22Jan2025

Industry Reviews / Latest News & Report

Comments: No Comments.

The overall situation of Vietnam’s medical devices market

Vietnam, with an aging population and rising expenditure for healthcare from both citizens and the government, presents a promising and dynamic market for medical device investment.

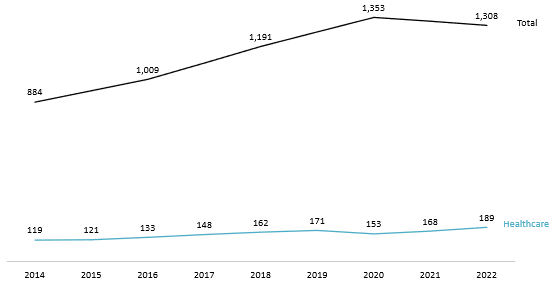

Vietnamese citizens are growing older as the proportion of the elderly increased from 11.9% in 2019 to 13.9% in 2023[1] and is expected to make up a fourth of the total population by 2050[2]. The restructuring of the population signifies a need for a better healthcare system[3]. While this elderly group poses the greatest demand and spending potential, the increasing demand for healthcare services is shared among the general population. In particular, from 2020 to 2022, annual total expenditure per capita decreased by 3.3% nationwide and 13.5% in urban areas [4], but spending on healthcare increased by nearly 25%, from 153 USD to 189 USD.

Annual total expenditure and healthcare expenditure per capita in Vietnam in 2014-2022

Unit: USD

Source: WHO Global Health Expenditure Database, GSO, B&Company’s Synthesis

To meet the domestic needs, the Vietnam government plans to allocate nearly one billion USD from 2021 to 2025 as medium-term investment capital for the healthcare sector to develop infrastructure, facilities, and equipment to support and improve the general health services for the public[5]. With such drivers, Vietnam’s medical equipment market expects substantial growth soon. The market is estimated at 1.67 billion USD at the end of 2023, making it the 8th largest in the Asia-Pacific region[6], and is projected to reach 2.1 billion USD by the end of 2026[7], with a CAGR of 8%.

However, the supply of medical devices in Vietnam faces many challenges to meet the rising demand. The Ministry of Health (MoH) reported in 2022 that shortages of medicine and medical devices occurred at 90% of central-level hospitals, especially for emergency care, intensive care, cardiology, and surgery equipment[8]. Low domestic supply is one attribute of such insufficiency. Products manufactured locally are mainly of basic and common categories while high-tech medical products are scarce[9] due to the low technological level of Vietnamese companies[10] and modest high-tech inward investment[11]. This forces the country to rely heavily on overseas imports, which account for up to 90% of the total supply[12]. The shortages are further amplified due to complicated regulations from the government[13]. It is required that manufacturers must register their products with the Infrastructure and Medical Device Administration (IMDA) before circulation[14]. However, the authorization process is inefficient, with approximately 3,000 out of 11,300 applications remaining unread and unapproved in 2024[15], heavily disrupting both domestic and international supply.

Market share of medical devices in Vietnam

Vietnam’s domestic production of medical devices is highly dominated by companies with foreign investment. According to the B&Company enterprise database, in 2022, the ten biggest medical device manufacturing companies were all foreign direct investment (FDI) companies and accounted for nearly 75% of the industry’s revenue. Japanese companies have actively invested in Vietnam and have been leading manufacturers in the country (See Table 1). Meanwhile, domestic companies face significant challenges in competing with imported products and FDI firms. The MoH highlighted that local suppliers are mainly small and micro-sized businesses[16], limiting their capability in R&D investment and high-tech production[17]. Competition in the basic medical device segment is intense when imported products benefit from subsidies from their home countries while domestic producers feel more pressure on their costs by high import taxes on raw materials[18]. A lengthy authorization process hampers the development of local companies as it takes longer for them to respond to the market[19].

Table 1: Top medical device manufacturing companies in 2022

| No. | Company Name | Source of investment | City/Province |

| 1 | Sonova Operations Center Vietnam Co., Ltd. | Switzerland | Binh Duong |

| 2 | Terumo BCT Vietnam Co., Ltd. | Japan | Dong Nai |

| 3 | Terumo Vietnam Co., Ltd. | Japan | Ha Noi |

| 4 | Hoya Lens Vietnam Co., Ltd | Japan | Binh Duong |

| 5 | Omron Healthcare Manufacturing Vietnam Co., Ltd. | Japan | Binh Duong |

| 6 | B.Braun Vietnam Co., Ltd. | Malaysia | Ha Noi |

| 7 | Asahi Intecc Hanoi Co., Ltd. | Japan | Ha Noi |

| 8 | Matsuya R&D (Vietnam) Co., Ltd. | Japan | Dong Nai |

| 9 | Mani Hanoi Co., Ltd. | Japan | Thai Nguyen |

| 10 | Nikkiso Vietnam, Inc. | Japan | Ho Chi Minh City |

Source: Enterprise Database, B&Company’s Synthesis

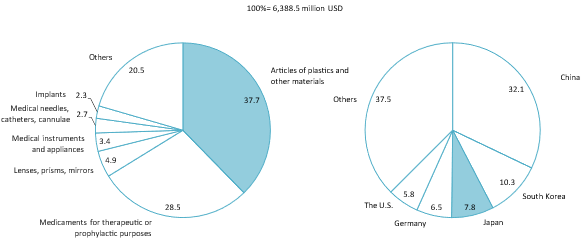

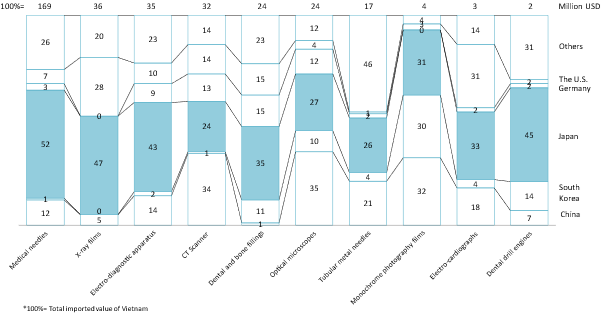

Regarding Vietnam’s import structure of medical devices, Vietnam mainly imports from China, Korea, Japan, Germany, and the United States[20], with top imported products being plastic medical devices and medicaments for therapeutic or prophylactic purposes making up nearly two-thirds of total imported value in 2023[21]. Japan was Vietnam’s main supplier of techonological advanced medical devices, such as medical needles, high-tech medical machineries, and dental products, while also contributing significantly to other important medical goods.

Vietnam’s import of medical devices by product category and country of origin in 2023 (unit: %)

Source: Trade map, B&Company’s Synthesis

Top medical device imported from Japan, compared with the total import to Vietnam in the same categories (Year 2023, unit: %)

Source: Trade map, B&Company’s Synthesis

Opportunities and challenges for investing in the medical devices sector in Vietnam

Vietnam’s evolving medical device market presents expansion opportunities for Japanese companies, either through exports or investment in local manufacturing.

Regarding exports, Japan has been a key supplier of advanced medical devices, dominating market share across multiple segments. Japanese equipment is extensively utilized in some central-level public and specialized hospitals, reflecting a high evaluation of Japanese medical devices in Vietnam[22] [23]. The import of medical devices is also favorable as Vietnam and Japan entered an Economic Partnership (VJEPA) in 2008, granting Japanese products preferential rates between 0% and 25%[24].

In terms of direct investment, the government has been promoting favorable conditions to raise foreign investment and encourage domestic production of medical devices. Recently, Ho Chi Minh City announced the Pharmaceutical Industry Development Project, which will operate until 2030, with a vision for 2045. This initiative aims to attract foreign investment by establishing specialized industrial clusters for pharmaceutical and medical device manufacturing while strengthening the supply chain[25]. The MoH also encourages domestic production by developing policies and frameworks for better commercialization of medical devices manufactured locally, as well as relaxing bidding regulations for public hospitals [26].

Handover of medical equipment from the Japanese Government to 4 central hospitals

Source: Vietnamplus

While the medical device manufacturing industry in Vietnam offers growing potentials, there are also challenges Japanese suppliers should notice and be prepared for.

Firstly, the government imposes strict regulations on the supply and circulation certification of medical devices to ensure safety. Companies are required to register their products with the IMDA or provincial health departments depending on the classifications[27]. In some cases, it even takes up to 2 to 3 years[28] to obtain valid documents.

Secondly, as for importation, an import license or a market authorization certificate is required to import medical devices, which can only be obtained by a legal entity in Vietnam[29]. Consequently, Japanese companies must either establish a representative office in Vietnam or distribute their products through a Vietnamese partner.

Lastly, investing in the sector presents inherent barriers. Setting up a manufacturing plant requires significant upfront capital to establish adequate production lines. Moreover, companies must invest further in R&D, production, and obtain market authorization before their products can be introduced to the market[30]. Japanese manufacturers should acknowledge these complexities when considering their expansion in Vietnam to fully benefit from the domestic market’s prospects.

[1] https://www.gso.gov.vn/du-lieu-va-so-lieu-thong-ke/2023/12/thong-cao-bao-chi-ve-tinh-hinh-dan-so-lao-dong-viec-lam-quy-iv-va-nam-2023/

[2] https://vietnam.unfpa.org/en/topics/ageing-6

[3] https://vietnam.unfpa.org/sites/default/files/pub-pdf/final_vie_factsheet-final_for_printing.pdf

[4] https://www.gso.gov.vn/wp-content/uploads/2024/06/NG-TONG-CUC-2023-Final.pdf

[5] https://thuvienphapluat.vn/van-ban/Dau-tu/Nghi-quyet-29-2021-QH15-Ke-hoach-dau-tu-cong-trung-han-giai-doan-2021-2025-484264.aspx

[6] https://baotintuc.vn/kinh-te/thi-truong-thiet-bi-y-te-viet-nam-thu-hut-nhieu-nha-dau-tu-nuoc-ngoai-20240801155034120.htm

[7] https://www.trade.gov/country-commercial-guides/vietnam-healthcare

[8] https://thuvienphapluat.vn/van-ban/The-thao-Y-te/Bao-cao-1528-BC-BYT-2022-thuc-trang-tinh-hinh-cung-ung-su-dung-thuoc-tai-co-so-kham-chua-benh-540779.aspx

[9] https://baodauthau.vn/thiet-bi-y-te-trong-nuoc-can-tiep-suc-post160380.html

[10] https://moh.gov.vn/documents/20182/212437/628Du-thao-To-trinh%20TTCP%2012.7.20.doc/2b1998aa-18c5-46be-a236-789a99a5f525

[11] https://baodautu.vn/von-fdi-dau-tu-vao-linh-vuc-duoc-pham-y-te-viet-nam-con-thap-d194453.html

[12] https://baodautu.vn/90-thiet-bi-y-te-o-viet-nam-deu-phai-nhap-khau-d112438.html

[13] https://laodong.vn/y-te/thieu-thuoc-trang-thiet-bi-y-te-van-dien-ra-cuc-bo-tai-mot-so-dia-phuong-1290233.ldo

[14] https://www.trade.gov/market-intelligence/vietnam-medical-device-registration

[15] https://vietnamfinance.vn/cap-phep-thiet-bi-y-te-hang-nghin-ho-so-ton-dong-dn-lo-lang-mat-co-hoi-d118634.html

[16] According to Vietnam’s Enterprise Database, small and micro-sized companies in the sector made up over 96% of total domestic companies in 2022 (295 out of 307 companies).

[17] https://moh.gov.vn/documents/20182/212437/628Du-thao-To-trinh%20TTCP%2012.7.20.doc/2b1998aa-18c5-46be-a236-789a99a5f525

[18] https://thanhnien.vn/thiet-bi-y-te-san-xuat-trong-nuoc-canh-tranh-khoc-liet-voi-hang-nhap-khau-185240816184151713.htm

[19] https://thanhnien.vn/thiet-bi-y-te-san-xuat-trong-nuoc-canh-tranh-khoc-liet-voi-hang-nhap-khau-185240816184151713.htm

[20] https://www.marketresearch.com/China-Research-and-Intelligence-Co-Ltd-v3627/Vietnam-Medical-Devices-Research-37608100/

[21] Total imported value of the two product types are 2.4 billion USD and 1.8 billion USD respectively compared to Vietnam’s total import value of medical devices being 6.4 billion USD in 2023 (Calculation based on data from Trade Map)

[22] https://www.vn.emb-japan.go.jp/itpr_ja/20240531_KHospital_vn.html

[23] https://www.vietnamplus.vn/ban-giao-thiet-bi-y-te-cua-chinh-phu-nhat-ban-cho-4-benh-vien-tw-post857798.vnp

[24] https://thuvienphapluat.vn/phap-luat/ho-tro-phap-luat/nhap-khau-thiet-bi-y-te-thi-ap-dung-thue-gia-tri-gia-tang-nhu-the-nao-nhap-khau-thiet-bi-y-te-phai–127355-39509.html

[25] https://moh.gov.vn/vi_VN/hoat-dong-cua-dia-phuong/-/asset_publisher/gHbla8vOQDuS/content/tphcm-khuyen-khich-doanh-nghiep-san-xuat-thuoc-va-trang-thiet-bi-y-te-trong-nuoc

[26] https://baochinhphu.vn/phat-trien-cong-nghiep-trang-thiet-bi-y-te-san-xuat-trong-nuoc-102276530.htm

[27] https://thuvienphapluat.vn/van-ban/The-thao-Y-te/Nghi-dinh-98-2021-ND-CP-quan-ly-trang-thiet-bi-y-te-493940.aspx?anchor=dieu_48

[28] https://thanhnien.vn/thiet-bi-y-te-san-xuat-trong-nuoc-canh-tranh-khoc-liet-voi-hang-nhap-khau-185240816184151713.htm

[29] https://www.trade.gov/market-intelligence/vietnam-medical-device-registration

[30] https://khoahocphothong.vn/san-xuat-thiet-bi-y-te-viet-nam-cong-nghe-cao-van-gap-kho-256686.html

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |