20Jan2026

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s energy drinks market is undergoing rapid structural change, driven by urbanization, rising incomes, and a shift toward more functional and health-oriented consumption. Regulatory developments targeting sugary beverages are pushing brands to accelerate innovation in low- and reduced-sugar formulations, while the expansion of convenience stores and e-commerce is reshaping distribution and usage occasions. The competitive landscape is led by a mix of strong domestic players and multinational brands, creating both opportunities and challenges for investors seeking growth through localized offerings and health-focused differentiation.

Market Overview

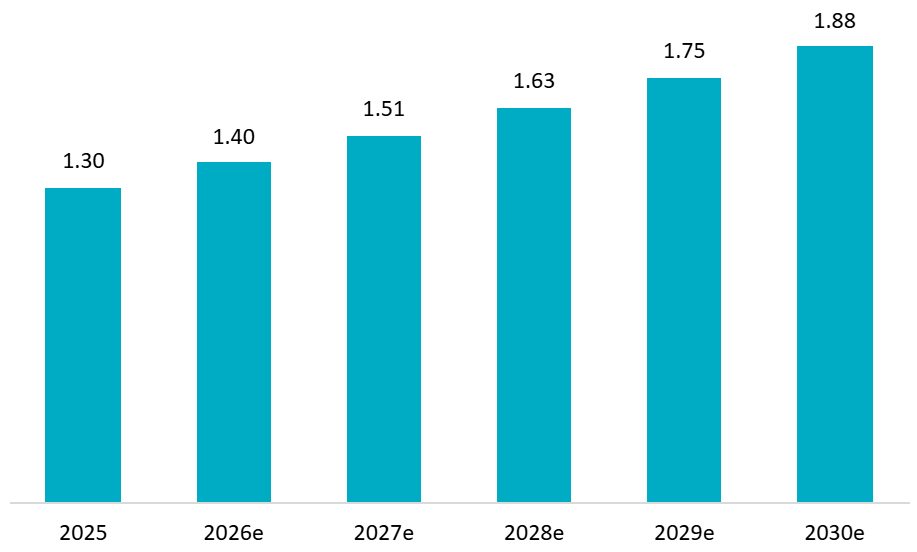

Vietnam’s energy drinks market is estimated at USD 1.30 billion in 2025 and is projected to reach approximately USD 1.88 billion by 2030, with a compound annual growth rate (CAGR) of about 7.8%[1]. This growth outlook is explained by Vietnam’s young and expanding workforce, the sustained role of energy drinks in work and study-related consumption occasions, and the category’s deep penetration across convenience stores and traditional trade, which together continue to support high purchase frequency despite emerging health and regulatory headwinds.

Vietnam Energy Drinks Market Size (2025 – 2030)

Unit: billion USD

Source: Mordor Intelligence

In 2025, non-carbonated energy drinks continue to dominate the category, accounting for approximately 47% of total revenue[2], reflecting consumer preference for lighter, easier-to-drink formats over traditional carbonated options. Direct-to-consumer (D2C) models are rapidly gaining importance, especially for small and mid-sized brands seeking scalable access to consumers without heavy reliance on traditional retail networks. Supermarkets/hypermarkets, convenience stores, and online retail are the main distribution channels, with supermarkets alone contributing about 44% of value sales in 2024[3], driven by broad assortments, loyalty programs, and cross-promotions that encourage impulse and stock-up purchases. However, limited store hours and the need for physical visits are creating opportunities for online channels to capture incremental demand, particularly for late-night and at-home consumption occasions.

From a geographic perspective, Ho Chi Minh City accounts for roughly 36% of the market value in 2025[4]. Large metropolitan markets such as Ho Chi Minh City, Hanoi, and Danang are at the forefront of the shift toward low-sugar energy drink offerings, with consumption levels already exceeding the national norm. Meanwhile, in tier-2 cities including Can Tho and Hai Phong, volume expansion is being driven by the rapid rollout of convenience stores, improving household purchasing power, and the growing presence of young workers in industrial zones.

Market Trends

One of the most significant developments affecting Vietnam’s energy drinks market is the impending regulatory change. The special consumption tax on sugary beverages regulated under Law No. 66/2025/QH15 of the National Assemblyis unintentionally accelerating low- and no-sugar innovation as major producers recalibrate formulations and pricing models to protect volume and margin. Specifically, from 2027, sugar-sweetened beverages with a sugar content of 5 mg per 100 ml will be subject to a special consumption tax at a rate of 8%, increasing to 10% from 2028. This regulation aims to protect public health by reducing overweight, obesity, and non-communicable diseases associated with excessive sugar consumption[5]. This policy intervention functions as both a challenge and an opportunity, rewarding companies that can successfully reformulate products while maintaining taste profiles.

The fitness revolution is reshaping product positioning. The country’s fitness boom is reshaping beverage repertoires as gym-goers, recreational athletes, and time-pressed professionals to embrace functional caffeine, B-vitamins, and botanical adaptogens in pursuit of performance gains. Consumers are no longer satisfied with refreshment alone; instead, they seek clearly defined benefits, such as digestive support from kombucha, sleep-enhancing herbal drinks, or naturally sourced energy boosters. As a result, this segment is expected to record a compound annual growth rate exceeding 12%, significantly outperforming the broader beverage market[6].

At the same time, advances in processing and production technologies are redefining product differentiation. Techniques such as cold-pressing, carbon-neutral manufacturing processes, and the expansion of plant-based formulations are gaining strong traction, particularly among younger, sustainability-conscious consumers who associate these attributes with quality and credibility.

Packaging is also undergoing structural transformation. No longer a purely functional element, it has become a strategic marketing and engagement tool. The adoption of recycled PET (rPET), personalized QR codes, and refill or reuse models is steadily moving toward mainstream acceptance and is expected to become a standard feature of the beverage market by 2025.

Main players

Vietnam’s energy drink market is characterized by a highly competitive mix of multinational brands and strong domestic players, each leveraging distinct strengths in branding, pricing, and route-to-market execution.

Table 1. Main players in Vietnam Energy Drink 2025

| Company | Year Founded

(in VN) |

Country | Profile | Main Products |

| Suntory PepsiCo Vietnam | 1994 | Japan & USA | Strategic partnership combining Suntory’s beverage expertise with PepsiCo’s distribution power. Strong portfolio across multiple beverage categories provides competitive advantages. | Sting (various flavors), Sting Gold, Pepsi energy variants |

| Tan Hiep Phat Beverage Group | 1994 | Vietnam | Largest domestic beverage producer with over one billion liters of annual production. Known for innovation in tea and energy drinks. Exports to 16 countries across Asia and beyond. | Number 1 (various flavors), Dr. Thanh herbal tea, Tea+ |

| Coca-Cola Vietnam | 1994 | USA | Global beverage leader leveraging an extensive distribution network and brand recognition. Competitive in energy drinks, although secondary to carbonated soft drinks. | Thums Up, Samurai, Monster Energy ([7]) |

| Red Bull Vietnam | 1999 | Austria & Thailand | Pioneer of the modern energy drink category, Red Bull maintains strong brand equity through extreme sports sponsorships and consistent product quality. Holds a significant market share despite growing domestic competition. | Red Bull Original, Red Bull Sugarfree, Red Bull Zero |

| Taisho Vietnam | 1999 | Japan | Pharmaceutical company bringing medicinal heritage to energy drinks. Focuses on functional benefits and health positioning rather than lifestyle marketing. | Lipovitan D, Lipovitan Mật Nhân, Lipovitan Tongkat Ali |

| Universal Robina Corporation (URC) | 2003 | Philippines | Diversified ASEAN food and beverage conglomerate. Strong regional distribution networks and multi-category expertise. Leading ready-to-drink tea player in urban Vietnam. | Red Dragon, C2 Cool & Clean, various snack-beverage combinations |

| Masan Consumer Corporation | 2004 | Vietnam | Part of the Masan Group conglomerate with strong FMCG capabilities. Aggressive growth strategy combining product innovation with sports marketing. Leading international expansion among Vietnamese players. | Wake-Up 247 (coffee-flavored), Compact, EnerZ |

| AJE Group | 2010 | Peru | Latin American multinational with an aggressive Asian expansion strategy. Known for value pricing and efficient operations. Strong presence across emerging markets. | Big Cola, Volt Energy |

| Monster Beverage Corporation | 2014 | USA | Premium positioning with emphasis on extreme sports and youth culture. Limited distribution compared to mass-market competitors, but strong brand aspirational value. | Monster Energy, Monster Pipeline Punch, Monster Rossi, Monster Chaos, Monster Ultra |

| Osotspa (M-150) | 2019 | Thailand | Historic Thai beverage company with strong regional presence. M-150 benefits from established Southeast Asian brand equity and a distinctive non-carbonated formula. | M-150 Energy Drink |

Source: B&Company’s synthesis

The competitive landscape reveals several strategic patterns. Vietnam’s energy drinks market is dominated by key players such as Tan Hiep Phat, Suntory PepsiCo, Red Bull Vietnam, Coca-Cola Vietnam, and Masan Consumer, who collectively control most of the market value[8]. These companies benefit from economies of scale in sourcing, bottling, and nationwide merchandising. This market structure, with concentration at the top while remaining fragmented in lower tiers, creates both barriers to entry for new players and opportunities for niche positioning among smaller competitors.

Coffee-flavored energy drinks represent a uniquely successful innovation in Vietnam. According to Frost & Sullivan, in 2024, Masan, with its product Wakeup 24/7, was ranked fourth in the Vietnamese energy drink market with a 10% market share[9]. This product bridges traditional Vietnamese coffee culture with modern energy drink functionality, demonstrating how localization drives market success.

Energy drink prices reflect market segmentation strategies. Energy drink prices in Vietnam typically range from 11,000 to 18,000 VND, with premium options like Monster priced around 28,000 VND to 31,000 VND per 355ml can. However, premium products face brand recognition challenges compared to more affordable alternatives, suggesting price sensitivity remains a primary purchase driver for mainstream consumers.

Implications for Foreign Investors

Key Opportunities

Health-focused innovation pipeline: The impending 2027 sugar tax creates first-mover advantages for companies developing genuinely appealing low-sugar and functional formulations. Success requires moving beyond simple sweetener substitution to create products consumers actively prefer rather than reluctantly accept. Investment in R&D capabilities for natural sweeteners, botanical extracts, and functional ingredients positions companies ahead of regulatory curves.

Premium segment development: The growing middle class and increasing health consciousness create opportunities for premium products. However, success requires educating consumers on functional benefits by justifying higher prices. Premium options like Monster face lower brand recognition compared to more affordable alternatives. Sustained investment in consumer education and experience marketing proves essential for premium positioning.

E-commerce and Digital marketing: Vietnam’s high internet penetration and strong social media engagement have accelerated the shift toward e-commerce channels as a critical route to market for energy drink brands. Online marketplaces and social commerce platforms enable digital-native brands to reach consumers directly, support rapid product trial through promotions and livestream sales, and collect real-time consumer insights. Within this ecosystem, micro-influencer marketing and user-generated content campaigns are particularly effective in driving awareness and conversion among Gen Z consumers, who represent the core demographic for energy drinks.

Key Challenges

Intense Price competition: Domestic manufacturers operate with significantly lower cost structures than international entrants. Vietnamese consumers remain highly price-sensitive, with mainstream products clustering in the 8,000 VND – 18,000 VND range. Foreign investors must either accept lower margins or develop compelling differentiation justifying premium prices.

Established Brand loyalty: Red Bull, Sting, and Number 1 emerged as the top three most recognized brands in Vietnam’s energy drink market. Breaking through established preference structures requires sustained marketing investment and clear differentiation. Me-too products struggle regardless of distribution strength.

Regulatory complexity: The 2027 sugar tax represents visible regulatory risk, but broader food safety, labeling, and advertising regulations continue evolving. Foreign investors face complexity in navigating Vietnamese regulatory requirements while managing relationships with government stakeholders at national and provincial levels.

Cultural localization requirements: Vietnamese consumers’ preference for consuming energy drinks with ice and food rather than on-the-go represents a fundamental difference from Western consumption patterns. Product positioning, packaging formats, and serving suggestions must accommodate local preferences rather than importing global templates unchanged.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[1] https://www.mordorintelligence.com/industry-reports/vietnam-energy-drinks-market

[2] https://www.thereportcubes.com/infographics/energy-drink-market-vietnam

[3] https://www.mordorintelligence.com/industry-reports/vietnam-energy-drinks-market

[4] https://www.thereportcubes.com/infographics/energy-drink-market-vietnam

[5] https://thoibaotaichinhvietnam.vn/ap-thue-tieu-thu-dac-biet-voi-nuoc-giai-khat-co-duong-tu-nam-2027-178303.html

[6] https://dhmarketing.vn/toan-canh-thi-truong-nuoc-giai-khat-2025-co-hoi-thach-thuc-va-xu-huong/

[7] Coca-Cola is the official distributor of Monster Energy in Vietnam, following Coca-Cola’s acquisition of an equity stake in Monster and its use of Coca-Cola’s extensive distribution network to expand Monster’s reach to consumers in international markets.

[8] https://www.mordorintelligence.com/industry-reports/vietnam-energy-drinks-market

[9] https://masanconsumer.com/wp-content/uploads/2025/06/MSC_AR_2024_ENG_compressed.pdf