10Jan2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s meat industry is experiencing robust growth, driven by rising demand for processed and chilled meat products. Chilled meat has recently gained popularity due to its superior quality and alignment with consumers’ increasing expectations for safe and premium meat.

Vietnam market overview of meat processing

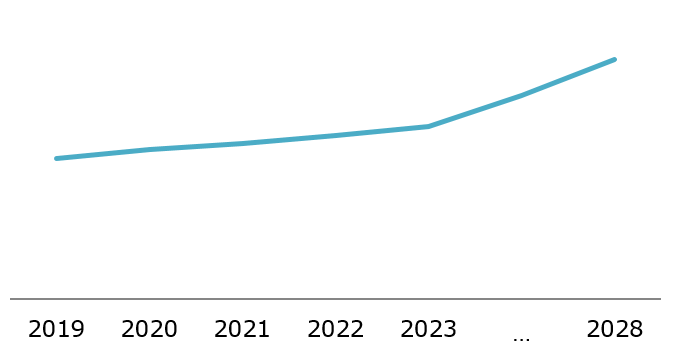

Meat production in Vietnam has been steadily increasing each year. The processed meat segment (including chilled meat and cured products such as sausages and cold cuts) has shown continuous growth, rising from 135 million kilograms in 2019, surging significantly from 2023 onward, reaching 146 million kilograms in 2024, and is projected to hit 164 million kilograms by 2028. The revenue from processed meat products has steadily increased over time, growing from 0.9 billion USD in 2019 to 1.2 billion USD in 2024, and it is estimated 1.6 USD billion by 2028. This growth reflects the rising consumer demand for convenient meat products that cater to the fast-paced lifestyle of modern society. Notably, chilled meat — an emerging segment within processed products — is gaining popularity among Vietnamese consumers due to its nutritional benefits and food safety.

Processed meat market revenue in Vietnam 2019 – 2028

Unit: Bil USD

Source: Statista

The value of Vietnam’s meat market achieved a compound annual growth rate (CAGR) of 4.4% during the 2018–2023 period, primarily driven by beef, goat meat, and chicken. Beef consumption is expected to grow by more than 13% during the 2022-2026 period, double the growth rate of pork. By 2026, Vietnam will need over 420 thousand tons of beef, while domestic production is estimated to meet only slightly more than 270 thousand tons in total. The increase in beef demand is driven by the growing middle-class population and changing consumer preferences towards high-quality and healthy meat. Furthermore, leading fresh meat brands in Vietnam, such as Meat Deli, VISSAN Herbal Pork, and CP Food, currently focus predominantly on pork production. This indicates a significant gap in the market for beef, presenting opportunities for businesses to cater to this unmet demand.

Investments in Vietnam’s chilled meat industry

In Vietnam’s meat market, several foreign and domestic enterprises have previously invested, particularly in the chilled meat and processed meat sectors. On the domestic side, Masan MEATLife has developed MEATDeli, bringing bring advanced meat processing technology to Vietnam. The company focuses on chilled pork products and has established processing complexes such as MEAT Ha Nam and MEATDeli Sai Gon, which comply with European standards. On the foreign side, CP Foods, a brand under the Charoen Pokphand Group (CP Group) headquartered in Thailand, has also made significant investments. CP Vietnam’s activities include livestock farming, animal feed production, pork and poultry production, and seafood processing, with a strong focus on providing chilled meat and processed meat products such as sausages, cold cuts, and canned goods. Currently, chilled meat is distributed directly through retail stores located near traditional markets and via large retail supermarket chains such as Winmart, AEON, and Mega Market, …

Picture of MeatDeli in the supermarket

Source: MeatDeli’s website

Recognizing the immense growth potential of Vietnam’s meat industry and the market gap, Japanese corporation Sojitz, in partnership with Vinamilk’s subsidiary Vilico, has launched the Vinabeef chilled beef processing plant in Tam Dao, Vinh Phuc Province, in December 2024. This facility represents a significant milestone in the country’s meat processing sector and reflects Sojitz’s strategic commitment to expanding its footprint in Vietnam.

With a total investment of $500 million, the project spans an impressive 75.6 hectares. It consists of two key components: a modern cattle farm with the capacity to house 10,000 head of cattle and an advanced processing plant designed to handle up to 30,000 cattle annually, translating into 10,000 tons of premium beef products. The plant is equipped with technology and complies with international food safety standards, ensuring high-quality beef products for both domestic and potential export markets. By March 2025, a cattle farm will be added, establishing a fully integrated supply chain from breeding and raising cattle to processing and distributing beef, ensuring consistent, high quality and reliable production.

The VINABEEF Tam Dao complex

Source: MEKONG – ASEAN Magazines

Conclusion

Vietnam’s meat industry is rapidly expanding, driven by increasing demand for processed and chilled meat products. As consumers place greater emphasis on food safety, nutrition, and quality, chilled meat—produced with strict processing and preservation standards—has become a preferred choice. Established brands like MEATDeli and CP Foods are actively producing and distributing chilled meat through retail outlets and supermarket chains. However, beef, a highly nutritious and healthy option, remains an underserved segment in the chilled meat market, with demand significantly outpacing domestic production. This presents a substantial opportunity for investment and market growth.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |