31Dec2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

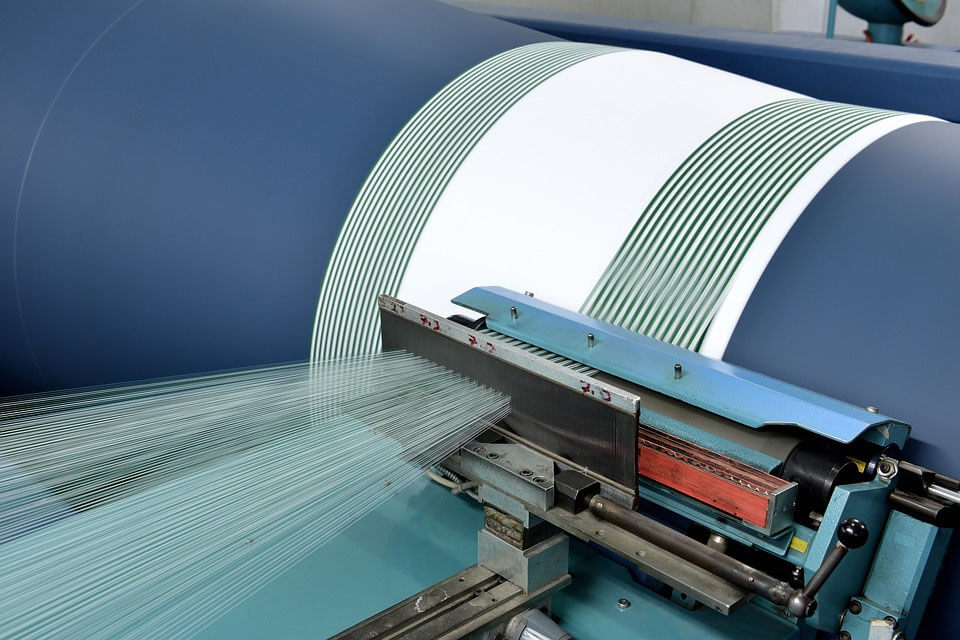

Vietnam’s apparel manufacturing sector in 2025 remains a key destination for global sourcing, supported by strong export performance, extensive free trade agreements, and established production capabilities. However, structural dependence on imported raw materials, rising labour costs, and tightening sustainability requirements are reshaping industry dynamics. Strategic recommendations are outlined for foreign investors seeking to enhance value creation, supply chain resilience, and long-term competitiveness.

Overview of the Apparel Industry in Vietnam

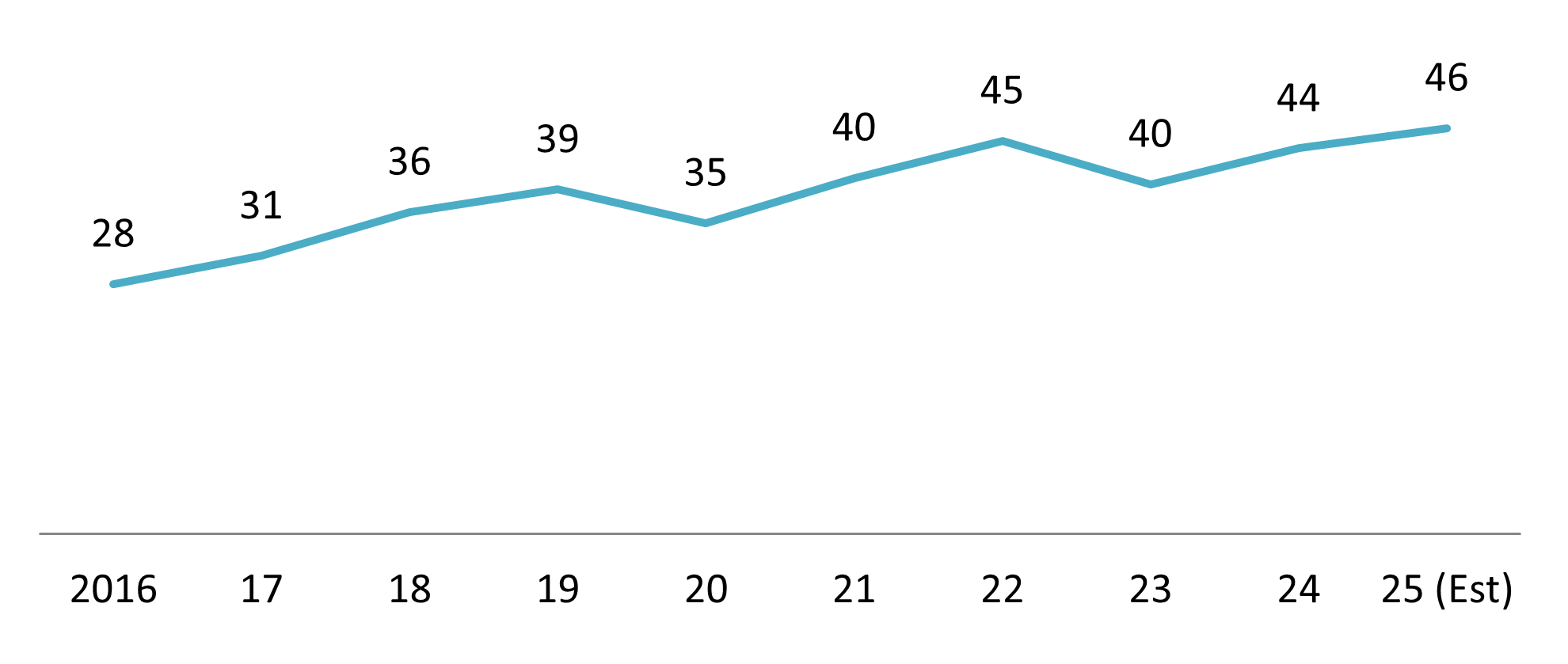

Vietnam’s apparel and textile industry is a key pillar of the national economy and among the world’s largest garment exporters. In 2025, Vietnam’s textile and garment exports remain robust, with export turnover projected at approximately USD 46 billion. This marks a 5% growth year-over-year, and reaches the highest value over the past decade, retaining the position as one of the top 3 textile and garment exporting countries in the world[1]. The main export markets of Vietnamese apparel products are the USA, EU, Japan and Korea[2].

Vietnam textile and garment export value (2016-2025)

Unit: USD Billion

Source: National Statistics Office

Vietnam’s apparel industry is export-oriented, supplying most of its output production to the world demand. On the other hand, domestic consumption accounts for a comparatively small share (only 12% total production value)[3]. However, the domestic market is gradually growing alongside rising incomes and retail demand, offering additional strategic space for vertically integrated, value-added brands.

Challenges of the Vietnamese Apparel Industry

Despite the impressive growth and strong global position, the industry is facing a number of structural challenges that could undermine its competitiveness and ability to sustain long-term growth if left unaddressed. These pressures are reshaping the operating environment for manufacturers and investors alike, making strategic adaptation increasingly critical.

Supply chain problems: Reliance on imported input and low value-added production

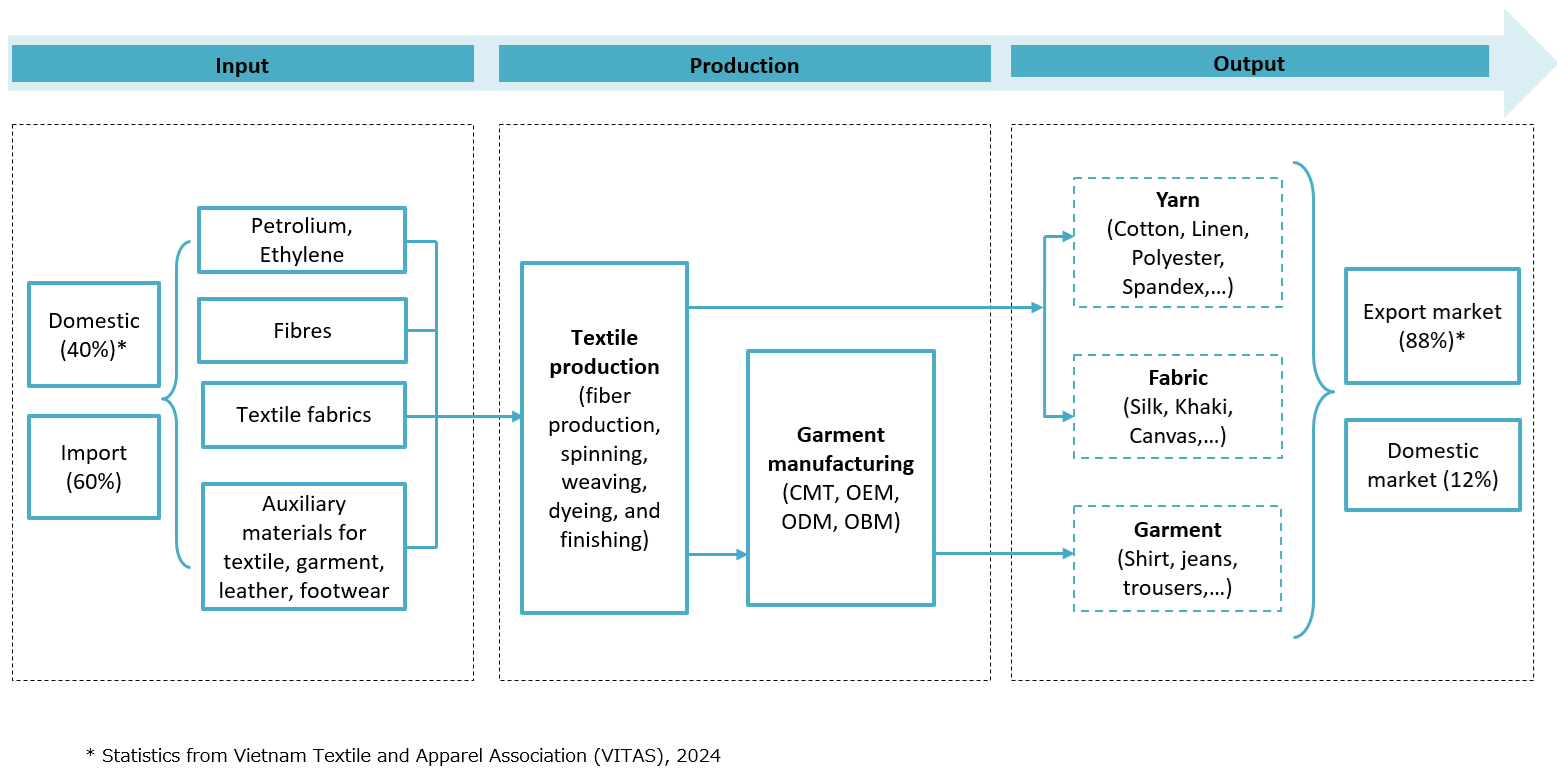

Source: B&Company Synthesis

Despite being one of the world’s largest garment exporters, Vietnam has limited domestic capacity in raw material production, especially in high-quality woven and knitted fabrics. Approximately 60% of textile raw materials are imported; the domestic supply only satisfies around 40% demand[4]. Every year, Vietnam uses around 400,000 tonnes of cotton, but domestic production only supplies 1% of the cotton demand[5].

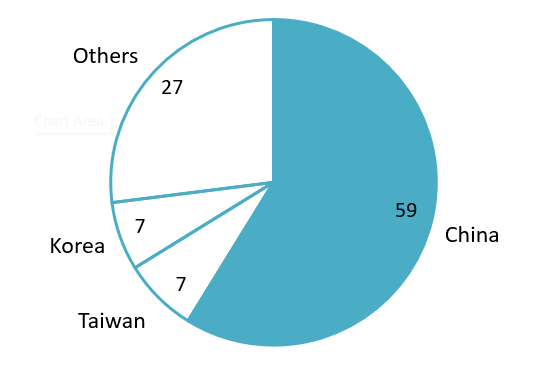

In the first 11 months of 2025, regarding the import value of apparel raw materials, China is the main supplier, accounting for more than half of the import value. This high dependence creates supply chain vulnerability and limits the industry’s ability to fully benefit from free trade agreements with strict rules of origin requirements (such as EVFTA and CPTPP). Taiwan and Korea come second and third, respectively, each accounting for 7%.

Import value of apparel raw materials in the 11 months of 2025

100% = USD 25.7 Billion

Source: Vietnam Customs

Vietnam’s strength lies primarily in the production stage, especially in garment assembly. The majority of factories operate under the CMT (Cut – Make – Trim) model, where buyers provide designs, fabrics, and accessories, and Vietnamese firms focus on cutting, sewing, and finishing. They also largely adopt OEM (Original Equipment Manufacturing), where manufacturers source raw materials themselves and complete orders for foreign brands. Although these models have enabled Vietnam to scale rapidly and integrate into global supply chains, it generates thin margins, limited bargaining power, and high exposure to buyer concentration risks. Value capture is largely confined to wages and basic manufacturing fees, while higher-margin activities (design, material innovation, brand ownership, and retail) remain offshore[6].

Rising labor cost and workforce shortages

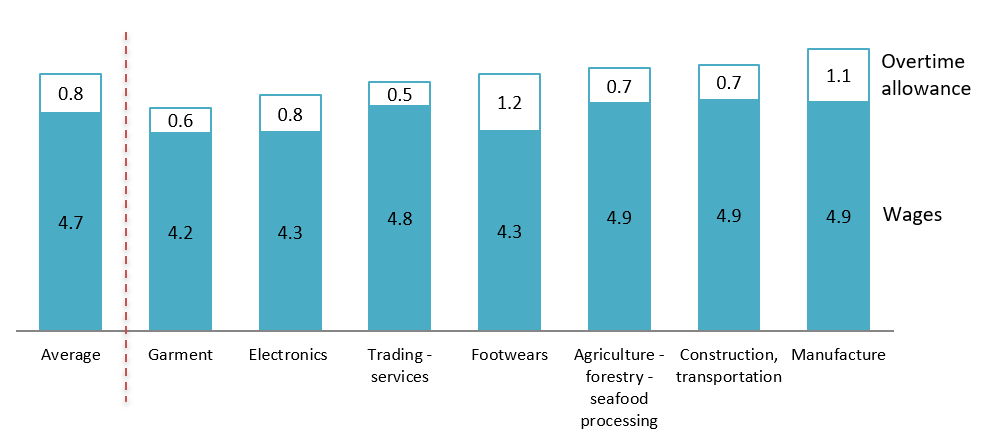

Vietnam’s garment sector employs over 3 million workers, making it one of the largest employers in the country’s manufacturing landscape. Recently, rising labour costs have become an issue. Minimum wages and average incomes have increased steadily over the past decade, gradually eroding Vietnam’s traditional cost advantage over regional competitors such as Bangladesh and Cambodia, particularly for labour-intensive CMT operations.

At the same time, the industry is experiencing a noticeable shift in workforce preferences. Younger workers increasingly favour employment in technology, services, and higher-income industrial sectors rather than factory-based garment work, leading to labour shortages and higher turnover rates in apparel manufacturing[7]. This shift is partly driven by the relatively low wage levels in the garment industry compared with other sectors, as well as demanding working conditions and limited career progression. As a result, manufacturers face growing recruitment and retention challenges.

Workers’ wages in some industries in Vietnam (2021)

Unit: VND Million

Source: Institute of Workers and Trade Unions

Growing sustainability pressure

Environmental sustainability is placing growing pressure on Vietnam’s apparel industry. The garment sector has a heavy environmental footprint due to high energy use, large water consumption, and chemical wastewater[8]. As one of the world’s largest garment exporters, Vietnam faces increasing expectations to meet strict environmental standards set by key export markets such as the EU, the United States, and Japan. These markets are tightening rules on carbon emissions, chemical use, wastewater discharge, and product traceability, making sustainability a basic requirement for market access rather than a competitive advantage. Failure to meet these standards may result in higher costs, order losses, or trade barriers. In addition, Vietnam has strengthened domestic environmental regulations for textile production, increasing compliance pressure on manufacturers, particularly in water-intensive processes such as dyeing and finishing[9].

Recommendations to overcome difficulties

Build autonomy in supplying

Businesses operating in Vietnam’s apparel industry should proactively diversify their sourcing strategies to reduce excessive dependence on China for raw materials. Using the “China + 1” approach in this case, Vietnam’s industry can seek for textile of the same price from India, Pakistan or Indonesia, and source high-quality, functional textiles from Japan, Korea[10].

Beyond sourcing diversification, deeper upstream investment is increasingly critical. Joint ventures in spinning, weaving, dyeing, and finishing within Vietnam can reduce import dependence, shorten lead times, and improve compliance with rules-of-origin requirements under trade agreements such as EVFTA and CPTPP. Although upstream projects require higher capital and stricter environmental compliance, they offer long-term strategic value by strengthening supply chain resilience and enabling greater value capture within Vietnam

Upgrade value creation in producing

Vietnam’s apparel industry remains dominated by CMT and OEM operations, which generate thin margins and leave manufacturers highly dependent on buyer-driven contracts. As labor costs rise, environmental compliance tightens, and competition from lower-cost countries intensifies, Vietnam can no longer rely on scale and efficiency alone. As a result, transitioning to higher value-added models is not optional but essential. Those models, such as ODM (Original Design Manufacturing) and OBM (Original Brand Manufacturing), encompass design, product development, branding, and direct market access.

Commit to sustainability and traceability

Environmental compliance is no longer optional. Investors must treat sustainability-related investments such as wastewater treatment, energy efficiency, and emissions monitoring as prerequisites for maintaining access to key export markets and long-term buyer relationships.

In parallel, technology plays a critical role in meeting sustainability and buyer requirements. Digital procurement systems, traceability platforms, and data-driven factory management enable transparency from fibre to finished garment, supporting ESG reporting and due-diligence obligations. International brands increasingly require suppliers to demonstrate traceability and real-time compliance data, making technological transparency a strategic necessity rather than an operational upgrade.

Leveraging the Domestic Market

Although domestic consumption accounts for only around 12% of Vietnam’s apparel production, the local market is expanding alongside rising incomes and urbanization. Specifically, Vietnam’s domestic market can serve as a strategic buffer during periods of export slowdown or global demand volatility, helping to stabilize cash flows and factory utilization[11].

The domestic market also offers a lower-risk environment for developing branding, retail, and product differentiation capabilities. By testing products, pricing, and marketing strategies locally, investors can strengthen brand-building skills before expanding into regional or global consumer markets. This approach supports long-term value creation and reduces exclusive reliance on contract manufacturing for foreign brands[12].

Takeaway for Foreign Investors

Vietnam’s apparel industry has reached a turning point. While the sector continues to benefit from strong export performance as leading global exporter, the traditional model based on cheap labour and imported raw materials is no longer sustainable. Rising production costs, supply chain vulnerabilities, and stricter environmental requirements mean that cost-based competitiveness alone can no longer secure long-term success.

Looking ahead, future winners will be investors willing to invest vertically and strategically. In this new phase of development, competitiveness in Vietnam’s apparel industry will be defined less by cost advantages and more by resilience, value creation, and long-term sustainability.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[1] https://wtocenter.vn/tin-tuc/29250-textile-and-garment-exports-are-estimated-to-reach-46-billion-in-2025-maintaining-viet-nams-position-among-the-top-3-in-the-world

[2] https://www.customs.gov.vn/

[3] https://trungtamwto.vn/tin-tuc/30879-xoay-truc-ve-thi-truong-noi-dia-huong-di-cho-nganh-det-may-viet-nam

[4] https://vietnambiz.vn/khoang-60-nguyen-phu-lieu-det-may-dang-phai-nhap-khau-chu-yeu-tu-trung-quoc-2025731657921.htm

[5] https://trungtamwto.vn/an-pham/30713-det-may-da-giay-cho-cu-hich-tu-cong-nghiep-ho-tro

[6] https://ocd.vn/chuoi-gia-tri-nganh-det-may-viet-nam/

[7] https://www.apo-tokyo.org/ (Vietnam Textile and Garment Sector)

[8] https://www.mckinsey.com/industries/retail/our-insights/redesigning-apparel-manufacturing-in-asia-a-pattern-for-resilience

[9] https://kinhtevadubao.vn/ap-luc-esg-trong-nganh-det-may-thich-ung-cua-doanh-nghiep-viet-nam-31340.html

[10] http://www.vietnamtextile.org.vn/tin-tuc_p1_1-1_2-1_3-597_4-261_9-2_11-10_12-215_13-2142.html

[11] https://trungtamwto.vn/tin-tuc/30879-xoay-truc-ve-thi-truong-noi-dia-huong-di-cho-nganh-det-may-viet-nam

[12] https://baochinhphu.vn/khai-thac-tiem-nang-thi-truong-noi-dia-cho-det-may-da-giay-viet-nam-102250822164053825.htm