2025年10月13日

最新ニュースとレポート / ベトナムブリーフィング

コメント: コメントはまだありません.

ベトナムの再生可能エネルギー市場は、急速な経済成長と政府の強力なコミットメントに牽引され、東南アジアで最も活力のある市場の一つとなっています。再生可能エネルギーは既にベトナムの設備発電容量の約27%を占めています。第8次電力開発計画(PDP8)に基づく最近の政策は、この数値をさらに引き上げ、2030年までに再生可能エネルギーによる発電量を2800万~36%にすることを目標としています。これは、ベトナムの再生可能エネルギー市場への参入を目指す外国投資家にとって、大きなチャンスがあることを示唆しています。

ベトナムの再生可能エネルギー市場の概況

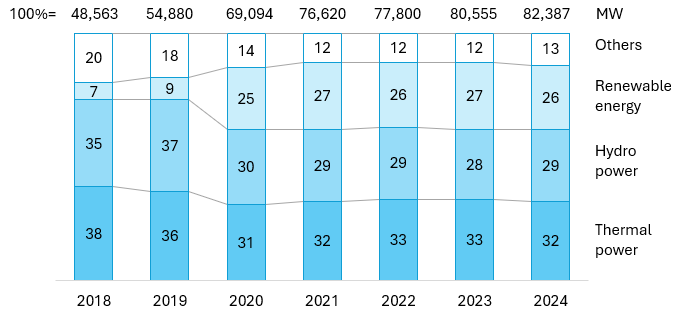

ベトナムは過去10年間で再生可能エネルギーのブームを経験し、小規模なプレイヤーから地域のリーダーへと変貌を遂げました。2023年末までに、ベトナムの太陽光発電容量は東南アジア最大(18.6GW)となりました。[1]再生可能エネルギー(主に太陽光と風力)は現在、国の設備発電容量の約27%を占めています。[2]この目覚ましい増加は、支援政策とベトナムの有利な地理条件(豊富な太陽光と強風が吹く 3,000 km の海岸線)によって推進されています。

ベトナムの設置電力容量

出典: B&Company 編集

政府は、エネルギー安全保障と気候変動対策への取り組みを背景に、再生可能エネルギーを強く推進しています。新たに承認されたPDP8(2023年)では、ベトナムは2030年までに再生可能エネルギーによる電力供給量を28~36%、2050年までに74~75%に増加させることを目標としています。[3] これまでの石炭と水力発電への依存からの抜本的な転換です。ベトナムは、再生可能エネルギー、特に太陽光と風力による発電の最大化を目指しています。

2030年と2050年に向けたベトナムの電源構成

| 電源 | 2030年の電力容量 | 電力容量2050 | ||

| MW | % | MW | % | |

| 太陽 | 46,459 – 73,416 | 25-31 | 293,088 – 295,646 | 35-38 |

| 水力発電 | 33,294 – 34,667 | 15-18 | 40,624 | 5 |

| 陸上および沿岸風力 | 26,066 – 38,029 | 14-16 | 84,696 – 91,400 | 11 |

| 石炭火力発電 | 31,055 | 13-17 | 0 | 0 |

| 蓄電電源 | 10,000 – 16,300 | 5-7 | 95,983 – 96,120 | 11-12 |

| 洋上風力 | 6,000 – 17,032 | 3-7 | 113,503 – 139,097 | 15-17 |

| Nuclear power | 4,000 – 6,400 | 2-3 | 10,500 – 14,000 | 1-2 |

| バイオマス | 1,523 – 2,699 | 1 | 4,829 – 6,960 | 1 |

| 廃棄物発電 | 1,441 – 2,137 | 1 | 1,784 -2,137 | 0.2-0.3 |

| その他の電源 | 14,628-23,453 | 6-13 | 129,496-152,697 | 17-18 |

| 全体 | 183,291 – 236,363 | 100 | 774,503 – 838,681 | 100 |

出典:決定768/QĐ-TTg

ベトナムは当初、2019年から2021年にかけて、太陽光発電と風力発電の活性化を図るため、大幅な固定価格買い取り制度(FiT)を導入しました。風力発電容量は、2013年の53MWから2023年には約5,888MWに増加しました。その後、系統のボトルネックにより、2022年には太陽光発電が約13億kWh抑制されました。現在、政策は系統のアップグレード、2024年までの大口需要家向け直接電力購入契約(DPA)、蓄電池の推進、系統のデジタル化、屋上太陽光発電の促進を通じた持続可能な成長へと軸足を移しており、2030年までに建物の50%に屋上太陽光発電を普及させることを目標としています。制度は固定価格買い取り制度から競争入札へと移行しつつありますが、税制優遇措置や輸入関税の免除といった優遇措置は、外国資本や専門知識の誘致に引き続き活用されます。

ベトナムの再生可能エネルギー市場の主要プレーヤー

歴史的に、ベトナムの再生可能エネルギー導入は外国投資家が主導してきました。タイ、シンガポール、日本などの企業が資本と技術を持ち込み、初期の太陽光発電所や風力発電所を建設しました。しかし、同時に、大規模プロジェクトにおける国内企業の役割について疑問が生じました。現在、ベトナムの有力企業が台頭するにつれ、この傾向は変わりつつあります。複数の地元コングロマリット(Vingroup、Trungnam、TTC、BIMなど)がクリーンエネルギー分野で積極的に事業を拡大しています。

| いいえ | 会社 | 設立 | 本部 | 国 | プロフィール |

| 1 | ベトナム電力(EVN) | 1995 | ハノイ市 | 「Vietnam's | 国営の公益事業独占企業(発電、送電網、小売)。ベトナムの電力インフラの大部分を管理し、IPPプロジェクトの唯一のオフテイカーである。EVNは大規模水力発電所を運営しており、新たな再生可能エネルギー発電設備の導入に不可欠な存在である。 |

| 2 | ヴィングループ(ヴィンエネルゴ) | 1993 | ハノイ市 | 「Vietnam's | ベトナム最大のコングロマリット(不動産、小売、自動車)がVinEnergo(2024年設立)を通じてエネルギー事業に参入。大規模な太陽光発電および風力発電プロジェクト(例えば、4.5GWの洋上風力発電)を計画している。[4]これは再生可能エネルギーへの国内投資の増加を示している。 |

| 3 | トゥルンナムグループ | 2004 | ハノイ市 | 「Vietnam's | ベトナムを代表する民間エネルギー開発会社。450MWの太陽光発電所や、国内最大の風力発電所(ダクラクの400MWエアナム)など、最大級の再生可能エネルギープロジェクトを建設。[5]グリッドインフラとバッテリーストレージにも投資しています。 |

| 4 | TTCグループ(タンタンコン) | 1979 | ホーチミン市 | 「Vietnam's | 多角経営コングロマリット(砂糖、不動産、エネルギー)。エネルギー部門(TTCエナジー/GEC)を通じて、TTCは太陽光発電所と風力発電プロジェクトを開発してきた。太陽光発電所に関しては、ガルフ(タイランド)などの外国投資家と提携している。[6] 風力プロジェクトを所有しています (例: バクリューの 300 MW)[7]. |

| 5 | バンブーキャピタル(BCG) | 2011 | ホーチミン市 | 「Vietnam's | インフラと再生可能エネルギーに注力する新興コングロマリット(BCG Energy経由)。複数の太陽光発電所(例:フーミ太陽光発電所)や風力発電プロジェクトに投資しています。BCGは国際的なパートナーと積極的に連携し、クリーンエネルギーポートフォリオを全国規模で拡大することを目指しています。 |

| 6 | BIMグループ | 1994 | ハノイ市 | 「Vietnam's | 再生可能エネルギー部門を有する大手民間コングロマリット(不動産、農業)。フィリピンのACENと提携し、ベトナム最大級の太陽光発電所(ニントゥアン省330MW)を開発。[8]BIM は風力発電やその他のグリーンプロジェクトにも拡大しています。 |

| 7 | ガルフ・エナジー・デベロップメント | 2011 | バンコク | タイ | タイ最大の電力会社の一つで、ベトナムのエネルギーセクターに積極的に投資しています。ガルフは、タイニン省の太陽光発電所(TTCグループとの合弁事業)をはじめ、様々なプロジェクトに投資しています。[9] 陸上および洋上風力発電所(例:ベンチェの310MW洋上風力)[10]. |

| 8 | B.グリムパワー | 1878 | バンコク | タイ | タイ最古のインフラ複合企業であり、多数の発電所を運営しています。B.Grimmはベトナムの太陽光発電分野における初期の外国投資家であり、例えば、420MWのDau Tieng太陽光発電クラスター(アジア最大級)の共同開発に携わっています。また、ベトナムにおける新たな再生可能エネルギープロジェクトの模索を続けています。 |

| 9 | ACEN(アヤラコーポレーション) | 2011 | マニラ | フィリピン | アヤラ・グループのエネルギー部門であり、東南アジアにおける再生可能エネルギーへの有力な投資家。ACENは約7GWの再生可能エネルギーを保有し、太陽光および風力発電プロジェクトの共同開発を通じてベトナムに進出した。BIMグループと提携し、ニントゥアン省に330MWの太陽光発電所を建設した。[11] また、複数の風力発電所(例:40MWのムイネー風力発電所)に出資しています。 |

| 10 | オルステッドA/S | 2006 | フレデリシア | デンマーク | 世界最大の洋上風力発電開発会社。オルステッドはベトナムの洋上風力発電の可能性を探っており、ベトナム沿岸における大規模洋上風力発電所の調査のため、現地パートナー(T&Tグループ等)と契約を締結しました。プロジェクトはまだ初期段階ですが、オルステッドの関与は、ベトナムの新興洋上風力発電分野に貴重な専門知識と自信をもたらします。 |

出典:B&Company編集

もう一つの洞察は、市場の広範さです。太陽光発電(公益事業規模および屋上設置型)、陸上風力、そして最先端の洋上風力発電まで、幅広い分野にまたがっています。各社はそれぞれ異なるセグメントに特化しています。例えば、B.GrimmやACENといった企業は太陽光発電と陸上風力発電所に注力している一方、OrstedやCIP(デンマーク)は洋上風力発電の機会をターゲットとしています。主要電力会社であるEVNは、すべてのプロジェクトが最終的にEVNの送電網に接続され、長期PPAに基づいてEVNに電力を販売するため、セクター全体を支えています。投資家は皆、EVNの単一購入者モデルとその進化する規制の範囲内で事業を展開しなければなりません。

ベトナムの再生可能エネルギー市場における機会と課題

ベトナムの再生可能エネルギー市場への参入は大きな可能性を秘めていますが、同時に落とし穴も存在します。外国投資家は、市場参入にあたり、以下の機会と課題を検討する必要があります。

重要な機会

| 急増するエネルギー需要 | ベトナムの電力需要は2030年まで毎年約10~12%増加すると予測されている。[12]この成長と、政府の新規石炭火力発電所に対する規制により、再生可能エネルギーの拡大に大きな余地が生まれています。安定した電力を供給できるプロジェクトは、すぐに市場が開拓され、高い稼働率が得られるでしょう。 |

| 豊かな自然の可能性 | ベトナムは世界クラスの再生可能資源を有しています。南部では日射量が高く、洋上風力発電の潜在能力は311GWと推定されており、これは世界最大級の規模です。[13]この比類のない資源基盤は、ベトナムが、他のASEAN諸国ではほとんどサポートできない大規模な洋上風力発電所を含む、数ギガワットの収益性の高い太陽光発電所や風力発電所を誘致できることを意味します。 |

| 政府の支援とネットゼロ目標 | 政府の政策環境は依然として非常に良好です。減税措置、土地賃料の免除、再生可能エネルギー機器への低輸入関税などの優遇措置が利用可能です。[14]ベトナムの2050年までのネットゼロ排出へのコミットメント(COP26で約束)とPDP8の目標は、クリーンエネルギープロジェクトを優先する強い政治的意思を示している。[15]長期的なビジョンを持つ外国人投資家は、概ね良好で安定した政策動向(固定価格買い取り制度がオークションへと進化する中での短期的な調整はあるものの)から恩恵を受けることができる。 |

| 未開拓セグメント | グリッド規模の発電所以外にも、屋上太陽光発電、蓄電池、グリーン水素などの分野が台頭しており、政策によって奨励されている。[16]外国投資家は、ベトナムが送電網の回復力向上と再生可能エネルギーの統合を奨励している高度なソリューション(例:蓄電システム、スマートグリッド技術)の提供においてニッチ市場を開拓することができます。 |

主な課題

| 規制の不確実性 | ベトナムは再生可能エネルギーに前向きな姿勢を示しているものの、政策の詳細は変更される可能性があります。固定価格買取制度から入札モデルへの移行は、プロジェクトの経済性に不確実性をもたらしました。[17]プロジェクトの承認、PPA交渉、料金設定の手続きは、長引く官僚的な手続きとなる場合があります。規制(オークションルール、グリッドコードなど)は依然として変化し続けているため、投資家は常に機敏に対応し、情報を入手する必要があります。規制の不一致や実施の遅れは依然として大きな懸念事項です。[18]. |

| グリッドインフラストラクチャの制約 | 再生可能エネルギーの急速な成長に比べて、電力網は未発達です。多くの太陽光発電・風力発電プロジェクトは、送電網のボトルネックにより生産量の抑制に直面しています。[19]最も脆弱なリンクは、まさに再生可能資源が最も豊富な地域(ベトナム中部および南部)にあります。送電網のアップグレードが追いつくまで(政府はこれに取り組んでいますが、時間がかかります)、新規プロジェクトは出力抑制や接続遅延のリスクにさらされます。外国投資家は送電網拡張のタイムラインを考慮し、プロジェクト計画の一環として送電網の改善に投資するか、提唱するべきです。 |

| PPAと銀行融資可能性の問題 | ベトナムの再生可能エネルギーに関する標準的なPPAは、投資家保護が不十分であるとして批判されてきた(EVNの支払義務に対する政府保証の欠如、紛争解決の難しさなど)。多くのプロジェクトは依然として資金調達を確保しているものの、こうした契約リスクや為替リスクは資金調達コストの上昇につながる可能性がある。これらの条件が改善されるか、保証によって緩和されない限り、投資家はノンリコース・プロジェクトファイナンスの調達に困難を経験する可能性がある。 |

| 土地と許可のハードル | 土地の権利と許可の取得は複雑になりがちです。再生可能エネルギープロジェクトは環境影響評価を受ける必要があり、洋上風力発電には広範な海洋空間計画が必要です。地域社会との重複(洋上風力発電の場合は漁場、太陽光発電の場合は農地)は、適切に管理されなければ社会的な反対につながる可能性があります。例えば、一部の風力発電所は、事業開始前に長期間にわたる地域社会との協議を余儀なくされました。外国の開発業者は、現地での土地取得とステークホルダーとの協議を慎重に進めなければならず、現地の問題への対応は多くの場合、現地のパートナーに頼らざるを得ません。 |

ベトナムの再生可能エネルギー市場への参入への影響

ベトナムの再生可能エネルギー市場は、アジアで最も急速なエネルギー転換の一つに外国投資家が参入できる魅力的な機会を提供しています。成功の鍵は、現地市場の複雑さを理解すること、つまり政府の計画との整合性、現地のステークホルダーとの連携、そしてインフラおよび規制リスクの軽減にあります。

– 優先分野風力発電、太陽光発電、商業・産業用屋上太陽光発電、蓄電池、系統デジタル化などが含まれます。地域的に大きな投資機会があるのは、風力・太陽光発電に関してはビントゥアン省、ニントゥアン省、バリア・ブンタウ省などの中南部回廊地域、沿岸・洋上風力発電に関してはソクチャン省、チャビン省、ベンチェ省、バクリュー省などのメコンデルタ沿岸地域、大規模太陽光発電と蓄電池を組み合わせたタイニン省、ビンフオック省、ロンアン省、アンザン省などの南東部ソーラーベルト地域、拡張可能な屋上ポートフォリオに関してはバクニン省、バクザン省、ハイフォン省、ハイズオン省、タイグエン省、クアンニン省などの北部産業集積地です。

– 信頼できる地元企業と提携する: ベトナムの既存企業との合弁事業や提携は、規制手続き、土地取得、地域社会との関係構築を容易にするだけでなく、現地参加に対する政府の期待に応えることにもつながります。市場参入に成功する企業は、しばしばこうした「ローカリゼーション」のアプローチ、つまり外国資本と技術を国内ステークホルダーの関与と融合させるアプローチを模倣しています。

– グリッドフレンドリーなソリューションに焦点を当てる: 送電網の制約を考慮すると、ソリューション(エネルギー貯蔵、送電網のアップグレード、あるいは太陽光、風力、貯蔵を組み合わせたハイブリッドプロジェクト)を取り入れる投資家は、プロジェクトの承認とパフォーマンスにおいて優位に立つでしょう。EVNや関係当局と連携して送電網統合計画を策定したり、プロジェクト専用の送電網に投資したりすることで、出力抑制リスクを軽減できます。ベトナムは、バッテリーを備えたプロジェクトや消費地に近いプロジェクトを奨励しています。[7]したがって、提案をそれに応じて調整すると、成功の可能性が向上します。

– 長期的なコミットメントと柔軟性: 規制当局(例えば、商工省、ERAV)との関係を構築し、政策変更に柔軟に対応し続けることが重要です。政策の移行期間(関税調整や承認手続きの長期化など)には、忍耐が必要となる場合があります。

B&Company株式会社 は、ベトナムに拠点を置く日本企業の市場調査・投資コンサルティング会社です。外国投資家がベトナム市場に自信を持って参入し、事業を拡大できるよう支援しています。ベトナムの再生可能エネルギー市場に関する深い洞察と信頼できるパートナーネットワークを活用し、以下の方法で投資家をサポートしています。

– 市場調査レポート: 明確な継続/中止の推奨事項と優先順位が付けられた州とセクターを含む最新の市場ビュー(規模、ポリシー、グリッド、競争)。

– ベトナムでのパートナー探し: パートナーのロングリストからショートリストへの絞り込み、評判のチェック、そして合弁事業のパートナーを確保するための会議の企画。

– M&Aアドバイザリー: 取引の発掘とデューデリジェンスのサポート(技術、商業、法務、ESG)

*ご注意: 本記事の情報を引用される場合は、著作権の尊重のために、出典と記事のリンクを明記していただきますようお願いいたします。

| B&Company株式会社

2008年に設立され、ベトナムにおける日系初の本格的な市場調査サービス企業として、業界レポート、業界インタビュー、消費者調査、ビジネスマッチングなど幅広いサービスを提供してきました。また最近では90万社を超える在ベトナム企業のデータベースを整備し、企業のパートナー探索や市場分析に活用しています。 お気軽にお問い合わせください info@b-company.jp + (84) 28 3910 3913 |