26Aug2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s F&B market grows strongly in 2024

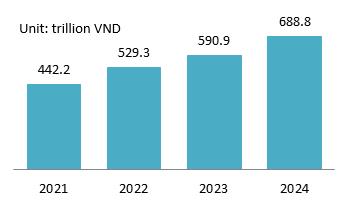

In 2024, Vietnam’s food and beverage (F&B) industry reached a market size of more than 688.8 trillion VND, confirming its rapid expansion and role as one of the largest household spending categories. Dine-in services still dominate overall revenue, showing that physical spaces, in-person service, and on-site dining remain the core characteristics of the market [1].

Vietnam F&B Revenue 2021-2024

Source: iPOS and Nestle

The industry’s strong momentum is supported by a steadily expanding economy, rising disposable income, and a young, urban population that is increasingly open to new dining experiences. At the same time, the recovery of international tourism has fueled demand for diverse formats such as fast-casual dining, delivery-first models, and innovative beverage chains, signaling a shift toward more modern and flexible consumption patterns.

Key consumer trends and shifts in customer behavior

Vietnamese consumers are showing a more selective and value-driven approach to F&B spending. Rather than cutting back, they optimize budgets: for example, purchases under 35,000 VND per beverage have increased significantly, reflecting smart everyday spending. Yet at the same time, nearly 70% of consumers dine out one to three times per week, with singles and young couples dining out even more frequently. Eating out has become both a social activity and a lifestyle expression [1].

Health consciousness has surged post-pandemic. Consumers are increasingly looking for organic products, clean-label foods, and drinks with clear origins. A February 2024 survey by Statista (targeting 2,757 people aged 16 and over) found that about 86% had eaten vegetarian food, and 44% consumed vegetarian food several times a week, illustrating how nutrition and wellness are becoming mainstream [2].

Alongside this, convenience remains a decisive factor: takeaway and delivery are now standard, driven by urban lifestyles and digital-first habits where app-based ordering and e-wallet payments dominate. Overall, behavior combines smart spending, health and sustainability concerns, selective premiumization, and experience-driven consumption.

These shifts are fueling broader structural changes in Vietnam’s F&B market. Health and wellness products—including plant-based, nutrient-rich, and functional foods—are expanding rapidly, especially in urban centers where vegetarian and vegan restaurants are booming. Premiumization and convenience also define the market: rising incomes are pushing demand for artisanal coffee, imported cheeses and wines, and gourmet ready-to-eat meals, while ready-to-drink beverages and on-the-go snacks are popular in major cities. Yet affordability remains crucial, with discount chains, bulk packs, and promotional bundles continuing to drive volume.

Digital transformation is accelerating sharply. Online food delivery has grown quickly, with the number of users projected to double between 2021 and 2025. Platforms like GrabFood, ShopeeFood, and Baemin now dominate urban foodservice, while digital payments have become ubiquitous across cafés and supermarkets [3]. Meanwhile, sustainability and local sourcing are gaining momentum, with eco-friendly packaging and farm-to-table supply chains helping brands stand out.

The service landscape is also shifting. Franchise and chain formats are expanding, gradually overtaking mom-and-pop shops. International and regional players are scaling fast in fast food, coffee, bubble tea, and juice bars, while new models like ghost kitchens address surging delivery demand. Convenience store chains such as GS25 and Circle K are reshaping grocery retail, increasingly competing with traditional markets [4].

Hanoi vs. Ho Chi Minh City: The 2 leading cities in F&B industry

Ho Chi Minh City is Vietnam’s most dynamic and competitive F&B market, driven by high population density, strong consumer demand for convenience, and openness to innovation. By contrast, Hanoi emphasizes cultural depth, quality, and experiential dining, making it ideal for premium and heritage-rich F&B concepts. Together, these two cities serve as complementary growth poles shaping Vietnam’s evolving F&B service sector.

Comparison of Ho Chi Minh City and Hanoi

| Criteria | Ho Chi Minh City (HCMC) | Hanoi |

| Population | 9.5 million | 8.7 million |

| Per capita GRDP | ~180 million VND | ~163,5 million VND |

| Share of F&B establishments | 27.1% of national total | 25.5% of national total |

| Store growth (H1 2024) | -5.97% | +0.1% |

| Share of national F&B revenue | 39.78% (largest in VN) | 14.48% |

| Average spend per meal | 69,599 VND | 80,327 VND |

| Consumption pattern | Frequent dining out, lower spend per meal; strong demand for convenience and delivery | Less frequent dining, higher spend per meal; emphasis on quality and cultural/experiential dining |

| Market characteristics | Highly competitive, innovative, suitable for franchises, chains, delivery-first models; ideal testing ground for new concepts | Stable, refined, culture-driven; suitable for premium dining, experiential cafes, and heritage-focused concepts |

| Examples | Highlands Coffee, Phúc Long, cloud kitchens, fusion/international brands | Michelin-starred Gia, T.U.N.G Dining, Giảng Café, Old Quarter heritage cafés |

Source: B&Company compilation

Recommendations for the F&B Industry in Hanoi and Ho Chi Minh City

Vietnam offers a fast-growing and dynamic F&B sector, but success requires local adaptation. Foreign investors should focus on balancing global expertise with local tastes. Enhancing traditional Vietnamese dishes (e.g., Phở, Bún chả) through premium sourcing, refined cooking, and authentic cultural storytelling can build trust and differentiation. At the same time, opportunities exist in fusion cuisine, premium beverage concepts, and modern dining formats, which appeal strongly to Vietnam’s young, urban consumers.

Scalability is key. Franchise and chain models, cloud kitchens, and delivery-first operations can optimize costs and expand reach in dense urban centers like Hanoi and Ho Chi Minh City. Strategic partnerships with local players—whether in sourcing, distribution, or brand positioning—help foreign entrants navigate regulatory complexity and consumer preferences more effectively.

Investors should also tap into emerging trends: rising demand for health-conscious and functional foods, the rapid growth of digital ordering and cashless payments, and consumer appetite for experiential dining that integrates food, culture, and tourism. Establishing strong brand storytelling, adopting sustainable practices, and leveraging Vietnam as a testbed for innovative concepts will enhance competitiveness and long-term growth potential.

[1] iPOS and Nestle, F&B industry report 2024 <Access>

[2] Ho Chi Minh City becomes the capital of vegetarians. Plant-based trends quietly spreading <Access>

[3] VnEconomy, Food delivery market to be expanded <Access>

[4] Industrial News, Welcoming Newcomer GS25: How Will Vietnam’s Retail Pie Be Divided? <Access>

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |