16Jun2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Overview of Industrial Sector M&A in 2025

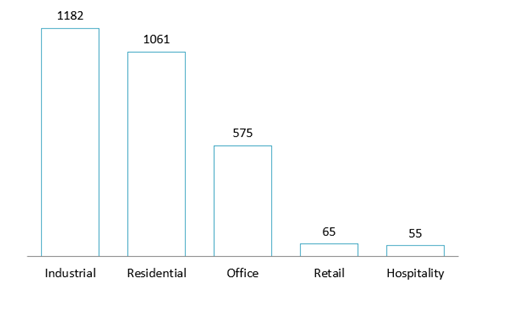

Between 2022 and the first nine months of 2024, Vietnam’s industrial real estate sector led all property segments in total transaction value, reaching USD 1,182 million. This underscores the sector’s strategic importance and growing investor confidence, driven largely by Vietnam’s expanding role in global manufacturing. Residential real estate followed closely at USD 1,061 million, while the office segment posted moderate activity at USD 575 million. In contrast, retail and resort properties saw relatively low transaction values—USD 65 million and USD 55 million respectively—reflecting slower recovery and shifting market dynamics post-pandemic.

Total Transaction Value by Property Type (2022- 9M 2024)

Unit: Million USD

Resource: MSCI RCA

Building on this strong foundation, Vietnam’s real estate M&A market has seen strong momentum in recent years, with deal value in 2024 exceeding $1.8 billion across 13 major transactions[1]. The sector accounted for around 18% of total M&A activity, making it one of the top three most active industries[2]. Key drivers include increased foreign investor participation—especially from Japan, South Korea, Singapore, etc., as well as favorable legal reforms such as the 2024 Land Law. Notable deals include Vingroup’s $982 million acquisition of SDI Investment and Sycamore Company’s $553 million investment in Binh Duong’s industrial zone1. Industrial, residential, and resort real estate are leading the trend, with strong prospects for continued growth.

Notable M&A Projects in Vietnam

| No. | Project name | Year | Location | Total investment capital

(million USD) |

| 1 | FV Hospital Acquisition | 2023 | Ho Chi Minh City | 381 |

| 2 | VPBank – SMBC Stake Sale | 2023 | Hanoi | 1500 |

| 3 | Sycamore – Binh Duong Project | 2024 | Binh Duong | 553 |

| 4 | Gamuda Land – Eaton Project | 2024 | Ho Chi Minh City | 320 |

| 5 | Pizza 4P’s Investment | 2024 | Ho Chi Minh City | Not disclosed |

| 6 | CDH – Bach Hoa Xanh Stake | 2024 | Nationwide (Mobile World Group) | 1700 |

| 7 | AG&P LNG – Cai Mep Terminal | 2024 | Ba Ria – Vung Tau | 500 |

| 8 | VinFast – SPAC Merger | 2023 | International (Listed on NASDAQ) | 23000 |

| 9 | SABECO Acquires SABIBECO | 2024 | Ho Chi Minh City | Not disclosed |

| 10 | Kido Group Acquires Hung Vuong Plaza | 2024 | Ho Chi Minh City | Not disclosed |

| 11 | SeABank – Finance Company to AEON | 2024 | Hanoi | Not disclosed |

Source: BC synthesis

Complementing these regulatory improvements are substantial upgrades to transportation infrastructure, deep-water ports, and logistics networks, all of which enhance Vietnam’s appeal as a regional manufacturing and supply chain hub[3]. Moreover, a rising focus on sustainability has spurred interest in green industrial parks that align with global Environmental, Social, and Governance (ESG) standards[4]. Despite these positive drivers, investors must navigate ongoing challenges such as rising industrial land prices, delays in land clearance, and regulatory compliance—factors that remain critical to the success of M&A activities in this dynamic sector[5].

The reasons Vietnam is an attractive destination for M&A in the Industrial Real Estate Sector

– Strategic Geographic Location[6]:

Vietnam is located at the center of the Southeast Asian supply chain, boasting over 3,200 km of coastline and numerous major ports. It lies along the East Sea shipping route, through which nearly 40% of global goods pass, providing a significant advantage as an ideal hub for transshipment and manufacturing.

– Open Policies and Legal Reforms[7]:

The amended Land Law and the Real Estate Business Law in 2024 simplify investment procedures and increase transparency regarding land ownership and usage rights. These reforms are crucial for M&A transactions and create favorable conditions for foreign direct investment (FDI) companies to carry out smooth M&A activities.

– Stable Political and Geopolitical Environment[8]:

Vietnam maintains political stability and a neutral stance amid global uncertainties, positioning itself as a reliable alternative destination amid the global supply chain shift away from China caused by the US-China trade war and geopolitical risks in Northeast Asia.

– Strong Domestic Market Growth:

With nearly 100 million people and a rapidly expanding middle class, domestic consumption is increasing, driving demand for production, logistics, and industrial infrastructure development[9] — key factors that support industrial real estate M&A deals.

How Can B&Company Support M&A Projects in the Industrial Real Estate Sector?

Investing in or conducting mergers and acquisitions (M&A) in Vietnam’s industrial real estate sector presents significant opportunities—but also involves a complex set of challenges. Successful transactions require meticulous due diligence, particularly in verifying the legal status of the project and land use rights. It is essential to ensure that the property is fully compliant with legal requirements, has all necessary permits in place, and is free from ownership or usage disputes that could impede investment or development.

Beyond legal verification, infrastructure and logistics play a pivotal role in the valuation and long-term viability of any industrial real estate asset. Factors such as proximity and accessibility to seaports, highways, and major industrial hubs significantly influence the attractiveness and functionality of a site. Investors must also consider occupancy rates, the quality and reliability of existing tenants, ongoing cash flow, and the property’s potential for future expansion. Additionally, evaluating local government incentives—such as tax benefits or streamlined regulatory procedures—can help maximize investment returns and minimize post-acquisition risks.

With over two decades of hands-on experience in Vietnam’s business environment, B&Company is uniquely positioned to support both foreign and domestic investors in navigating the M&A landscape within the industrial real estate market. Our comprehensive service offerings include:

– Feasibility Studies & Location Analysis

We assist investors in identifying optimal industrial zones by conducting an in-depth analysis of location-specific advantages and challenges. Our studies evaluate market potential, growth forecasts, competitive dynamics, and infrastructural connectivity to help ensure that each project is strategically aligned with the investor’s objectives.

– Development of a Target Partner List

Our team conducts thorough market scans to identify and profile potential acquisition targets or joint venture partners. This includes financial health assessments, legal due diligence, operational background checks, and compatibility analysis to ensure that partners are viable and aligned with the investor’s strategic vision.

– Facilitating Connection & Negotiation

Acting as a trusted intermediary, we bridge the gap between international investors and local stakeholders. We provide cultural and commercial insight during negotiations, help manage expectations on both sides, and work to create mutually beneficial agreements that are fair, transparent, and sustainable.

– Legal Compliance & Policy Monitoring

B&Company offers ongoing guidance on Vietnam’s evolving legal and regulatory landscape. We support our clients in navigating processes related to land use rights, environmental regulations, licensing, and the legal transfer of ownership—ensuring compliance every step of the way.

– Post-M&A Integration & Performance Monitoring

Our services don’t end with the transaction. We continue to support clients through the integration phase, helping implement management strategies, monitor key performance indicators, and refine operational models to enhance profitability and ensure the long-term success of the investment.

B&Company’s deep understanding of Vietnam’s regulatory environment, combined with our strategic market insights and wide-reaching local networks, makes us a valuable partner for any investor looking to enter or expand within the industrial real estate sector through M&A.

[1] https://b-company.jp/ma-situation-in-real-estate-sector/

[2] https://assets.kpmg.com/content/dam/kpmg/th/pdf/2024/09/unleashing-opportunities-in-vietnam.pdf

[3] https://www.vietnam-briefing.com/news/vietnams-industrial-zones-2025-2030-growth-outlook.html

[4] https://www.ey.com/en_vn/insights/sustainability/industrial-real-estate-m-a-driven-by-vibrant-elements

[5] https://theinvestor.vn/geopolitical-impacts-on-vietnams-exports-can-hinder-ma-in-2025-kpmg-exec-d13562.html

[6] https://www.worldbank.org/en/country/vietnam/overview

[7] https://www.freshfields.com/en/our-thinking/briefings/2024/03/vietnam-land-law-2024–key-changes-from-maforeign-investment-perspectives

[8] https://english.elpais.com/economy-and-business/2025-05-03/vietnam-trapped-by-two-giants-a-strategic-piece-in-the-us-china-trade-war.html

[9] https://vir.com.vn/growth-prospects-available-for-vietnams-industrial-parks-128651.html

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |