05Feb2025

Industry Reviews / Latest News & Report

Comments: No Comments.

Vietnam’s education investment for 2024 is expected to reach nearly 16% of the total national budget, aligning with global standards when compared to countries like the United States (13%), Indonesia (18%), and Singapore (20%)[1]. This reflects the government’s growing commitment to investing in education. With substantial investment capital from major global players and the government’s focus on promoting EdTech growth, Vietnam is increasingly becoming a promising destination for investors seeking opportunities in this sector.

Overview of the Educational Technology Market in Vietnam

Educational Technology Services in Vietnam can be divided into different categories such as LMS (learning management system), Content and Learning Materials, STEAM/STEM (Science, Technology, Engineering, (Arts) and Mathematics) Education, Tools and Platforms, Language Learning, and App-based Learning. While preschool, K-12 (students from grade 1 to 12), and corporate training & professional development are the most focused customer groups, K-12 Education remains the primary segment in the Vietnamese market, with 80% of EdTech companies targeting this group[2].

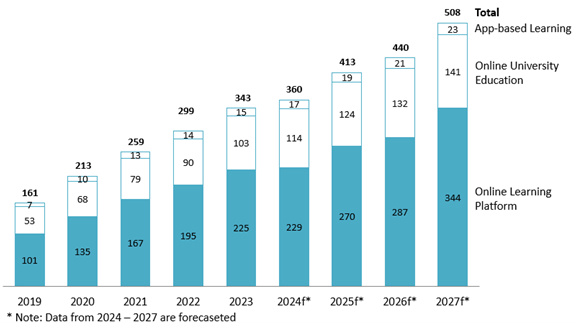

In 2023, the E-Learning market reached 328 million USD in revenue, marking a 15% increase from 2022[3]. Particularly, app-based learning alone receives a value of 15 million USD, boosting a 7% increase year-on-year[4]. This resulted in a growth surge in the future as E-learning CAGR is forecasted at nearly 12%, from 2025 to 2028.

Revenue of the E-Learning market in Vietnam (2019 – 2027f)

Unit: Million USD

Source: Statista

In terms of STEAM/STEM education, during the 2021–2022 and 2022–2023 academic years, approximately 90 thousand STEM lessons were implemented across Vietnam, including at the preschool level[5]. Additionally, K-12 educational institutions have adopted Learning Management Systems (LMS) and school management tools, such as Smas and VioEdu, to streamline and enhance education management. Tools and platforms like Quizizz and Azota are also being widely used to support teaching activities effectively. In Hanoi, many secondary and high schools are looking to integrate AI into teaching and management processes further to improve education quality and enhance students’ skills[6].

Rising Demand for Educational Technology in Vietnam

On average, Vietnamese family are willing to dedicate 24% of their household spending to education[7]. In addition, parents are increasingly encouraging their children to engage in coding and technology-related classes in order to equip them with digital skills essential for the modern era[8]. The growing penetration of smartphones and internet connectivity across the country, in which by January 2024, around 79% of Vietnamese people had access to the internet, and 170% of the population had mobile connections[9], has made EdTech tools more accessible and essential for the K-12 education system.

Moreover, the job market is becoming increasingly competitive, especially with the emergence of international enterprises that have raised the standards and expectations of employers. To navigate this challenging recruitment landscape, university students and employees are turning to EdTech services designed for professional development. These include STEM education centers that help enhance skills and provide hands-on experience with real-world projects; tools and platforms offering certifications to strengthen CVs; and language learning solutions that prepare individuals for widely recognized certifications such as IELTS or JLPT. The synergy between corporate upskilling demands and innovative educational technology is driving a transformative shift in workforce development, presenting significant opportunities for EdTech to deepen its market presence.

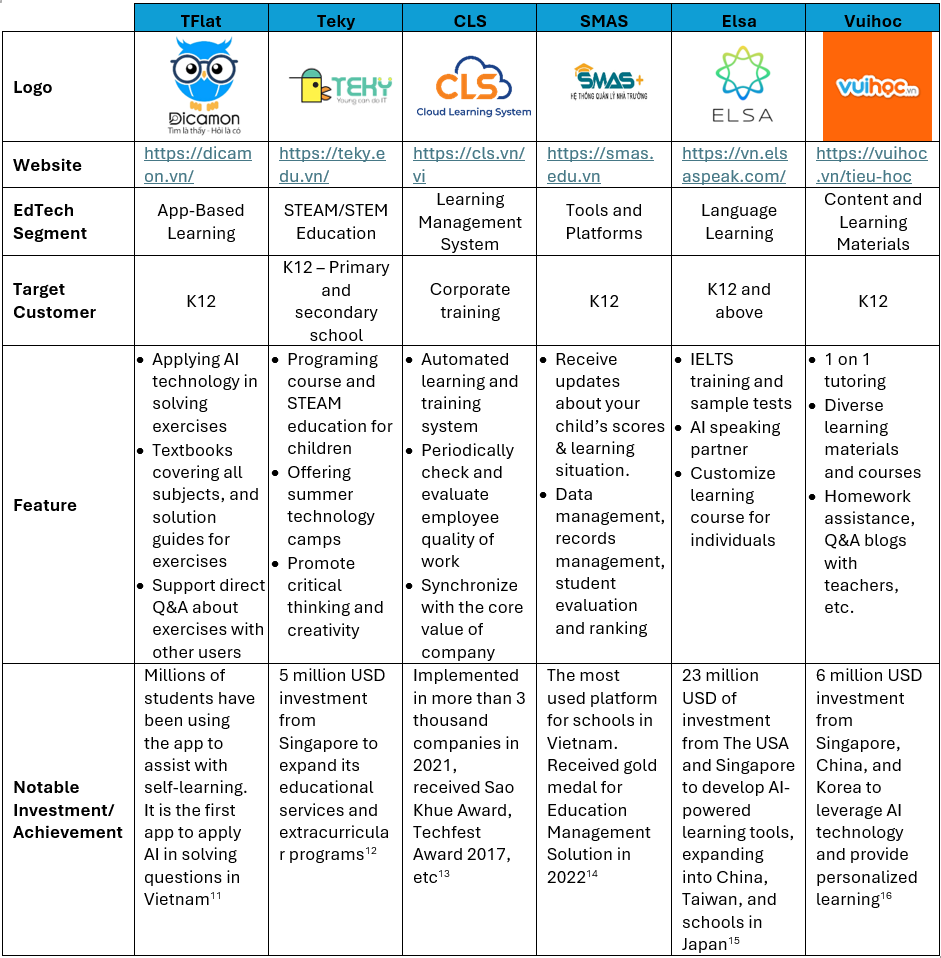

Notable investment and key players of EdTech in Vietnam

In 2023, EdTech received over 400 million USD in investments from 70 investors and the majority of the funding focuses on Language Learning, STEM Education, Content and Learning Materials[10]. The year 2023 also witnessed the rise of numerous Vietnamese’s EdTech startups and the accelerated development of existing companies in the sector, with several standout companies emerging as key players.

Key players in the EdTech market in Vietnam

Sources: B&Company Complication

Government support and policies

As Vietnam embraces rapid digital transformation, the role of government initiatives in steering the education sector toward innovation and inclusivity has become increasingly evident. Recognizing the importance of lifelong learning and digital integration, the Vietnamese government has enacted policies to modernize the nation’s educational framework.

Vietnam Policies to Further Promote EdTech Implementation

| Decision | Policy name | Terms on Promoting EdTech Implementation |

| Decision 1373/QĐ-TTg (2021) | Building a Learning Society for the 2021-2030 Period | · 90% of universities and 80% of vocational training centers to implement digital learning technologies by 2030

· Encourages EdTech solutions tailored to vocational and professional training to prepare the workforce for technological advancements · Allocates funding for the development of innovative EdTech systems and open-access digital libraries, enhancing both formal and informal education |

| Decision No. 131/QĐ-TTg (2022) | Strengthening the application of IT and digital transformation in education and training from 2021 to 2025 | · Prioritizes building digital infrastructure in educational institutions, including high-speed internet and interactive learning tools. Ensuring rural and disadvantaged areas benefit from EdTech advancements.

· Implementing STEAM/STEM education starting from primary school to foster a culture of technology-enhanced education. · By 2025, more than 50% of higher education offers E-Learning. Create Content and Learning materials that contain 50% of all K12 curriculum |

| Circular No. 30/2023/TT-BGDDT (2023) | Regulations on Management and Operation of Online Education Platforms | · Establishes guidelines for EdTech platforms, ensuring compliance with national educational standards for content quality and usability. Requires platforms to undergo regular evaluations for their effectiveness and accessibility to learners.

· Actively supports collaboration between public and private entities to enhance the reach and quality of EdTech offerings. |

Source: B&Company Complication

Challenges to market growth

Vietnam’s EdTech market, despite its rapid development, faces several significant challenges that hinder its broader growth. Firstly, there is a geographic disparity in access to digital education, with EdTech solutions primarily concentrated in major cities like Hanoi and Ho Chi Minh, leaving rural and suburban areas underserved. Secondly, many public schools still lack the necessary infrastructure to effectively implement EdTech tools such as: Outdated hardware, and inadequate tech facilities. Finally, while government policies are in place, the lack of specific actions, funding, and implementation measures has slowed the progress of EdTech companies, particularly in underserved regions.

[1] Skill Bridge (2024). Sự Phát Triển Của Ngành EdTech Tại Việt Nam: Hành Trình Tăng Trưởng Và – Skills Bridge

[2] Vietnam EdTech Report (2023). Educational Technology Expected to Rise in the Future <Access>

[3] Statista (2024). Vietnam E-Learning Market Report <Access>

[4] Statista (2024). Educational App Market in Vietnam <Access>

[5] Vietnam EdTech Agency (2023). Overview of EdTech in Vietnam <Access>

[6] Hanoi Department of Education and Training (2024). Promote the Implementation of AI in Education and School Management Across Hanoi <Access>

[7] Hanoi Economic and Urban Newspaper (2022). Vietnam’s Invesment in Education <Access>

[8] The Education and Times Newspaper (2023). Programming Education Trends for Young Children Among Families <Access>

[9] Data Reportal (2024). Vietnam Digital Report in 2024 <Access>

[10] LinkedIn (2024). Vietnam’s EdTech Sector is Surging Ahead <Access>

[11] Vietnam Information and Communication Magazine (2023). Dicamon Assisting Student in Self-Learning <Access>

[12] Vietnam Briefing (2023). EdTech in Vietnam: Understanding Foreign Investment Trends in 2023 <Access>

[13] Cloud Learning System (2021). More Than 3 thousand Companies Using CLS <Access>

[14] VnExpress (2022). SMAS Received Gold Medal in the Stevie Awards <Access>

[15] Elsa Speak Vietnam (2023). Elsa Speak Successfully Raised 23 million USD in Total Investment <Access>

[16] VnExpress (2023). E-Learning Platform Vuihoc Gained 6 Million USD Investment <Access>

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |