Vietnam’s alcoholic drinks market stands as one of the most dynamic sectors in Southeast Asia, driven by its traditional beer culture and a growing interest in premium beverages such as spirits and wine. Japanese brands are increasingly exploring opportunities within this market, leveraging changing consumer preferences, the rise of e-commerce, and a favorable outlook for high-end products. However, regulatory challenges such as tax hikes and strict consumption laws add complexity to this environment.

The Structure of Vietnam’s Alcoholic Drinks Market

Vietnam’s alcoholic drinks market reached 5.4 billion liters in 2023, with beer accounting for above 90% of the total consumption. Beer has long been a staple of Vietnamese social life, making it the dominant product segment. International players like Heineken, Carlsberg, and local giants such as Sabeco maintain strong market positions [1].

Consumers choose to buy drinks at Winmart supermarket in Cau Giay district, Hanoi

Source: Kinhtedothi.vn

High raw material prices, reduced consumption, and policies to reduce the harmful effects of alcohol and beer abuse are the main causes negatively affecting the sales of alcoholic beverage enterprises in 2023. Therefore, expectations for a breakthrough in revenue and profit of the alcoholic beverage industry in 2024 are not expected to be optimistic [2]. Recently, a large enterprise in the industry, the Heineken Quang Nam Brewery, had to temporarily suspend operations. For the first time in decades, the company’s consumption market in Vietnam has dropped by double digits [3]. From 2021 to July 2024, Sabeco faced significant challenges, with both production output and revenue declining compared to 2019. The company’s factories struggled as input costs surged by 20-40%, while sales prices could not be adjusted, putting immense pressure on production operations. Similarly, Habeco reported that its 2023 consumption volume dropped by approximately 30% compared to 2019, forcing a 25% reduction in its workforce and a 10% budget cut. The company has suffered continuous losses, recording its 27th consecutive quarterly loss by the end of 2023, with cumulative losses reaching 457.7 billion VND

While spirits such as soju and local rice liquors have found increasing popularity, wine consumption has also gained traction, driven by tourism and the rise of fine dining [4]. Additionally, craft beverages are gaining popularity, catering to young urban consumers seeking unique drinking experiences. Moreover, enterprises in the alcoholic beverage industry (wine, beer) have made changes in production and business. Some companies have begun to switch to low-alcohol, non-alcoholic beverages or fruit-flavored low-alcohol cocktails and beers. For example, Heineken with 0.0% alcohol beer or the Chill brand (Goody Group Joint Stock Company) with a variety of bottled fruit cocktails with alcohol content of about 4.5%…[5]

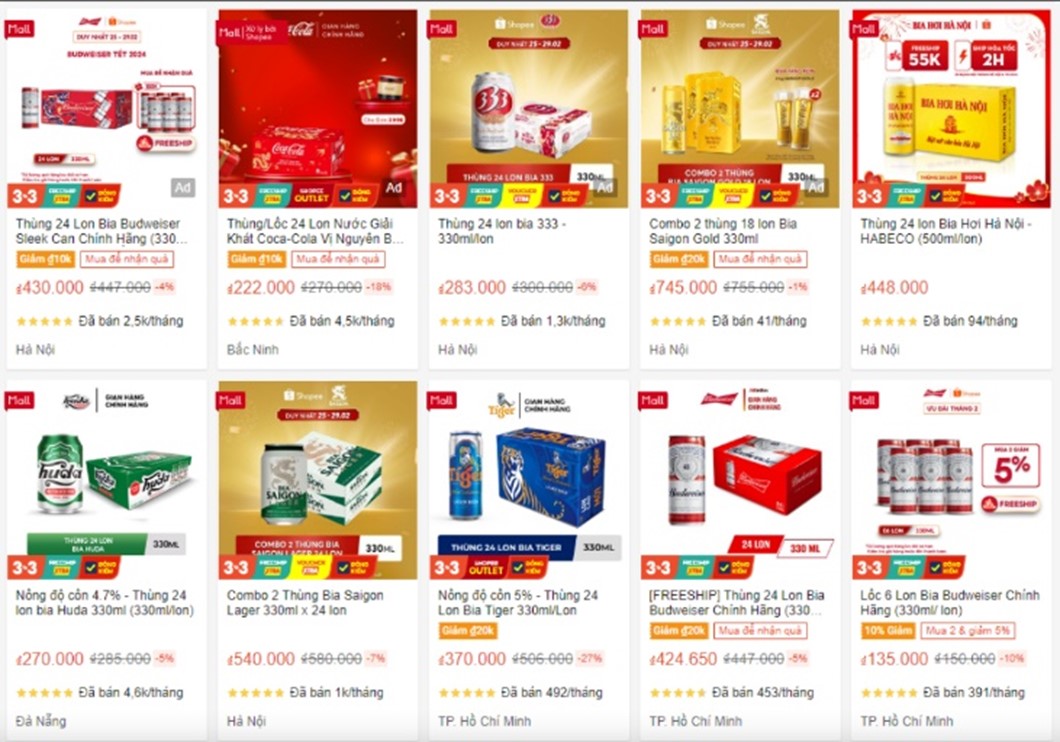

In Vietnam, alcohol is distributed through various channels such as supermarkets, shopping malls, grocery stores, convenience stores, and traditional retail systems. However, e-commerce (EC) is becoming a prominent channel, especially after the impact of the COVID-19 pandemic, when consumers prioritize online shopping for convenience and safety [6]. EC platforms thrive in large cities and attract many young people, thanks to the combination of fast delivery services and digital advertising.

Several beer brands enter EC platform

Source: Congnghevadoisong.vn

Government Regulations and Their Impact

Vietnam’s government is currently proposing new regulations aimed at controlling alcohol consumption. Proposed tax increases will raise excise taxes on beer and spirits to 100% by 2030 [7], impacting product affordability and reshaping the market landscape. These measures aim to reduce overconsumption and promote public health, but they also pose challenges for businesses reliant on mass-market alcohol sales.

Decree 100/2019/ND-CP, which imposes strict penalties on drunk driving in Vietnam, officially came into effect on January 1, 2020 [8]. This decree enforces a zero-tolerance policy, meaning drivers can be penalized for having any trace of alcohol in their blood or breath. Its implementation has significantly impacted behavior, leading to a decline in alcohol consumption, especially in social drinking settings like restaurants and beer halls [9]. This regulation aims to enhance road safety but has also posed challenges to Vietnam’s beverage industry, with notable drops in alcohol sales since its enforcement.

Contributing to reducing traffic violations

Source: Laodongthudo.vn

Despite these challenges, the market offers long-term growth potential, particularly in premium segments. As consumer incomes rise and tastes evolve, there is increasing demand for higher-quality, artisanal spirits and wines. Japan, with its renowned expertise in premium beverages, sees this shift as an opportunity to enter Vietnam’s market effectively [10].

The participation of Japanese wine brands

Japanese alcoholic beverages in Vietnam include various types such as whisky, sake, shochu, and umeshu (plum wine), with notable brands like Suntory (Yamazaki and Hibiki whiskies) and Choya (umeshu). These products are distributed through multiple channels, including import stores, specialty Japanese shops, Japanese restaurants, and increasingly, e-commerce platforms. The growth of e-commerce offers significant opportunities for Japanese brands to reach urban consumers in cities like Hanoi and Ho Chi Minh City, especially following the removal of restrictions on selling high-alcohol-content drinks online [11]. These products are distributed through multiple channels, including import stores, specialty Japanese shops, Japanese restaurants, and increasingly, e-commerce platforms. The growth of e-commerce offers significant opportunities for Japanese brands to reach urban and rural consumers in cities like Hanoi and Ho Chi Minh City, especially following the removal of restrictions on selling high-alcohol-content drinks online [12].

Several types of Japanese wine brands in the Vietnam market

Source: Elflamico.com

However, the market faces stiff competition from other brands, such as Korean soju and whiskies from Europe and the U.S, especially in the whisky and light spirits segments [13]. A rising trend is the increasing popularity of Japanese alcohol as gifts for holidays and special occasions, particularly in gift sets for corporate clients, including Japanese companies operating in Vietnam. The growing population of Japanese expatriates in Vietnam also contributes to the rising demand for these beverages[14].

Strategic Recommendations for Japanese Brands

To succeed in Vietnam’s competitive alcoholic drinks market, Japanese brands must adopt targeted strategies. One essential approach is focusing on urban areas, where consumers are more open to new experiences and willing to pay for premium products. Ho Chi Minh City and Hanoi, with their growing populations and vibrant nightlife, offer ideal markets for high-end beverages [15].

Partnerships with local companies will be crucial. Collaborating with Vietnamese distributors, retailers, or even breweries can help Japanese brands overcome logistical challenges and gain market insights. Furthermore, offering cultural experiences through product launches—such as sake tastings or collaborations with Vietnamese chefs—can enhance brand appeal.

In addition to physical presence, investing in e-commerce is essential. Japanese brands can launch their products on local online platforms and develop direct-to-consumer strategies to build trust and reach a broader audience. Establishing quality assurance mechanisms and ensuring product authenticity will be critical for success in the online marketplace.

Japanese alcoholic beverages with strong potential in Vietnam include sake, umeshu, and whisky. Sake, particularly Junmai and Daiginjo, complements Vietnamese cuisine and fits well with the trend of premium dining. Umeshu, with its sweet plum flavor, appeals to younger consumers and women, while Japanese whiskies like Hibiki and Yamazaki attract connoisseurs with their quality and craftsmanship, positioning Japanese beverages to capture the premium segment and enhance dining experiences.

Conclusion

The Vietnamese alcoholic drinks market is evolving, with a growing demand for premium spirits, wine, and artisanal beverages alongside the dominant beer segment. Japanese brands have an opportunity to enter this market by focusing on urban consumers, e-commerce, and partnerships with local distributors. However, they must navigate regulatory complexities, such as rising taxes and strict consumption laws. Success will depend on understanding local preferences and differentiating products through quality, innovation, and cultural storytelling, helping them compete effectively in a dynamic market.

[1] https://www.researchandmarkets.com/reports/5983626/vietnam-alcoholic-beverages-industry-research

[2] https://kinhtedothi.vn/thi-truong-nganh-do-uong-co-con-nam-2024-khong-may-lac-quan.html

[3] https://baodautu.vn/nganh-do-uong-doi-mat-nhieu-thach-thuc-lon-d219935.html

[4] https://www.fitchsolutions.com/bmi/food-drink/vietnam-alcoholic-drinks-outlook-increased-excise-taxes-will-not-dampen-sector-growth-over-long-term-16-07-2024

[5] https://kinhtedothi.vn/thi-truong-nganh-do-uong-co-con-nam-2024-khong-may-lac-quan.html

[6] https://www.researchandmarkets.com/reports/4517657/food-and-drink-e-commerce-in-vietnam

[7] https://en.vneconomy.vn/100-of-exise-tax-proposed-for-beer-and-alcohol-by-2030.htm

[8] https://vietnamlawmagazine.vn/how-new-rules-on-prevention-of-adverse-effects-of-alcohol-will-impact-alcohol-advertising-and-promotion-practice-note-27137.html

[9] https://theinvestor.vn/vietnams-strict-drink-driving-rules-dampen-brewers-spirits-d8506.html

[10] https://www.fitchsolutions.com/bmi/food-drink/vietnam-alcoholic-drinks-outlook-increased-excise-taxes-will-not-dampen-sector-growth-over-long-term-16-07-2024

[11] https://drinks-intel.com/spirits/how-is-the-spirits-category-navigating-japans-evolving-alcohol-landscape-market-intel/

[12] https://www.globenewswire.com/news-release/2024/07/31/2921945/0/en/Vietnam-Alcoholic-Drinks-Market-Analysis-Trends-and-Forecasts-to-2028-Shochu-Soju-Continues-to-Register-Strong-Growth.html

[13] https://www.euromonitor.com/alcoholic-drinks-in-japan/report

[14] https://www.researchandmarkets.com/reports/4622451/vietnam-retail-market-share-analysis-industry

[15] https://www.fitchsolutions.com/bmi/food-drink/vietnam-alcoholic-drinks-outlook-increased-excise-taxes-will-not-dampen-sector-growth-over-long-term-16-07-2024

| B&Company, Inc.

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles