05Jan2026

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Over the years, Japan has remained one of Vietnam’s leading strategic partners and the country’s third-largest investor, with FDI flowing strongly into electronics and electronic components, precision engineering, and supporting industries for automobiles and motorcycles. As a result, factory location selection has become a pivotal decision for operational efficiency and long-term expansion. This article examines the spatial distribution of Japanese firms across Vietnam’s key industrial parks, identifies the major industrial clusters that attract the highest concentration of Japanese businesses in the North and the South, and highlights the key factors shaping their location choices.

Overview of Vietnam’s Industrial Park System and Japanese Companies

Diplomatic relations between Vietnam and Japan were established in 1973 and have developed over more than 50 years. In November 2023, the two countries upgraded their ties to a Comprehensive Strategic Partnership, providing a solid foundation for regional stability and prosperity. At the second dialogue in 2025 between the Prime Minister and Japanese businesses, Japan was reaffirmed its status as one of Vietnam’s largest investors. As of the end of July 2025, Japan had 5,608 active projects in Vietnam with total registered investment capital of USD 79.4 billion, ranking third among 151 countries and territories investing in Vietnam, with notable projects such as the Nghi Son Refinery and Petrochemical Project, the Smart City project in Dong Anh District (Hanoi), and the Nghi Son 2 BOT thermal power plant project[1].

Prime Minister Pham Minh Chinh chairs a dialogue with Japanese businesses

Source: Baochinhphu

Regarding industrial park supply, as of 2025 Vietnam has 478 established industrial parks, providing approximately 101.6 thousand hectares of industrial land. Of these, 324 industrial parks are already in operation with about 68 thousand hectares of industrial land, while 153 industrial parks are under development with around 32.6 thousand hectares expected to become available in the coming period[2]. In the first eight months of 2025, the average occupancy rate of operational industrial parks remained at 75%, with key provinces in the North reaching roughly 83% and the South about 92%[3].

Besides that, B&Company’s enterprise database reveals that by 2023, over 3,200 Japanese companies were operating in Vietnam, making up more than 15% of all FDI enterprises in the country. Notably, around 30% of these Japanese companies are located within industrial parks

Japanese companies in the industrial park by region in 2023

100% = 1,069 companies

Source: B&Company Enterprise Database

In terms of the composition of Japanese companies located in industrial parks by economic region, the distribution is heavily concentrated in two key growth poles: the Southeast (48%) and the Red River Delta (42%), which together account for roughly 90% of all Japanese firms in industrial parks. In contrast, the Central region and other areas represent only a small share (around 5% each), highlighting a clear disparity in investment attractiveness across regions.

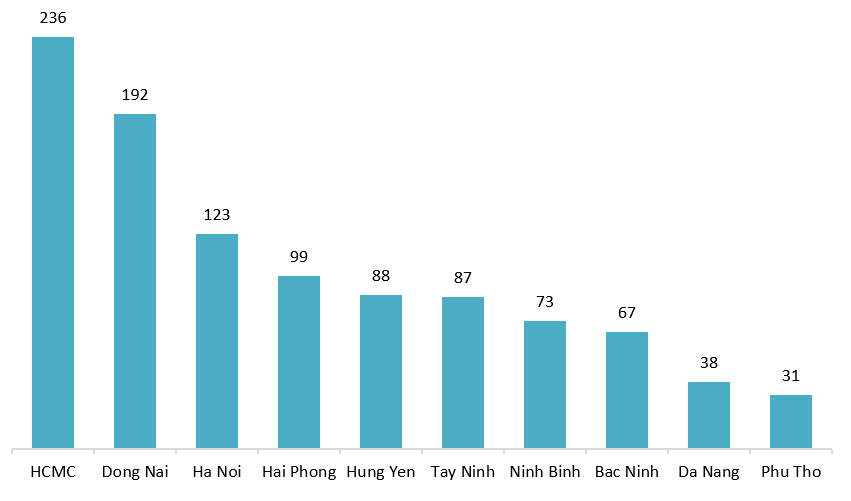

Top 10 provinces with the highest concentration of Japanese companies in industrial parks in 2023

Unit: Company

Source: B&Company Enterprise Database

At the provincial level, Ho Chi Minh City and Dong Nai lead in the number of Japanese companies located in industrial parks, with 236 and 192 firms respectively, reflecting the Southeast’s role as a manufacturing and logistics hub. Hanoi, Hai Phong, and Hung Yen rank next, indicating that the Red River Delta is the second major magnet, particularly for export-oriented manufacturing and supporting industries. The clear gap between the leading group and other localities such as Da Nang and Phu Tho suggests that Japanese investment remains highly concentrated in a handful of “familiar destinations.”

Why Japanese companies tend to choose the Northern and Southern industrial corridors

Japanese companies tend to cluster in the Southern industrial corridor (Ho Chi Minh City–Dong Nai) and the Northern industrial corridor (Hanoi–Hai Phong–Bac Ninh–Hung Yen) because these areas simultaneously offer logistics advantages, a mature industrial ecosystem, a stable investment environment, and consistently strong local governance quality.

– Logistics and export advantages: These growth poles are closely connected to major seaports and container ports, helping optimize both cost and delivery lead time. Notably, the ports around Ho Chi Minh City and Hai Phong are among the world’s top 100 busiest container ports. Specifically, Ho Chi Minh City Port ranked 22nd with throughput exceeding 9.1 million TEUs in 2024, while Hai Phong Port ranked 29th (up four positions from 2024) with throughput of around 7.1 million TEUs in 2024[4].

– A well-established and increasingly complete industrial ecosystem: Once a strong production cluster and supplier network is in place, later entrants often “follow the ecosystem” to more easily secure partners, services, and labor—especially in export-oriented industries. Examples include Amata Industrial Park in Dong Nai, which hosts major Japanese firms such as NOK, Tokyo Ink, Nikko, and Okamoto, and Thang Long I Industrial Park in Hanoi, where large Japanese companies such as Canon, Panasonic, Mitsubishi, and Daikin are present[5].

– A favorable investment climate and strong governance quality: Several leading localities score highly on business environment indicators. For example, Hai Phong was announced as ranking 1st in the 2024 Provincial Competitiveness Index (PCI) with 74.84 points, while Hung Yen entered the Top 10 for the first time with 70.18 points—signaling improvements in governance and greater business friendliness in key industrial park locations[6].

– High standards for infrastructure and environmental compliance: Industrial Park clusters in Ho Chi Minh City–Dong Nai and Hanoi–Hai Phong–Hung Yen–Bac Ninh are often valued by Japanese investors for relatively integrated technical infrastructure and increasingly stringent environmental compliance requirements—particularly centralized wastewater collection and treatment capacity. In Dong Nai Province, 100% of industrial parks have wastewater collection and treatment systems that meet standards. In the North, Hai Phong likewise reports that 100% of its industrial parks meet wastewater collection and treatment standards[7].

Some popular Japanese industrial parks in Vietnam for Japanese companies:

1. Thang Long I Industrial Park

Source: Tlip1

| Name | Thang Long I Industrial Park – Hanoi |

| Location | Thien Loc Commune, Hanoi City, Vietnam |

| Website | https://tlip1.com/en/home-eng/ |

| Investor | Dong Anh Co. & Sumitomo Corp. Joint Venture |

| Year of Operation | 1997 – 2047 |

| Planned Area | 302 hectares |

| Rental Area | N/A |

| Occupancy Rate | 100% (2024) |

| Rental Price | 200 USD/m2 |

| Number of Japanese companies | 60 (2023) |

| Name of major Japanese companies | Canon, Denso, Yamaha, Panasonic, Kamogawa, Matsuo, Mitsubishi, etc |

| Fields of Active Companies | Electronics and electronic components, precision engineering and molds/dies, supporting industries for automobiles and motorcycles, electrical equipment and high-tech products |

B&Company’s synthesis

2. Thang Long II Industrial Park

Source: Tlip2

| Name | Thang Long II Industrial Park – Hung Yen |

| Location | Lieu Xa Commune, Yen My District, Hung Yen Province, Vietnam |

| Website | https://tlip2.com/en |

| Investor | Sumitomo Corporation |

| Year of Operation | 2006 – 2056 |

| Planned Area | 528 hectares |

| Rental Area | 401 hectares |

| Occupancy Rate | 96% (2024) |

| Rental Price | 140 USD/m2 |

| Number of Japanese companies | 56 (2023) |

| Name of major Japanese companies | Hoya Glass Disk, Kyocera, Panasonic, Toto, Toyota, Hitachi, etc |

| Fields of Active Companies | Electrical, electronic industries and advanced materials/optical technologies, mechanical engineering and metalworking/manufacturing, supporting industries for electronics and automobiles, export-oriented clean manufacturing. |

B&Company’s synthesis

3. Long Duc Industrial Park

Source: Long Duc IP

| Name | Long Duc Industrial Park – Dong Nai |

| Location | Long Duc Commune, Long Thanh District, Dong Nai Province, Vietnam |

| Website | https://longduc-ip.com.vn/en/ |

| Investor | Long Duc Investment Limited Liability Company (a joint venture with Sojitz, Daiwa House, Kobelco Eco-Solutions, and Donafoods) |

| Year of Operation | 2013 – 2063 |

| Planned Area | 270 hectares |

| Rental Area | N/A |

| Occupancy Rate | 100% (2024) |

| Rental Price | 165 USD/m2 |

| Number of Japanese companies | 42 (2023) |

| Name of major Japanese companies | Terumo, Yazaki Eds, etc |

| Fields of Active Companies | Electronics and components, precision engineering, supporting industries, clean manufacturing. |

Source: B&Company’s synthesis

4. My Phuoc 3 Industrial Park

Source: Khucongnghiep

| Name | My Phuoc 3 Industrial Park – Ho Chi Minh City |

| Location | My Phuoc Ward & Thoi Hoa Ward, Ho Chi Minh City, Vietnam |

| Website | N/A |

| Investor | Becamex IDC |

| Year of Operation | 2006 – 2056 |

| Planned Area | 997 hectares |

| Rental Area | N/A |

| Occupancy Rate | 99% (2024) |

| Rental Price | 175 USD/m2 |

| Number of Japanese companies | 39 (2023) |

| Name of major Japanese companies | Kraft Vina, Kubota, Keiden, Tomoku, Nawa, Daigaku, Sakai Chemical, etc |

| Fields of Active Companies | Multi-industry manufacturing, electronics, mechanical/processing, and logistics-oriented production. |

B&Company’s synthesis

5. Japan – Hai Phong Industrial Park (Nomura Hai Phong)

Source: Datxanhmienbac

| Name | Japan – Hai Phong Industrial Park – Hai Phong |

| Location | An Duong District, Hai Phong City, Vietnam |

| Website | https://www.nhiz.vn/en/index.html |

| Investor | Joint venture between Hai Phong City and Nomura Financial Group |

| Year of Operation | 1994 – 2044 |

| Planned Area | 153 hectares |

| Rental Area | N/A |

| Occupancy Rate | 98% (2024) |

| Rental Price | 120 USD/m2 |

| Number of Japanese companies | 38 (2023) |

| Name of major Japanese companies | Yazaki, Toyoda Gosei, Akita, Fujikura, Nissei, Nippon Kodo, etc. |

| Fields of Active Companies | Electronics and components, precision engineering, supporting industries, clean manufacturing. |

B&Company’s synthesis

De-risking industrial park selection in Vietnam and how B&Company can support your success

First, choose the industrial corridor before choosing the industrial park. Japanese manufacturers typically concentrate where supply chains are well developed, the labor pool is strong, and the business environment is supportive. Define your must-haves (port access, highway connectivity, workforce availability, and key suppliers) first, then shortlist industrial parks located within that corridor.

Second, evaluate logistics based on operational reality—not map distance. “Near the port” can still mean hidden costs if last-mile routes are congested or trucking is restricted by time windows. Industrial parks that are tightly connected to deep-sea port clusters and integrated logistics systems tend to deliver more predictable lead times and better scalability for export-oriented operations.

Third, use the Japanese ecosystem as a selection filter—and leverage data to validate it quickly. Many Japanese companies prefer industrial parks where Japanese tenants and Japan-standard suppliers are already present to reduce friction in quality management and compliance.

With over 15 years of experience in market research and investment consulting for Japanese and international firms, B&Company helps foreign investors understand the market, find reliable partners, and execute effective strategies in Vietnam. B&Company supports Japanese investors at each critical step of industrial park selection in Vietnam, including:

– Developing an industrial park selection strategy: Building a strategy-led shortlist of industrial parks based on location, industry fit, logistics, cost structure, and scalability.

– Site visits and land assessment: Organizing and joining site visits, liaising with industrial park developers and local stakeholders, and verifying land availability, infrastructure readiness, and real operating conditions.

– Partner search and business matching: Identifying potential partners, suppliers, and customers within and around targeted industrial parks to help investors quickly build a reliable local ecosystem.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Cover photo: Long Duc IP

[1] Viet Nam – Japan Strengthen Comprehensive Cooperation in a New Era <Access>

[2] Vietnam Has 478 Industrial Parks in Operation with a High Occupancy Rate <Access>

[3] Vietnam Industrial Real Estate Situation in 2025 <Access>

[4] Three Vietnamese Ports Shortlisted Among the World’s 100 Busiest Container Ports <Access>

[5] Provinces and Industrial Parks in Vietnam with a High Concentration of Japanese Companies <Access>

[6] Announcement of the 2024 Provincial Competitiveness Index (PCI) Report <Access>

[7] Hai Phong Is Determined Not to Create New Environmental Hotspots <Access>