09Jun2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s rubber industry is experiencing strong growth, with output and export value reaching record levels. However, the industry also faces significant challenges from new international regulations and increasingly fierce competition from other rubber-producing countries.

Rubber Production in Vietnam

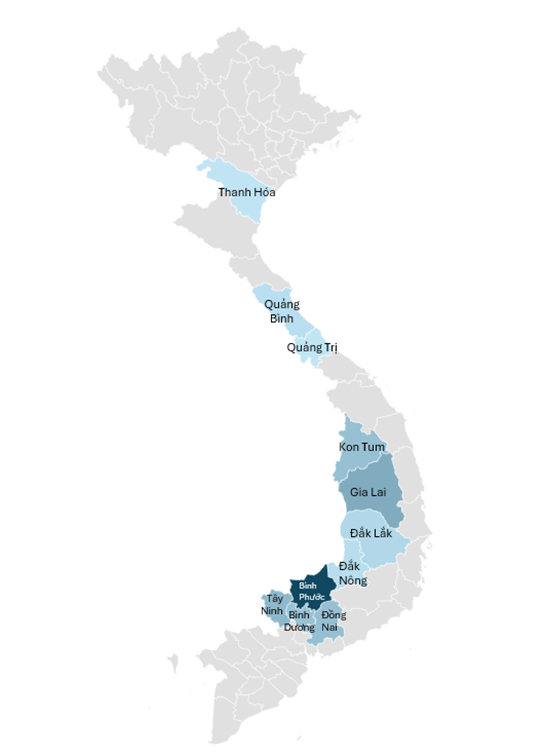

Vietnam is currently the third largest producer of natural rubber in the world, after Thailand and Indonesia. Vietnam has around 930,000 hectares of rubber plantations. Most of these are in the Southeast region, which makes up 60% of the total area. The Central Highlands also contributed significantly, with nearly 26% of the plantations ([1]). In 2024, Vietnam currently has a rubber growing area of about 910 thousand hectares, with latex output reaching 1.3 million tons per year ([2]).

Main rubber plantation areas in Vietnam

Source: B&Company Vietnam

Export situation and main market

Vietnam remains one of the top five global exporters of natural rubber. In 2024, the country exported around 2 million tons of rubber, earning a record-high turnover of USD 3.4 billion. ([3]). By Q1 2025, exports totaled 421,000 tons, worth approximately USD 781 million, with 86.8% of export revenue coming from Asian markets ([4],[5]).

The average rubber export price in January 2025 will reach 1,859 USD/ton, up 9.3% compared to the average price in 2024 which is 1,701 USD/ton. This increase is mainly due to the global supply shortage, with a forecast shortage of about 1.24 million tons in 2024 ([6]).

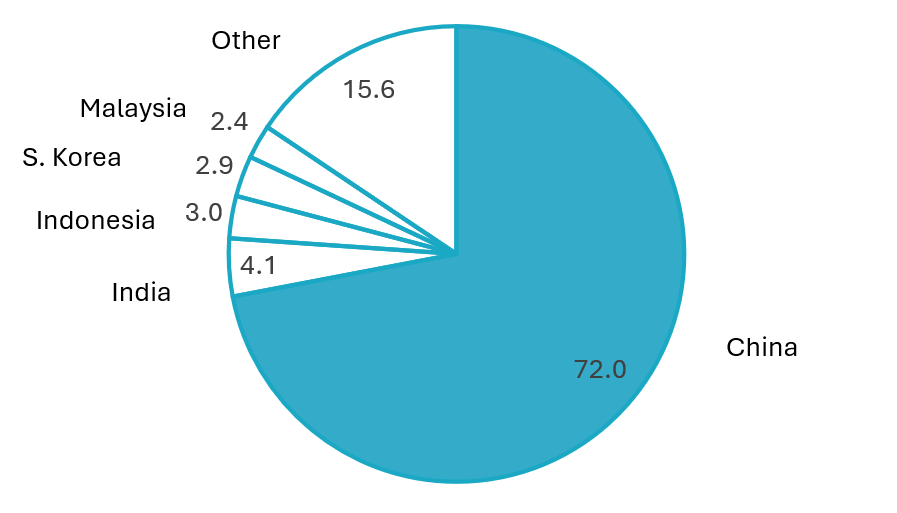

The five largest rubber export markets of Vietnam in the first quarter of 2025 were all in Asia. The export value to most markets increased sharply, except for India. In terms of volume, rubber exports to Malaysia and Indonesia grew impressively, 4.9 times and 2.3 times higher than in the same period last year, while exports to China, India, and South Korea decreased ([7]).

Main export market in the first 3 months of 2025

100% = 781 million USD

Source: giaothuong.congthuong.vn

Challenges for Vietnam’s Rubber Export

a. Vietnam’s Heavy Reliance on the Chinese Market

China remains Vietnam’s most important rubber export destination, accounting for 72% of export volume and 71% of revenue in 2024. In 2024, Vietnam shipped nearly 1.5 million tons of rubber to China, worth approximately USD 2.4 billion ([8]).

However, the competition in China and globally is intensifying. Thailand remains China’s top rubber supplier, exporting more than 750,000 tons in the first quarter of 2025—up 27.6% from the same period last year—and making up 34.4% of China’s total rubber imports. Meanwhile, Vietnam’s share has fallen significantly. During the same period, Vietnam exported 342,165 tons to China—a 12.5% decrease compared to Q1/2024. Its market share fell to 16.1%, down from 22.3%, signaling mounting competitive pressure.

Despite Vietnam’s close geographic and trade ties with China, the structure of its rubber exports presents a strategic weakness. The bulk of its rubber exports consist of raw or minimally processed natural rubber and blended rubber. In Q1/2025, Vietnam exported over 238,500 tons of this blend, worth nearly USD 467 million—99.8% of which went to China. While this product category accounts for a growing share of total rubber exports (rising from 56.8% to 63.3%), it also reflects Vietnam’s heavy reliance on low-value-added goods.

b. Rising Regulation Pressure

Another challenge for Vietnam’s rubber market is the EU’s Deforestation Regulation (EUDR), taking effect in December 2024. The policy presents significant hurdles due to Vietnam’s heavy reliance on rubber imports from Cambodia which is over 64% of its total imports—where traceability is difficult to ensure. Most rubber is produced by smallholder farmers who often lack the legal and technical capacity to meet the regulation’s strict requirements. In response, Vietnam is encouraging the formation of cooperatives and investing in digital tracking tools to strengthen supply chain transparency and maintain access to the EU market. ([9])

Government Initiatives and the Future of the Industry

In response to structural weaknesses and growing competition, the Vietnamese government is taking active steps to support the rubber industry. Under Decision No. 431/QD-BNN-TT dated January 26, 2024, approving the Project on developing key industrial crops by 2030, the Ministry of Agriculture and Rural Development sets a target that by 2030, the total rubber area in the country will reach about 800 – 850 thousand hectares; 100% of latex and rubber wood will have a growing area code to trace the origin of the product ([10]).

Vietnam’s heavy reliance on the Chinese rubber market highlights the urgent need to diversify its export destinations. The United States offers a promising alternative since it has recently reduced its dependence on rubber imports from traditional suppliers like Canada, Mexico, and China as a result of tariff sanctions. This opens opportunities for Vietnam to expand its presence. In 2024, Vietnam exported 29,200 tons of rubber to the US, valued at 50.6 million USD, with its market share growing modestly from 1.5% in 2023 to 1.7%. Although this remains low compared to regional competitors such as Thailand (16.4%) and Indonesia (22.5%) the US’s large and quality-demanding market presents significant potential for growth ([11]). To capitalize on this, Vietnamese rubber producers must focus on improving product quality to meet stringent US standards and capture a larger share of this valuable market.

Conclusion

To ensure the long-term sustainability of its rubber industry, Vietnam must prioritize improving productivity and aligning with global environmental and traceability standards. Emphasizing higher-value, deep-processed rubber products will enhance export value and reduce dependence on raw materials. As global competition intensifies from countries like Thailand, Indonesia, and emerging suppliers—Vietnam should invest in modern technology, diversify its markets, and strengthen quality control to remain competitive and resilient in the evolving global rubber trade.

[1] https://www.berubco.com.vn/cao-su-duoc-trong-nhieu-nhat-o.html

[2] https://tapchicongthuong.vn/gia-duy-tri-muc-cao–xuat-khau-cao-su-nam-2024-du-bao-dat-khoang-3-3-2-ty-usd-126509.htm

[3] https://baochinhphu.vn/gia-cao-su-tang-cao-tu-xuat-khau-102250119070001572.htm

[4] https://caosu.com.vn/thi-truong-cao-su/gia-cao-su-tang-manh-ky-vong-mo-rong-thi-phan-va-gia-tang-gia-tri/

[5] https://giaothuong.congthuong.vn/xuat-khau-tang-manh-gia-cao-su-can-moc-lich-su-moi-386056.html

[6] https://giaothuong.congthuong.vn/thang-12025-gia-cao-su-xuat-khau-cua-viet-nam-tang-32-374672.html

[7] https://giaothuong.congthuong.vn/xuat-khau-tang-manh-gia-cao-su-can-moc-lich-su-moi-386056.html

[8] https://cafef.vn/trung-quoc-mua-hang-trieu-tan-vang-trang-de-theo-duoi-giac-mo-xe-dien-nhung-lai-giam-nhap-tu-viet-nam-188250505142954721.chn

[9] https://vietnamnews.vn/economy/1694795/eu-deforestation-rules-pose-challenges-for-rubber-production-in-viet-nam-cambodia.html

[10] https://baotintuc.vn/infographics/muc-tieu-den-nam-2030-dien-tich-cao-su-cua-ca-nuoc-khoang-800-850-nghin-ha-20240216061236569.htm

[11] https://www.dnse.com.vn/senses/tin-tuc/hai-dong-luc-chinh-cho-nhom-co-phieu-cao-su-35004253

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |