01Aug2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Despite the high adoption rates of technology applications in F&B restaurant management, most businesses only utilize these tools at a basic level due to challenges such as high initial costs, limited technological expertise, and organizational resistance. The report concludes with strategic recommendations for a phased digital transformation and customized approaches for technology providers to more effectively penetrate the SME segment.

The Vietnamese F&B Market Landscape

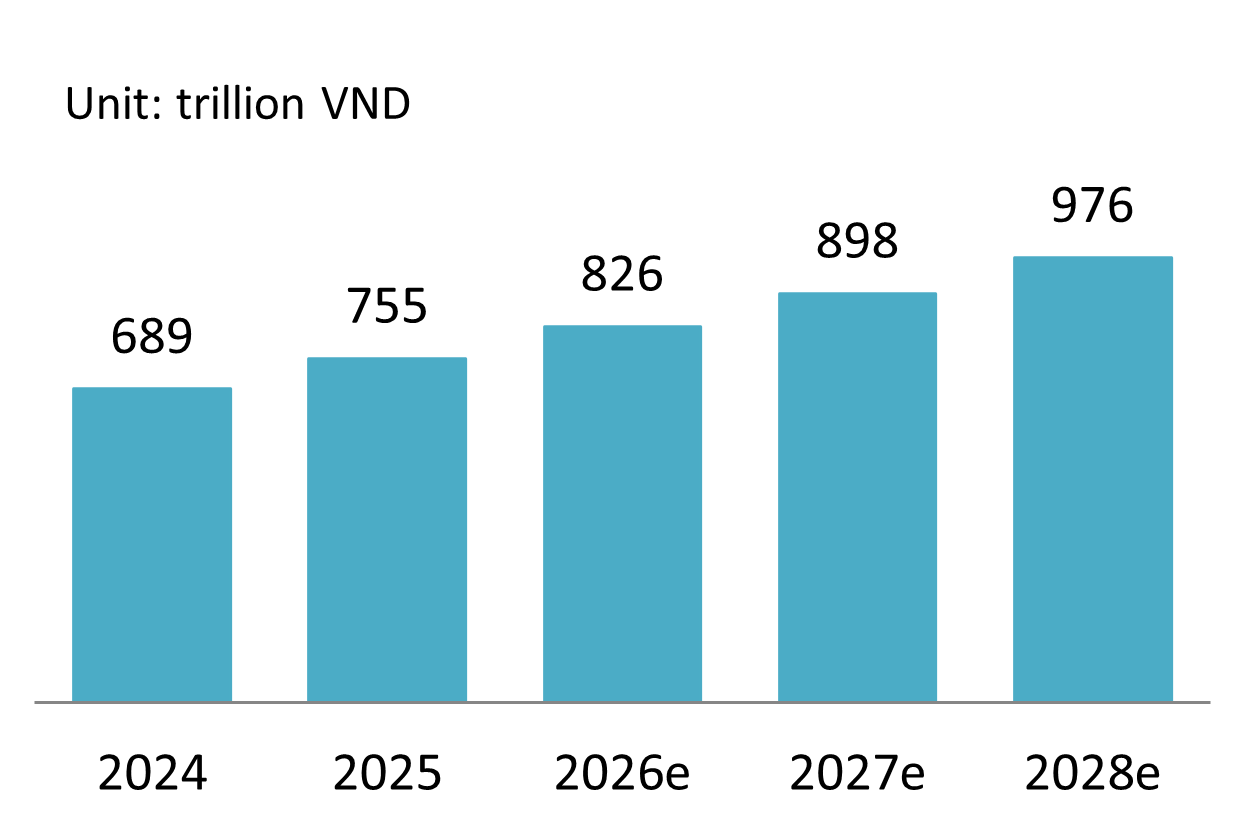

As of 2024, Vietnam has approximately 323,000 active F&B establishments, highlighting a highly competitive market marked by rapid turnover, with 30,000 closures recorded in just the first half of the year. Despite this volatility, business sentiment remains optimistic: 79.6% of operators are confident in the sector’s growth prospects, and more than half plan to expand their operations soon. The F&B industry is projected to reach VND 755 trillion in revenue by 2025, reflecting a growth of around 9.6% compared to 2024 [1].

F&B revenue outlook 2025-2028

Source: iPOS

This positive outlook, however, masks a structural vulnerability. The market is heavily fragmented and dominated by nearly 280,000 micro-sized businesses, which form the backbone of the industry. While they are driving market expansion, these small players face significant challenges due to limited resources, weak bargaining power, and increasing competition from large, tech-enabled F&B chains.

Vietnam consumer behavior

There’s a clear shift in consumer spending habits: people are spending less per order but going out more often. For drinks, high-priced options (over VND 70,000) are losing popularity, while more affordable choices are gaining ground. The share of consumers spending VND 21,000–35,000 per drink rose from 29.6% in 2023 to 40% in 2024. Meanwhile, those spending under VND 20,000 increased from 4.3% to 12.3%. Altogether, over 52% of consumers now spend less than VND 35,000 per drink [1].

Despite lower spending per order, consumption frequency has jumped. Daily drinkers tripled year over year, and those drinking 3–4 times per week rose sharply from 17.4% to 32.8%. A similar trend is seen in dining behavior: the share of people eating out 3–4 times a week also grew from 17.4% in 2023 to 32.8% in 2024 [1]. Another survey even found that 28.9% of diners reported eating out this often—up from just 17.9% in 2022 [2].

This creates big pressure on F&B businesses, especially small ones. Lower spending per order but higher frequency means they must serve more customers to make the same money, while fixed costs like rent and salaries remain unchanged. As a result, improving efficiency is now essential. Every second saved and every cost controlled counts. This is why adopting technology in daily operations has become more important than ever to stay profitable.

Technology in Use in Vietnam

(Point of Sale) System

The POS system is the most widely adopted and foundational technology in Vietnam’s F&B industry, serving as the backbone of daily operations. However, the level of utilization varies significantly across businesses. Most use POS systems as a modern version of the traditional cash register, focusing on basic functions such as order processing, payment, invoice printing, and multi-channel payment support through e-wallets (e.g., Momo, VNPay, ZaloPay) or bank cards. In more advanced applications, POS systems are also used for table and floor plan management, sales data reporting and analysis, and integration with kitchen display systems, enabling greater operational efficiency.

Customer Relationship Management (CRM)

Among the three pillars of F&B operational technology, CRM holds the most strategic potential but remains underutilized by Vietnamese SMEs. Most businesses only apply it at a basic level—storing customer information or running simple point-accumulation programs via POS. Advanced features such as customer segmentation, automated marketing, and feedback management—which are key to enhancing customer experience and increasing lifetime value (LTV)—are rarely implemented [3]. In the context of tightening profit margins, neglecting CRM means missing out on the most effective tool for building sustainable revenue, forcing SMEs into a costly cycle of acquiring new customers for low-margin transactions.

Inventory Management

Inventory management plays a critical role in controlling costs and maximizing profitability in F&B operations. Yet, most SMEs in Vietnam still rely on manual methods or basic stock-in/out tracking via software, without leveraging advanced features like recipe-based usage tracking, low-stock alerts, or shrinkage analysis. These tools, which help tighten control over materials and reduce losses, are often ignored due to the initial setup effort required. In a low-margin environment, the lack of digital inventory control leads to daily, unnoticed cost leakages. The three main barriers hindering effective tech adoption among SMEs are limited financial resources, low digital literacy, and conservative operational mindsets.

Comparison of Key POS Providers in Vietnam

| Criteria | KiotViet | Sapo FnB | iPOS.vn |

| Pricing Model | Monthly/annual subscription, affordable cost | Monthly/annual subscription, offers both free and paid plans | One-time license (on-premise) or monthly subscription (cloud); setup fee required |

| Target Customers | SMEs, small retail shops across various industries | Restaurants, cafes, omnichannel sellers (online & offline) | Medium to large restaurant and café chains, businesses needing advanced solutions |

| Key Features | Barcode-based sales & inventory, basic CRM, simple reporting, tablet orders | Table-side ordering, layout management, recipe-based inventory, VIP CRM, and delivery integration | F&B-specific system, chain management, Smart Kitchen, iPOS CRM, customized business reports |

| Strengths | Easy to use, low cost, supports multi-industry businesses | Strong omnichannel capabilities, wide integration with delivery partners, intuitive interface | Comprehensive F&B ecosystem, trusted by many major brands |

| Weaknesses | Limited CRM & analytics; sales staff may lack experience | It can be complex for beginners due to feature richness | High initial and ongoing costs; more suitable for large-scale chains |

Source: B&Company compilation

Barriers to Technology Adoption in F&B SMEs

Financial Constraints: Many small F&B businesses see tech investment as too costly compared to their current earnings. Beyond software fees, costs include hardware (e.g., POS machine ~5–10 million VND, printer ~2 million VND, tablet ~5 million VND), monthly subscriptions, and ongoing maintenance. The fear of uncertain ROI keeps many hesitant to fully digitize operations [5].

Lack of Knowledge & Tech Anxiety: Owners often admit they’re not familiar with tech and feel overwhelmed by too many software options. Without a clear understanding, they set vague goals and fear they or their staff won’t be able to use the system effectively, leading to hesitation or abandonment during onboarding [5].

Mindset & Company Culture: Many SMEs still rely on paper-based processes and resist change. Staff may see new tools as an extra workload rather than support. As a result, technology is applied superficially, reducing impact and wasting investment. “New tech with old habits” often leads to digital transformation failure [5].

Conclusion

The F&B SME segment in Vietnam—though fragmented and modest in scale—represents a fertile yet demanding market for technology providers. While it offers significant growth potential, winning over this segment requires more than just offering advanced features. Most SMEs face financial constraints, a lack of digital skills, and deeply rooted traditional mindsets. Therefore, technology providers must shift from a conventional, feature-heavy approach to one that is more empathetic, streamlined, and tailored to local realities.

– Simplify products & offer flexible pricing: Design software with intuitive interfaces and remove unnecessary features that overwhelm users. Consider freemium models or affordable monthly subscriptions to lower financial barriers and encourage initial adoption.

– Communicate based on real business outcomes: Instead of highlighting technical features, focus on tangible benefits such as “reduce ingredient loss by 15%” or “boost customer return rate.” Use educational content—like blogs, webinars, and case studies—to demonstrate how your solution solves specific operational challenges.

– Localize deeply, not just linguistically: Integrate with Vietnam’s local ecosystem, including e-wallets like Momo and ZaloPay, local delivery platforms, and e-invoicing systems. Ensure your software aligns with real-world workflows, regulations, and business habits of Vietnamese F&B operators.

[1] iPOS and Nestle, báo cáo thị trường kinh doanh F&B tại Việt Nam năm 2024 <Access>

[2] Mekong Food and Drink Show, According to the Food & Beverage Market Report in Vietnam recently released by IPOS.vn, by the end of 2023, the F&B sector recorded impressive growth compared to 2022, with total revenue exceeding VND 590 trillion <Access>

[3] iPOS, 9 Benefits of Restaurant Management Software You Might Not Know <Access>

[4] CRMVIET, Applications of CRM in the F&B Industry <Access>

[5] KiotViet, Digital Transformation in the F&B Industry – Many Small Vendors Face Challenges <Access>

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |