23Dec2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s coffee shop market is becoming one of the most dynamic segments in the F&B sector, driven by rapid chain expansion, digital ordering and strong loyalty to local brands. Compared to 2024, there is a slight increase in the number of coffee chain stores in 2025 as leading chains such as Highlands Coffee, Phuc Long open new stores in Ho Chi Minh, Hanoi and other cities/provinces. Changing consumer habits, more frequent coffee shop visits, and new market trends are reshaping competition and creating new entry points for foreign investors.

Market Overview

The domestic Food and Beverage (F&B) sector in Vietnam features coffee shops as a fast-growing and relatively premium sub-segment. In 2025, from small alleyway cafés to high-end coffee chains, Vietnam boasted over 500,000 coffee shops[1], which is much higher than the number of roughly 317,299 coffee and tea shops nationwide at the end of 2023[2].

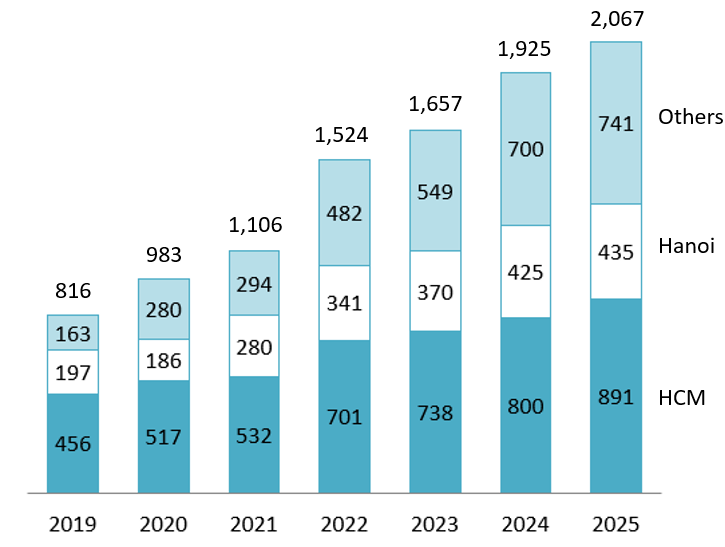

Vietnam’s coffee chain network has expanded strongly from 2019 to 2025. Total chain stores more than doubled, rising from 816 outlets in 2019 to 2,067 in 2025. Ho Chi Minh City remains the largest hub, increasing from 456 to 891 stores, but growth is no longer concentrated only there. Hanoi’s network also expanded from 197 to 435 outlets, while the most dramatic change came from other cities and provinces, where chain stores jumped from 163 to 741, making this group larger than Hanoi by 2025.

Number of coffee chain stores in Ho Chi Minh, Ha Noi, and others

Unit: stores

Source: Q&Me

Main players

Local brands overwhelmingly dominate the coffee shop market, not only in store count but also significantly in terms of revenue, with Highlands Coffee and Phuc Long standing as the revenue leaders. While the market is clearly segmented, foreign brands like Starbucks remain in the premium niche, whereas homegrown players like Trung Nguyen anchor the traditional and cultural segment. Younger, trendy Vietnamese chains such as Katinat have demonstrated rapid growth, closing the gap with established incumbents not just through physical expansion, but through product agility. These rising stars are redefining the sector by moving beyond traditional coffee; they are actively driving traffic by introducing novel, trend-driven beverages, such as fruit teas, matcha fusion, and seasonal concepts, into their menus to cater to the fluid preferences of the Gen Z demographic.

In terms of physical presence, in 2025, Milano is estimated to have reached 2000 stores, and Highlands Coffee has reached about 855 stores. Other major chains are also significant players: Phuc Long has grown to roughly 237 outlets, Katinat to around 93 outlets, and Starbucks to 127[3].

List of some main coffee chain stores in Vietnam

| No. | Coffee brand | Year founded | First city | Home country | Number of coffee stores 2025 |

| 1 | Milano | 1996 | HCMC | Vietnam | 2000 |

| 2 | Highlands | 1999 | HCMC | Vietnam | 855 |

| 3 | Trung Nguyen | 1996 | HCMC | Vietnam | 464 |

| 4 | Viva Star Coffee | 2013 | HCMC | Vietnam | 329 |

| 5 | Phuc Long | 2000 | HCMC | Vietnam | 237 |

| 6 | Starbucks | 2013 | HCMC | USA | 127 |

| 7 | Guta Café | 2016 | HCMC | Vietnam | 96 |

| 8 | The Coffee House | 2014 | HCMC | Vietnam | 93 |

| 9 | Katinat | 2016 | HCMC | Vietnam | 93 |

| 10 | Passio | 2006 | HCMC | Vietnam | 88 |

Source: Q&Me

Market trends

Leading coffee chains are strategically expanding by moving beyond central business districts (like District 1 and the Landmark 81 area) into suburban districts and Tier-2 cities, leveraging rising incomes and new retail developments[4]. At the same time, these brands are experimenting with multiple formats. Beyond traditional sit-down outlets, concepts like Highlands Coffee’s drive-thru stores show how chains are adapting to Vietnam’s motorbike-dominated traffic and the habit of integrating a coffee stop into daily commutes. This format strengthens their reach and reflects a broader market shift towards speed and convenience in the F&B sector.

Alongside network expansion, major coffee shop brands are reshaping their menus and positioning. Many chains are moving away from a pure coffee focus and now operate more as broad beverage brands. Tea, fruit teas and matcha have become key growth drivers, with a significant share of revenue coming from non-coffee items. This evolution is especially visible in the strategies of Phuc Long and Katinat, which actively use colourful, innovative drinks to attract Gen Z. Today’s Gen Z demonstrates a preference for cold coffee and innovative fusion concepts, such as combining matcha with coconut juice, over traditional hot beverages. According to Brands Vietnam (2025), this demographic is highly attracted to brands that are perceived as “trendy,” “friendly,” and “youthful.” [5]

Digitalisation is essential, with major chains rolling out mobile apps, loyalty programs, and tight integration with delivery platforms (ShopeeFood, GrabFood). Highlands, Katinat, and Starbucks actively promote app-based ordering and membership benefits for repeat visits and data-driven marketing. This is complemented by the design of stores as experience-driven “third spaces” for working and socialising. Concepts such as Katinat’s “villa-like” outlets encourage longer dwell times, higher transaction values and more frequent visits, reinforcing the role of coffee shops as everyday destinations rather than occasional treats.

In 2024, the survey of nearly 3,000 restaurants, eateries and coffee shops and 4,000 consumers across the country found that 30.4% of participants went to coffee shops once or twice a week, up 7.8 percentage points[6]. This trend is notably driven by the mid-income segment in 2025: a report indicates that consumers earning VND 5–10 million/month have the highest visit frequency (1–3 times/week), closely followed by the VND 10–20 million/month bracket. Customers in these income groups are predominantly office workers, freelancers, and students. Significantly, 40% of customers choose coffee shops for work purposes, alongside other motives like relaxation, trying new drinks, or starting the day[7].

Finally, brand engagement is amplified through social media and merchandise. Viral campaigns built around limited-edition cups, seasonal concepts, and exclusive merchandise are now core marketing levers for brands like Katinat, Starbucks, and Highlands, effectively generating online buzz and driving foot traffic. For example, Starbucks launched a Vietnamese version of its ceramic mug, Phúc Long accompanied the April 30th military parade, and Highlands launched its “Proud of Vietnamese Coffee Quintessence” campaign.[8]

Implications for foreign investors

The Vietnamese coffee shop market offers compelling opportunities underpinned by resilient demand, with high visit frequency among urban consumers ensuring stability even amid economic shifts. Despite current intense competition, there is still ample whitespace for differentiated positioning, particularly in specialized segments such as third-wave/single-origin coffee, health-focused and plant-based menus, and high-convenience models like drive-thru formats. Furthermore, the market is highly attractive for international expansion due to a favorable regulatory environment that supports franchising, with many local investors actively seeking partnerships to become master franchisees for reputable international coffee shop brands.

However, the main challenges in Vietnam’s coffee sector revolve around intense price and location competition, as prime spots in Hanoi and Ho Chi Minh City are already dominated by leading local brands, leading to high rents and strong pressure on beverage pricing. This forces new entrants to either pay a premium for flagship stores or innovate using smaller formats like kiosks and drive-thrus. Furthermore, companies must overcome the hurdle of deeply ingrained local taste preferences, as Vietnamese consumers heavily favor robusta-style coffee, condensed milk, and sweet, tea-based drinks. Brands that attempt a pure “Western” taste profile will remain niche unless they successfully localize their menus to suit these popular preferences.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[1] https://vietnamnews.vn/economy/1692991/viet-nam-s-coffee-shops-boom-amid-business-closures.html

[2] https://vietnamnews.vn/economy/1656282/fierce-battle-for-billion-dollar-market-share-between-coffee-chains-in-viet-nam.html

[3] https://cafef.vn/cuoc-chien-chuoi-ca-phe-phuc-long-tang-79-cua-hang-katinat-duoi-sat-nut-rieng-the-coffee-house-ngam-ngui-dong-cua-1-3-188250516080502639.chn

[4] https://vir.com.vn/beverage-chains-take-on-new-models-122342.html

[5] https://www.brandsvietnam.com/congdong/topic/346424-ipos-vn-va-nestle-professionalcong-bo-bao-cao-thi-truong-kinh-doanh-am-thuc-tai-viet-nam-nam-2024

[6] https://e.vnexpress.net/news/business/economy/vietnamese-consumers-eat-out-visit-cafes-more-often-4727722.html

[7] https://mibrand.vn/wp-content/cache/all/tin-tuc/mibrand-40-khach-hang-lua-chon-quan-ca-phe-cho-muc-dich-lam-viec/index.html

[8] https://younetmedia.com/en/introducing-the-h1-2025-coffee-shop-social-media-report-announcing-the-top-10-most-prominent-brands/