24Jun2025

Highlight content / Industry Reviews / Latest News & Report

Comments: No Comments.

Vietnam’s fresh meat sector is experiencing a critical phase of transformation, driven by shifts in consumer behavior, technological adoption, and increasing competition with imported products. This article provides a comprehensive analysis of Vietnam’s fresh meat market, exploring its key characteristics, the forces shaping its evolution, and its future trajectory.

Pork market remains strong, but challenges remain

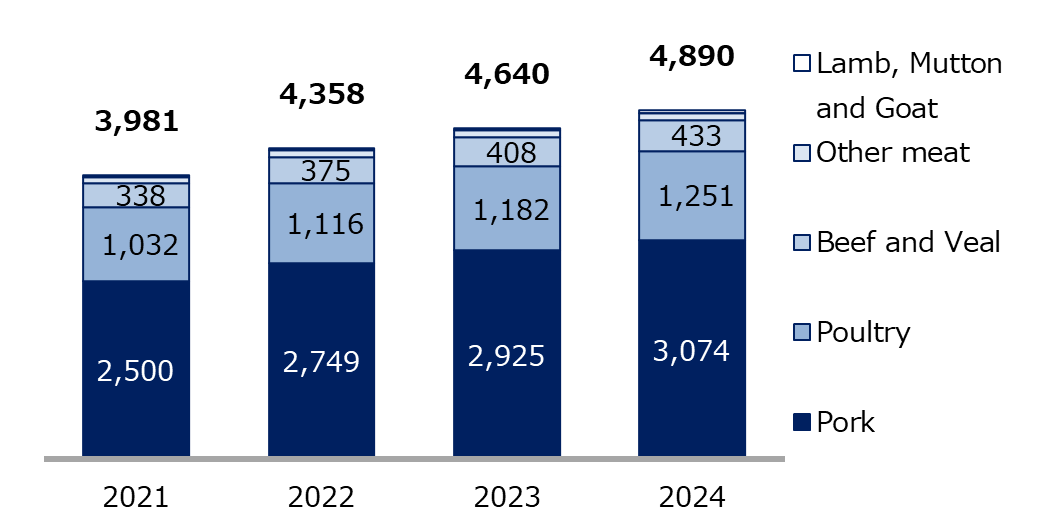

In 2024, Vietnam’s meat production is expected to reach approximately 4.9 million tons, a 5% increase from the previous year. Pork accounted for approximately 63% of the total, reaching more than 3 million tons (Figure 1). However, the spread of African swine fever (ASF) cast a shadow over the stable growth of the market. Due to the outbreak of ASF in 44 provinces, approximately 39,000 pigs were culled, and the supply chain was disrupted [1]. Thanks to measures taken by the Ministry of Agriculture and Rural Development and others, the spread of infection is finally being contained.

[Figure 1] Meat sales volume by category (thousand tons)

Source: Euromonitor

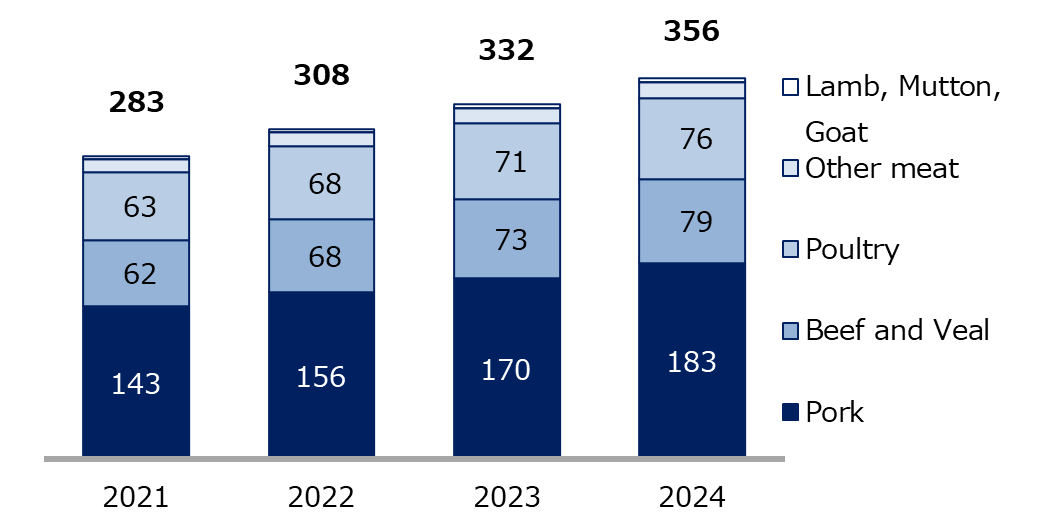

Nevertheless, the pork market remains large, with retail sales expected to reach VND183 trillion (approximately more than 1 trillion yen) in 2024, accounting for roughly half of the total (Figure 2). Vietnam is the largest pork consumer in Southeast Asia, with per capita consumption reaching 37 kg, up 3 kg from the previous year [2].

[Figure 2] Retail sales by meat category (VND trillion)

Source: Euromonitor

90% of Products Still Unbranded—A Fragmented Market

Vietnam’s meat market remains fragmented despite its size. More than 90% of meat products in circulation are unbranded [3]. Consumers prefer fresh, warm “hot meat” and generally buy from wet markets. This traditional trade channel accounts for around 80% of the total market, while modern retail accounts for only 20% [4].

On the other hand, CP, Vissan, and Japfa Domestic and international brands such as Comfeed, are beginning to strengthen their presence in modern trade, primarily in urban areas, and are expanding their lineup of chilled and frozen products and processed foods to attract the next generation of consumers.

Safety and security orientation is growing among young people

In recent years, there has been a growing trend toward safety and security, particularly among young people, with products such as “antibiotic-free,” “organic,” and “direct from the farm.” This has led to an increase in demand for chilled meat with traceability. Although it currently accounts for only about 10% of the overall market, this is a segment that is expected to grow in the future [5].

Demand for pre-sliced, pre-marinated, and pre-cooked meat products that offer convenience is also growing in urban areas, and sales through modern retail channels are likely to be a growth driver for the meat industry going forward.

The battle between domestic and foreign players

Vietnam is also modernizing its livestock industry. In addition to the major Vietnamese companies Dabaco , Masan , and Tan Long , Thailand’s CP and Indonesia ‘s Japfa are also in the market. Foreign investors such as Comfeed are also actively expanding their investments, accelerating the shift from small-scale, self-sufficient farms to large-scale semi-industrial farms.

Symbolizing this is the large-scale investment by the Japanese general trading company Sojitz. Vietnam’s first chilled beef processing plant, completed in [6]Tam Dao, Vinh Phuc Province, boasts an annual production capacity of 10,000 tons and is equipped with a state-of-the-art processing line and a fattening facility with a capacity of 10,000 head. It is a model case of centralized management of the entire supply chain.

[Figure 3] Prime Minister Chinh visits the Vina Beef plant (March 2025)

Source: Vinh Phuc TV

On the other hand, the presence of imported meat products from the United States, Australia and Brazil is also increasing. There is a strong tendency among consumers to think that “imported products are safer and of higher quality,” and domestic producers are being forced to strengthen not only price competitiveness but also both quality and branding.

New business opportunities in a transforming market

Vietnam’s meat market still has a lot of room for growth, but it remains fragmented and highly competitive. Changing consumer habits call for the modernization of the meat value chain, and rapid response is essential in all sectors, from agriculture to processing and distribution.

Local brands need to maintain their strengths in traditional markets while working on developing traceable, high-added-value products. Opportunities are also expanding for foreign companies to take advantage of quality and brand power to capture the market. Vietnam’s “hot market” is now moving towards the next stage.

[1] Source: Euromonitor

[2] Source: INTECH Technology Innovation Investment (online media) article ” Outlook for Vietnam’s Meat Industry in the Coming Period ” (March 2025), Ho Chi Minh City Party Committee article ” Vietnamese Rank 4th in the World for Pork Consumption ” (April 2025)

[3] Source: Office of the Government of the Socialist Republic of Vietnam article, ” Vietnam Among Top 10 Countries in Pork Consumption Worldwide ” (June 2024) .

[4] Source: Euromonitor

[5] Source: Euromonitor

[6] Source: Mekong ASEAN (online media) article ” Sojitz Opens 10,000-Ton Chilled Beef Processing Plant in Tam Dao ” (December 2024)

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |