17Oct2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s rapidly expanding digital health market offers strong potential for wearable technology, especially in remote patient monitoring and preventive care. Driven by government digitalization initiatives, a tech-savvy population, and rising healthcare demands, wearables can bridge critical gaps in chronic disease management and care continuity. Success depends on compliance with local regulations, strategic partnerships, particularly with private insurers, and a phased approach from wellness applications to clinically integrated solutions.

Market Overview of the Vietnam digital health market

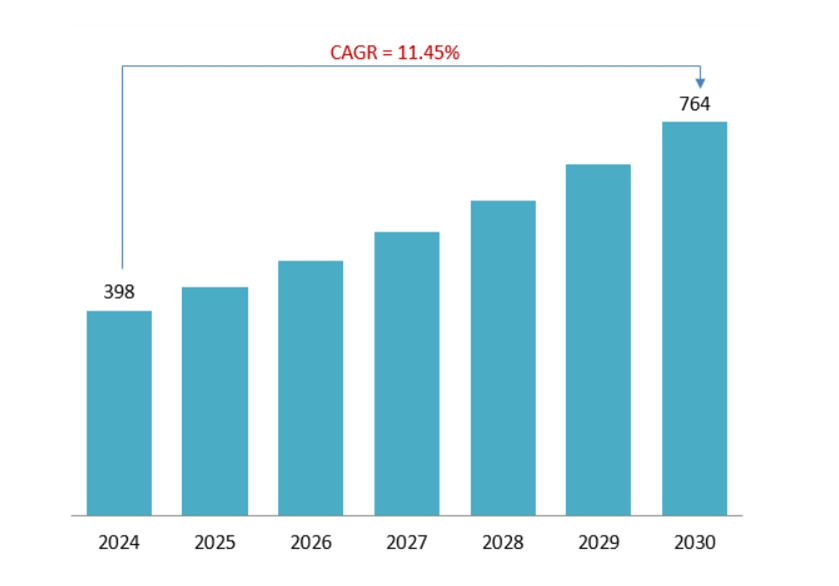

Vietnam’s digital health market is experiencing strong growth, projected to expand from USD 398 million in 2024 to USD 764 million by 2030, with a CAGR of 11.45%[1]. This growth is fuelled by a digitally-savvy population and the need to modernize the healthcare system, particularly through the use of wearable technologies like Remote Patient Monitoring (RPM). RPM is expected to help address the rising burden of Non-Communicable Diseases (NCDs) and improve Continuity of Care (COC)[2], two key healthcare challenges in the country.

Digital Health Market 2024 – 2030

Unit: million USD

Source: TechSci Research

To tap into this market, companies must ensure compliance with Vietnam’s regulatory landscape, which includes data localization under the Cybersecurity Law and adhering to medical device classifications as per Decree 53/2022[3] and Decree 98/2021[4]. A B2B2C model, especially partnerships with private insurers, offers the most immediate monetization potential, positioning businesses to capitalize on the demand for digital health solutions in the country[5].

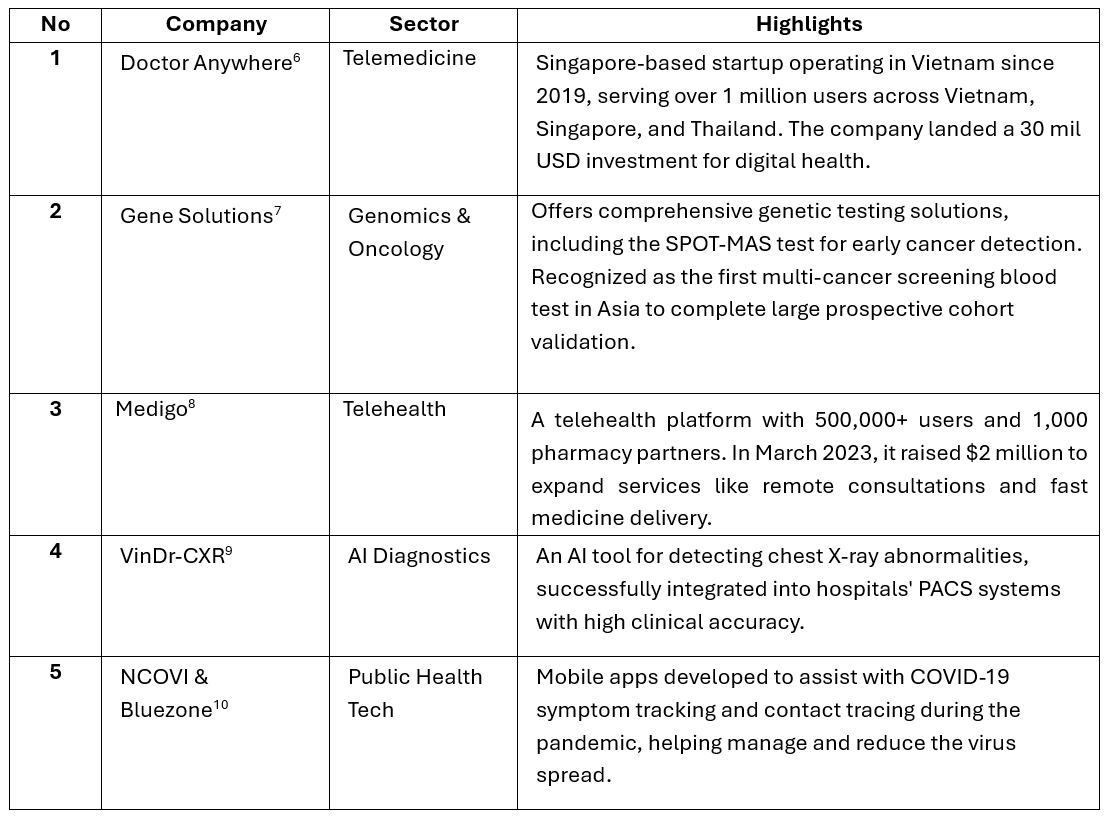

The growth of the HealthTech market in Vietnam is both impressive and indicative of a larger trend in digital health adoption. Here are some case studies that underscore the market’s potential:

Vietnam HealthTech Market Case Studies

In the HealthTech sector, several companies are driving technological advancements across various healthcare domains. These innovations are not only transforming healthcare delivery but also expanding access to quality care, especially in underserved areas. As more companies enter the market, the integration of AI, telemedicine, genomics, and digital health services will continue to propel the industry forward, ensuring a healthier and more connected future for Vietnam’s population.

Wearable Technology and Its Role in Vietnam’s Digital Health Market

Vietnam’s wearable technology market is estimated at USD 290 million in 2024 and projected to reach USD 981 million by 2033, reflecting a robust compound annual growth rate (CAGR) of 14.5% during 2025–2033. This growth is driven by expanding 5G connectivity, rising consumer interest in health monitoring, and increasing integration of smart devices into daily life. The market spans multiple product categories, including wrist-wear, eye/headwear, footwear, neckwear, and body-wear and serves diverse applications in consumer electronics, healthcare, and enterprise sectors, highlighting Vietnam’s accelerating shift toward connected and data-driven lifestyles[11].

Major Market Players

Vietnam’s wearables technology market is dominated by foreign brands (such as Garmin, Apple, Xiaomi, Huawei and Samsung) with Vietnamese players holding minimal share. Winning technologies center on advanced health sensing (ECG, SpO₂, fall detection), precise GPS/multi-band GNSS, AMOLED displays, long battery life, and robust training analytics. While brand leadership remains foreign, Vietnam’s role in the global supply chain is rising as a manufacturing base for devices like Apple Watch and AirPods.

– Garmin: Leads Vietnam’s smartwatch market by value share (≈32% in 2024, IDC), driven by premium fitness and outdoor models such as Forerunner and fēnix. Garmin’s devices feature AMOLED displays, multi-band GNSS, and advanced training analytics, appealing to professional and lifestyle users alike[12].

Source: vietnam.vn

– Apple: The Apple Watch dominates the high-end segment with advanced features such as ECG, SpO₂, and fall detection. Notably, Vietnam has become a key manufacturing hub for Apple Watch and AirPods[13], with suppliers like Luxshare-ICT expanding local operations, strengthening Vietnam’s role in the global wearable supply chain.

Source: Akirasport

– Xiaomi, Huawei, and Samsung: Compete aggressively in the mass-market segment with affordable smartbands and watches offering long battery life, stress tracking, and GPS, making wearables accessible to a broader demographic.

Source: Tiki, Huawei, Samsung

Strategic Implications for Foreign Investors

Vietnam’s digital health market offers strong opportunities but faces major challenges related to regulatory complexity and infrastructure gaps, demanding a compliance-first market entry strategy. Medical devices are regulated by classification under Decree 98/2021 and Circular 05/2022, with low-risk devices (Class A) requiring minimal registration, while diagnostic or monitoring wearables (Class C/D) need a Ministry of Health certificate and stricter approval[14]. Data security laws, including the Cybersecurity Law (Decree 53/2022) and the Personal Data Protection Decree (Decree 13/2023), require local data storage and impose severe penalties for noncompliance, making adherence essential.

For foreign brands entering Vietnam’s smart-wearables market, a rigorous assessment of distribution channels and a clearly defined product strategy are critical to successful entry and sustained growth.

– Product strategy. Choose a clear lane—premium performance or value mass market—and align features and price accordingly. Prioritize must-have specs: accurate health metrics (heart rate, blood oxygen, electrocardiogram where permitted), multi-band GPS, readable AMOLED, week-long battery, and solid water resistance. Localize for Vietnam with Vietnamese UI, notification mapping for popular local apps (e.g., Zalo, MoMo), motorbike-friendly controls, and heat/humidity durability.

– Distribution approach. Build an omnichannel backbone: secure shelf space with national retailers and telcos (The Gioi Di Dong, FPT Shop, Viettel), scale online via Shopee/Lazada/TikTok Shop, and add experiential touchpoints (in-store try-ons, gym/fitness pop-ups). Bundle with telco plans and corporate wellness programs (employers, gyms, insurers) to lift activation and retention.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[1] https://www.techsciresearch.com/report/vietnam-ehealth-market/7913.html

[2] https://biblio.ugent.be/publication/01JMBY7DGRAN25Z1X5JRGQZ24D

[3] https://www.trade.gov/market-intelligence/vietnam-cybersecurity-data-localization-requirements

[4] https://www.pureglobal.com/markets/vietnam/vietnam-medical-device-and-ivd-classification-and-grouping

[5] https://www.nucamp.co/blog/coding-bootcamp-viet-nam-vnm-education-how-ai-is-helping-education-companies-in-viet-nam-cut-costs-and-improve-efficiency

[6] https://vietcetera.com/en/vietnam-innovator-doctor-anywhere-lands-a-30m-usd-investment-for-digital-health-as-demand-in-vietnam-surges

[7] https://www.mekongcapital.com/our-investment/gene-solutions-2025/

[8] https://vietnamnews.vn/economy/1499952/telehealth-platform-medigo-bags-2-million-in-series-a-funding.html

[9] https://arxiv.org/abs/2104.02256

[10] https://www.exemplars.health/emerging-topics/epidemic-preparedness-and-response/digital-health-tools/ncovi-and-bluezone-in-vietnam

[11] https://www.imarcgroup.com/vietnam-wearable-technology-market

[12] https://vietnamnet.vn/en/how-high-income-vietnamese-choose-smartwatches-2422573.html

[13] https://www.vietnam-briefing.com/news/apples-production-strategy-in-vietnam.html/

[14] https://www.pureglobal.com/markets/vietnam/vietnam-medical-device-and-ivd-classification-and-grouping