28Jan2026

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s healthy drink market gained visible momentum in 2025 as both policy signals and shifting consumer preferences pushed brands to rethink what “better-for-you” means. Low-sugar and sugar-free options are increasingly moving from a nice-to-have feature to a clear purchase criterion, while functional benefits such as hydration, electrolytes, and fermentation are becoming more mainstream across categories. In response, major domestic players have accelerated portfolio upgrades and new launches. The market is showing a lot of opportunities and also challenges for foreign investors aiming to invest in the healthy drinks in Vietnam.

Overview of Vietnam’s beverage market: The decline of unhealthy beverage categories

According to EMR, the Vietnam beverage market is projected to grow at a CAGR of 4.7% between 2026 and 2035 to reach nearly USD 25.71 billion by 2035. Among them, non-alcoholic beverages have a significantly higher CAGR of 5.3%[1].

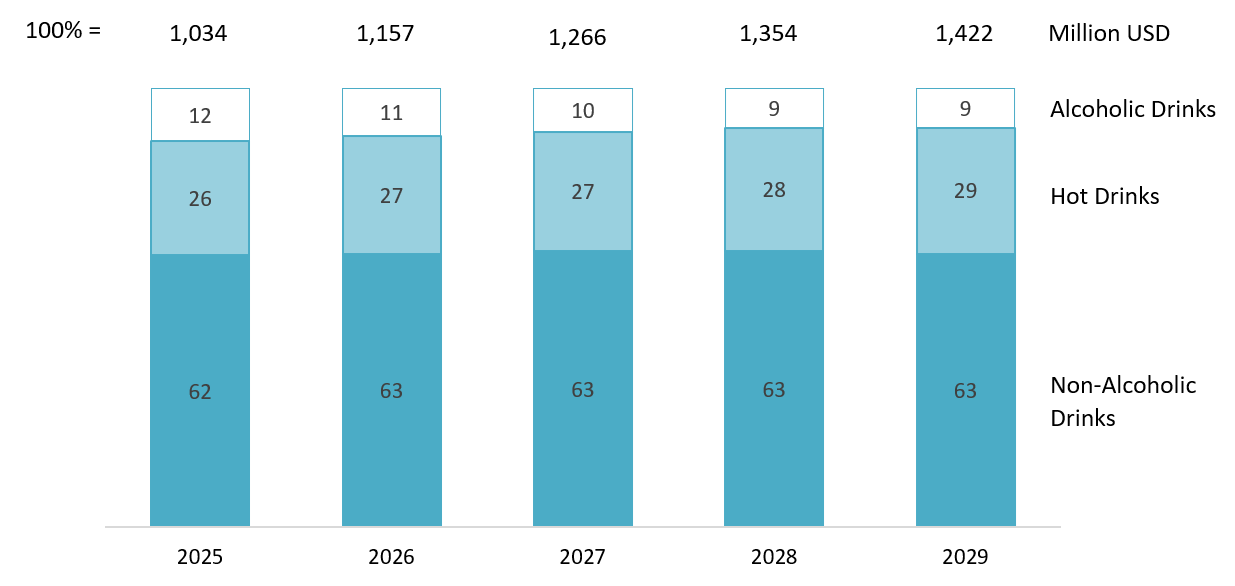

Predicted beverage market in Vietnam by revenue, 2025-2029

Source: Statista

During the 2025–2029 forecast period, Vietnam’s beverage market revenue structure indicates a gradual decline in alcoholic beverages: their share is expected to fall from 12% in 2025 to 9% by 2028–2029. In contrast, non-alcoholic beverages are projected to remain broadly stable at around 62–63% throughout the period.

The declining consumption of beverage categories perceived as less healthy is being driven simultaneously by policy measures and consumer behavior. On the policy side, at the 9th session on 14 June 2025, the National Assembly passed the Special Consumption Tax Law. Under this law, spirits with an alcohol content of 20% ABV or higher and beer will be taxed at 65% from early 2026; the rate will then increase by 5 percentage points each year, reaching 90% by 2031. In the non-alcoholic segment, policy pressure is also rising for sugar-sweetened soft drinks: beverages with sugar content exceeding 5g per 100ml (as defined by Vietnamese standards) will be subject to a tax, phased in at 8% from 2027 and 10% from 2028. Importantly, this measure targets sugar-sweetened soft drinks and excludes products such as 100% fruit juice, coconut water, milk/dairy-based beverages, mineral water, and liquid nutritional foods/supplements[2].

At the same time, a survey of Insight Asia on more than 500 consumers shows that high sugar content, artificial ingredients in beverages, and health concerns are prompting people to cut back on purchasing conventional soft drinks. As a result, as many as 28% of consumers tend to choose low-sugar or sugar-free beverages and are willing to pay a premium if they perceive clear health benefits[3]. These factors have created favorable conditions for the emergence of healthier beverage products, especially low-sugar or sugar-free lines, functional drinks, and products positioned as beneficial for health.

Key trends in 2025

The decline in the consumption of less healthy soft drinks has driven several new trends in Vietnam’s beverage market in 2025, including:

– The rise of low-sugar and sugar-free product lines: In 2025, demand for low/no-sugar options has shifted from a nice-to-have feature to a clearly defined purchasing criterion. InsightAsia survey indicates that low/no-sugar options are among the factors influencing purchase decisions (46%), while high sugar content is the biggest barrier causing consumers to cut back on soft drinks (82%). The National Assembly’s approval of a special consumption tax on sugary beverages has also put pressure on brands to reformulate and expand low-/no-sugar portfolios earlier. Notably, InsightAsia reported strong growth for Tea+ within the RTD tea segment, driven by low-sugar variants and more premium positioning—suggesting that “low sugar” is a tangible growth lever rather than merely a marketing message[4]

– The rise of functional beverages: In 2025, hydration–electrolyte drinks, energy-boost beverages, and products fortified with vitamins/minerals became more prominent, supported by real demand and a faster-paced lifestyle. Functional benefits have emerged as a key purchase driver (52%) and are also among the most appealing product trends (78%)[5]. Alongside this, the market continued to see new functional/fermented launches—for example, Vinamilk introduced Kombucha HAYĐẤY on 5 August 2025, contributing to the broader mainstreaming of “better-for-you” beverage options[6].

– Natural ingredients and local flavors gaining traction: In 2025, consumers are not only looking for low sugar but are also paying closer attention to product naturalness and locally resonant flavors. Natural ingredients are a meaningful purchase driver (42%), and within RTD tea, they are a key secondary driver (68%). In addition, 52% of consumers are open to herbal/botanical infusions, and there is growing interest in Vietnamese-inspired fruit profiles such as lychee and calamansi (kumquat)—highlighting strong headroom for “natural” formulations aligned with Vietnamese taste preferences[7]. For instance, TH announced TH true TEA Natural Guava Tea and Natural Kumquat Tea in 2025, emphasizing all-natural ingredients and familiar fruit flavors[8].

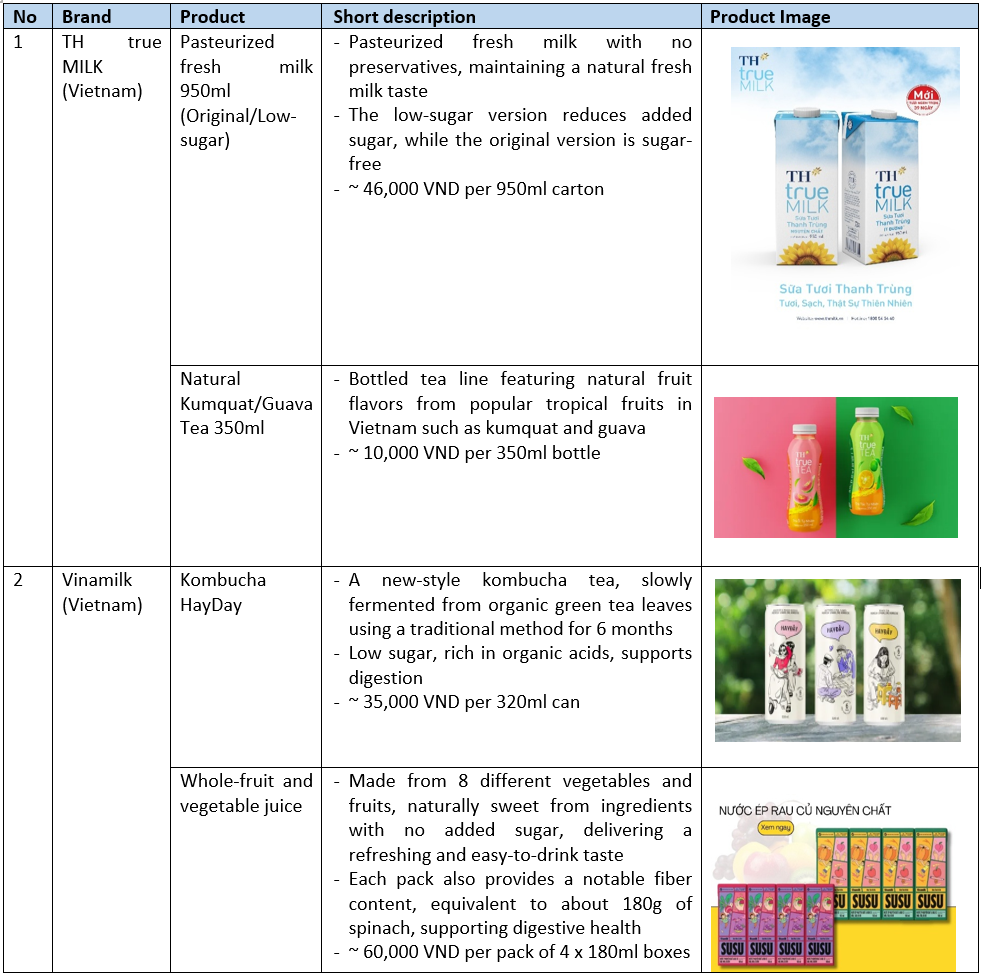

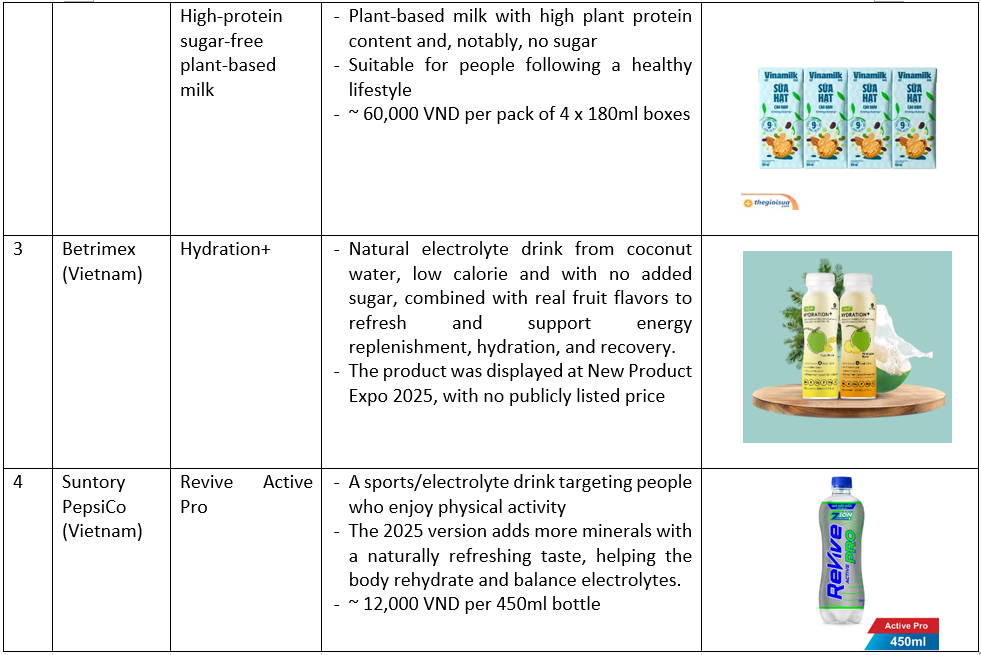

Some healthy drink products released in 2025

In 2025, Vietnam saw a wave of new “better-for-you” beverage launches from leading domestic brands such as Vinamilk, TH true Milk, Betrimex, and Revive – highlighting how major players are moving quickly to align with the country’s increasingly health-conscious consumption trend.

B&Company’s synthesis

In 2025, major beverage companies in Vietnam continued to steer their portfolios toward healthier choices in a practical, easy-to-understand way, with benefits that fit daily needs. In dairy, brands focused more on sugar control and clearer nutrition positioning through low-sugar or sugar-free options, as well as higher-protein and plant-based products. At the same time, the market expanded beyond dairy into other health-oriented formats such as kombucha and fruit and vegetable juices. Functional beverages also became more visible, especially products built around hydration and electrolyte replenishment, often combined with fruit flavors or added minerals to match active, busy lifestyles. Overall, the idea of health in beverages is moving beyond simply reducing sugar and shifting toward more specific benefits, creating room for higher value-added product lines.

Implications for foreign investors

Vietnam’s healthier beverage segment is being driven by both regulation and real consumer demand. Stronger policy pressure on high-sugar drinks and alcoholic beverages is encouraging reformulation, while also accelerating the growth potential of low-sugar and sugar-free options. On the consumer side, sugar control is increasingly shaping purchase decisions, meaning these products are becoming part of mainstream consumption rather than a niche. There is also clear potential for product lines that feel locally relevant, using familiar Vietnamese flavors and botanicals such as kumquat, lychee, passion fruit, lemongrass, ginger, and herbal ingredients to reinforce a natural image and stand out in a competitive market.

However, the opportunity comes with meaningful barriers. Companies need to manage compliance carefully, especially in how sugar content is measured, declared, and documented. From a product perspective, cutting sugar often affects taste, while consumers still prioritize a pleasant drinking experience, so reformulation usually requires multiple testing rounds and investment in alternative ingredients and processing technologies. These changes can raise costs, putting pressure on pricing and marketing budgets, particularly for products positioned at a premium or requiring consumer education. Finally, competition is intense, as large incumbents hold strong advantages in research, branding, and distribution, so new entrants will need a clear point of differentiation, a focused channel strategy, and strong execution to scale.

Some recommendations for foreign investors looking to enter Vietnam’s healthy beverage market include the following.

– First, position low-sugar and sugar-free offerings as the core growth pillar, while investing seriously in formulation trials to ensure the taste profile fits Vietnamese preferences.

– Second, differentiate through local flavors and ingredients such as kumquat, lychee, passion fruit, lemongrass, ginger, and herbal botanicals, supported by simple, easy-to-grasp benefit messaging.

– Third, build a compliance and transparency foundation from the outset, from sugar measurement and disclosure to ingredient labeling and nutrition information, to reduce risk and strengthen consumer trust.

– Fourth, execute a test-and-scale rollout, prioritizing modern trade and e-commerce to validate demand early, while partnering with strong local distributors to accelerate national coverage.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[1] https://www.expertmarketresearch.com/reports/vietnam-beverage-market

[2] https://nld.com.vn/tang-thue-tieu-thu-dac-biet-voi-ruou-bia-len-70-tu-nam-2027-196250614085345948.htm

[3] https://insightasia.com/wp-content/uploads/2025/06/2504-Beverage-Market-0425.pdf

[4] https://insightasia.com/wp-content/uploads/2025/06/2504-Beverage-Market-0425.pdf

[5] https://insightasia.com/wp-content/uploads/2025/06/2504-Beverage-Market-0425.pdf

[6] https://www.brandsvietnam.com/congdong/topic/brand-updates-w32-2025-vinamilk-kombucha-giao-hang-nang

[7] https://insightasia.com/wp-content/uploads/2025/06/2504-Beverage-Market-0425.pdf

[8] https://tuoitre.vn/tap-doan-th-ra-mat-tra-oi-va-tra-tac-tu-nhien-th-true-tea-moi-20250617172956707.htm