21Nov2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s private hospital market is expanding, driven by the rise of the middle class, population aging, overcrowding in public hospitals, and supportive government policies. Leading private hospital chains such as Vinmec, Hoan My, Tam Anh, and Xuyen A are actively scaling their networks, strengthening international partnerships, accelerating digital transformation, and developing medical tourism. This context creates attractive opportunities for foreign investors to cooperate in niches such as medical tourism, modern healthcare with high technology, and intensive and long-term care. However, this requires long-term strategies, strong regulatory understanding, and a clear commitment to high-quality standards.

Overview of the private hospital chains market in Vietnam

The private healthcare sector is helping to ease the burden on public hospitals and expand access to high-quality services for the population. The number of private hospitals has been growing rapidly over the past years. By the end of 2022, Vietnam has about 320 private hospitals with more than 22 thousand beds[1]. As of 2024, Vietnam has more than 400 private hospitals and tens of thousands of private clinics, accounting for around 24% of all hospitals nationwide. However, beds in private hospitals account for only 5.8% of the total. In Hanoi, these figures are slightly higher, with 44 private hospitals accounting for 29% of the city’s hospitals and nearly 3,000 beds, equivalent to 6.5% of total hospital beds in the city[2]. In Ho Chi Minh City, there are around 65 private hospitals with nearly 4,700 beds, making up about 12% of the city’s total hospital beds[3].

According to projections, the private healthcare market is expected to grow by around 7.5% annually during 2025–2030[4], driven by factors such as:

– Supportive policies and strategic orientation for the private healthcare sector: In February 2024, Decision No. 201/QD-TTg set a target for private medical facilities to account for 15% of total hospital beds by 2030 and 25% by 2050[5]. For the 2025–2030 term, the Vietnam Private Hospital Association has outlined a strategy to encourage its members to expand investment, develop new hospitals, upgrade infrastructure, and promote the application of science and technology alongside advanced treatment methods[6].

On the morning of August 3, the Vietnam Private Hospital Association held the 3rd Congress of Delegates for the 2025-2030 term

Source: Diendandoanhnghiep

– Growth of the middle class and higher spending power: Rising income levels and the expansion of the middle class provide a stable demand base for private healthcare services, especially in the mid- to high-end segments. It is estimated that the middle class will account for 26% of the population by 2026 and could reach 50 million people by 2050[7]. In addition, GDP per capita is projected to reach USD 7,500 by 2030, with average disposable income increasing by around 56%[8].

– Population aging and demand for long-term care: Vietnam is aging at one of the fastest rates in the world, with people aged 60 and above accounting for about 11.9% of the population in 2019 and projected to exceed 25% by 2050; the country is expected to become an “aged society” around 2036[9]. The World Bank highlights that aging will significantly increase demand for long-term care, rehabilitation, chronic disease management, and specialized treatment, creating room for private hospital chains to develop specialty centers, personalized treatment services, and comprehensive care packages for older adults[10].

– High outbound medical spending: The Ministry of Health estimates that around 40,000 Vietnamese travels abroad for medical treatment each year, with total spending of roughly USD 2 billion, mainly in Thailand, Singapore, and South Korea[11]. This indicates that a segment of demand for high-quality services, transparent processes, and personalized care has not yet been fully met domestically.

– Digitalization and innovation in healthcare delivery: Hospital Information Systems (HIS), Electronic Health Records (EHR), and telemedicine are being adopted more widely. Leading public hospitals and private providers are at the forefront of investing in digital platforms, remote consultation, patient data management, and AI-assisted diagnostics, helping private hospital chains optimize operations, standardize service quality across multiple sites, and gain a competitive edge over standalone hospitals[12].

International Cooperation Trends

Alongside network expansion, private hospital chains in Vietnam increasingly view international cooperation as a strategic lever to enhance quality standards, broaden service offerings, and strengthen brand credibility. Key cooperation trends can be seen through several models:

– Wave of M&A and strategic investments from regional groups: Mergers and acquisitions enable foreign investors to enter the market more quickly, while helping Vietnamese hospitals upgrade governance and service standards. The acquisition of FV Hospital by Thomson Medical Group (Singapore) for approximately USD 381.4 million in 2024 is recognized as one of the largest healthcare transactions in Southeast Asia in recent years, underscoring the attractiveness of Vietnam’s high-quality healthcare market[13].

– Management contracts and operational franchising with international partners: Rather than only providing capital, many international healthcare groups adopt management agreement models that bring governance systems, clinical protocols, brand value, and networks of medical experts. The case of Raffles Medical Group (Singapore) becoming the controlling shareholder and signing a management agreement with American International Hospital (AIH) in Ho Chi Minh City (from 2023) is a representative example[14].

– Clinical collaboration and digital transformation partnerships: Leading chains are intensifying collaboration in medical expertise and technology to build long-term competitive advantages. Vinmec is a notable example, with Vinmec Times City and Central Park joining the Cleveland Clinic Connected network (2023–2024) and developing Vinmec Can Gio based on Cleveland Clinic standards, alongside joint programs in key specialties such as cardiology, oncology, and neurology[15]. In parallel, many private hospitals are becoming “testbeds” for digital transformation, exemplified by the comprehensive partnership between GE HealthCare and Tam Anh General Hospital System (May 2024) on AI-powered equipment, technology transfer, training, and research[16].

– Medical tourism and regional healthcare ecosystem development: The Ministry of Health is developing plans for high-quality healthcare services linked with medical tourism for 2025–2030, aiming to build internationally accredited facilities to attract regional patients and reduce outbound medical travel by Vietnamese citizens[17]. Several private hospitals, such as Vinmec, FV, Tam Anh, and Hanh Phuc, have begun to clearly position themselves in medical tourism by offering comprehensive service packages for international patients—for example, Vinmec’s dedicated “Medical Tourism” services with support in scheduling, interpretation, and treatment coordination across multiple facilities connected to major tourist and resort destinations[18].

Vinmec Healthcare System operates 9 hospitals across Vietnam

Source: Vinmec

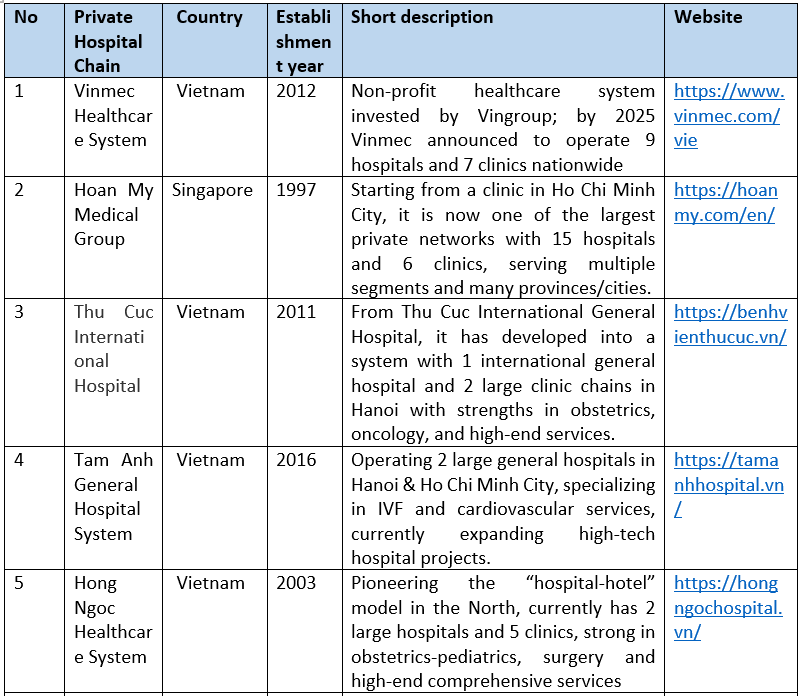

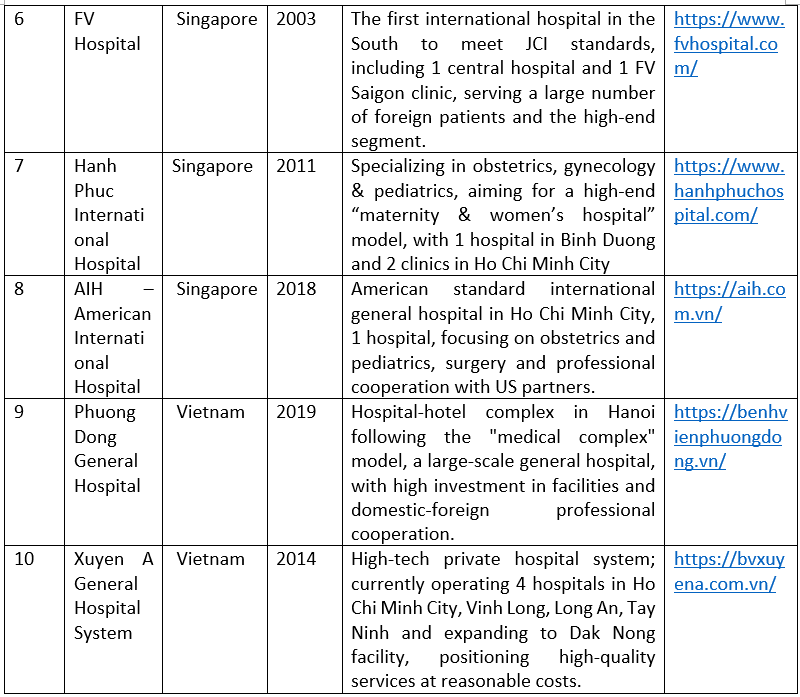

Key private hospital chains in Vietnam

The rapid expansion of private healthcare in Vietnam is being driven by a group of hospital systems and chains with clear scale, branding, and market positioning. The following players are among the key “core hubs” shaping the high-quality healthcare segment and international collaboration landscape.

B&Company’s synthesis

Vietnam’s private hospital market is entering a “chainization” phase, with domestic groups like Vinmec, Hoan My, Thu Cuc, Tam Anh, Hong Ngoc, and Xuyen A expanding nationwide and standardizing services. Specialized systems such as Hanh Phuc and Phuong Dong focus on niche areas and “medical complex” models in obstetrics, pediatrics, IVF, and high-end care. The involvement of international investors (Thomson Medical–FV, Raffles Medical–AIH) underscores Vietnam’s potential as a regional medical hub. As scale, brand, and technology become key advantages, small independent hospitals face growing pressure to join chains, form partnerships, or upgrade their models to stay competitive.

Implications for foreign investors

Foreign investors see clear opportunities in Vietnam’s private hospital market, driven by rising demand for quality care from the growing middle class, aging population, and patients seeking treatment abroad. National planning (Decision 201/QD-TTg) also promotes private sector growth by expanding private hospital beds and positioning it as a key pillar of the health system. With leading chains (Vinmec, Hoan My, Tam Anh, Thu Cuc, Xuyen A, FV, AIH) and trends in international partnership, digital transformation, and medical tourism, there remains significant potential for collaboration in capital, management, technology, and expertise—especially in specialized care, long-term treatment, and high-end hospitals in cities and tourist areas.

However, market entry remains challenging due to complex regulations on licensing, land, pricing, and insurance, as well as strict standards on quality, ethics, and transparency. Competition is intensifying as local chains leverage strong brands and networks, while skilled medical staff are scarce and investment costs are high. Long payback periods and reputational risks further heighten barriers for newcomers.

Therefore, instead of building hospitals from scratch, foreign investors should adopt a long-term strategy in three directions:

(1) Pursue M&A or strategic joint ventures with existing private chains to leverage local brands, patient networks, and licenses—combining management contracts, clinical process transfer, and technology sharing;

(2) Focus on high-demand but undersupplied areas such as oncology, cardiology, premium obstetrics and pediatrics, rehabilitation, geriatrics, long-term care, and medical tourism aligned with international standards;

(3) Invest systematically in digital transformation and human resource development (HIS/EHR, AI diagnosis, telehealth, quality control, joint training) while ensuring compliance with national planning, ethics, and social responsibility.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[1] Viet Nam News. Private hospitals look to capture growing healthcare market, profitability varies Access

[2] Private healthcare accounts for 24% of hospitals nationwide Access

[3] Vietnam Investment Review. Private healthcare boosts its presence Access

[4] Government News Portal – Private healthcare is an indispensable part of the national health system (Access)

[5] The Government of Vietnam – Decision No. 201/QD-TTg on National Health System Planning 2021–2030 (Access)

[6] Vietnam Business Forum – Two major directions of the Vietnam Private Hospital Association, term 2025–2030 (Access)

[7] Vietnam Investment Review – Middle class reaches 50 million: a service sector will boom (Access)

[8] The National Assembly of Vietnam – Law No. 81/QH2023 on Medical Examination and Treatment (Access)

[9] UNFPA Vietnam – Population and healthcare statistics (Access)

[10]World Bank – Vietnam Health Sector Overview (Access)

[11] Ministry of Health (Vietnam) – Vietnam has all the conditions to develop medical tourism (Access)

[12] B&Company – Digital Transformation in Vietnam’s Healthcare Sector: Paving the Way for a Healthier Future (Access)

[13] Vietdata Research – Vietnam Private Healthcare Market Report (Access)

[14] FV Hospital – Official website (Access)

[15] VietnamPlus – Vietnam’s medical tourism potential (Access)

[16] Raffles Medical China – Corporate overview (Access)

[17] American International Hospital (AIH) – Official website (Access)

[18] Raffles Medical Vietnam – Official website (Access)