15Jun2024

Industry Reviews / Latest News & Report

Comments: No Comments.

Plastic Waste: A large resource in Vietnam

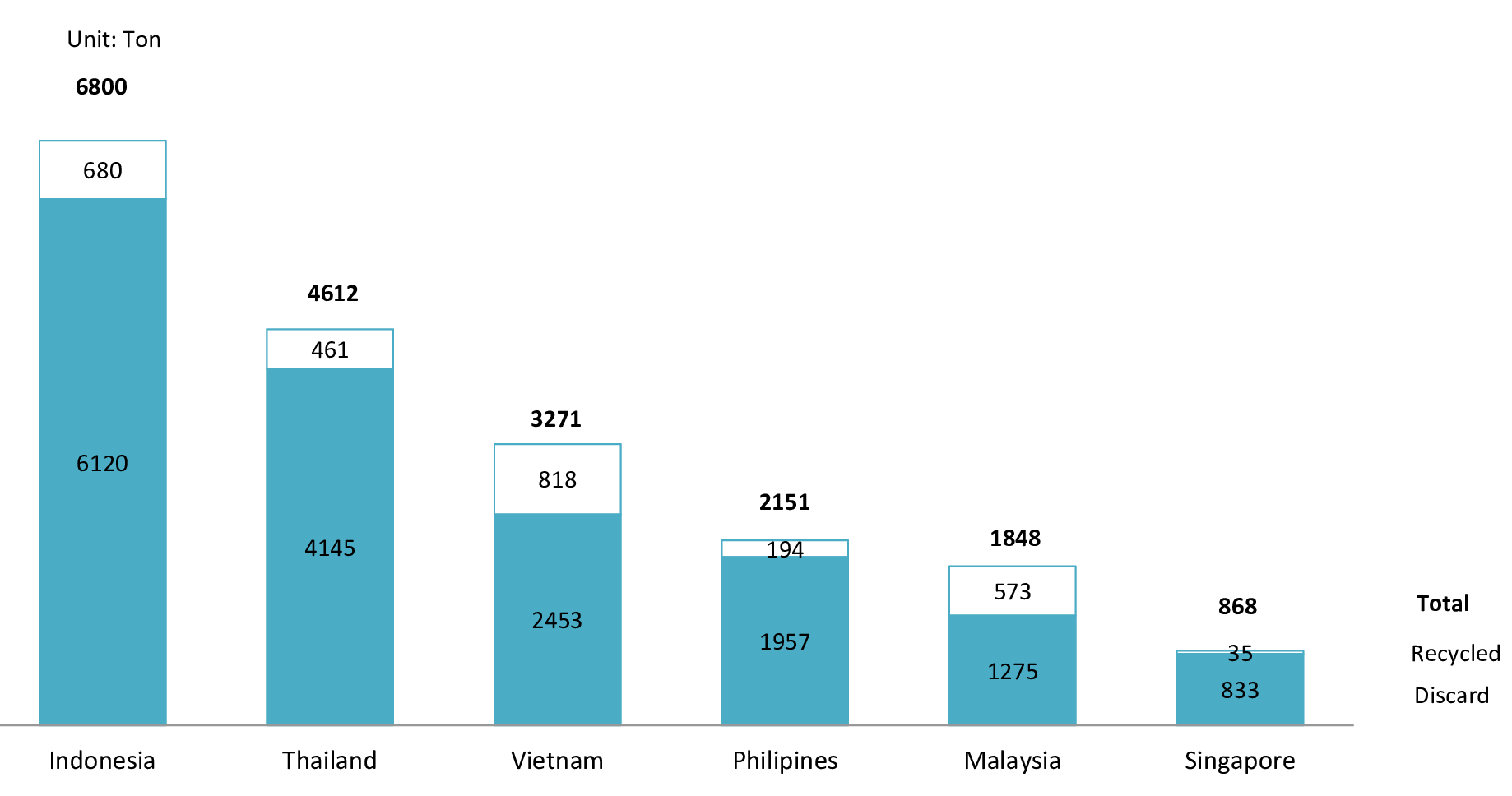

Vietnam has a very high demand for plastic, using about 3.9 million tons of PET, LDPE, HDPE, and PP plastics per year[1], leading to a large amount of disposal. However, only a few amounts have been recycled. As shown in Figure 1, the number of recycled plastic waste in some ASEAN countries in general, and Vietnam in particular is still limited. In 2021, only 817.5 thousand tons (25%) were recycled, while approximately 2.45 million tons (75%) were discarded in Vietnam[2].

Plastic Waste Disposal in some ASEAN countries, by treatment types in 2021

Plastic waste in Vietnam is considered an economic resource that has not been fully exploited for its profit potential. This is due to the following reasons. Firstly, there are inefficient and deficient recycling facilities, mostly located in craft villages, that use outdated technology and equipment. Their recycled plastic products can only meet demand in the low-end market segment. Meanwhile, formal recycling enterprises could meet only 30%[3] of the total recycling demand. Most of the recycling companies are mainly domestic companies. In 2021, Lien Minh was the plastic recycling company with the largest recycling capacity, with 75,000 tons per year[4]. Among the top 10 largest companies in the industry, there is only one joint venture with Japan, Q.M.T – JP Plastic, with a production capacity of 25,000 tons[5] per year.

Plastic waste in Vietnam is considered an economic resource that has not been fully exploited for its profit potential. This is due to the following reasons. Firstly, there are inefficient and deficient recycling facilities, mostly located in craft villages, that use outdated technology and equipment. Their recycled plastic products can only meet demand in the low-end market segment. Meanwhile, formal recycling enterprises could meet only 30%[3] of the total recycling demand. Most of the recycling companies are mainly domestic companies. In 2021, Lien Minh was the plastic recycling company with the largest recycling capacity, with 75,000 tons per year[4]. Among the top 10 largest companies in the industry, there is only one joint venture with Japan, Q.M.T – JP Plastic, with a production capacity of 25,000 tons[5] per year.

Second, low-quality yet costly input due to the low waste segregation rate and impurities, scatter resources. As a result, there is a higher loss rate when using domestic plastic waste for recycling compared to imported, more stable, and cleaner sources[6]. According to Duy Tan Recycling[7], the loss rate from the collected source as input for recycling production can be up to nearly 40%, while in other countries in the EU, this rate is only around 10-20%.

Lastly, the recent legal policy on plastic waste management, such as standards for recycled plastic products or mandatory recycled content levels, lacks detailed guidance for effective implementation. As a result, manufacturers and importers struggle to set up effective collection networks and meet their responsibilities for recycling plastic packaging.

The potential of the Plastic Recycling Industry in the future

In the coming time, given the large demand for plastics and abundant plastic waste resources, together with the sustainable development and green transition trend, this market is expected to have significant potential in the future[8] (The projected CAGR of the market size 2024-2032: 7.6%[9])

In particular, the Vietnamese government has strongly promoted the development of the recycling plastic industry to address the problems associated with the growth of the plastics industry and the mismanagement of plastic waste. One of the key efforts is the implementation of Extended Producer Responsibility (EPR) regulations on 1/1/2024. With EPR, manufacturers and importers must collect and recycle discarded plastic packaging by self-organizing, delegating to a third party, or contributing funds to the Vietnam Environmental Protection Fund[10].

The recycling rate for plastic packaging[11], regulated by EPR

|

No. |

List of Products and Packaging |

Mandatory recycling rate for the first 3 years |

|

1 |

Hard PET |

22% |

|

2 |

Hard HDPE, LDPE, PP, PS |

15% |

|

3 |

Hard EPS |

10% |

|

4 |

Hard PVC |

10% |

|

5 |

Other hard plastic packaging |

10% |

|

6 |

Single-material flexible packaging |

10% |

|

7 |

Multi-material flexible packaging |

10% |

Source: Appendix XXII, Degree No. 08/2022/NĐ-CP

In the context of sustainable development, the plastic recycling industry is poised for growth with increasing demand for recycled plastic, particularly in industries reliant on plastic. For example, the packaging industry is actively seeking more environmentally friendly alternatives, and recycled plastic has emerged as a promising solution. Major brands are committing to sustainable packaging such as Coca-Cola, Lavie, TH, Pepsi, and Nutifood. This creates an opportunity for the recycling sector to meet the market demand.

In addition to domestic production, the requirement for recycling plastic materials is projected to surge since Vietnam’s recycled plastic products aiming for export in the near future need to meet green standards. For example, the EU requires that 50% of packaging plastic materials should be recycled by 2025, and 55% by 2030[12].

Furthermore, the daunting issue of source separation of waste to provide better input for recycling activities is also being improved as the community awareness in Vietnam for waste separation and collection is increasing. According to the results of interviews with residents[13], 50% of households are now practicing source separation of waste, significantly higher than around 31% in 2019.

In summary, with significant untapped potential, the “green transition” trend, and efforts from the Vietnamese government, the plastic waste recycling industry is expected to continue growing strongly in the future.

[1] WWF Report (2022), Current Status And Solutions To Promote Plastic Waste Recycling In Vietnam .

[2] Le Xuan Dong (2022), Solutions for promoting the plastic recycling industry in Vietnam, FiinGroup <Assess>

[3] WWF Report (2022), Current Status And Solutions To Promote Plastic Waste Recycling In Vietnam.

[4] Le Xuan Dong (2022), Solutions for promoting the plastic recycling industry in Vietnam, FiinGroup <Assess>

[5] Q.M.T-JP Plastic website <Assess>

[6] WWF Report (2022), Current Status And Solutions To Promote Plastic Waste Recycling In Vietnam

[7] BCV In-depth-Interview Result

[8] World Bank (2021): Market Study for Vietnam: Plastic Circularity Opportunites and Barriers

[9] https://www.imarcgroup.com/vietnam-recycled-plastics-market

[10] VnEconomy (2024). Every year, Vietnam discharges 1.8 million tons of plastic waste into the environment. Assess: Here

[11] Law on Environmental Protection in Vietnam 2020; Degree No. 02/2022/NĐ-CP and Degree No. 08/2022/NĐ-CP

[12] https://kinhtedothi.vn/phai-phat-trien-ben-vung-thi-truong-tai-che-rac-thai-nhua.html

[13] Tran Thu Huong (2021). Current Situation Survey Study Plastic Waste In Vietnam. Assess: here; Sample size: 394 households in 10 provinces/cities in Vietnam.

B&Company

This article has been published in the column “Read Vietnamese trends” of ASEAN Economic News. Please see below for more information

|

B&Company, Inc. Công ty nghiên cứu thị trường của Nhật Bản đầu tiên tại Việt Nam từ năm 2008. Chúng tôi cung cấp đa dạng những dịch vụ bao gồm báo cáo ngành, phỏng vấn ngành, khảo sát người tiêu dùng, kết nối kinh doanh. Ngoài ra, chúng tôi đã phát triển cơ sở dữ liệu của hơn 900,000 công ty tại Việt Nam, có thể được sử dụng để tìm kiếm đối tác kinh doanh và phân tích thị trường. Xin vui lòng liên hệ với chúng tôi nếu bạn có bất kỳ thắc mắc hay nhu cầu nào. info@b-company.jp + (84) 28 3910 3913 |

Đọc thêm những bài phân tích khác

[/vc_column_text][/vc_column][/vc_row]

- All

- Business

- E-Commerce

- Economic

- Exhibition

- Food & Beverage

- Healthcare

- Human Resources

- Investment

- IT & Technology

- Multi-country Research

- Regulation

- Retail & Distribution

- Seminar

- Temporarily closed

- Tet

- Tourism & Hospitality