10Dec2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s food and beverage (F&B) industry is one of Southeast Asia’s fastest-growing consumer sectors. HCMC remains the country’s commercial powerhouse, hosting the largest concentration of restaurants, cafés, coffee chains, quick-service brands, international franchises, and nightlife venues. The city’s expanding middle class, strong tourism inflow, and rapidly modernizing retail landscape make it a highly attractive but extremely competitive battleground for F&B operators.

Vietnam F&B Market Overview

Vietnam’s F&B services industry remains one of the most dynamic consumer sectors in Southeast Asia. After decades of expansion, the market continues to scale in both value and diversity of concepts. According to industry estimates, Vietnam’s F&B sector surpassed USD 29 billion in 2025 and is on track to approach USD 37 billion by 2028[1], maintaining strong momentum across restaurant, café, beverage chain, and delivery segments.

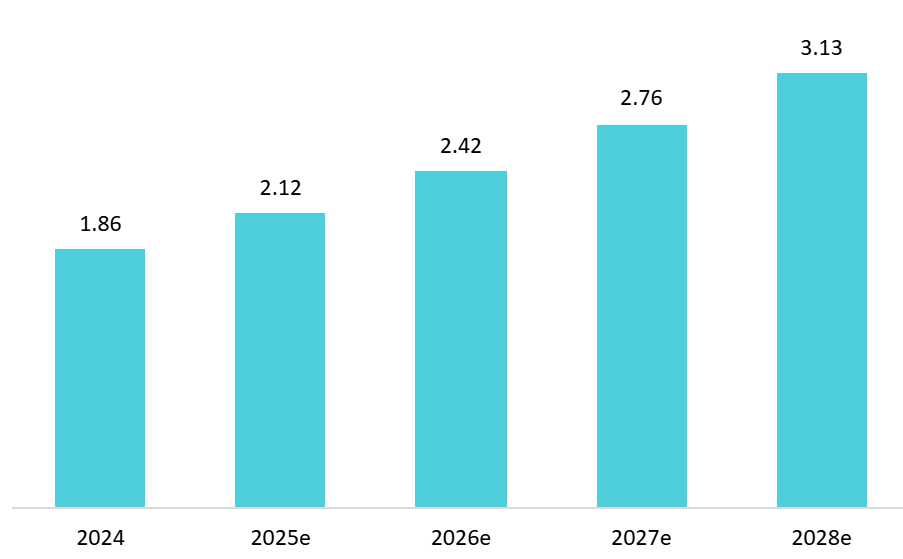

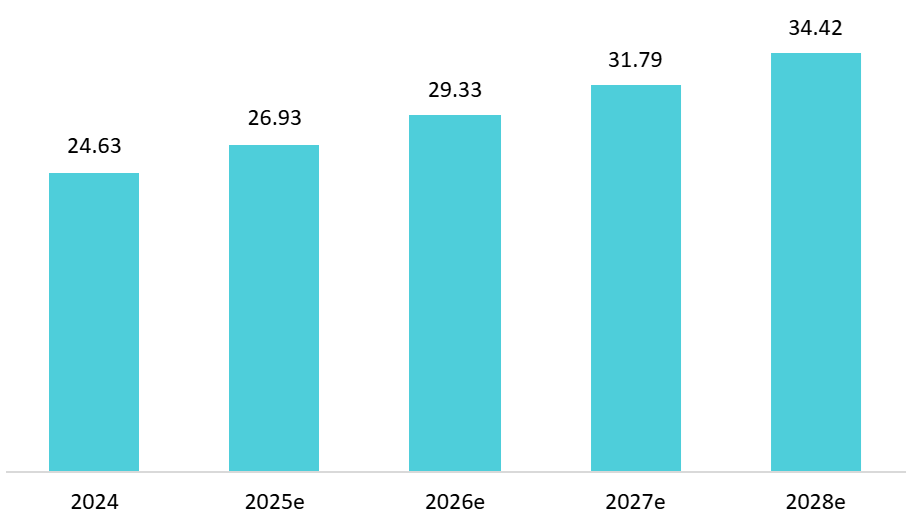

Within this growth, F&B chains are expected to increase revenue by 14.4% in 2025, reaching USD 2.12 billion, outpacing independent outlets, which are forecasted to grow at a more modest 9.3%, reaching USD 26.93 billion. This reflects a continued shift toward scaled, chain-operated formats, as consumers favor standardized quality, consistent pricing, and strong brand trust.

Revenue growth outlook for Vietnam’s F&B chain market

Unit: billion USD

Revenue growth outlook for Vietnam’s independent F&B outlets

Unit: billion USD

Source: iPOS and Nestle

Meanwhile, the F&B sector is undergoing a major structural shake-out. As of mid-2025, Vietnam recorded 299,900 active F&B outlets, reflecting a 7.1% decline compared to 2024[2]. Both Hanoi and Ho Chi Minh City saw more than 11% of their establishments exit the market within six months, continuing the “second wave of clean-up” that started in late 2023. This contraction is fueled by the proliferation of micro-scale shops that tend to “open fast – close fast – learn fast”, a dynamic intensified by rising operating costs and changes in consumer behavior. For new market entrants and expanding chains, the result is paradoxically favorable: while operational risks remain high, the wave of closures has released a significant number of high-quality street front and mall units, creating a window of opportunity for brands with strong capital, disciplined operations, and a scientific approach to location selection.

Ho Chi Minh City as a Unique and Highly Competitive F&B Hub

In this context, choosing the optimal F&B location in Ho Chi Minh City (HCMC) has become one of the most consequential strategic decisions for operators. The city’s market differs significantly from Hanoi’s, not only in scale and density but also in how consumer mobility, residential distribution, and lifestyle habits shape demand. While Hanoi’s retail geography is more centralized, HCMC functions as a polycentric network of consumption hubs, each with its own demographic clusters, rental patterns, and social rhythms.

Dense young population

Ho Chi Minh City hosts the largest concentration of restaurants in Vietnam, representing nearly 40% of all F&B establishments nationwide, almost triple the number found in Hanoi, the second-largest market[3]. The city also possesses Vietnam’s largest concentration of office workers, students, expats, and young professionals, forming high-value customer bases that support a wide range of F&B models. In the national F&B enterprise survey, 75.7% of respondents reported that office workers constitute their primary customer segment, making it the dominant consumer group in 2025[4].

This demographic concentration is especially pronounced in Districts 1 and 3, in the Binh Thanh – District 1 border, and in the newly developed Thu Duc City, where corporate offices, technology firms, startups, and universities cluster. These areas exhibit predictable daytime traffic and strong weekday consumption, which is crucial for cafés, lunch-oriented restaurants, bakeries, and fast-casual dining. This is important because HCMC has become the center of Vietnam’s 24/7 café and co-working coffee culture. Operators such as Three O’Clock, The Coffee House Signature, and independent workspace cafés report that revenue per customer can increase by up to 50% when offering late-night service, power outlets, meeting rooms, or hourly packages[5]. This trend reinforces the importance of selecting locations near educational institutions, residential complexes favored by young professionals, and corridors with strong nighttime economies.

Intense street-front competition

At the same time, inflation and rising rental costs have pressured operators across all price segments. The retail landscape in Ho Chi Minh City continues to show a clear divergence between central and non-central districts. CBD (Central Business Districts) areas such as Dong Khoi, Nguyen Hue, and Ly Tu Trong remain resilient, with steady demand supporting average asking rents of nearly USD 280/m² per month[6]. Looking ahead, the affordable and mid-range retail segments are expected to dominate tenant mix strategies, as landlords prioritize categories like F&B and lifestyle services that can reliably attract foot traffic despite economic fluctuations.

While new malls such as Centre Mall in District 6 opened with healthy occupancy levels of around 75%, many non-CBD shopping centers are experiencing rising vacancy as weaker retailers, particularly in F&B, fashion, beauty, and entertainment, close under mounting operational pressures. As a result, net absorption in Q1 2025 fell by more than 60%, pushing the citywide vacancy rate slightly higher to 7.1%, with non-CBD areas reaching 8.5%. This widening performance gap between CBD and non-CBD areas signals both risks and opportunities for F&B brands, depending on their positioning and cost structure[7].

Location Strategies for Different F&B Models in Hanoi

Rather than a single dominant downtown core, HCMC consists of several parallel consumption hubs, each driven by different lifestyle clusters, traffic flows, demographic profiles, and infrastructure development trajectories. This makes the city’s F&B location strategy inherently more complex, but also more opportunity-rich compared to Hanoi’s more centralized retail geography. Based on current market conditions, demographic patterns, real estate trends and delivery-platform data, four strategic location models will define the next 5-7 years of F&B expansion in Ho Chi Minh City.

Target High-density lifestyle Corridors rather than Traditional Prime CBD Frontages

Ho Chi Minh City’s consumption pattern is shifting away from expensive “golden-frontage” locations toward dense lifestyle corridors where daily footfall is driven by office workers, students, and young professionals. While CBD rents have grown significantly, revenue growth in those streets has not kept pace. A 100 m² retail unit on Nguyễn Huệ Walking Street (HCMC) costs 350-500 million VND per month in rent, yet average monthly revenue is only 1.2–1.8 billion VND, resulting in a gross profit margin of under 10%. Instead, corridors such as Vo Van Tan, Nguyen Dinh Chieu (District 3), Phan Xich Long (Phu Nhuan), Nguyen Gia Tri (Binh Thanh), and university-adjacent districts now outperform prime streets in both rent efficiency and repeat traffic.

These areas offer the dual advantage of strong daytime office consumption and vibrant evening economies, making them ideal for cafés, desserts, and fast-casual dining. Brands like Highlands Coffee, Phuc Long, Ong Bau, and Guta Coffee have achieved some of their strongest store-level performance along these corridors[8]. The urban lifestyle corridor thrives because HCMC’s consumers integrate café and food consumption into their daily routines, using cafés as workspaces, meeting points, or evening social anchors.

Expand into Residential Mega-clusters and Micro-neighborhoods with Strong Delivery Density

The second strategy centers on the apartment mega-cluster ecosystem, a defining feature of HCMC’s real estate landscape. The city has significantly more high-rise residential units and large-scale townships than Hanoi. Complexes like Vinhomes Central Park, Vinhomes Grand Park, Phu My Hung, Celadon City, and Cityland compounds in Go Vap each house tens of thousands of residents, forming self-contained consumption ecosystems. Delivery penetration is extremely high in these zones, especially among families, young couples, and working adults who prefer the convenience of app-based ordering[9]. Vietnam F&B industry report also highlights that delivery demand in mega-compounds is rising faster than in traditional street-front areas. F&B brands operating inside or adjacent to these residential ecosystems benefit from lower rental risk, stable foot traffic from residents, and consistently strong delivery density – a balance rarely achievable in CBD locations.

Leverage emerging “Hidden gems” Micro-locations aligned with Gen Z behavior

One of the most significant shifts in Vietnam’s F&B landscape, especially in Ho Chi Minh City is the rapid rise of micro-locations hidden within small alleys, secondary streets, and sub-commercial zones. Gen Z, now Vietnam’s largest F&B consumer group, no longer prefers flashy spaces but seeks authenticity, convenience, and quality. Case studies such as The Alley, where 7/10 branches in HCMC are located in lanes < 3m wide yet earn 1.2-1.5 billion VND monthly[10], demonstrate that strategically selected “hidden gem” locations can outperform expensive main-street sites. F&B brands should deploy data-driven micro-location selection, prioritizing youth-dense clusters (universities, co-working hubs, dormitories) within 1-3 km from CBD where consumption remains high, but competition and rent are lower. Popular streets like Tran Phu (District 5), Nguyen Gia Tri (Binh Thanh), and Su Van Hanh (District 10) now have high-performing alley-based F&B clusters where foot traffic is organically generated by students, young professionals, and delivery drivers, not by traditional retail visibility.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[1] https://ipos.vn/bao-cao-nganh-fnb-2024/

[2] https://b-company.jp/the-trend-of-mass-closure-of-fb-stores-in-the-first-half-of-2025/

[3] https://viracresearch.com/overview-of-fb-market-in-2022-trends-for-2023/

[4] https://ipos.vn/fnbreport1h2025/

[5] https://ipos.vn/fnbreport1h2025/

[6] https://www.cbrevietnam.com/insights/figures/ho-chi-minh-city-figures-q1-2025

[7] https://www.cbrevietnam.com/insights/figures/ho-chi-minh-city-figures-q1-2025

[8] https://asia.nikkei.com/Business/Business-trends/

[9] https://b-company.jp/vietnams-fb-industry-consumer-shifts-city-insights-and-investment-outlook/

[10] https://vietstock.vn/2025/09/cuoc-tai-dinh-vi-cua-cac-chuoi-ca-phe-118-1356397.htm