The food cold chain plays a critical role in maintaining the safety, quality, and freshness of perishable products, including meat, seafood, dairy, fruits, and vegetables. In Vietnam, the demand for food cold chain is huge but the facility is still not developed enough.

The increase of key sector demand urging for the development of cold storage

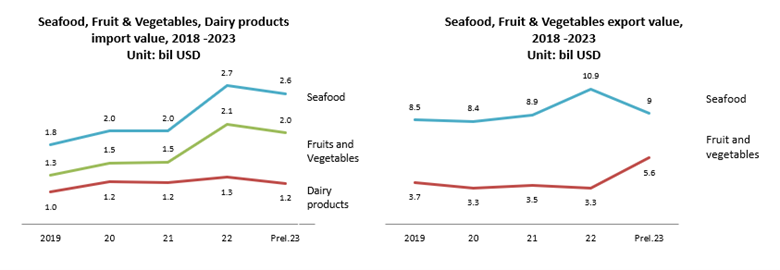

According to Vietnam Briefing, Vietnam’s cold storage logistics industry is forecast to reach US$295 million by 2025[1]. One of the key driven to the development of cold storage is the growth demand for food consumption. According to Vietnam General Statistic Offics (GSO), frozen and fresh items has quite high average monthly expenditure per capita. For example, meat(2.6kg), shrimp and fish (1.1kg), fruit and vegetables (3.1 kg) (2022). Vietnam’s import and export value of food that need reserve in cold (fishery, meat, fresh fruit and vegetables) has increased in 5 years. With the increased consumer preference for fresh food, and the high standard for international export standard, the cold chain is expected to flourish in the next few years.

Source: GSO, General Statistic Year Book (2023)

Moreover, the rise of e-commerce and online grocery platforms, especially after the COVID-19 pandemic, has intensified the need for efficient cold chain solutions to deliver perishable goods. Companies like Tiki, Shopee, and Lazada have also cooperated with 3rd parties to expand the efficient of their fresh food delivery services.

Food cold chain infrastructure situation

Although the demand is high, the infrastructure, in the otherwise, remains underdeveloped and struggles to meet the growing demand driven by the country’s expanding agricultural trade, modern retail sector, and shifting consumer preferences towards chilled and frozen foods. According to Euromonitor, in December 2019, Vietnam only has 48 cold warehouses with a total capacity of 600,000 pallets.[2]. Moreover, Cold storage facilities in Vietnam are heavily concentrated in the southern regions, especially the Mekong Delta, where seafood processing is prominent, leaving the northern and central areas underserved. For instance, major companies like Lineage Logistics have expanded significantly in the south, with 36,650 pallets in Binh Duong compared to 20,000 pallets in Bac Ninh[3]. Similarly, AJ Total operates 31,000 pallets in Long An, while only having 23,000 pallets in Hung Yen[4].

Main Players

The food cold chain market in Vietnam is highly fragmented, with a mix of local and foreign players. While local companies offer competitive pricing, foreign firms are generally regarded as providing premium services due to their advanced technology and infrastructure. Some of the main players in the cold storage and cold transportation sectors include based on market share by capacity:

Lineage Logistics

| Homepage | https://www.onelineage.com/ |

| Establish year | 2012 |

| Nationality | USA |

| Overview | Lineage Logistics is one of the world’s largest temperature-controlled logistics providers. It has a network of strategically located facilities across multiple countries, including Vietnam. |

| Business field | Temperature-controlled storage, transportation, port logistics, and supply chain management solutions, specifically catering to the food industry |

| Capacity | 81,000 pallets (cold storage), with main storages in Binh Duong, Ho Chi Minh city, Bac Ninh |

Transimex

| Homepage | https://transimex.com.vn/ |

| Establish year | 1990 |

| Nationality | Vietnam |

| Overview | Transimex is one of the largest local players in Vietnam’s cold chain market. The company provides a range of services, including warehousing and transportation, and has steadily expanded its cold storage facilities to meet growing demand in the southern region |

| Business field | 2PL, 3PL, Contract logistics, General warehouse, Cold storage

Refrigeration warehouse, CFS warehouse, Bonded warehouse, Document storage, Cross-docking service, Value-added services |

| Capacity | 17,000 pallets (cold storage) with main storage in Ho Chi Minh city |

ABA Cooltrans

| Homepage | https://aba.com.vn/ |

| Establish year | 2008 |

| Nationality | Vietnam |

| Overview | Aba Cooltrans is one of the leading companies in Vietnam specializing in cold chain logistics, particularly focused on refrigerated transportation and cold storage. ABA Cooltrans plays a critical role in ensuring the freshness and safety of perishable goods, including seafood, meat, fruits, vegetables, and processed foods, by providing end-to-end cold chain solutions for businesses in the food and beverage sector. |

| Business field | Refrigerated Transportation, Cold Storage, Last-Mile Delivery |

| Capacity | 265,000 pallets (Cold transportation) with main storages in Hanoi and Ho Chi Minh city |

Opportunities

The increasing demand for fresh and frozen foods is driving up the need for higher quality assurance, which, in turn, emphasizes the importance of effective food preservation. This trend directly impacts the expansion of the cold chain industry, as maintaining optimal temperature and storage conditions is essential to ensure product quality and safety. As the food industry grows, the need for advanced cold chain solutions becomes critical to manage and safeguard the integrity of perishable products, leading to a rise in investment and development within the cold chain sector.

- Increase export food quality: Vietnam’s food exports, particularly in seafood and tropical fruits, rely heavily on cold chain logistics to meet international quality standards, especially for markets like the U.S., EU, and Japan. Free trade agreements (FTAs) like the CPTPP and EVFTA further enhance the need for advanced cold chain infrastructure to support export growth.

- Investment raise in cold chain: There is significant potential for investment in expanding cold storage facilities, especially in rural agricultural regions, where access to cold chain services is limited. Technological advancements such as IoT-based temperature monitoring, blockchain for traceability, and energy-efficient refrigeration systems present opportunities to improve efficiency and sustainability.

Overall, Vietnam’s cold chain sector offers immense opportunities for both domestic and international players, particularly in the areas of infrastructure development, technology adoption, and export logistics.

Challenges

Despite the growth prospects, Vietnam’s food cold chain sector faces several challenges that need to be addressed for sustained long-term success.

- High Energy Costs: Cold storage and transportation are energy-intensive operations. The rising cost of electricity and fuel poses a significant challenge to maintaining competitive pricing in the market. Companies must balance the need for reliable cold chain services with the challenge of managing operational costs.

- Fragmented Market Structure: Vietnam’s cold chain market is highly fragmented, with many small-scale providers that lack the capacity and technological sophistication of larger international firms. This fragmentation can lead to inefficiencies, particularly in cold transportation, where independent providers may not adhere to stringent quality standards.

- Oversupply in Key Areas: While investment in cold chain infrastructure has been robust, certain regions, particularly in southern Vietnam, are facing an oversupply of cold storage facilities. This has led to underutilization of capacity and lower occupancy rates, which can affect profitability. Providers need to carefully manage their expansion plans to avoid further market saturation.

Conclusion

The food cold chain sector in Vietnam is poised for significant growth, driven by rising consumer demand, expanding export markets, and continued investment from both local and foreign players. However, the industry also faces challenges, including high operational costs, market fragmentation, and regional oversupply. Companies that can navigate these challenges while capitalizing on technological advancements and emerging market opportunities are likely to thrive in Vietnam’s evolving cold chain landscape.

[1] https://www.vietnam-briefing.com/doing-business-guide/vietnam/sector-insights/vietnam-s-cold-storage-industry-drivers-challenges-and-market-entry

[2] https://vir.com.vn/cold-chain-logistics-in-high-demand-92343.html

[3] https://www.eria.org/uploads/media/7_RPR_FY2018_11_Chapter_3.pdf

[4] https://vnexpress.net/kho-lanh-rong-hang-chuc-nghin-m2-cua-aj-total-viet-nam-4371882.html

| B&Company, Inc.

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles