11Feb2025

Latest News & Report / Vietnam Briefing

Comments: 1 Comment.

Vietnam’s ride-hailing market is one of Southeast Asia’s most dynamic sectors, reflecting the country’s rapid urbanization and digital transformation. With Bolt’s recent foray into entering Vietnam, the market is poised for further competition.

Overview of Vietnam’s ride-hailing market

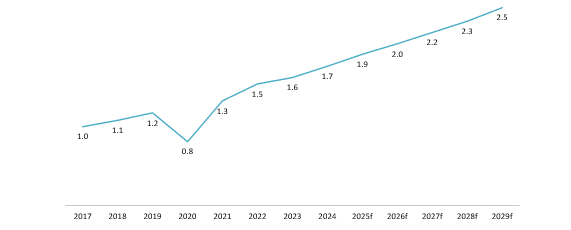

Vietnam has emerged as a hotspot for ride-hailing services. In 2024, Vietnam’s ride-hailing market was valued at 1.7 billion USD with a 9% growth rate[1]. The burgeoning market quickly rebounded after the COVID-19 pandemic in 2020 with a CAGR of over 8% to increase from 1.3 billion USD in 2021 to an estimated 2.5 billion USD in 2029. The adoption of ride-hailing services has also been growing steadily, from 22.8 million to 28.1 million users between 2017 and 2024, reaching 37 million users in 2029, corresponding with a penetration rate of 36%. Key urban cities such as Ho Chi Minh and Hanoi see most activities of the industry and ride-hailing services have become an integral part of everyday activities[2].

Total revenue of Vietnam’s ride-hailing market (Unit: Billion USD)

Source: Statista Market Insights

The ride-hailing market, encompassing on-demand transportation via mobile apps, is thriving due to Vietnam’s expanding digital economy and demand for affordable, convenient transport. With 4G mobile broadband covering 99.8% of the country in 2023 and 84% smartphone penetration, ride-hailing apps are easily accessible to both users and drivers[3]. Vietnam lacks a comprehensive and adequate public transportation system to meet the citizens’ needs, making ride-hailing services highly desirable due to its availability[4]. Furthermore, ride-hailing services attract potential young users through cheaper pricing schemes, fueling its growing user base[5]. A typical two-wheeler ride will cost around 13,000 VND (0.5 USD) for the initial two kilometers, then 5,000 VND ($0.2) per additional kilometer. Four-wheeler fares start at around 29,000 VND (1.2 USD) and incrementally rise by 10,000 VND (0.4 USD).

Table 1: Ride fares in Ho Chi Minh City of major ride-hailing apps in Vietnam

| No. | Services | Vehicle | Minimum fare for the first 2 km (Unit: VND) | Fare per additional km

(Unit: VND/km) |

| 1 | GrabBike | Two-wheeler | 11,700 – 16,000 | 4,300 – 5,300 |

| 2 | beBike | Two-wheeler | 13,2000 – 14,500 | 4,328 – 5,000 |

| 3 | Xanh SM Bike | Two-wheeler | 12,200 – 15,700 | 4,200 – 5,200 |

| 4 | GrabCar | Four-wheeler | 26,700 – 34,200 | 9,100 – 13,000 |

| 5 | beCar | Four-wheeler | 30,500 – 36,400 | 10,300 – 12,400 |

| 6 | Xanh SM GreenCar | Four-wheeler | 20,000 (Base fare) | 12,000 – 15.500 |

Source: Grab, Be, Xanh SM, B&Company synthesis

Emerging trends continue to enhance service quality and user experience. Mobile wallets such as MoMo, ZaloPay, and VNPay, popular among younger consumers, have partnered with ride-hailing platforms to enable seamless cashless payments[6]. Additionally, the diversification of services—including motorbike taxis, deliveries, and food delivery—creates an ecosystem that caters to Vietnam’s fast-paced urban lifestyle to drive consumer engagement. Lastly, leading ride-hailing companies have worked on addressing peak-hour challenges, such as Grab who has been working on new in-app functions to make rush-hour rides more affordable[7].

Competition landscape of Vietnam’s ride-hailing market

The domestic ride-hailing market is characterized by intense competition with frequent shakeouts. Currently, the market is mainly dominated by three players, which are Grab, Xanh SM (GSM), and Be.

– Grab: Since entering Vietnam in 2014, Grab has maintained market leadership, holding a 60% share by the end of 2023[8]. Its success stems from a broad service portfolio—including ride-hailing, food delivery, and financial services—along with an extensive driver network and aggressive promotions, making it the top-of-mind brand[9].

– GSM: Despite being one of the newest entrants, GSM achieved rapid growth, reaching second place with an 18% market share within seven months of launch in 2023.[10]. In addition to its rapid expansion domestically, GSM has also entered international markets, such as its strategic entry to Indonesia to become the country’s first electric ride-hailing services[11].

– Be: Launched in 2018, Vietnamese startup Be has emerged as a strong local contender, securing a 9% market share in 2023[12]. Positioned as an “all-in-one” platform, Be differentiates itself through strategic partnerships, offering alternatives like electric two-wheeler ride-hailing via GSM and financial services in collaboration with FWD Vietnam Insurance[13].

Be’s collaboration with Hanoi Metro to promote green transportation

Source: CafeF

The rise of upcoming ride-hailing brands also brings forward the fall of other industry players. In 2024, GoJek, a then prominent industry player from Indonesia, exited the market after its market share fell from 30% in 2022 to 7% in 2024[14]. In 2018, Uber, a giant player in the industry, was forced to sell its operation in Southeast Asia to its direct competitor Grab after 4 years in Vietnam’s market and having partnered with 350.000 drivers. These shakeups further highlight the volatility and competitiveness of the ride-hailing market in Vietnam.

Bolt’s potential entry to Vietnam’s ride-hailing market

Despite intense competition, Vietnam’s ride-hailing market remains attractive, with Bolt, a ride-hailing and food delivery unicorn, signaling potential entry.

Founded in 2013, the Estonian startup has expanded to over 600 cities across 50 countries[15]. In 2024, it reported 2.1 billion USD in revenue, ranking among Europe and Africa’s fastest-growing tech firms while competing with Uber. In Southeast Asia, Bolt launched in Thailand (2020) and Malaysia (2024).

Vietnam appears to be the next destination of Bolt amidst its global expansion prior to IPO. The company has announced multiple job listings in Ho Chi Minh City, opening the app for public download, as well as introducing Vietnamese as one of the applicable in-app languages. While no public announcements have been made, these actions indicate possible Bolt’s establishment in the country.

Bolt’s website introduces Vietnamese layout, signifying possible market entry

Source: Bolt

The entry of Bolt is poised to shake up the domestic market. Beyond traditional ride-hailing services, it is expected to offer food and grocery delivery, rentals, and corporate mobility solutions. Its competitive advantage lies in the competitive commission system with drivers and partners, a lower fare than its competitor, and a youthful brand image targeting a younger audience[16]. A competitive set of service offerings and a strategic market approach can allow Bolt to disrupt the strong growth momentum of two Vietnamese players as well as further erode Grab’s dominance in the domestic market.

Conclusion

Vietnam’s ride-hailing market is one of Southeast Asia’s most dynamic and competitive sectors, driven by rapid urbanization, digital transformation, and increasing consumer adoption. The market has seen frequent shakeouts, with major exits due to intense competition and rapid growth of new players. New entrants and innovations, such as the potential entry of Bolt, will play a crucial role in shaping the future of Vietnam’s ride-hailing industry.

[1] Statista Market Insights. Ride-hailing – Vietnam <Assess>

[2] Vietnamnews. Ride-hailing market sees fiercer competition <Assess>

[3] Vietnamplus. Digital infrastructure development paves the way for national digital transformation breakthroughs <Assess>

[4] VnEconomy. Challenges to increase public transport market share to 35%, Hanoi to introduce dedicated bus lanes <Assess>

[5] VnExpress. Reasons Why Young People Choose Ride-Hailing Services During Peak Hours <Assess>

[6] Vietnambiz. Ride-hailing Apps Collaborate with E-wallets: A Symbiotic Relationship for Survival? <Assess>

[7] VnExpress. Reasons Why Young People Choose Ride-Hailing Services During Peak Hours <Assess>

[8] Vietnamnet. Vietnam’s ride-hailing market to reach US$2.16 billion by 2029 <Assess>

[9] Vietnamnews. Ride-hailing market sees fiercer competition <Assess>

[10] Vietnamnet. Vietnam’s ride-hailing market to reach US$2.16 billion by 2029 <Assess>

[11] Vietnamplus. Xanh SM to launch in Indonesia, becoming the first electric taxi <Assess>

[12] Vietnamnet. Vietnam’s ride-hailing market to reach US$2.16 billion by 2029 <Assess>

[13] BrandsVietnam. From a pure ride-hailing app, how did Be develop into a multi-service consumer platform? <Assess>

[14] Investment News. Vietnam’s Ride-Hailing Market: Gojek Withdraws, Intensifying the Three-Way Race <Assess>

[15] VIR. Uber rival Bolt to make foray into Vietnam’s ride-hailing market <Assess>

[16] VIR. Vietnam’s ride-hailing market attracts global and local competition <Assess>

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Related article

1 Comment

Comments are closed.

“Bolt科技据称考虑通过IPO推出网约车业务” – Realnews my