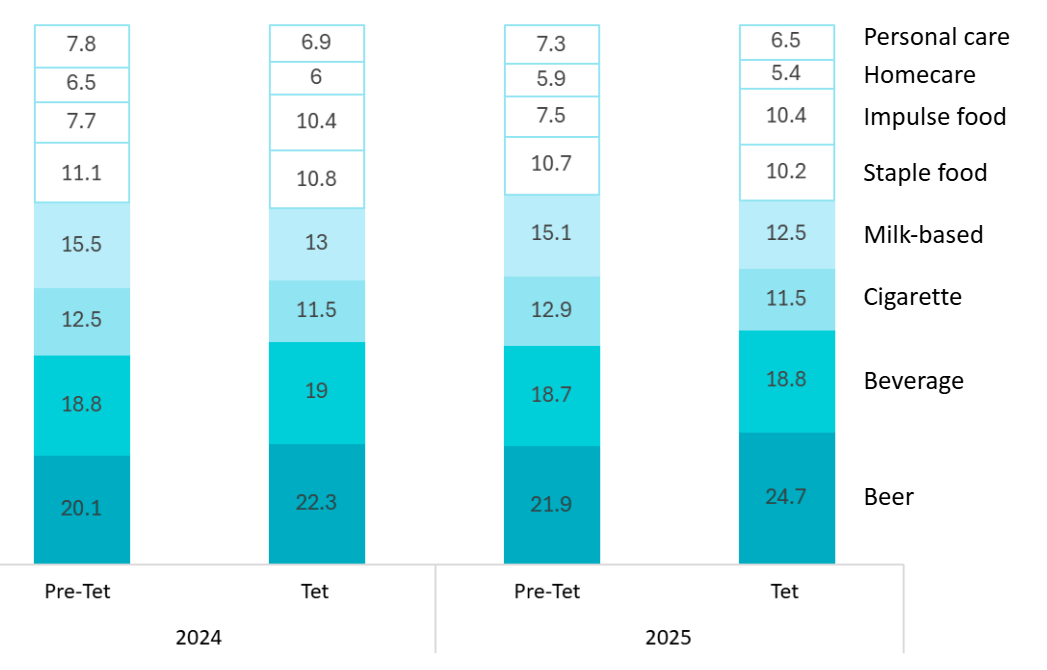

Following the same pattern seen during Tet 2025, when beer’s FMCG value share climbed from 21.9% to 24.7% and Impulse food rose from 7.5% to 10.4%, driven by social and festive occasions, these categories are expected to remain resilient and continue contributing at high levels in Tet 2026.

Value % Contribution of Tet and Pre-Tet to FMCG by Super Groups

Unit: %

Source: NIQ

While imported confectionery, alcoholic beverages, and packaged snacks continue to be popular gift choices, there is a clear shift toward more practical imported items with everyday usage value, such as fresh imported fruits, cooking oil, spices, and fish sauce. Gift baskets (Hampers) remain central to Tet traditions but content and pricing have evolved substantially. Customized hampers increasingly influence purchasing decisions, with retailers offering flexible basket composition allowing consumers to align gifts with recipient preferences and budget constraints. Regional specialty products featuring OCOP-certified items from various provinces demonstrate growing appreciation for Vietnamese agricultural diversity and authentic local production.

Price points span wide ranges to accommodate diverse budgets. Simple Tet gift baskets with rice, cooking oil, and moderately priced cakes and candies cost around 500,000 VND or less[9], while agricultural specialty gift baskets range from 800,000 to 2,000,000 VND per basket[10]. Gift boxes are designed with diverse price ranges from 49,900 VND, 95,000 VND to over 100,000 VND, making it easy for consumers to choose according to their budget[11].

A Vietnamese gift basket (hamper)

Source: Tra Viet

Beauty demand typically surges during Tet, particularly among female consumers seeking a polished appearance for the New Year. According to Metric Analytics, beauty sales on Shopee and TikTok Shop reached VND 11.15 trillion during Tet 2025, up 42% year-on-year, with 104.1 million units sold, indicating strong peak-season demand. Consumers tend to focus on facial skincare, hair and body care, nail products, and beauty gift sets, with facial skincare accounting for over half of total beauty sales on Shopee[12].

Increase in demand for Beauty-related products

Source: Cocoon Vietnam

Implications for Brands and Retailers

Compete on perceived value, not price alone

Tet 2026 consumers are increasingly rational and value-oriented, balancing tradition with budget discipline. Purchasing decisions emphasize functionality, trust, and relevance to close family relationships rather than social display or status signaling. This shift calls for strategies that communicate clear value-for-money, supported by transparent pricing, flexible product configurations, and customization options. Brands that align with real household needs while preserving cultural symbolism are more likely to earn both seasonal sales and long-term loyalty beyond Tet.

Rebalance portfolios across channels

Traditional trade is expected to remain the backbone of Tet consumption in 2026, particularly for essential goods and neighborhood-based purchasing. However, the accelerating role of modern trade and e-commerce signals the need for a rebalanced channel strategy, rather than channel substitution. Brands should continue to secure availability and visibility in traditional trade while selectively leveraging modern retail for hygiene assurance, curated assortments, and gifting solutions. Social commerce is no longer a supporting channel but is increasingly becoming central to shopping behavior, especially during peak seasons such as Tet. For businesses, this means that Tet strategies can no longer rely solely on discounts but must be built around strong content, livestream engagement, and seamless shopping experiences.

Focus on Key categories

Category growth during Tet 2026 is likely to be concentrated rather than broad-based. Beer, impulse foods, and milk-based beverages are positioned as key growth drivers, supported by social consumption occasions, convenience needs, and rising health awareness. In parallel, practical gift items and daily-use essentials are replacing luxury-oriented gifting, reinforcing a shift toward selective up-trading, where consumers trade up only in categories with strong festive relevance and perceived value. Brands should prioritize investment in these “occasion-fit” categories while avoiding overextension into premium segments that lack cultural or functional justification.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[1] https://nielseniq.com/global/en/insights/analysis/2025/winning-vietnams-tet-holiday-optimizing-fmcg-growth-for-the-next-season/

[2] https://vneconomy.vn/nhu-cau-hang-thiet-yeu-co-the-tang-den-30-trong-mua-sam-tet.htm

[3] https://www.vietnamplus.vn/ha-noi-doanh-nghiep-tang-luong-du-tru-hang-hoa-binh-on-thi-truong-tet-tu-5-30-post1088606.vnp

[4] https://nhandan.vn/hang-tet-doi-dao-gia-ca-on-dinh-post937749.html

[5] https://nielseniq.com/global/en/insights/analysis/2025/winning-vietnams-tet-holiday-optimizing-fmcg-growth-for-the-next-season/

[6] https://2036413.hs-sites-na2.com/hubfs/Decision%20Lab%20-%20Tet%20Consumer%20Path-to-purchase%20Report.pdf

[7] https://en.vietnamplus.vn/hcm-city-market-reflects-cautious-practical-tet-spending-trends-post335246.vnp

[8] https://thuongtruong.com.vn/news/mua-sam-tet-2026-du-bao-don-ve-4-tuan-cuoi-va-su-troi-day-cua-kenh-thuong-mai-xa-hoi-157644.html

[9] https://www.vietnam.vn/en/thi-truong-gio-qua-tet-chu-trong-tinh-thiet-thuc-gia-mem

[10] https://www.vietnam.vn/san-pham-ocop-gia-lai-nhon-nhip-vao-mua-phuc-vu-tet

[11] https://www.vietnam.vn/en/doi-dao-hang-hoa-tet-binh-ngo-2026-chu-dong-tu-som-binh-on-tu-goc

[12] https://metric.vn/resource/blog/metric-tet-2026-nen-kinh-doanh-gi-phan-tich-xu-huong-mua-sam-tu-du-lieu-tren-san-tmdt