31Jan2026

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s middle class is expanding rapidly and increasingly spreading beyond major urban centers into rural areas, creating new demand for modern retail formats. Rising rural incomes and changing consumption preferences are accelerating the shift from traditional wet markets to modern trade, led primarily by domestic retailers with strong local capabilities. While foreign retailers remain more cautious in their expansion, targeted format adaptation and partnership-driven strategies can enable them to participate effectively in Vietnam’s evolving rural retail landscape.

The middle class in Vietnam is expanding

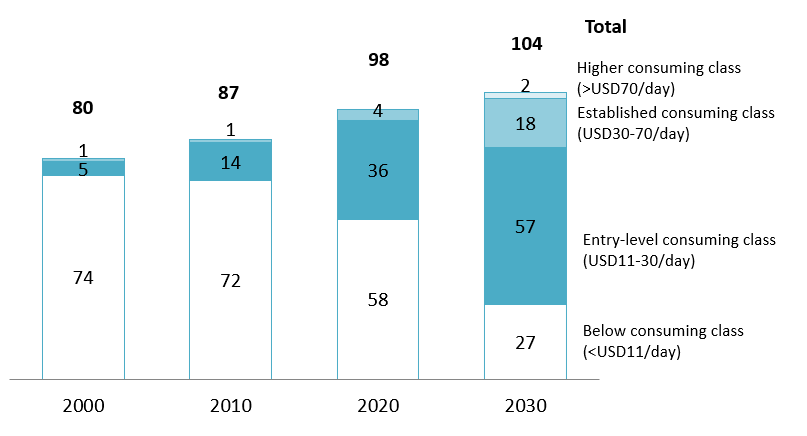

In Vietnam, the middle class comprises households and individuals with sufficient income and stability to afford consumption beyond basic necessities, such as education, healthcare, quality housing, and discretionary spending[1]. To classify, the middle class is people spending between USD 11 and USD 110 per day, while the consuming class includes anyone who spends over USD 11 per day[2]. According to McKinsey research, Vietnamese people are increasing their daily spending, and millions of people are joining the consuming class. It is projected that 74% Vietnamese population will enter the consuming class in 2030, rising from 40.8% in 2020[3].

Vietnam’s population by daily spending (2000-2030)

Unit: million people

Source: McKinsey

This expansion is rooted in sustained economic growth, integration into global value chains, and shifts in the labor market. Rising incomes and increased educational attainment contribute to higher consumption power. Middle-class Vietnamese often prioritize spending on education, healthcare, housing, and experiences such as travel and leisure[4]. Vietnam’s middle class is rising noticeably in urban, major cities such as Hanoi and Ho Chi Minh City, where job opportunities, higher wages, and services are more accessible[5].

The growth is significant in rural areas

Vietnam’s middle class is not only growing in size but also geographically dispersing beyond the largest metropolitan centers.

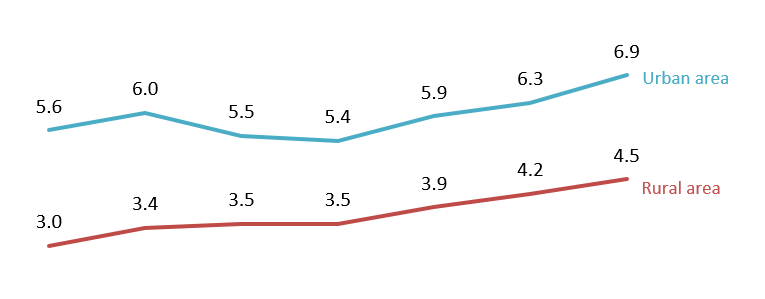

Traditionally, rural Vietnam was associated with subsistence livelihoods and low incomes. However, rural households have seen continuous income improvements, partly due to agricultural productivity gains, rural industrialization, and migration income. Even when they remain below urban levels, the rise is consistent with a CAGR of 7.1% during 2018-2024, higher than the urban CAGR (3.4%).

Vietnam’s monthly average income per capita (2018-2024)

Unit: Million VND

Source: National Statistics Office

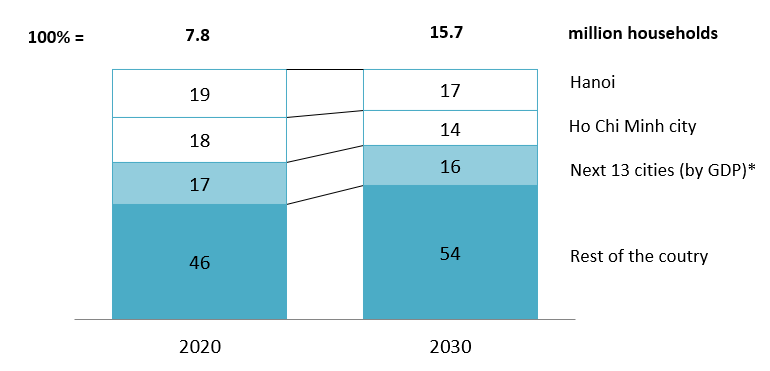

According to McKinsey’s projection, households with annual income greater than USD 22,000 will double in 2030 compared to 2020. Hanoi and Ho Chi Minh City are the main contributors, yet the regions beyond big cities witness a larger proportion and higher CAGR (8.84%) during the period.

Households with annual income greater than USD 22,000 (2020-2030)

Unit: %

*The next 13 cities are Hai Phong, Can Tho, Bien Hoa, Da Nang, Hue, Vung Tau, Nha Trang, Buon Ma Thuot, Vinh, Quy Nhon, Ha Long, Rach Gia, and Long Xuyen

Source: McKinsey

Middle-class growth as a driver for Retail modernization

Vietnam’s rural area is where 62.9 million Vietnamese consumers live, which accounts for 61.4% of the country’s total population[6]. However, for decades, these areas remained dominated by traditional retail channels such as wet markets and small family-run grocery stores with limited selection, no standardized pricing, and largely informal operations.

The expansion of the rural middle class has been a primary driver behind the spread of modern retail. As rural incomes improve, consumer demand shifts from subsistence purchasing toward expectations of quality, transparency, convenience, and service reliability[7]. Realizing this shift, retailers in Vietnam have identified rural areas as a strategic growth frontier and have aggressively expanded their networks to capture this opportunity.

A mini go! store in Hoa Thanh town, Tay Ninh province

Source: Central Retail

Domestic retailers clearly dominate in store count and geographic spread. Chains such as WinCommerce, Bach Hoa Xanh, and Saigon Co.op can expand rapidly because they possess deep local market knowledge, established domestic supply chains, and operating models suited to low-margin, high-frequency consumption. In contrast, foreign retailers tend to prioritize capital efficiency, brand positioning, and risk control, resulting in fewer but larger provincial nodes rather than dense rural penetration.

Expanding towards the rural area, chains innovate in store format to better adapt to local customers. Instead of deploying large supermarkets, retailers typically introduce small-format minimarts or convenience stores. These stores focus on a curated assortment of fast-moving consumer goods and daily necessities that match rural purchasing habits, allowing retailers to balance cost efficiency with accessibility while remaining close to residential clusters[8]. This trend can be witnessed in both domestic brands and foreign retailers as well[9].

Expansion activities from notable retail brands

| Name | Expansion beyond big cities |

| Vietnamese retailers | |

| Wincommerce | · In 2025, on average, 50 Winmart+ Rural stores were open every month.

· Winmart+ Rural stores are minimarts, focusing on a curated assortment of FMCG and daily necessities, suitable for small towns. |

| Bach Hoa Xanh | · After consolidating its presence in Southern Vietnam, Bach Hoa Xanh continues to roll out stores into Northern and Central rural provinces.

· In the first 8 months of 2025, Bach Hoa Xanh newly opened 463 stores, of which over 50% are concentrated in Central area. |

| Saigon Co.op | · Saigon Co.op utilizes the format call Co.op Smile, small-format neighborhood stores suitable for rural and semi-rural settings

· Co.op Smile stores are newly opened in the Central Highlands, bringing high-quality Vietnamese products to customer with reasonable price |

| Foreign retailers | |

| Central Retail | · Central Retail Vietnam has deployed mini go! stores in semi-urban and rural locations (such as Tan Uyen, Hoa Thanh, Nhon Trach)

· Stores provide services such as supermarkets, playgrounds, and F&B services. |

| AEON | · AEON is placing new supermarkets and shopping centres in provinces such as Tay Ninh (AEON Tan An) and Hung Yen (AEON Van Giang)

· Mid-sized supermarkets and flexible store formats designed to serve suburban and provincial residents |

B&Company’s Synthesis

Challenge and implications for foreign investors

Despite the growing attractiveness of rural Vietnam, foreign retailers face structural challenges in scaling beyond provincial markets. These include limited ability to roll out dense store networks under low-margin conditions, weaker familiarity with rural consumer behavior, and higher operating and compliance costs compared with domestic players. In addition, strong price sensitivity among rural consumers constrains foreign retailers’ typically higher-cost sourcing models, while regulatory formalization and evolving rural development criteria further increase operational complexity. As a result, foreign players tend to expand cautiously, favoring selective provincial hubs rather than deep rural penetration.

As a result, to tap into the promising rural and suburban market in Vietnam, foreign brands should focus on targeted positioning, local adaptation, and partnership-driven models:

– Adopt selective, cluster-based expansion strategies: Focus on high-income rural districts and secondary cities that act as consumption hubs for surrounding areas, rather than pursuing nationwide rural coverage

– Leverage partnerships and local alliances: Collaborate with domestic retailers, wholesalers, or local store operators to reduce entry barriers, improve cost efficiency, and accelerate market learning.

– Differentiate beyond price competition: Compete on food safety, quality assurance, private labels, customer experience, and value-added services rather than direct price matching with domestic chains.

– Integrate omnichannel and service layers: Use e-commerce, click-and-collect, loyalty apps, and service add-ons (e.g. bill payment, community services) to enhance customer stickiness and justify modern retail adoption.

– Align expansion with policy and rural development frameworks: Position investments in line with national rural modernization goals and new regulatory standards to access incentives and reduce compliance risks.

The rise of the rural middle class is reshaping Vietnam’s retail landscape, shifting growth momentum beyond major cities and accelerating the modernization of consumption. While domestic retailers currently lead this transformation, foreign investors that adapt their formats, partnerships, and expansion strategies can still capture meaningful opportunities in Vietnam’s this phase of retail growth.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[1] Lam Dong Newspaper, Vietnamese middle class (https://baolamdong.vn/tang-lop-trung-luu-va-tuong-lai-thinh-vuong-cua-viet-nam-341758.html)

[2] World Data Lab, China vs. India — Where is the momentum in consumer spending? (https://blog.worlddatalab.com/wdl/china-vs.-india-where-is-the-momentum-in-consumer-spending)

[3] McKinsey, The new faces of the Vietnamese consumer (https://www.mckinsey.com/~/media/mckinsey/featured insights/future of asia/insights/the new faces of the vietnamese consumer/the-new-faces-of-the-vietnamese-consumer-vt.pdf)

[4] Cimigo, Vietnam economic class and rising affluence (https://www.cimigo.com/en/trends/vietnam-economic-class/)

[5] Eastspring Investment, Investing in Vietnam’s middle-income boom (https://www.eastspring.com/insights/thought-leadership/investing-in-vietnams-middle-income-boom)

[6] National Statistics Office, Press release on population, labor, and employment situation in Q4 and 2025 (https://www.nso.gov.vn/tin-tuc-thong-ke/2026/01/thong-cao-bao-chi-ve-tinh-hinh-dan-so-lao-dong-viec-lam-quy-iv-va-nam-2025/)

[7] Masan Group, WinCommerce opens nearly 50 new WinMart+ Rural stores every month (https://masangroup.com/news/market-news/WinCommerce-opens-nearly-50-new-WinMart-Rural-stores-every-month.html)

[8] The Leader, Retail businesses are accelerating their exploration of rural markets. (https://theleader.vn/doanh-nghiep-ban-le-tang-toc-khai-pha-thi-truong-nong-thon-d42083.html)

[9] AEON Press Release, AEON accelerates expansion, aiming to triple its scale by 2030 (https://corp.aeon.com.vn/wp-content/uploads/2025/08/FINAL_AVN_TCBC_Retaining-Aug_AEON-tang-toc-mo-rong.pdf)