20Oct2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Japanese retailers are expanding rapidly in Vietnam thanks to vibrant consumer demand, strong urbanization, and the appeal of modern retail models combined with e-commerce. The advantage of “Japanese quality” helps them easily gain trust, while Vietnamese consumers increasingly pay attention to store experiences, services, and products with streamlined designs and reasonable prices.

Overview of the retail market in Vietnam and Japan

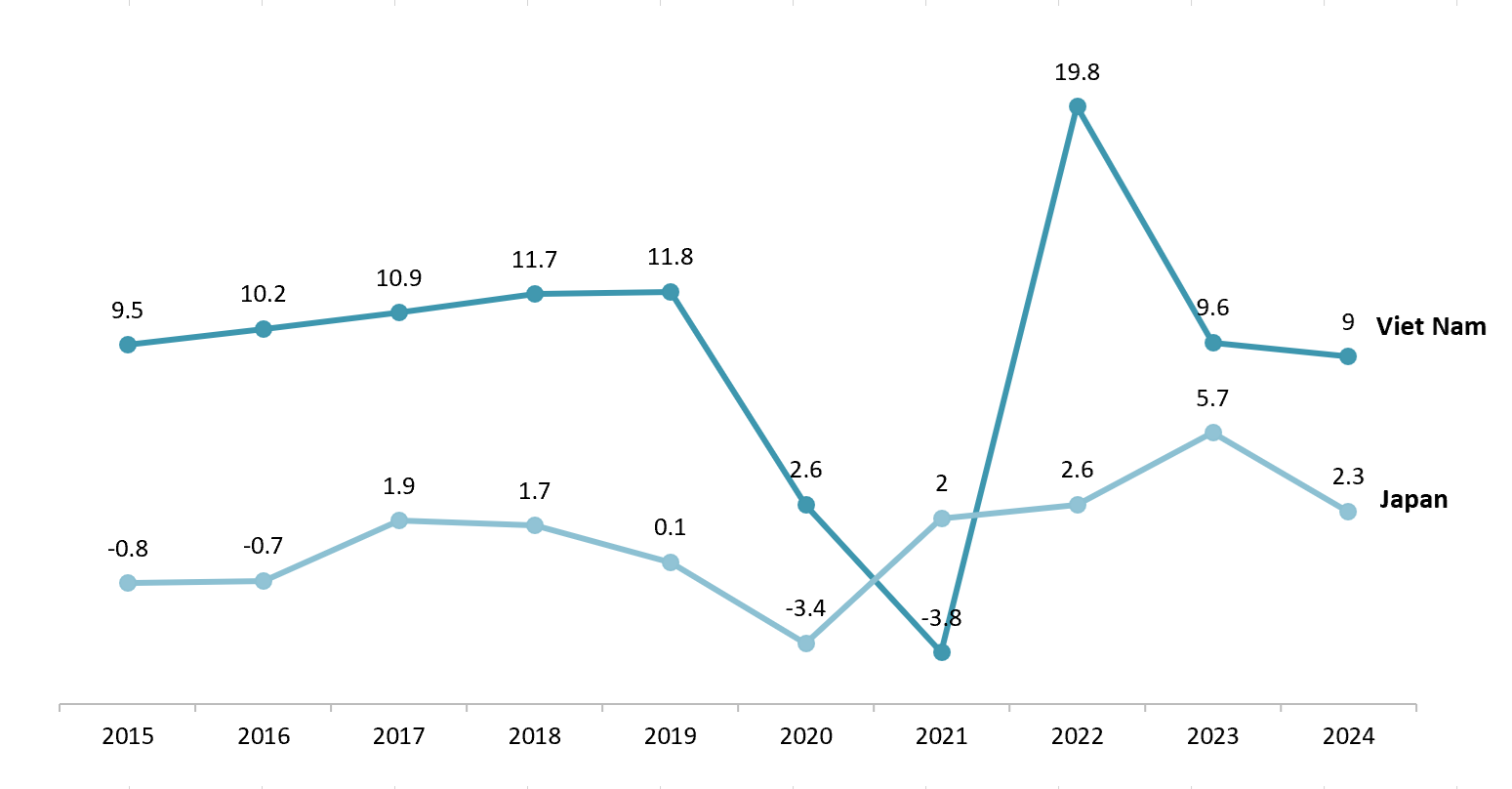

Japan’s nominal retail growth after the pandemic follows a “bounce-then-cool” trajectory: 2022: +2.6%, 2023: +5.7%, 2024: +2.3%. This reflects a recovery in purchasing power in 2023 and then a slowdown in 2024 as the price environment and real incomes put pressure on consumption[1]. Meanwhile, the scale of retail sales of goods and services in Vietnam is growing rapidly and steadily: 2022: +19.8%, 2023: +9.6%, 2024: +9.0%. This is a high-growth chain thanks to the recovery of domestic demand after Covid, the reopening of service tourism, and the expansion of modern retail channels[2]. In the medium and long term, many sources forecast that the Vietnamese retail market will continue to increase steadily until 2030. According to Mordor Intelligence, the market size is expected to reach 162.87 billion USD (2025) and 209.19 billion USD (2030), CAGR ≈ 5.13% in the period 2025–2030[3].

Nominal retail sales growth of goods and services in Vietnam and Japan

Unit: %

Source: General Statistics Office of Vietnam and Focus Economics

In addition, the retail channel structure in Vietnam is shifting: according to the synthesis from 2020-2024, the traditional channel decreased its proportion from 73% to 61%, while the “modern retail channel” increased from 22% to 29% and e-commerce from 5% to 10%. This creates a large space for retailers with the capacity to operate chains and optimize their portfolios[4].

In terms of location, Hanoi and Ho Chi Minh City are still the “locomotives”, but the satellite industrial provinces (Bac Ninh, Hung Yen, Hai Phong; Binh Duong, Dong Nai, Long An) have emerged thanks to their worker population, commercial land fund and new shopping center infrastructure. AEON’s plan to expand its chain to 2030 is a clear indicator of the trend of “going to the province”[5].

Market trends of Japanese retailers in Vietnam

As modern trade matures in Vietnam, Japanese retailers are deepening their presence. The trends below show how they are expanding—through diversified formats, “Japan-quality” positioning, a category shift toward beauty/health, and faster O2O integration.

– Expanding diverse store models: Japanese retailers are accelerating the opening of new points of sale with many types. AEON is promoting both suburban shopping malls and small-scale supermarkets in the inner city to expand the market[6].

– Brand positioning and Japanese style experience: Japanese retailers focus on bringing a Japanese experience that is unique in quality and service. Products at Japanese chains are highly appreciated for their good quality and strict control processes – factors that have convinced Vietnamese people to trust Japanese products for many years[7].

– Changes in priority product categories: Previously, Japanese chains were mainly famous for household goods and food, but recently, the cosmetics and health care group has grown strongly. Matsumoto Kiyoshi (Japan’s leading pharmaceutical and cosmetic chain) has continuously expanded in Vietnam, showing that Vietnamese people increasingly prefer Japanese cosmetics and functional foods[8].

– O2O trends and the role of e-commerce: The period 2023–2025 will see Japanese retailers actively deploying the online-to-offline (O2O) model. Many Japanese businesses have put their products on e-commerce platforms or opened their own sales websites. For example, AEON Vietnam has developed multi-channel services such as shopping via phone, AEON Eshop website, and home delivery, integrated with membership programs[9].

Matsumoto Kiyoshi Vietnam Store

Source: Báo Dân Trí

Main Japanese retailers in Viet Nam

The Vietnamese retail market currently has the presence of several typical businesses, ranging from shopping malls and supermarkets to convenience stores, fashion and lifestyle, household appliance, and pharmaceutical retail chains. The presence forms are diverse, from subsidiaries to joint ventures. Geographically, the focus is still on Hanoi-HCMC, but suitable models help brands to be ready to expand to industrial clusters.

| Type | No | Company | Entry year to Vietnam | Number of stores | Main store location | Website |

| Shopping Mall | 1 | AEON Mall VN | 2014 | 11 | Ha Noi, HCMC | https://aeonmall-vietnam.com |

| 2 | Takashimaya VN | 2016 | 1 | HCMC | https://www.takashimaya-vn.com | |

| Supermarket | 3 | AEON MaxValu | 2014 | 20 | Ha Noi, HCMC | https://aeonmaxvalu.aeon.com.vn/ |

| 4 | FujiMart | 2018 | 19 | Ha Noi | https://fujimart.vn/ | |

| Convenience store | 5 | Ministop | 2015 | ~ 187 | Ha Noi, HCMC | https://www.ministop.vn/vi |

| 6 | FamilyMart VN | 2009 | ~ 160 | HCMC | https://www.familymart.com.vn | |

| 7 | 7-Eleven VN | 2017 | ~130 | HCMC | https://www.7-eleven.vn | |

| Fashion/ Lifestyle | 8 | Uniqlo | 2019 | 30 | Ha Noi, HCMC | https://www.uniqlo.com/vn |

| 9 | MUJI | 2020 | 17 | Ha Noi, HCMC | https://www.muji.com/vn | |

| Household appliance | 10 | Kohnan | 2016 | 16 | Ha Noi, HCMC | – |

| 11 | Daiso | 2008 | 9 | Ha Noi, HCMC | https://www.daisovietnam.com/ | |

| 12 | Nitori | 2023 | 4 | HCMC | https://www.nitori.com.vn/vi | |

| Drug store | 13 | Matsumoto Kiyoshi VN | 2020 | 17 | Ha Noi, HCMC | https://matsumotokiyoshi.com.vn |

Source: B&Company compilation

Japanese retail chains are accelerating expansion in Vietnam along two tracks: (1) speeding up format roll-outs and network density in major cities, and (2) adding new niches—drugstores, home-furnishing, and home centers—to meet modern shopping habits. In fashion/lifestyle, after building coverage in Hanoi and HCMC, UNIQLO announced a move into the Central region with its first Hue store in 2025, signaling a region-by-region scaling strategy rather than scattered single points. In hypermarkets/malls, AEON plans to triple scale by 2030 (from 8 to 16 malls while aggressively growing supermarkets and small-medium size supermarket formats), reinforcing its role as “retail infrastructure” for Japanese goods and allied partners such as Sumitomo’s FujiMart (which reached 19 stores in Hanoi as of June 2025). In home-furnishing, Nitori opened its first store at SORA gardens SC (Binh Duong) in December 2023 and is scouting further sites—evidence that the “Japanese interiors & homeware” wave is entering a new cycle following Kohnan’s home-center market entry in 2016. In health & beauty, after Matsumoto Kiyoshi (2020), Tsuruha launched its first store in HCMC in August 2025, suggesting a two-horse race in Japanese drugstores that could scale quickly on service standards and private-label assortments.

Implications for the Japanese retailer for market entry

From a market-entry perspective, Vietnam is sustaining strong domestic demand, providing a stable foundation for chain formats and network expansion. A young, rapidly urbanizing consumer base tends to prioritize “quality–safety–reliability,” while the “Made in Japan” image is widely associated with high quality and worth paying for. Consumer surveys such as Q&Me repeatedly find that Japan maps to “High quality/Trust/Worth paying,” and accelerating digital adoption is widening the space for O2O models, enabling Japanese brands to connect online and offline seamlessly.

Opportunities, however, come with challenges. Competition between foreign and domestic players is intensifying, demanding sharper category differentiation and operational discipline. In beauty, pressure from Korea and local rivals is especially visible on e-commerce platforms: K-beauty has accelerated quickly (Shopee Korea reported that orders shipped to Vietnam rose more than fivefold during 2021–2023) and commands a sizable import share. If Japanese assortments refresh slowly or lack an “entry price” tier, they risk falling behind shifting trends.

Strategically, Japanese retailers can prioritize in:

– For product and brand, preserve the core of Japanese quality while localizing taste, sizing, and packaging; add an opening price point and limited editions to capture momentum. Increase the innovation cadence (quarterly/monthly) and use rapid online test-and-learn before scaling offline to curb inventory risk and optimize product lifecycles.

– On channels, combine mall locations with small/compact stores to improve coverage and cost efficiency, and deploy Click & Collect, ship-from-store, and marketplace presence to broaden digital touchpoints.

– For location strategy, beyond Hanoi and HCMC, a sensible trajectory includes the Central region (Hue/Da Nang), the Southern industrial belt (Binh Duong/Dong Nai), and Northern provinces near ports/industrial parks (Hai Phong/Bac Ninh/Thai Nguyen).

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[2] NSO Vietnam+2NSO Vietnam+2.