09Jan2026

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s supermarket market is undergoing steady expansion as part of the broader transition toward modern retail. The sector is shaped by strong domestic retailers, increasing participation from foreign players, and evolving consumer expectations around quality, transparency, and shopping experience. Structural changes in distribution, geographic expansion beyond major cities, and supportive regulatory reforms are accelerating the shift away from traditional trade. Together, these dynamics position supermarkets as a great potential within Vietnam’s modern retail ecosystem.

Overview of the Vietnamese Supermarket Market

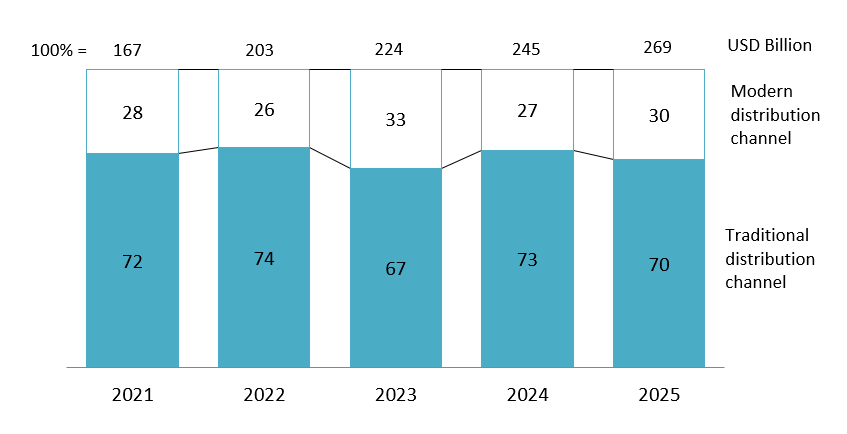

In 2025, the total retail sales of goods and services nationwide reached USD 269 billion, a 10% increase compared to 2024. By 2025, modern retail channels (including e-commerce, supermarket, shopping malls, convenient stores, specialty stores) represent around 30% of total retail sales, a 22% increase compared to 2024. This indicates the higher growth rate of modern channels. The room for growth is still large thanks to higher consumer spending and retail modernization[1].

Total retail sales of goods and services revenue by Distribution channels (2021-2025)

Source: Agency for Domestic Market Surveillance and Development – Ministry of Industry and Trade

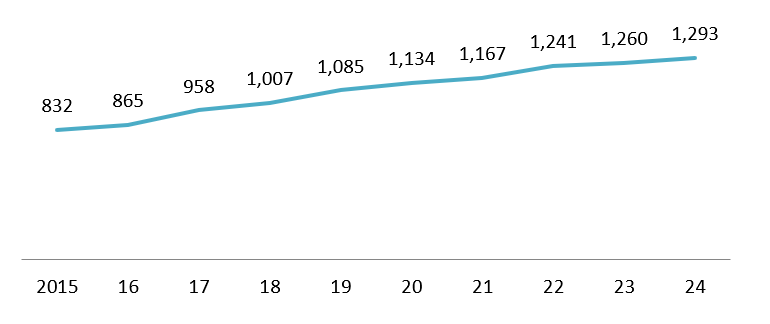

The number of supermarkets has risen over the past decade, reflecting the strategic importance of modern, organized retail formats compared with traditional markets, which remain large but comparatively stagnant. The number of supermarkets increased every year with a CAGR of 5% in the period of 2015-2024. On the other hand, the number of traditional markets dropped from 8,660 in 2015 to 8,274 in 2024, indicating a CAGR of –0.51%[2].

Number of supermarkets nationwide 2015-2024

Unit: Supermarkets

Source: National Statistics Office

Main players in the market

Vietnam’s supermarket sector is shaped by a mix of large domestic retail groups and established foreign retailers, reflecting the broader structure of modern trade development

Major players in the market

| No. | Company | Country of origin | Chain Names | Geographical distribution |

| 1 | Masan Group | Vietnam | Winmart | Nationwide |

| 2 | Saigon Co.op | Co.opmart | Nationwide | |

| 3 | Central Retail | Thailand | Big C, Go!, Top market | Urban and Suburban |

| 4 | TCC Corporation | MM Mega Market | Urban Centers | |

| 5 | LOTTE Group | Korea | LOTTE Mart | Major Cities |

| 6 | AEON Group | Japan | AEON Mall, AEON MaxValu | Major Cities |

| 7 | BRG &

Sumitomo Corporation |

Vietnam & Japan | Fujimart | Hanoi focus |

Source: B&Company Synthesis

Domestic retailers dominate Vietnam’s supermarket landscape in terms of store coverage, supply chain localization, and consumer familiarity. WinMart, operated by WinCommerce under Masan Group, is positioned as a nationwide supermarket chain that integrates food retail with Masan’s broader FMCG ecosystem. Ever since owning the retail system, WinCommerce has aggressively expanded its distribution network, particularly in rural areas, which remain underserved by other retailers. In 2025 alone, the company opened around 800 new stores, with about 70% located in rural areas[3]. Saigon Co.op is one of Vietnam’s earliest and longest-standing retailers. Originally serving Ho Chi Minh City and southern provinces, it has expanded significantly into northern provinces over the past decade[4].

Foreign retailers contribute significantly to raising operational standards, store design, and assortment sophistication in Vietnam’s supermarket market. AEON supermarkets are typically embedded within large shopping malls and target middle- to high-income consumers. Lotte Mart focuses on large-format supermarkets with a mix of imported and local goods, appealing to urban family shoppers[5]. Central Retail’s chains have strong nationwide coverage and play an important role in linking Vietnamese agricultural products to organized retail distribution[6].

AEON Xuan Thuy supermarket

Source: Bao dau tu

Overall, the competitive landscape reflects a clear division of strengths: domestic supermarket chains excel in localization, price sensitivity, and supply chain flexibility, while foreign players compete through branding, shopping experience, and quality assurance. Competition between these groups has accelerated improvements in logistics, private labels, and supplier standards across the entire sector. Rather than displacing local players, foreign supermarkets have intensified competitive discipline, contributing to the maturation of Vietnam’s supermarket market within the broader modern trade ecosystem.

Upcoming trends in the market

Rising Demand for Quality, Traceability, and Omnichannel Shopping

Vietnamese consumers are increasingly quality- and experience-oriented. It is highlighted that brand reputation, product origin transparency, and quality have moved up consumer priorities, reflecting heightened expectations in supermarket choice[7]. Grocery shoppers increasingly seek traceability, fresh produce, and well-curated assortments, alongside digital engagement such as app-based promotions and personalized communications. Omnichannel experiences where physical supermarket visits integrate with online services are shaping how consumers shop, indicating that traditional offline-only supermarket models may lose ground if they do not embrace technology.

Growing Presence of Domestic Products

Supermarkets have become important distribution platforms for Vietnamese agricultural and food products, which now account for approximately 85–90% of shelf space in many modern retail chains of Saigon Co.op[8]. Government programmes promoting domestic consumption further reinforce this trend. The growing presence of Vietnamese produce in supermarkets enhances consumer trust while strengthening domestic supply chains and supporting local producers.

Expansion beyond Major Cities and Store format changes

Supermarket expansion is moving beyond Hanoi and Ho Chi Minh City to second and third-tier cities and even rural zones. Cities like Da Nang, Can Tho, and Hai Phong are becoming strategic targets due to rising incomes and less saturated retail markets. The rural areas are not only tapped into by local brands but also foreign brands such as Central Retail[9]. Additionally, hybrid formats that blend supermarket breadth with convenience appeal are emerging, as players develop mid-sized and mini supermarkets that capture both every day and bulk shopping occasions[10]. These format innovations reflect efforts to meet diverse consumer schedules and preferences

Regulatory Accelerating Modern Retail

Government policy plays a central role in shaping supermarket development. The Retail Market Development Strategy to 2030 emphasizes modernising retail infrastructure, improving supply chain efficiency, and integrating digital technologies[11]. Regulatory focus on food safety, domestic product promotion, and digital transformation supports supermarket expansion while encouraging higher operational standards. The issuance of Decree No. 70/2025/NĐ-CP on invoices and records also enhances transparency, requires traditional retail channels to adopt, and poses an advantage for modern retail channels[12].

Implications for Foreign Investors

Vietnam’s supermarket sector presents significant long-term opportunities, underpinned by structural shifts toward modern retail, supportive government policies, and evolving consumer behavior. However, competitive and operational challenges remain. Domestic retailers benefit from deep localization, dense store networks, and strong supplier relationships, making market entry difficult for foreign players without local adaptation. Price sensitivity among consumers, especially outside major cities, further constrains purely premium positioning strategies.

To capitalize on Vietnam’s supermarket growth while mitigating market entry risks, foreign investors are advised the following actions:

– Pursue partnerships or joint ventures with local retailers, suppliers, or logistics providers to accelerate localization and regulatory compliance.

– Differentiate beyond price by focusing on quality assurance, private labels, in-store experience, and supply chain transparency.

– Localize product sourcing to align with “Vietnamese-first” consumption policies and consumer trust in domestic goods.

– Adopt an omnichannel operating model, integrating physical supermarkets with digital platforms, loyalty systems, and data-driven promotions.

– Target selective geographies and formats. Foreign brands are performing well in urban centers because of unique offerings and premium positioning. They can consider other areas such as secondary cities, where modern retail penetration is still developing and competition is less intense.

Vietnam’s supermarket market offers structural, policy-supported growth, but success for foreign investors depends less on scale alone and more on local integration, regulatory readiness, and strategic differentiation.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[1] Vietnam News, Việt Nam a potential investment market for retailers (https://vietnamnews.vn/economy/1635878/viet-nam-a-potential-investment-market-for-retailers.html)

[2] National Statistics Office, Number of supermarkets as of annual 31st December by province (https://www.nso.gov.vn/en/px-web/?pxid=E0804&theme=Trade%2C%20Price%20and%20Tourist)

[3] CafeF, According to statistics from the Ministry of Industry and Trade: WinCommerce and Long Châu are the largest retail and pharmaceutical chain businesses in Vietnam.(https://cafef.vn/bo-cong-thuong-thong-ke-wincommerce-long-chau-lon-nhat-viet-nam-nganh-ban-le-chuoi-duoc-pham-188260104192018776.chn)

[4] Agency for Domestic Market Surveillance and Development – Ministry of Industry and Trade, Report on Vietnam’s Domestic Market 2025 (https://dms.gov.vn/documents/d/guest/bc-ttnd-2025-pdf)

[5] Lotte Mart, Network (https://lottemart.com.vn/he-thong/)

[6] Central Retail, Business Activities (https://centralretail.com.vn/hoat-dong-kinh-doanh/thuc-pham/)

[7] Vietnam Report, Top 10 Reputable Retail Companies in 2025 (https://vietnamreport.net.vn/Top-10-Cong-ty-uy-tin-nganh-Ban-le-nam-2025-11262-1006.html)

[8] Agriculture and Environment, Vietnamese produce anchors supermarket shelves ahead of Tet 2026 (https://van.nongnghiepmoitruong.vn/vietnamese-produce-anchors-supermarket-shelves-ahead-of-tet-2026-d790979.html)

[9] Nhip cau dau tu Magazine, Supermarket comes to the village. (https://nhipcaudautu.vn/kinh-doanh/sieu-thi-ve-lang-3362357/)

[10] The gioi tiep thi, Mini-supermarkets, scattered throughout residential areas, are becoming increasingly prevalent. (https://thegioitiepthi.danviet.vn/sieu-thi-mini-mo-len-loi-trong-khu-dan-cu-chiem-uu-the-20240903153105421-d28734.html)

[11] Decision No. 2326/QĐ-TTg Approving the Strategy for the Development of the Vietnamese Retail Market to 2030, with a vision to 2050 (https://thuvienphapluat.vn/van-ban/Thuong-mai/Quyet-dinh-2326-QD-TTg-2025-Chien-luoc-phat-trien-thi-truong-ban-le-Viet-Nam-den-2030-677998.aspx)

[12] SHS Research, Retail Market Report 2025 (https://s3-storage.shs.com.vn/shs-website/NGANH_BAN_LE_HANG_TIEU_DUNG_DEC_2025_ef112c5cbc.pdf)