29Jul2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Market Outlook

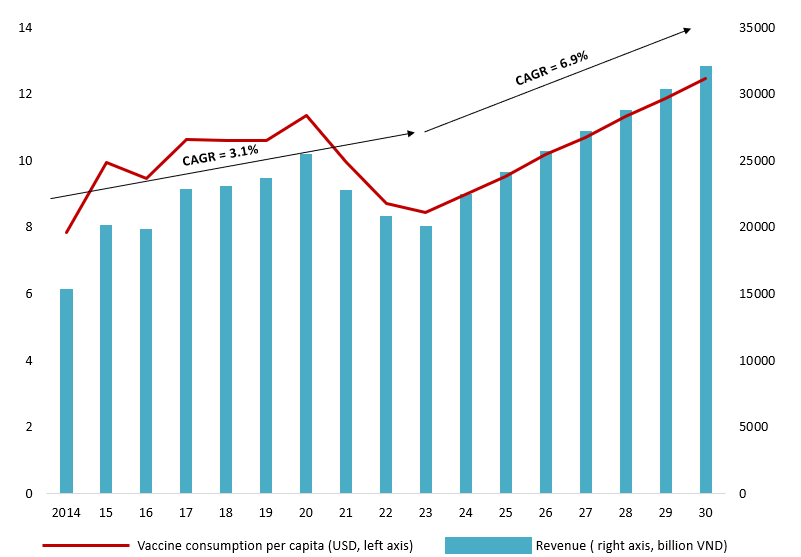

Between 2014 and 2023, Vietnam’s vaccine market revenue grew at a compound annual growth rate (CAGR) of 3.1%, driven by rising disposable incomes and steady population growth [1]. However, in the past three years, revenues declined due to the impact of the COVID-19 pandemic in 2021 and 2022—which limited mobility and vaccination activities—as well as vaccine supply shortages in 2023.

Looking ahead, VDSC forecasts the vaccine market to accelerate, expanding at a projected CAGR of 6.9% during the 2024–2030 period [1]. Per capita vaccine spending is expected to continue its upward trajectory, rising around USD 12 USD/person by 2030. This growth will be primarily supported by increasing disposable incomes and sustained public awareness of health and disease prevention.

Vietnam’s Vaccine Revenue and Consumption, prediction for 2030

Source: DNSE

The Rise of Private Immunization Chains

Vietnam’s immunization system consists of two parallel and complementary pillars: a publicly funded program ensuring broad access to essential vaccines, and a growing private network that offers greater choice and service quality for those able to pay.

Comparison Between the Public Immunization System (EPI) and Private Vaccination Services

| Expanded Program on Immunization (EPI) | Private Immunization Services | |

| Responsible Authorities | · Ministry of Health

· Preventive Medicine Centers |

· Private enterprises

· Private hospital |

| Cost | · Free

· (Funded by the government) |

· Paid depends on vaccines and providers |

| Vaccine Portfolio | · Limited

· (around 10-12 basic vaccines) |

· Diverse, including new and combination vaccines |

| Target | · Children under 10

· Pregnant women |

· All age groups |

| Service quality and facilities | · Basic facilities

· Often at local health stations |

· Modern

· Well-equipped clinics with customer service and amenities |

| Vaccine Availability | · Occasional shortages due to procurement and tendering processes | · Stable, well-managed supply with investment in cold chain infrastructure |

| Scheduling Flexibility | · Fixed schedules determined by public health centers | · Flexible, can be booked according to individual needs |

Source: B&Company Compilation

Emerging players in the private sector

In the past 5–7 years, private providers have gained significant ground in Vietnam’s vaccination market by addressing limitations of the public system—such as long wait times, overcrowding, and vaccine shortages. They also meet growing demand for adult and non-EPI vaccines like HPV and seasonal flu. The market is evolving into a group oligopoly, with fierce competition among major chains driving improved service quality and expanding consumer choice.

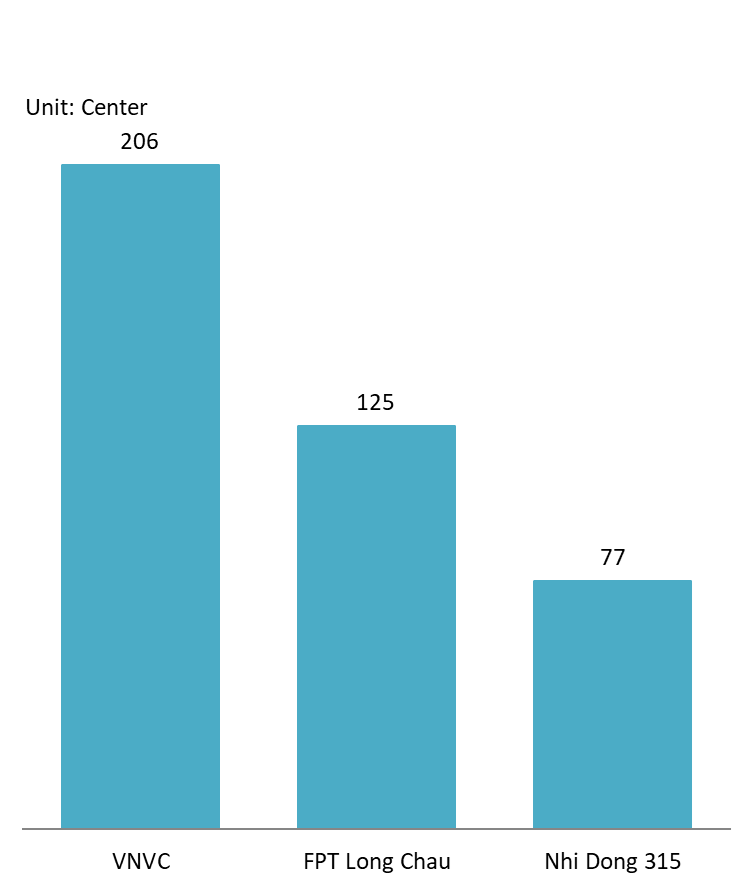

Top 3 Private Providers – Number of Centers

Source: DNSE

VNVC – The Full-Service Vaccinator

VNVC currently dominates Vietnam’s private vaccination market with an estimated 46% market share. It operates the largest vaccination network in the country, with 206 centers across 34 provinces and cities. Backed by Eco Pharma and Tam Anh General Hospital, VNVC benefits from a robust healthcare ecosystem, enabling it to scale rapidly while maintaining service quality and trust among consumers.

FPT Long Châu – The Fast-Rising Challenger

Although FPT Long Châu is expected to capture only around 6% of the market in 2024, it is growing at a remarkable pace. The company has expanded its vaccination network to 125 centers and aims to reach 150 locations in the near future. Leveraging its extensive Long Châu pharmacy chain, the brand creates strong customer synergies and positions itself competitively by offering vaccine prices 2–7% lower than major rivals.

Nhi Đồng 315 – The Niche Specialist

Nhi Đồng 315 focuses on a more specialized segment, primarily serving Ho Chi Minh City and surrounding provinces. While its market share remains small and unreported, the chain differentiates itself by integrating pediatric clinics with vaccination services. This “all-in-one” model appeals to parents seeking convenient, child-focused healthcare solutions in a single location.

From Coverage to Business Opportunity

Unmet Vaccination Needs Beyond Children

While Vietnam’s Expanded Program on Immunization (EPI) has achieved over 95% coverage among children, other age groups—including adolescents, adults, and seniors—remain underserved. Coverage for high-value vaccines such as HPV, pneumococcal, shingles, and seasonal flu is still below 5% [2]. For instance, HPV vaccination rates among girls in Vietnam remain under 12%, compared to over 80% in Malaysia thanks to well-established school-based programs [2]. These gaps highlight a substantial untapped market, especially as public awareness of non-communicable diseases continues to rise. Expanding adult and senior immunization services could unlock a large, underserved market and significantly improve profit margins for private providers.

Urban Middle Class Drives Demand for Premium Vaccination Services

Rising incomes and urbanization in cities like Ho Chi Minh City and Hanoi are accelerating the shift from basic immunization to premium vaccination experiences. Urban consumers now expect convenience, digital integration, and broader vaccine choices. Features such as online booking, electronic vaccination records, and bundled vaccine packages are becoming essential. VNVC has successfully capitalized on this trend by offering adult-targeted vaccine packages, while FPT Long Châu leverages its widespread pharmacy network to reach adults in tier-2 cities—where public options are limited and pricing is key [5]. Developing modern vaccination centers for adults and families in urban areas offers strong potential for customer retention and revenue growth.

Conclusion

The lifetime vaccination model not only addresses service gaps in Vietnam’s current immunization system but also opens compelling business opportunities across multiple segments—from urban adults to institutions and tier-2 markets. Private players who invest early in supply chain capacity, service innovation, and targeted segmentation strategies will likely lead the next wave of market growth.

[1] DNSE, Comparing the Cash-Generating Capacity of Vietnam’s Three Largest Vaccination Centers <Access>

[2] KPMG, Life course immuzation in Vietnam <Access>

[3] UNICEF DATA <Access>

[4] CafeF, The Competitive Landscape of Vietnam’s $2 Billion Vaccine Market<Access>

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |