04Nov2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

The first half of 2025 saw a large-scale wave of closures in Vietnam’s food and beverage (F&B) sector, with more than 50,000 outlets shutting down. This occurred amid rising costs for ingredients, labor, and premises, alongside a softening in consumer demand. The “open fast – close fast” phenomenon indicates the market is entering a shakeout phase, in which brands with solid fundamentals and clear value propositions tend to hold firm and expand, while weaker models retreat.

F&B Market Overview

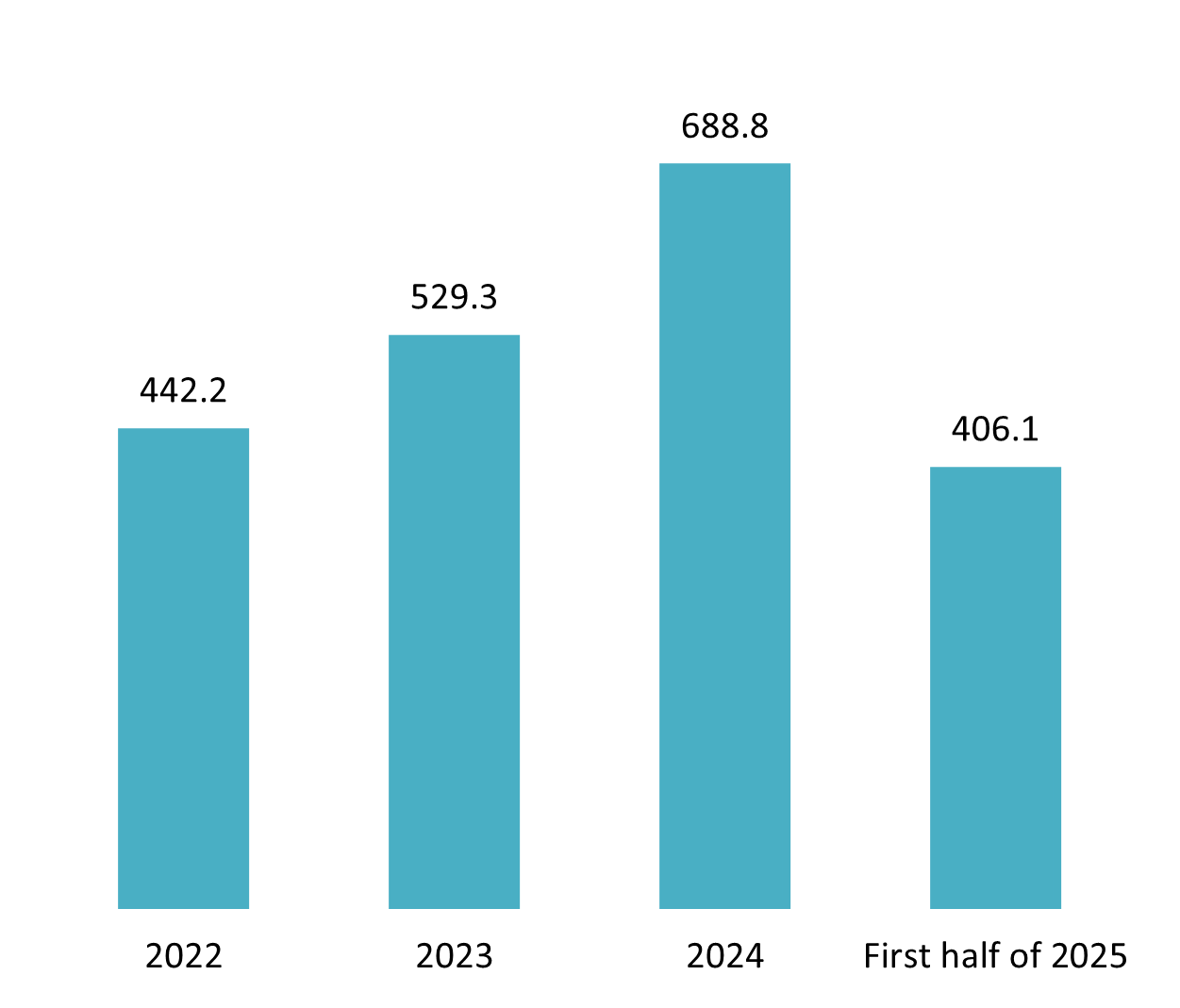

In the first half of 2025, revenue in Vietnam’s F&B market is estimated at VND 406.1 trillion—equivalent to 58.9% of total revenue in 2024 and only a slight increase from the same period last year (VND 403.9 trillion). This growth is considered below expectations, as earlier forecasts projected around 10% growth for 2025. Given current consumption momentum, the second half of the year is likely to grow by at most about 9.6% compared to the first half, in line with the projected scenario [1].

Vietnam F&B market revenue (2022 – H1 2025)

Unit: trillion VND

Source: IPOS

In terms of structure, Vietnam’s F&B market is highly fragmented, with tens of thousands of small standalone outlets operating alongside large-scale chains. By 2025, the number of modern trade F&B chains is estimated to reach nearly 5,000, still a very small number compared to the total of over 331,000 F&B stores[2]. The main models include fast and convenient quick-service restaurants (fast food), coffee and milk-tea chains, traditional eateries, and bars/pubs. In non-alcoholic beverages, coffee and milk tea account for a notable share.

Store supply is shrinking markedly. By the end of Q2 2025, the total number of F&B outlets stood at about 299,900, down 7.1% from 2024. Notably, both Hanoi and Ho Chi Minh City recorded declines of over 11%, reflecting a simultaneous slowdown in the two market flagships. The reason is first six months of the year are typically a natural market shakeout before entering a cycle of new openings and restructuring, as large chains focus on restructuring, exiting unprofitable locations, and potentially opening new ones elsewhere[3].

Nevertheless, the market remains highly dynamic, as new domestic and foreign F&B brands continue to enter Vietnam and expand their presence, especially in the café and milk tea sectors. Several foreign F&B brands have successfully entered the Vietnamese market recently. In the beverage segment, CHAGEE (China) and The Venti (South Korea) have made notable debuts, while the Japanese casual Italian restaurant chain Saizeriya opened its first branch at Giga Mall, Ho Chi Minh City, in May this year.

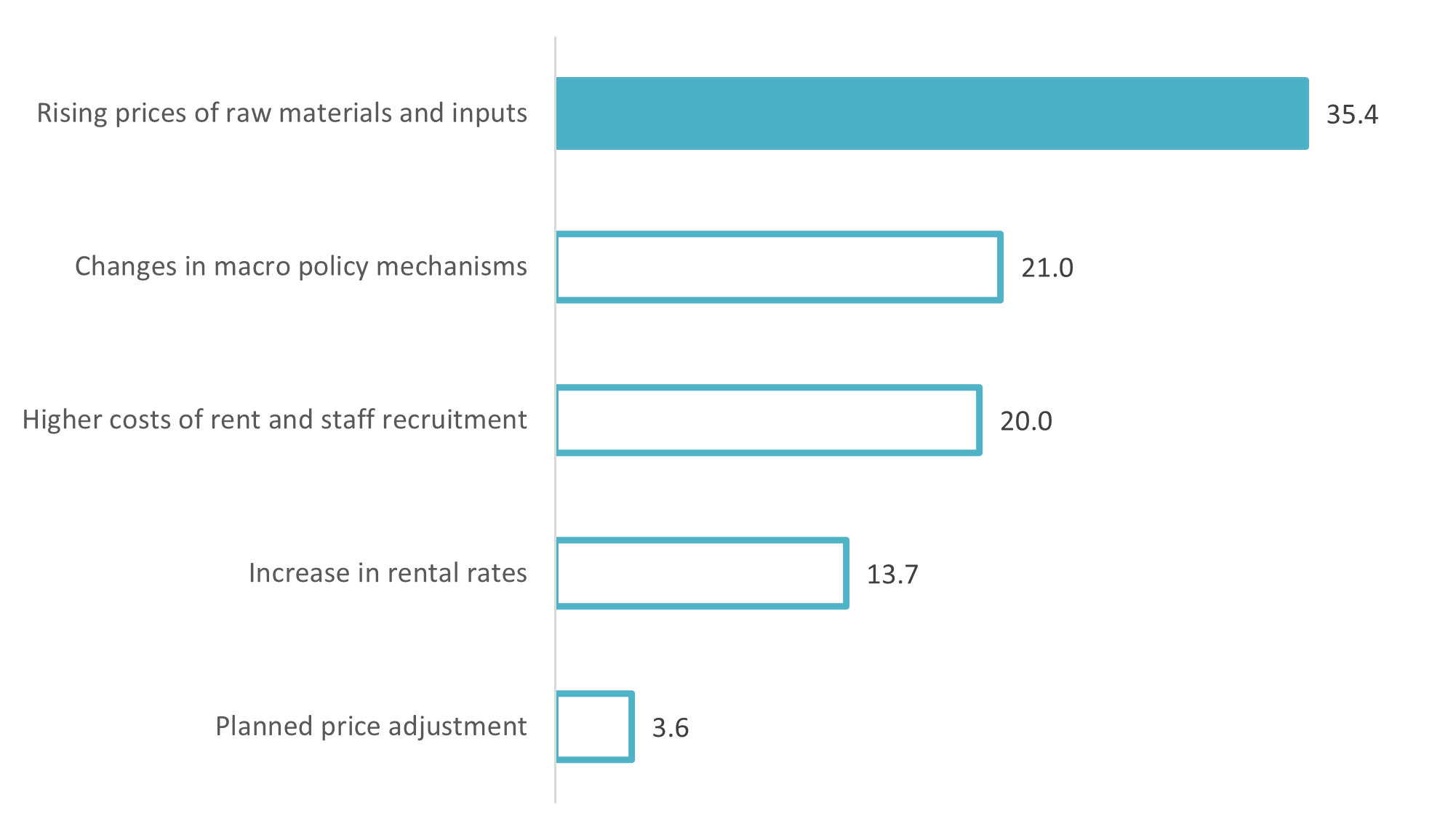

Factors prompting F&B businesses to increase prices

Unit: %

Source: IPOS

Market Trends

The Vietnamese F&B market is changing fast after a tough period. The points below show a major shakeout, the need to adjust prices quickly, and the growth of ultra-low-price formats in HCMC.

– Intense shakeout: The F&B market is entering a restructuring cycle; nearly 18% of businesses are in severe decline, while stable/growing players dominate. 2025 is a “natural filter”: brands that are agile and operationally efficient will rebound; slow adapters risk being weeded out.

– Pricing based on adaptability: Pricing capability now reflects competitive strength. Brands with clear positioning, differentiated products, and loyal customer bases can adjust prices proactively; those reliant on price-sensitive customers risk revenue drops without a supporting strategy.

– Boom of ultra-low-price formats in HCMC: “7K VND–69K VND” models use loss-leader pricing to attract traffic and lift ticket size via toppings/add-ons/combo. They run lean (trimmed menus, takeaway focus) and locate near residential and student areas to optimize costs and throughput.

– Coffee x co-working: Spreading across Hanoi and HCMC (e.g., Workflow Space, Contrast Coffee, Tiny Cafe), these formats maximize premises nearly 24/7, offering quiet zones, meeting rooms, and membership plans to serve flexible work and relaxation needs.

– Consumer dining behavior is showing new trends: specifically, office workers are eating out for lunch more often but spending more cautiously, while weekend dining is more frequent and spending more – especially at mid-range and experiential restaurants – indicating a gradual shift from budget options to more value-focused formats.

The “Vien Vien” Bubble tea shop with super cheap prices from only 7K VND

Source: Tra sua Vien Vien

“Tiem lau nha An” with fish hot pot for only 69k VND

Source: vietinsiders

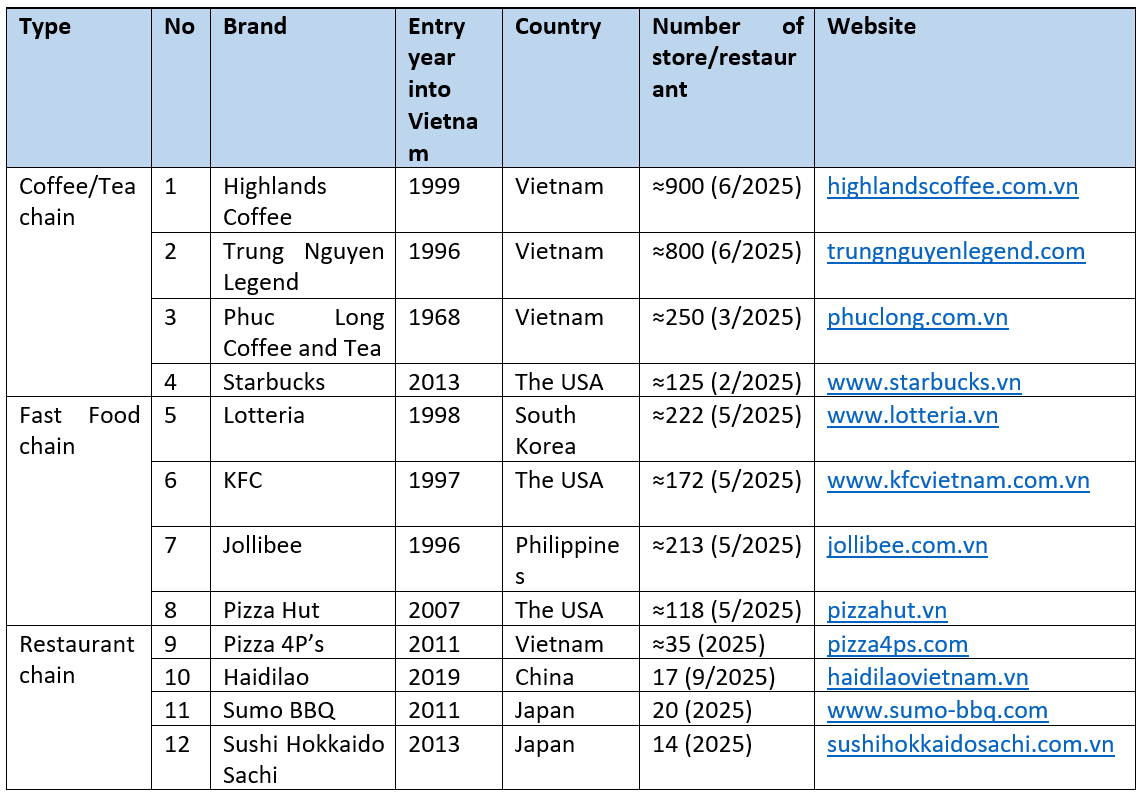

Representative F&B brands in the Vietnamese market

Vietnam’s F&B market includes both major local brands and international chains. It spans many categories, from tea and coffee to fast food and large, experience-focused restaurants.

Source: B&Company’s synthesis

Large chains still have a dense footprint, but signs of consolidation have appeared after a period of rapid expansion. Coffee/tea players remain relatively resilient thanks to flexible formats (kiosks, partnerships within retail ecosystems). By contrast, fast-food chains are under margin pressure: most are streamlining menus, closing underperforming sites, and prioritizing high-traffic locations or delivery-attached stores. In full-service restaurants, where networks are smaller and operating costs higher, strategies are shifting toward “destination” venues rather than mass rollouts.

Implications for investors

The shakeout that is reducing store counts is creating gaps in both locations and demand—a clear opening for new entrants with flexible business models. The standout growth windows lie in office-worker lunches (high frequency, fast & tasty) and weekend dinners, where consumers are willing to pay more for destination experiences. Even after experimenting with ultra-cheap food, consumers lean toward the mid-tier for its balance of quality and stable pricing, providing a durable demand base for brands that standardize quality and price transparently.

The market is entering a strong filtering phase, eliminating inefficient outlets and raising operating standards. New entrants will face head-to-head competition with large, established chains with strong brands—and also with emerging ultra-low-price concepts. At the same time, rising input costs and other expenses (rent, labor, logistics, and delivery platforms) are squeezing margins, requiring disciplined operations and supply-chain management.

Recommendations for investors entering Vietnam’s F&B market

(1) Site selection: prioritize clusters around office buildings for fast, convenient lunch formats (kiosks/takeaway/combos), plus a few weekend destination sites focused on experience (ambiance, shareable menus, beverage upsell).

(2) Scenario-based pricing: build a three-tier playbook (value–mid–premium) and track input-cost movements closely to make differentiated, incremental price adjustments instead of sharp hikes.

(3) “Light-capex, test-fast, scale-fast” model: pilot each site for 6–8 weeks at low cost; if KPIs are met, scale by clusters of 3–5. Emphasize takeaway/delivery-friendly formats to serve peak lunch hours quickly.

(4) Strengthen PR and marketing activities: through short content that exploits lifestyle and culinary trends of young office workers and urban weekend diners. At the same time, brands should highlight the value and experience aspects of space, social sharing appeal, and limited-time offers.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[1] https://ipos.vn/

[2] https://sinhvien.dinhtienminh.net/

[3] https://cafef.vn/