06Aug2025

Highlight content / Highlight Content JP / Highlight content vi / Industry Reviews / Latest News & Report

Comments: No Comments.

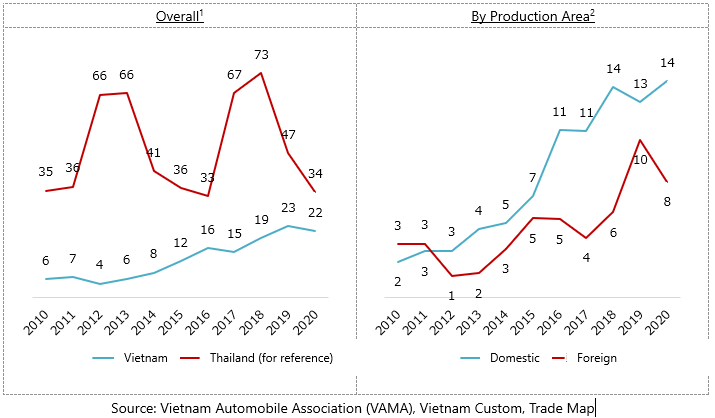

The spread of environmentally friendly vehicles in Vietnam is accelerating. With gasoline prices remaining high and consumers becoming increasingly environmentally conscious, interest in electrification is growing year by year, with hybrid electric vehicles (HEVs) attracting attention. While their popularity is steadily increasing, the tax gap between hybrid electric vehicles (HEVs) and battery electric vehicles (BEVs) is likely to determine the future direction of their growth.

Japanese companies dominate the hybrid market, with five models accounting for 80% of the market

The pioneer of hybrid vehicles in the Vietnamese market was the Toyota Corolla Cross HV, which was released in 2020. This was followed by the Honda CR-V, Toyota Innova Cross, Suzuki XL7, and Ertiga, among others, and by 2024, new HEV sales were expected to reach approximately 9,900 units, accounting for approximately 2% of all new vehicles.

Japanese cars dominate sales, with the above five models accounting for more than 80% of the market. All of them are mid-priced but offer a certain level of fuel efficiency, and are popular among the middle class in urban areas.

[Figure 1] Share of new HEV and EV car sales (%)

Increasing focus on fuel efficiency, the issue of price and tax reversal

According to a consumer survey conducted by Deloitte in March 2024, the top reasons cited for choosing HEVs or BEVs were “low fuel costs” and “concerns about climate change.” In particular, interest in energy-efficient vehicles has increased significantly since the rise in fuel prices in 2021.

Meanwhile, a major factor behind the slower growth of HEVs compared to BEVs in Vietnam is the tax system. Under the current system, the special consumption tax rate for HEVs is 21-150%, while for BEVs it is limited to just 1-5% during the interim period from 2022 to 2027. To give a concrete example, the selling price of the Suzuki Ertiga (HEV) is USD 21,500 base price plus approximately USD 3,500 tax, or approximately USD 25,000. In comparison, the VinFast VF5 (BEV) is USD 19,160 base price plus approximately USD 890 tax, or approximately USD 20,500, resulting in a clear price difference.

Due to this reversal phenomenon, the convenience of HEVs, such as not needing charging infrastructure, is currently overshadowed by their price.

As the battle for BEVs begins, the outcome of policies will be key

In the future, HEVs and BEVs will compete for consumer choice on the same field as “environmentally friendly vehicles.” The price difference will be particularly crucial in the purchasing decisions of middle-income earners.

In Vietnam, BEV manufacturers such as VinFast and China’s BYD are actively launching their vehicles into the market, but the BYD vehicles that were introduced last year are somewhat expensive at over USD 25,000, and sales numbers are still expected to be limited. Currently, VinFast maintains an advantage in the popular price range for BEVs, leading the price competition with HEVs.

Redesigning policy support is key to market diversification

The Vietnamese government has positioned BEVs as the “mobility of the future” and has implemented preferential import and registration taxes. This has encouraged the spread of BEVs in the short term, but it has also been pointed out that HEVs, which are a more stable option both technically and operationally, are being neglected.

In the future, depending on the state of EV infrastructure development and the introduction of traffic restrictions in urban areas, there is ample room for HEVs to be reevaluated. The convenience and fuel efficiency of HEVs could be particularly attractive to users in regional cities and those who prioritize long-distance travel.

Will HEVs continue to grow, or will they be replaced by BEVs, which are supported by tax incentives? With the two intersecting, future policy trends will undoubtedly have a major influence on the direction of the market.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

![[Figure 1] Share of new HEV and EV car sales (%)](https://b-company.jp/wp-content/uploads/2025/08/Figure-1-Share-of-new-HEV-and-EV-car-sales.jpg)