11Nov2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam is one of Southeast Asia’s fastest-growing plastic manufacturing hubs, fueled by rising domestic demand, export-oriented production, and strong inflows of foreign investment. The backbone of this industry is plastic resin, the fundamental raw material for packaging, consumer goods, automotive components, electronics, and industrial manufacturing. As global corporations diversify supply chains into Vietnam, demand for plastic resin continues to rise, yet the country still heavily depends on imports of primary raw materials.

High-Quality Recycled Resin

Source: Teong Chuan

Market Overview of Vietnam’s Plastic Resin Sector

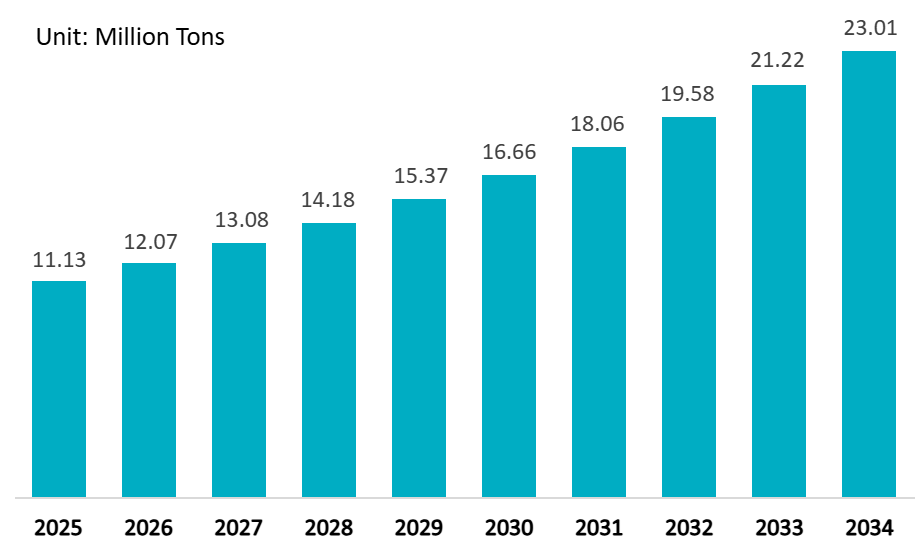

Vietnam has experienced a rapid expansion of plastic consumption over the last 10 years, becoming one of the most dynamic plastic markets in ASEAN. According to the Vietnam Plastics Association (VPA), Vietnam consumed roughly 11.2 million tons of plastic in 2025, and total demand is forecast to reach approximately 23 million tons by 2034, representing a CAGR of around 8-9%[1], among the highest in the region.

However, domestic resin supply remains limited. On average, currently, only 15-35% of resin demand is produced locally, while the rest must be imported as primary plastic materials[2]. In January-July 2025, Vietnam imported 5.55 million tons of plastic resin worth more than US$7.3 billion, an increase of 18.8% in volume and 11.6% in value year-on-year[3]. Key imported resins include PE, PP, PVC, PET, and engineering plastics, which support Vietnam’s growing role in global manufacturing.

Vietnam plastics market size (2025 – 2034)

Source: Expert Market Research

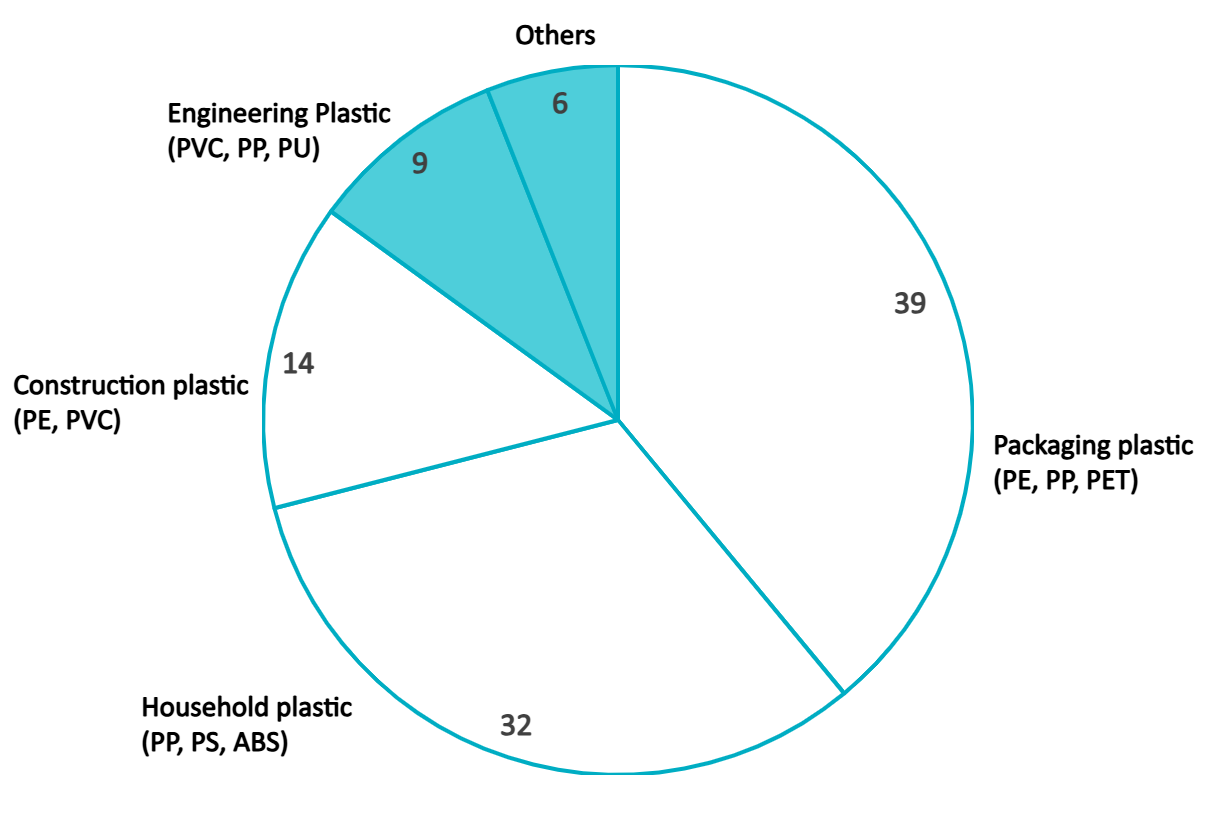

Main categories of plastic products produced by Vietnam in 2024

100% = 3 million tons

Source: Viegoglobal

In terms of domestic production, Vietnam currently produces key raw materials such as PVC, PP, PET, PS, and PE, with a combined capacity of nearly 3 million tons per year. Plastic products are manufactured from both virgin and recycled resins, giving the country flexibility in supply. This capability enables Vietnam to competitively produce a broad range of goods from packaging and consumer products to construction materials and higher‑tech plastics like automotive parts and computer components.

Market Trends: Shaping the Future of Plastic Resin

Vietnam’s plastic resin industry is undergoing a significant transformation, driven by shifting consumption patterns, sustainability demands, and industrial upgrading.

Shift Towards Sustainable Plastics

Growing environmental concerns and global pressure for sustainability are driving increased interest in recycled plastic resin (rPET, rPP, rPE) and bioplastics. The volume of recycled plastics consumed in Vietnam is estimated at 290.6 kilotons in 2024, and is projected to reach 561.7 kilotons by 2033, corresponding to a CAGR of 7.22%. Despite high consumption, recycling rates remain low: some studies estimate that only about one‑third of plastic waste is properly recycled nationwide, underscoring a substantial performance gap relative to advanced markets. In response, the government’s target is to achieve a 50% plastic waste collection and treatment rate by 2025, and to use 25% recycled content in plastic packaging by 2030. While still in nascent stages, the market for recycled plastics is projected to grow at a CAGR of over 15% in the coming years.

In response, many global and domestic brands in Vietnam are beginning to adopt sustainable packaging practices. For example, in 2022 Coca‑Cola Vietnam introduced bottles made from 100 % recycled PET (rPET), expected to avoid about 2,000 tonnes of new plastic annually in Vietnam. Nestlé MILO Vietnam also launched over 16 million paper straws in 2020 for its MILO Breakfast Drink, contributing to a reduction of around 6.7 tonnes of plastic waste

Expansion of Downstream Consumption, Led by Packaging and Manufacturing

A primary trend shaping Vietnam’s plastic resin market is the rapid expansion of downstream industries, particularly packaging and export‑oriented manufacturing. This growth is driven by rising demand for food and beverage packaging, e‑commerce logistics, and consumer goods. The packaging segment alone is forecast to grow at a 7.7% CAGR from 2025 to 2032, reflecting a structural shift toward lightweight, flexible plastic formats. As multinational electronics and automotive manufacturers relocate production to Vietnam, demand for higher‑grade engineering resins such as ABS, PC, and PA continues to expand alongside traditional PE and PP consumption. This sustained downstream growth reinforces Vietnam’s position as a high‑potential market for both commodity and performance resin suppliers.

Increasing Reliance on Imported Resin Due to Domestic Supply Constraints

A third defining trend is Vietnam’s heavy dependence on resin imports, a structural gap driven by limited domestic petrochemical capacity. Industry estimates indicate that 70% of plastic raw materials used in Vietnam are imported, especially PE, PP, and PVC[4]. Shipment data further signals accelerating import reliance: from September 2023 to August 2024, Vietnam recorded 39,516 shipments of plastic raw materials, representing 167% growth compared with the previous twelve‑month period. This reliance exposes domestic converters to fluctuations in global crude oil prices, currency volatility, freight disruptions and geopolitical shocks. However, it simultaneously creates clear entry points for international resin suppliers, distributors and traders to expand market presence.

However, Vietnam is gradually reducing this reliance as major domestic players expand production. In 2023, Long Son Petrochemicals (LSP) recently began operations with a capacity of 1.4 million tons of PE and PP annually, while Hyosung Vina Chemicals and BSR are scaling up local polypropylene and plastic pellet output, signaling early steps toward supply self-sufficiency.

Key Players

The Vietnamese plastic resin market is a dynamic arena dominated by a few large-scale petrochemical producers, particularly for commodity resins like PP and PVC. International and regional players such as Hyosung, SCG Chemicals (via Long Son Petrochemicals), and TPC Vina hold substantial market shares, benefiting from economies of scale and advanced technology. Domestic players like Binh Son Refining and Petrochemical JSC and PVFCCo are crucial for local supply, often leveraging their integrated energy or chemical complexes.

There is also a significant presence of international suppliers (e.g., Siam Cement Group, Dow Chemical) who primarily import specialized plastic resins to meet the diverse needs of downstream manufacturers. The market also sees numerous smaller local plastic compounders and recyclers who process and blend resins to create tailor-made solutions. Competition is driven by price, product quality, reliability of supply, and increasingly sustainable offerings.

| No | Name | Year Founded | Headquarter | Country | Main Product | Capacity |

| 1 | Hyosung Vina Chemicals Co., Ltd. | 2007 | Ba Ria – Vung Tau | South Korea | PP | Production of 300,000 tons/ year of PP[5] |

| 2 | SCG Chemicals (Vietnam) | N/A | Ho Chi Minh | Thailand | PE, PP, PVC, POF | Production of 1.4 million tons/ year of POF |

| 3 | Binh Son Refining and Petrochemical (BSR) | 2008 | Quang Ngai | Vietnam | PP | Production of 150,000 tons/ year of PP |

| 4 | An Thanh Bicsol Co., Ltd. | 2017 | Hai Phong | Vietnam | PE, PP, PVC, PS | Export ~500,000 tons of resin supply per year |

| 5 | Tin Phat Plastic & Chemical Joint Stock Company | 2018 | Ho Chi Minh | Vietnam | PP, PE, PET | – |

| 6 | TPC Vina Plastic and Chemical Corporation Ltd. | 1997 | Dong Nai | Vietnam | PVC

|

210,000 tons per year of PVC |

| 7 | Phu My Plastics Production JSC (PMP) | 2007 | Ba Ria – Vung Tau | Vietnam | PP | – |

| 8 | Stavian Chemical Joint Stock Company | 2009 | Hanoi | Vietnam | PE, PP, PET, EVA, PVC, ABS, HIPS, GPPS | – |

| 9 | Duy Tan Plastics Manufacturing Corporation | 1987 | Ho Chi Minh | Vietnam | PET | 60,000 tons per year of PET |

| 10 | Dow Chemical Vietnam | 2016 | Ho Chi Minh | USA | PE | – |

B&Company’s synthesis

Implications for Foreign Investors: Opportunities, Challenges, and Actionable Steps

Given Vietnam’s strong demand growth, import dependency, and evolving regulatory environment, the plastic resin sector presents both attractive opportunities and critical challenges for foreign investors.

Opportunities

| High Demand and Market Growth | The fundamental driver remains Vietnam’s robust economic growth, manufacturing expansion, and increasing domestic consumption (plastic consumption per capita over 54 kg in 2024[6]), ensuring sustained high demand for plastic resin. The overall plastic resin market is projected to grow at 8-10% CAGR |

| Strategic Location and Export Hub | Vietnam’s geographical position and extensive network of 15 FTAs make it an ideal base for producing plastic resins and products for export to ASEAN, China, EU, US, and other markets. Plastics exports reached $5.5 billion in 2024. |

| Government Support for Manufacturing | The government’s continued focus on attracting FDI into manufacturing, coupled with attractive investment incentives (e.g., 10% CIT for 15 years)[7], creates a favorable environment. FDI into the manufacturing and processing sector amounted to $15.3 billion in the first eight months of 2025. |

| Emerging Circular Economy | The push for sustainability and the circular economy (with targets of 50% plastic waste collection by 2025) opens doors for investments in recycled plastic resin production, bio-plastics, and advanced recycling technologies. The demand for recycled plastics is growing at over 15% CAGR. |

| Upgrading Domestic Capabilities | Approximately 70-80% of Vietnam’s plastic resin demand is met through imports, indicating a significant gap for higher-quality, specialized plastic resins that are currently imported, offering opportunities for advanced resin producers |

B&Company’s synthesis

Challenges

| Competition from Regional Players | The market faces strong competition from established regional petrochemical giants (e.g., from Thailand, Korea, Saudi Arabia) who have significant production capacities and often benefit from economies of scale |

| Raw Material Import Dependency | Vietnam still relies heavily on imported crude oil and naphtha for petrochemical production, making local plastic resin prices susceptible to global oil price fluctuations. |

| Environmental Regulations | While creating opportunities for sustainable solutions, increasingly stringent environmental regulations (e.g., EPR starting Jan 2024, plastic waste management targets) can add compliance costs and require adaptation for manufacturers. |

| Labor Skills | While a large labor force exists (over 50 million people), finding highly skilled technicians and engineers for advanced petrochemical and plastic resin production can be a challenge. Wage growth for skilled labor is also increasing at 8-10% annually[8]. |

| Infrastructure Gaps | While improving, some areas might still face challenges in terms of logistics, power supply, or specialized port facilities for bulk resin handling, particularly outside major industrial hubs. |

B&Company’s synthesis

Actionable Implications for Foreign Investors

Foreign investors entering Vietnam’s plastic resin market should prioritize value-added segments rather than competing in commodity resins. Targeting niche categories such as engineering plastics, medical-grade polymers, and high-performance compounds, growing at 10-12% annually, offers better margins and aligns with Vietnam’s expanding automotive and electronics sectors. Coupling this with R&D investment and technology transfer can elevate product sophistication and help secure incentives tied to innovation and industrial upgrading.

Sustainability-focused investments are increasingly attractive, given Vietnam’s commitment to 25% recycled content in packaging by 2030. Developing capabilities in rPET, rPP, rPE, or bioplastics enables firms to meet regulatory and consumer expectations while benefiting from green investment incentives. Projects aligned with circular economy principles, such as recycling or closed-loop resin systems, are particularly well-positioned.

To navigate the market effectively, foreign firms should form strategic partnerships or joint ventures with local players such as Phu My Plastics Production JSC or Binh Son Refining and Petrochemical JSC. These collaborations provide regulatory insight, access to distribution networks, and compliance with local content requirements, especially for projects located in industrial or export-processing zones, where fast-track procedures under Decree 19/2025 and tax incentives apply.

Vietnam’s broad FTA network, including EVFTA’s 99% tariff elimination, makes it an ideal base for resin export or re-export. Foreign investors can leverage cost competitiveness and preferential trade access by setting up localized compounding or processing hubs serving ASEAN and EU markets.

Finally, to ensure resilience, firms should prioritize supply chain optimization and workforce development. Vertical integration via local compounding or warehousing can reduce dependency on volatile resin imports, while partnerships with vocational institutions or in-house training programs will help address skill gaps in advanced manufacturing.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market.

Please do not hesitate to contact us if you have any queries.

info@b-company.jp + (84) 28 3910 3913

[1] Expert Market Research. (n.d.). Vietnam plastics market size, share, analysis, report 2024–2032. https://www.expertmarketresearch.com/reports/vietnam-plastics-market

[2] Vietnam Institute for Industrial and Trade Policy and Strategy. (n.d.). Overview of Vietnam’s plastic industry (Part 1). https://vioit.org.vn/en/strategy-policy/overview-of-vietnam-s-plastic-industry–part-1–4796.4144.html

[3] Mordor Intelligence. (n.d.). Vietnam plastics market growth, trends, and forecast (2024–2029). https://www.mordorintelligence.com/industry-reports/vietnam-plastics-market

[4] Vietnam News. (2024, February 21). VN plastics industry to reduce dependence on imported raw materials. https://vietnamnews.vn/economy/1635842/vn-plastics-industry-to-reduce-dependence-on-imported-raw-materials.html

[5] Hyosung Vina Chemicals. (n.d.). About us. https://hyosungvinachemicals.com/ve-chung-toi/

[6] VietnamPlus. (2024, June 17). Plastic waste reduction key to sustainable e-commerce development. https://special.vietnamplus.vn/2024/06/17/plastic-waste-reduction-key-to-sustainable-e-commerce-development/

[7] PwC Vietnam. (n.d.). Vietnam: Corporate – Tax credits and incentives. https://taxsummaries.pwc.com/vietnam/corporate/tax-credits-and-incentives

[8] Vietnam Briefing. (2024, May 29). Vietnam wages in 2025: Overview, trends & implications. https://www.vietnam-briefing.com/news/vietnam-wages-in-2025-overview-trends-implications.html/