18Nov2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam is rapidly evolving into a regional hub for smart manufacturing, with foreign-direct investment (FDI) factories increasingly adopting AI for manufacturing (Smart Manufacturing) to optimize production lines and enable predictive maintenance. Leveraging government strategies, cost-effective labour, and global supply-chain shifts, the Vietnamese manufacturing sector presents a compelling opportunity for investors seeking operational excellence and digital transformation.

Source: Talentnet

Market Overview

Vietnam’s manufacturing sector is a key engine of growth: in the first half of 2025, the processing & manufacturing subsector expanded by 10.11 % year-on-year and contributed 2.55 percentage points to GDP growth[1]. Foreign direct investment (FDI) is increasingly flowing into manufacturing: registered FDI in H1 2025 reached US$21.51 billion, up 32.6% year-on-year[2].

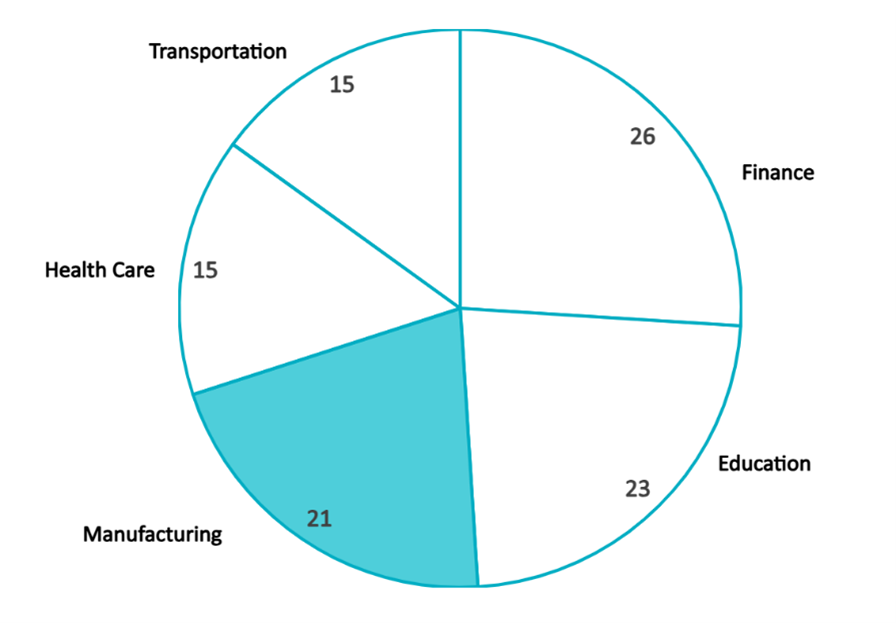

According to the Vietnam AI Annual Report 2025 (based on nearly 500 surveyed organizations), AI demand is rising fastest in finance (26%), education (23%), and manufacturing (21%), signalling strong momentum for smart-factory applications such as AI-vision and predictive maintenance[3].

Vietnam’s Leading AI-demanding sectors (2024)

Source: B&Company’s compilation from Vietnam AI Annual Report

In terms of the smart manufacturing market, the adoption of “AI for manufacturing (Smart Manufacturing)” in Vietnam is accelerating. Vietnam’s smart manufacturing market size was valued at USD 116.8 billion in 2024, and is projected to reach USD 303.6 billion by 2033, implying a compound annual growth rate (CAGR) of roughly 10.7%[4]. The standalone AI-in-manufacturing market (subset of smart manufacturing) is also forecast to grow from US$1.15 billion in 2025 to US$4.80 billion by 2031[5].

Market Growth Drivers

Rapid growth of manufacturing & FDI production base

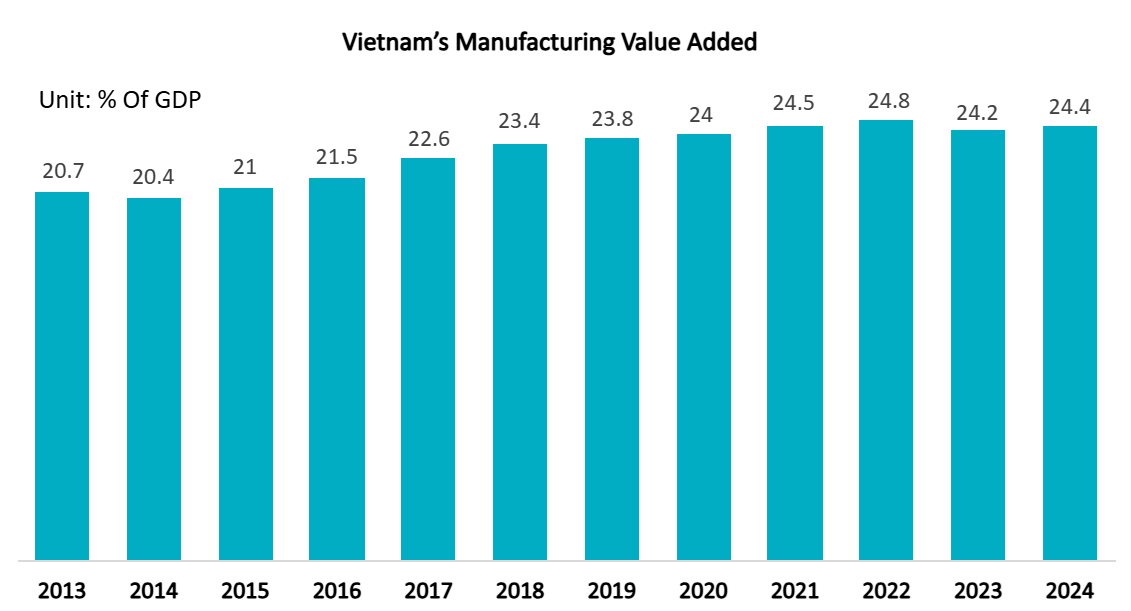

The manufacturing sector remains a key engine of growth in Vietnam, contributing more than 20% of GDP and attracting large foreign direct investment[6]. The share of manufacturing value added in Vietnam was 24.43% of GDP in 2024, according to Trading Economics data.

Source: Trading Economics

The government pushes for digital transformation and Industry 4.0

Vietnam’s Decision No. 2289/QD-TTg (2020) approves the National Strategy on the Fourth Industrial Revolution towards 2030, explicitly emphasizing manufacturing productivity, digital technologies, and smart production, encouraging technology upgrades and R&D investment[7].

Line optimisation and predictive maintenance take centre stage

As manufacturing costs rise (labour, logistics) and downtime becomes more expensive, FDI factories are prioritising AI use-cases that yield quick ROI: real-time process optimisation, bottleneck detection, AI-vision for defects, and condition-based maintenance. In addition, many units such as Siemens AG, ABB Ltd., Schneider Electric SE are integrating IoT to monitor, control and reduce downtime[8]. This shift creates a ready environment for advanced “AI for manufacturing” capabilities such as predictive maintenance and line optimization.

Competitive cost structure & supply-chain repositioning toward Vietnam

With global supply-chain diversification away from China, and factories increasingly located in Vietnam, many manufacturing operations are either new-build or being upgraded. Vietnam attracted USD 36.6 billion in FDI in 2024, the highest in six years, with around 60% flowing into manufacturing and processing. With labour costs 30-50% lower than in China and Thailand, global manufacturers such as Samsung, Foxconn, and Amkor are expanding new high-tech plants in industrial hubs like Bac Ninh and Bac Giang.

Productivity pressure & need for higher value-added manufacturing

Vietnam is increasingly turning to AI as a way to move beyond its low-cost manufacturing model. The country’s labor productivity remains low, only 7.6% of Singapore’s, 18% of Malaysia’s, and 45% of Thailand’s (ADB, 2023), while labor costs are rising compared to some nations, such as Bangladesh, and the young workforce is shrinking. These structural pressures push factories toward higher-value, automated, and AI-enabled production.

Strong market size and forecast for smart manufacturing

For example, the Vietnam smart factory market size was valued at around USD 839.8 million in 2024, projected to reach USD 2.03 billion by 2033 (CAGR ~10.3%)[9]. Digital-transformation alone was valued at USD 4.1 billion in 2024 and expected to grow to USD 16.2 billion by 2033 (CAGR ~14.9%). These large market potentials further drive investment in AI-enabled manufacturing.

Implications for Foreign Investors: Opportunities, Challenges & Actionable Implications

Source: Builtin

Opportunities

Vietnam’s rapid digital manufacturing transition and supportive government incentives are opening new avenues for foreign investors. Beyond cost advantages, the market now promises high-value opportunities in automation, smart factories, and AI-enabled production.

| High growth market for AI for manufacturing (Smart Manufacturing) | With a large manufacturing base, high FDI penetration, and strong growth forecasts for smart manufacturing, foreign investors introducing line-optimisation AI platforms and predictive-maintenance solutions are well-positioned. As Vietnam expands semiconductor and PCB assembly, Keysight provides AI-assisted testing analytics that predict failure rates, shorten test cycles, and improve yield, matching the surge of FDI in Bac Ninh, Bac Giang, and Ho Chi Minh City. |

| Cost and supply-chain advantage | Vietnam’s favourable cost base, improving infrastructure, and proximity to regional supply chains (ASEAN, Asia, global) make it an attractive manufacturing location; maximizing productivity via AI becomes a differentiator. |

| Government-backed incentives and industrial-park ecosystem | The policy environment is favourable for high-tech investment; locating in a “smart factory park” or high-tech zone will often improve access to incentives, clusters, and infrastructure. |

| Local talent and partner ecosystem | A growing local talent pool and domestic firms (as per the table) provide opportunities for partnership, outsourcing, or co-development of AI solutions, helping adapt to local manufacturing realities. |

| Fast ROI use-cases | Line-optimisation and predictive-maintenance are among the more mature AI use-cases in manufacturing, especially for FDI factories under global cost and quality pressures, making business cases more readily justifiable. |

B&Company’s synthesis

Challenges

Despite strong momentum, Vietnam’s manufacturing upgrade faces talent shortages, fragmented infrastructure, and limited local supplier capabilities. These constraints can slow scaling and add integration complexity for foreign firms.

| Maturity and readiness gap | Many factories (especially non-FDI or SMEs) still need infrastructure upgrades (sensors, connectivity), workforce up-skilling, and change-management alignment to fully benefit from AI for manufacturing[10]. |

| Integration complexity | Implementing AI for manufacturing requires integration of legacy machines, real-time data platforms, IoT sensors, and cloud/edge infrastructure, this can create capex, complexity and time-to-value issues. |

| Data quality & availability | Predictive maintenance and machine-learning models depend on robust historical data and sensor instrumentation, many factories are yet to reach that level. |

| Competitive pressure and cost discipline | As more firms adopt smart manufacturing, competitive differentiation narrows, and cost efficiency becomes table-stakes, investors must deliver clear performance improvements. |

| Talent and resourcing constraints | High-end AI engineers, data scientists and manufacturing-automation experts remain in short supply in Vietnam compared to more established markets; reliance on local talent may require training or global sourcing. A recent survey of nearly 100 organisations in the 2025 AI Annual Report found that 45% of AI solution providers cited “lack of high-quality talent” as their top barrier, almost double those citing infrastructure limitations (23%)[11]. |

B&Company’s synthesis

Actionable Implications

To succeed, foreign investors should prioritize partnerships with domestic manufacturers, leverage tax incentives, and invest in workforce development. Early movers that embed digital technologies and strong ESG practices will gain long-term competitive advantage.

Partner with local integrators

Foreign investors should engage domestic technology firms with manufacturing-integration experience to accelerate deployment, manage local workflows and compliance, and reduce time-to-value. For example, FPT Software implemented a Manufacturing Execution System (MES) for Carlsberg, a live proof that local teams can integrate production control, data capture, and analytics at scale.

Start with targeted use-cases

A second implication is the importance of beginning with focused, high-return use cases. Predictive maintenance, AI-vision defect detection, and takt-time or bottleneck optimisation remain the most commercially mature applications in manufacturing. Global evidence indicates that predictive maintenance can reduce unplanned downtime by 30-50 percent, extend equipment lifespan by 20-40 percent[12], and generate maintenance cost savings of 10-40 percent. Similar efficiency gains have been reported for AI-vision systems, which can substantially reduce scrap rates and inspection time.

By targeting a limited number of high-impact assets such as compressors, CNC machines, conveyors or welding robots, manufacturers can demonstrate early performance gains, thereby strengthening the business case for broader smart-factory transformation.

Build data infrastructure early

Ensure that factories are instrumented with IoT sensors, connected PLC/SCADA systems and real-time data capture so that AI algorithms have reliable inputs – this is a prerequisite for predictive maintenance and optimization. Vietnam’s expanding 5G commercialization, in which VNPT and Viettel have rolled out coverage across major industrial zones, supports low-latency data acquisition and edge analytics[13]. Standardizing tags, sensor protocols and data schemas early in deployment prevents fragmentation, a common reason that AI pilots fail to scale beyond proof-of-concept.

Leverage industrial-park/high-tech-zone benefits

Select manufacturing sites within special economic zones or smart-factory parks that deliver incentives, infrastructure (5G/edge/cloud), training programmes and streamlined admin. Current incentive structures include a preferential corporate income tax rate of 10 percent for 15 years and combined tax holidays for the first 13 years of operations in priority zones[14]. Given recent policy amendments that reward high-tech and transformational investment, locating smart manufacturing facilities in these zones reduces cost barriers for robotics, IoT devices, edge computing and AI platforms.

Plan workforce transition and change management

Although government policies such as Decision 2289/QD-TTg, Vietnam’s national strategy for the Fourth Industrial Revolution emphasize technology uptake, human-capital readiness remains uneven. Investing in targeted training for machine operators, technicians and maintenance teams on data literacy, predictive maintenance workflows, and AI-assisted quality control helps ensure that technology deployment translates into real productivity gains.

Measure and communicate ROI early

For internal buy-in and broader roll-out, define key performance indicators (KPIs) such as OEE improvement, downtime reduction, maintenance-cost savings, throughput gains and defect-rate reduction; track improvements and build the business case for scaling. Once pilot lines achieve target thresholds, scaling should occur through standardized data models, shared MLOps environments, and reusable predictive models across similar assets. Vietnam’s expanding 5G and cloud connectivity make multi-plant scaling technically feasible, particularly when combined with the implementation expertise of established local partners.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[1] Vietnam Briefing. (n.d.). Vietnam manufacturing tracker. https://www.vietnam-briefing.com/news/vietnam-manufacturing-tracker.html/

[2] The Investor. (n.d.). Vietnam’s registered FDI tops $21 bln in H1, the highest in 16 years. https://theinvestor.vn/vietnams-registered-fdi-tops-21-bln-in-h1-highest-in-16-years-d16221.html

[3] VietnamNet. (n.d.). Vietnamese enterprises in a race to build AI market. https://vietnamnet.vn/en/vietnamese-enterprises-in-race-to-build-ai-market-2454876.html

[4] IMARC Group. (n.d.). Vietnam smart manufacturing market. https://www.imarcgroup.com/vietnam-smart-manufacturing-market

[5] Mobility Foresights. (n.d.). Vietnam artificial intelligence in the manufacturing market. https://mobilityforesights.com/product/vietnam-artificial-intelligence-in-manufacturing-market

[6] McKinsey & Company. (2023, September 25). Boosting Vietnam’s manufacturing sector: From low cost to high productivity. https://www.mckinsey.com/featured-insights/asia-pacific/boosting-vietnams-manufacturing-sector-from-low-cost-to-high-productivity

[7] Baochinhphu. (n.d.). National strategy for the 4th industrial revolution. https://en.baochinhphu.vn/national-strategy-for-4th-industrial-revolution-11140283.htm

[8] Ken Research. (n.d.). Vietnam smart manufacturing market. https://www.kenresearch.com/industry-reports/vietnam-smart-manufacturing-market

[9] IMARC Group. (n.d.). Vietnam smart factory market. https://www.imarcgroup.com/vietnam-smart-factory-market

[10] VMOST Journal of Science & Technology. (n.d.). [PDF] Article. https://vmostscience.vjst.vn/index.php/vmost_jossh/article/download/273/256

[11] VnExpress International. (n.d.). Vietnam’s AI dreams run into a talent shortage wall. https://e.vnexpress.net/news/tech/vietnam-innovation/vietnam-s-ai-dreams-run-into-a-talent-shortage-wall-4960374.html

[12] McKinsey & Company. (n.d.). Manufacturing analytics unleashes productivity and profitability. https://www.mckinsey.com/capabilities/operations/our-insights/manufacturing-analytics-unleashes-productivity-and-profitability

[13] Vietnam News. (n.d.). Viet Nam telecom giants step up 5G commercialisation expansion. https://vietnamnews.vn/economy/1721016/viet-nam-telecom-giants-step-up-5g-commercialisation-expansion.html

[14] Vietnam Briefing. (n.d.). Tax incentives for businesses. https://www.vietnam-briefing.com/doing-business-guide/vietnam/taxation-and-accounting/tax-incentives-for-businesses