10Mar2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s convenience store market has undergone a remarkable transformation in recent years. With increasing urbanization, a rising middle class, and evolving consumer habits, the demand for modern retail formats has surged. Despite contributing only a small fraction to the total retail sector, convenience stores have experienced rapid growth, driven by international players dominating the market. This article explores the expansion strategies of 7-Eleven and GS25 into Hanoi, their competitive positioning, and the challenges they face in a highly contested retail landscape.

Overview of Vietnam’s Convenience Store Market

Although convenience stores account for only 0.3% of total retail sales in Vietnam, the sector has witnessed remarkable growth[1]. The compound annual growth rate (CAGR) of convenience store chains in the period 2020-2022 exceeded 18%[2]. The market holds significant growth potential due to key demographic factors, rapid urbanization, the expansion of the middle class, and the booming tourism industry.

As of early 2023, Vietnam had approximately 3,720 convenience stores, including mini-marts[3]. Among these, over 2,600 were concentrated in Ho Chi Minh City, while the remainder were spread across Hanoi and other regions[4]. Despite this expansion, Hanoi still lags behind HCMC in store density, indicating substantial room for growth in the capital.

Key Players in Vietnam’s Convenience Store Market

The Vietnamese convenience store market is dominated by foreign retail chains, which have leveraged strong financial backing, extensive management experience, and aggressive marketing strategies to capture market share[5]. As of late 2023, foreign brands accounted for the majority of total sales, with Circle K holding approximately 48%, FamilyMart 18.8%, Ministop 14.3%, and 7-Eleven 7.3%[6]. These leading global brands have gradually taken over the market, making it increasingly difficult for domestic companies to compete.

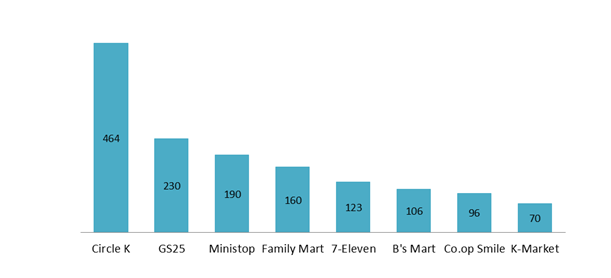

Number of convenience stores by brand (March 2025)

Unit: Stores

Source: B&Company

Among the international players, Circle K has the largest presence, with a total of 464 stores across Vietnam[7]. The brand was also the first foreign convenience store chain to enter the Vietnamese market[8].

GS25, the newest entrant, entered Vietnam in 2018 but has grown aggressively. Between 2021 and 2023, its revenue surged steadily, reaching over 1.5 trillion VND in 2023, marking a 23% year-over-year increase[9]. With 230 stores, the majority located in Ho Chi Minh City, GS25 has become Vietnam’s second-largest convenience store chain by store count. Other notable foreign brands include Ministop (entered in 2015), FamilyMart (entered in 2009), 7-Eleven (entered in 2017) and B’s Mart (entered in 2013).

In contrast, Co.op Smile is the only significant Vietnamese convenience store chain, operated by Saigon Co.op[10]. However, despite nearly a decade in the market, it has only 96 stores (including franchise locations)[11]. Revenue growth has remained modest at less than 2% per year, reaching 380 billion VND in 2023[12].

7-Eleven and GS25’s Expansion Strategy in Hanoi

At the beginning of 2025, both 7-Eleven and GS25 officially announced their plans to expand into Hanoi. The capital’s convenience store sector has been largely dominated by Circle K and WinMart+, with Circle K holding an almost complete monopoly in the 24/7 store segment. The entry of these two global giants is set to intensify competition and further energize the market.

7-Eleven Vietnam operates as a joint venture between the Japanese subsidiary of 7-Eleven (based in the U.S.) and Vietnam’s Seven System Corporation[13]. Before launching in Vietnam, 7-Eleven had ambitious plans to open 1,000 stores within a decade[14]. However, after nearly ten years, it has achieved less than one-tenth of that goal[15]. Despite slow expansion, 7-Eleven’s revenue has shown consistent growth: increasing by 18% in 2021, 26% in 2022, and 37% in 2023, reaching nearly 850 billion VND last year[16]. However, the chain remains one of the most unprofitable in the sector, with significant annual losses. After nearly eight years in Vietnam, 7-Eleven is finally entering Hanoi, signaling its expansion by recruiting staff and securing prime retail locations in early 2025.

Meanwhile, GS25, despite entering the market later than its competitors, has made impressive strides. By 2023, it had 209 stores, mainly concentrated in Ho Chi Minh City, making it the second-largest chain by store coverage[17]. GS25 is now actively expanding into Hanoi and, similar to 7-Eleven, began hiring personnel and securing retail spaces in early 2025[18]. The company has been scouting high-visibility locations in Hanoi’s busiest districts such as the Old Quarter, Ba Dinh, and Dong Da, targeting store sizes between 100 and 300 square meters[19]. This move reflects GS25’s strategy to establish flagship locations in prime areas to quickly build brand recognition in the capital.

Challenges behind the expansion: Intense competition and thin margins

Vietnam’s convenience store sector is highly competitive, making profitability a major challenge. Most convenience store chains operate at a loss in their early years, focusing on expansion rather than short-term profits.

According to the Ministry of Industry and Trade, Vietnam’s retail market is projected to reach $350 billion by 2025, contributing to 59% of the national GDP[20]. However, accepting financial losses to secure market share has become a common industry strategy. In recent years, only Circle K and K-Market have managed to generate profits in the Vietnamese convenience store market[21]. The combination of high operating costs, fierce competition, and evolving consumer preferences makes it difficult for most brands to reach profitability.

Among all convenience store brands, GS25 exemplifies this high-risk, high-reward strategy. The company has ambitious plans to reach 700 stores by 2027, even if it means sustaining short-term losses[22]. Although GS25’s financial losses decreased in 2023 compared to previous years, it remains one of the least profitable convenience store chains, recording a net loss of nearly 120 billion VND last year[23].

Another significant challenge for convenience store chains in Vietnam is consumer behavior. A large proportion of Vietnamese shoppers still prefer traditional retail channels, including wet markets, street vendors, and small independent grocery stores[24]. These small-scale retailers offer lower prices, minimal overhead costs, and strong neighborhood convenience, making them formidable competitors against modern convenience store chains[25]. Convincing Vietnamese consumers to shift their shopping habits away from traditional markets and embrace convenience store shopping remains a critical challenge for the industry.

The common type of independent grocery store in Vietnam

Source: B&Company

Conclusion

Vietnam’s convenience store market is experiencing rapid growth, driven by shifting consumer behaviors and expanding urbanization. However, despite their ambitious expansion plans, 7-Eleven and GS25 face formidable challenges in Hanoi. The highly competitive landscape, financial constraints, and strong consumer preference for traditional retail formats make market penetration difficult.

[1] Zing News. 7-Eleven and GS25 Expand North, Circle K No Longer Holds Monopoly in Hanoi <Access>

[2] Zing News. 7-Eleven and GS25 Expand North, Circle K No Longer Holds Monopoly in Hanoi <Access>

[3] Vietnam News. Convenience Stores Struggle to Make Profit <Access>.

[4] Vietnam News. Convenience Stores Struggle to Make Profit <Access>.

[5] Zing News. GS25, FamilyMart, and 7-Eleven Suffer Heavy Losses in Vietnam Despite Billions in Revenue <Access>

[6] Vietnam News. Convenience Stores Struggle to Make Profit <Access>.

[7] Zing News. 7-Eleven and GS25 Expand North, Circle K No Longer Holds Monopoly in Hanoi <Access>

[8] Zing News. 7-Eleven and GS25 Expand North, Circle K No Longer Holds Monopoly in Hanoi <Access>

[9] Zing News. 7-Eleven and GS25 Expand North, Circle K No Longer Holds Monopoly in Hanoi <Access>

[10] Zing News. GS25, FamilyMart, and 7-Eleven Suffer Heavy Losses in Vietnam Despite Billions in Revenue <Access>

[11] Zing News. GS25, FamilyMart, and 7-Eleven Suffer Heavy Losses in Vietnam Despite Billions in Revenue <Access>

[12] Zing News. GS25, FamilyMart, and 7-Eleven Suffer Heavy Losses in Vietnam Despite Billions in Revenue <Access>

[13] VietnamBiz. 7-Eleven and GS25 to Open Their First Stores in Hanoi <Access>

[14] VietnamBiz. 7-Eleven and GS25 to Open Their First Stores in Hanoi <Access>

[15] VietnamBiz. 7-Eleven and GS25 to Open Their First Stores in Hanoi <Access>

[16] Zing News. 7-Eleven and GS25 Expand North, Circle K No Longer Holds Monopoly in Hanoi <Access>

[17] VietnamBiz. 7-Eleven and GS25 to Open Their First Stores in Hanoi <Access>

[18] Dan Tri. 7-Eleven and GS25 Preparing to Enter Hanoi, Seeking 100-300m² Locations <Access>

[19] Dan Tri. 7-Eleven and GS25 Preparing to Enter Hanoi, Seeking 100-300m² Locations <Access>

[20] Vietnam News. Convenience Stores Struggle to Make Profit <Access>

[21] Vietnam News. Convenience Stores Struggle to Make Profit <Access>

[22] Vietnam News. Convenience Stores Struggle to Make Profit <Access>

[23] Vietnam News. Convenience Stores Struggle to Make Profit <Access>

[24] Vietnam Business Forum. The Battle of Convenience Stores in Vietnam <Access>

[25] Vietnam Business Forum. The Battle of Convenience Stores in Vietnam <Access>

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |