31Oct2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s solar power energy market is rapidly evolving, driven by favorable solar irradiation levels, fast-rising electricity demand, and a policy framework oriented towards renewable energy. With the government targeting significant capacity additions and corporate sourcing of clean power via DPPAs, the sector offers substantial opportunity for foreign investment but also carries regulatory and execution risks.

Vietnam’s Solar power plants

Source: Vietnam Briefing

Market Overview

Solar power in Vietnam enjoys a strong natural resource endowment: the Central and Southern regions have Global Horizontal Irradiation (GHI) of around 1,753 kWh/m²/year1, making large-scale solar farm and rooftop deployment viable. A Grand View Research report estimates that the Vietnam solar energy systems market generated USD 3.8 billion in 2022 and is expected to reach USD 12.4 billion by 2030 with a CAGR ≈16% from 2023-20302.

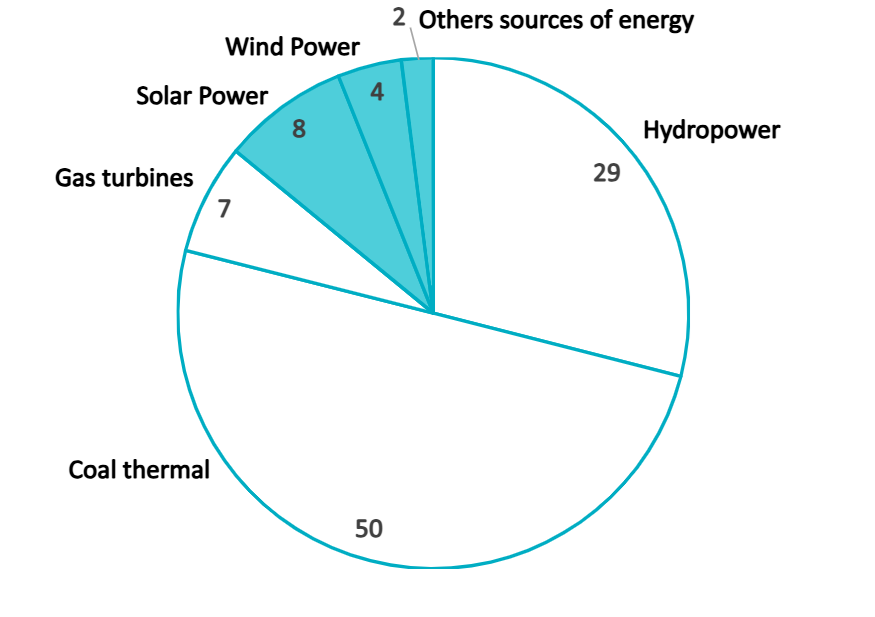

In terms of installed capacity, Vietnam has consistently ranked among Southeast Asia’s most robust solar markets. By the end of 2024, Vietnam had installed approximately 16,500 MW (16.50 GW) of solar capacity, representing about 25% of the country’s total power system capacity of approximately 82,400 MW3. In the first six months of 2024, renewable energy reached 20.73 billion kWh (accounting for 13.7%), of which solar power reached 13.91 billion kWh, and wind power reached 6.15 billion kWh4. In addition, electricity generation within the Solar Energy market is projected to reach 29.43bn kWh in 2025, representing a realistic intermediate step between current output and Vietnam’s long-term targets.

Structure of power source capacity of the entire system in 2024

100% = 308.73 billion kWh

Source: B&Company’s synthesis from Vietnam Electricity EVN Data

In addition, according to Vietnam Electricity EVN, total electricity transmitted in 2024 reached 246.66 billion kWh, representing a 10.76% increase compared with the same period in 2023. Transmission flows from the Central and Southern regions to the North remained consistently high, ensuring additional supply to meet Northern demand.

Current situation of solar power energy in Vietnam

The structure of the market is also evolving beyond traditional ground-mounted farms. Rooftop solar continues to expand in residential, commercial, and industrial facilities, while floating solar projects are increasingly deployed on reservoirs and hydropower lakes5. The introduction of Direct Power Purchase Agreements (DPPAs) has further strengthened demand by allowing large energy users to buy electricity directly from solar generators, reducing reliance on subsidized feed-in tariffs and creating a more commercially driven market6.

Vietnam’s rooftop Solar power

Source: Solar Quarter

However, rapid development has placed pressure on the grid. In several southern provinces, transmission capacity has not kept pace with new installations, resulting in curtailment and delays in grid connection7. To address this, the government and private sector are investing in grid modernization, digital monitoring, and energy storage solutions, though these upgrades will take time to fully resolve congestion issues.

Foreign investor participation remains strong. More than 90% of international investment in Vietnam’s solar and wind sectors has come from Asian markets such as Japan, Thailand, and the Philippines, with the remainder from Europe and North America8. Many projects are structured through joint ventures or EPC partnerships, allowing foreign firms to leverage local permitting experience and land-use knowledge.

Key Players

The market comprises both domestic Vietnamese players (EPC/manufacturing) and international entrants bringing technology/finance. Vietnam’s solar power energy market is no longer dominated by a single type of developer. Each main player occupies a distinct strategic niche. Song Giang Solarpower and Vu Phong Energy Group specialize in EPC contracting, rooftop installation, and O&M services, giving them strong execution capacity nationwide. Indefol Solar focuses on integrated solar solutions for homes and industries, while Sao Mai Group and PC1 Group invest in large ground-mounted plants and use solar to power their own industrial operations.

Key players in Solar power energy in Vietnam

| STT | Company | Year Founded | HQ / Country | Short Profile |

| 1 | PC1 Group JSC | 1963 | Vietnam | PC1 Group is a professional renewable energy investor, applying advanced technology, strict quality control, and efficient project management. It has successfully operated seven hydropower plants totaling 170 MW and is expanding into solar and wind energy. The Group targets 744 MW of clean power by 2025 and is currently developing three 48 MW wind projects in Quang Tri. |

| 2 | TATA Power Solar Systems Ltd | 1989 | India | One of India’s leading solar companies provides engineering, procurement, construction, and commissioning services nationwide. With over 30 years of experience and more than 3 GW of modules shipped globally, it operates advanced manufacturing facilities and delivers large-scale projects, including 450 MWp11 in Bikaner and a 100 MW plant with battery storage in Rajnandgaon. |

| 3 | B.Grimm Power Public Co Ltd | 1993 | Thailand | B.GRIMM Power is one of the largest foreign-invested energy companies in Vietnam and Southeast Asia, with more than 20 years of experience in project development. The company has invested in and operated multiple solar and wind power plants, and is now expanding into LNG-to-power projects, contributing to Vietnam’s long-term clean energy transition. |

| 4 | Sao Mai Group Corporation | 1997 | Vietnam | Sao Mai Group entered the clean energy sector following Vietnam’s 2017 solar incentive policy and became one of the country’s earliest solar investors. It has since operated rooftop and ground-mounted solar plants, including 1.07 MWp in 2017, 50 MWp in Long An, and 210 MWp in An Giang, while expanding rooftop installations across its facilities to reduce energy costs and enhance power autonomy. |

| 5 | Sharp Energy Solutions Corporation | 1998 | Japan | Wholly owned subsidiary created in 2018 when Sharp transferred part of its energy solutions business, delivers end-to-end solar services from development and marketing to installation and after-sales support in Japan and overseas. With strong global brand recognition and advanced photovoltaic technology, SESJ focuses on commercial and residential markets while expanding distribution networks for deeper market penetration. |

| 6 | ACWA Power | 2004 | Saudi Arabia | ACWA Power is a Saudi Arabian developer and investor in power generation, desalination, and green hydrogen, operating in 13 countries with 67 assets worth USD 67 billion. Its mission is to provide reliable, low-cost electricity and water. In Vietnam, the company operates the 50 MW Vinh Hao 6 Solar Plant, commissioned in 2019. |

| 7 | Indefol Solar | 2008 | Vietnam | Indefol Solar is a dedicated solar development company that specializes in renewable energy solutions, offering integrated services and products that enhance efficiency and sustainability for homes, buildings, and industries. They operate both as a manufacturer and service provider in the renewable energy sector, with a vision of achieving a 100% renewable world by 2050. |

| 8 | Vu Phong Energy Group JSC | 2009 | Vietnam | Specializing in Solar EPC services, offering installation, operation, and maintenance for both rooftop and farm solar power systems. With over 1,000 completed projects and a total installed capacity of approximately 700 MWp, the company is dedicated to advancing solar energy solutions and exploring other renewable energy sources. |

| 9 | Vietnam Sunergy JSC | 2015 | Japan | The company manufactures and distributes solar panels in Vietnam while developing advanced solar technologies and executing large-scale installations. Backed by 100% Japanese investment as a subsidiary of Fuji-Solar Japan, it leverages strong international partnerships to enhance quality10. To meet rising demand, the company is expanding production capacity and supporting wider solar adoption nationwide. |

| 10 | Song Giang Solarpower JSC | 2017 | Vietnam | An active participant in Vietnam’s solar sector, specializing in panel manufacturing, system installation, and engineering services9. With strong local experience and a solid market reputation, it continues to expand its capabilities and explore partnerships to support efficient project execution and wider adoption of solar power across the country. |

Sources: B&Company’s synthesis

On the international side, Vietnam Sunergy brings module manufacturing capability backed by Japanese investment, Sharp Energy Solutions provides advanced technology and global distribution, Tata Power Solar delivers large utility-scale EPC projects with storage, and B.Grimm Power develops multi-gigawatt renewable portfolios across Southeast Asia.

This “hybrid ecosystem” has accelerated sector maturity: foreign companies supply innovation and capital, while Vietnamese firms drive rapid implementation. As policy shifts toward competitive pricing and DPPA, locally grounded players are gaining greater influence in new solar development.

Drivers and Challenges Shaping Vietnam’s Solar Energy Market

Key Drivers

Vietnam’s solar energy market is expanding rapidly, driven by strong power demand, declining technology costs, and the government’s commitment to renewable energy. Attractive feed-in tariffs, improving investor confidence, and rising interest from both domestic and foreign developers have positioned solar power as one of the fastest-growing segments in the country’s energy mix.

| Government Support and Incentives | Vietnam provides tax incentives, import duty exemptions, and simplified rooftop licensing. Most notably, the DPPA scheme allows solar developers to sell electricity directly to commercial users, creating a market-based alternative to EVN’s single-buyer model. The government’s pledge to reach net-zero by 2050 at COP26 and the renewable expansion targets in PDP8 signal long-term political commitment. |

| High Solar Irradiance | The Central and Southern provinces record high solar irradiation, averaging ~1,753 kWh/m²/year. Provinces such as Ninh Thuan, Bình Thuan, and An Giang host large solar farms because the combination of high irradiation and flat land makes utility-scale projects economically viable. This natural advantage also allows rooftop installations on industrial zones to achieve rapid payback periods. |

| High market growth potential | Vietnam’s economy has been growing at an impressive rate, leading to a surge in electricity consumption. The country’s power demand is projected to grow by 8-10% annually, creating a substantial need for new power generation capacity. Solar power can help bridge this gap and reduce reliance on traditional fossil fuels12. This growth is supported by rising electricity demand from manufacturing, especially electronics and semiconductor clusters in Ho Chi Minh City and northern industrial parks. |

| Rising corporate adoption | Multinational manufacturers such as Samsung, LEGO, Nike suppliers, and Foxconn partners are installing rooftop solar to meet ESG obligations and reduce electricity bills13. Industrial zones in Binh Dương and Dong Nai are actively signing rooftop PPAs, helping companies secure energy cost stability while satisfying global “green supply chain” requirements. |

| International Funding and Partnerships | Companies from Japan, Thailand, and India continue to invest heavily. For example, Sharp Energy Solutions deploys advanced PV modules for commercial clients, Tata Power Solar delivers large utility-scale EPC projects with storage, and B.Grimm Power operates multi-MW solar farms in Southeast Asia. These players bring financing, high-quality technology, and large-project execution experience to Vietnam’s market. |

Source: B&Company’s synthesis

Key Challenges

Despite this momentum, the sector faces several obstacles that could slow its trajectory. Grid overload, inconsistent regulatory frameworks, project approval bottlenecks, and limited access to affordable financing continue to challenge developers and investors. Addressing these barriers will be essential for Vietnam to fully realize its solar potential and meet long-term sustainability targets.

| Grid congestion risk | Rapid deployment, especially in Ninh Thuan and Binh Thuan has outpaced transmission upgrades, causing curtailment in peak hours. Some solar plants must operate below their designed output because substations and transmission lines are overloaded. Without storage or new grid expansion, future utility-scale projects face operational risk. |

| Pricing and regulatory uncertainty | After FiTs expired, projects now rely on auctions, negotiated tariffs, or DPPA pricing. Several developers raised concerns about slow tariff approvals and delayed PPA payments, putting cash-flow pressure on investors. Although long-term policy remains supportive, short-term adjustments create uncertainty in project planning and bankability. |

| Complex land and permitting | Ground-mounted solar requires environmental impact assessments, provincial approvals, and grid-connection agreements. This process can take years and varies by region. Developers often partner with local companies to navigate land compensation, community consultation, and administrative procedures. |

| Foreign investor barriers | Vietnam allows 100% foreign ownership in renewable energy, but in practice, land access, permitting, and utility negotiations favor developers with strong local relationships. Many foreign investors choose joint ventures with Vietnamese EPC firms to reduce administrative risk14 |

| Data inconsistency | Market forecasts vary widely because some analysts measure hardware sales (equipment and EPC), while others measure operational electricity revenue. This leads to inconsistent market sizing reported by Grand View Research (USD 3.8B, 2022) versus IMARC (USD 742M, 2024), making benchmarking and valuation more complex. |

Source: B&Company’s synthesis

Implications for Foreign Investors

As the market shifts from subsidy-driven growth to competitive procurement, foreign developers and financiers need clearer strategies to stay competitive. The following implications outline key considerations for international investors seeking to enter or expand in Vietnam’s solar market.

Vietnam’s Solar power energy project

Source: Vietnam Finance

– Large and fast-growing market creates room for new entrants

The solar energy systems market is projected to increase from USD 3.8 billion in 2022 to USD 12.4 billion by 2030 (Grand View Research, 2024). This three-fold expansion indicates continued demand for capital, technology, EPC capacity, and storage solutions.

– Corporate demand supports long-term power purchase opportunities

Vietnam’s manufacturing sector uses more than 50% of national electricity consumption (Vietnam Electricity, 2023). With multinational factories committing to carbon reduction, rooftop and DPPA projects are expected to grow, particularly in industrial zones in Binh Dương, Dong Nai, Bac Ninh, and Hai Phong.

– DPPA enables revenue diversification beyond EVN

The newly issued DPPA scheme allows direct sales of renewable electricity to private companies. According to the Ministry of Industry and Trade, over 23 GW of renewable capacity has expressed interest in DPPA participation, offering foreign developers a new offtaker model beyond the single-buyer system.

– Technology-driven players have competitive advantages

Storage-integrated solar projects are gaining attention due to grid congestion. Vietnam’s PDP8 plans for 300-500 MW of battery storage by 2030, creating opportunities for foreign firms with BESS or hybrid solar-wind technologies.

– Local partnerships reduce administrative and land-risk exposure

While no formal ownership cap exists, more than 90% of foreign solar investors still form joint ventures with Vietnamese companies to manage land access, provincial approvals, grid connection, and community engagement.

– Grid capacity affects revenue security and return calculations

Curtailment in Ninh Thuan and Binh Thuan has reduced output for several projects, at times by 10-30% during peak hours. Investors must evaluate grid availability, substation access, and storage integration to protect financial performance.

– Financing and currency strategies are essential

Power purchase revenues are in VND, while financing is typically USD denominated. Exchange rate risk and delayed tariff approvals have slowed project financing, as highlighted by investor complaints covering over USD 13 billion in solar and wind assets.

– Strong long-term policy signals support bankability

Vietnam’s commitment to net-zero by 2050 and PDP8 targets for solar capacity reaching 27-34 GW by 2030 provide long-range clarity for investors developing multi-phase portfolios.

Conclusion

Vietnam’s solar power energy market presents a compelling opportunity for foreign investors, driven by strong fundamentals, supportive policy signals, and a growing demand base. However, the evolving regulatory regime, execution risk around grid and permitting, and sensitivity to policy shifts mean that careful structuring, strong local partnerships and proactive risk management are critical. By targeting segments such as rooftop/self-consumption and DPPAs, and by aligning financing and operational readiness with local conditions, investors can position themselves for success in Vietnam’s solar energy transition.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

*Cover photo: Vietnam Briefing

[1] B&Company, Positive prospects for investment in solar energy in Vietnam,

https://b-company.jp/solar-energy-en-2/.

[2] Grand View Research, Vietnam – Solar Energy Systems Market Outlook,

https://www.grandviewresearch.com/horizon/outlook/solar-energy-systems-market/vietnam

[3] EVN (Vietnam Electricity), Vietnam Electricity: Proud of tradition, confidently entering era of national growth, https://en.evn.com.vn/d/en-US/news/Vietnam-Electricity-Proud-of-tradition-confidently-entering-era-of-national-growth-60-163-500373

[4] Vietnam Energy Online, Electricity of Vietnam’s operating situation in the first 6 months of 2024 and subsequent months, https://vietnamenergy.vn/electricity-of-vietnams-evn-operating-situation-in-the-first-6-months-of-2024-and-subsequent-months-32866.html

[5] IEEFA – Institute for Energy Economics and Financial Analysis, Boom and Balance: Vietnam’s Clean Energy Transition, https://ieefa.org/resources/boom-balance-vietnams-clean-energy-transition

[6] WRI – World Resources Institute, Vietnam’s Direct Power Purchase Agreement Explained,

https://www.wri.org/insights/vietnam-direct-power-purchase-agreement

[7] EVN, Grid overload in Ninh Thuan & Binh Thuan: Losses not only for solar investors,

https://www.evn.com.vn/d6/news/Qua-tai-dien-mat-troi-khu-vuc-Ninh-Thuan-Binh-Thuan-Thiet-hai-khong-chi-cua-rieng-nha-dau-tu-dien-mat-troi-66-142-23998.aspx

[8] Energy Monitor, Vietnam’s foreign renewable investors need incentives,

https://www.energymonitor.ai/finance/vietnam-foreign-investors-in-dire-need-of-incentives-for-renewable-energy

[9] Mordor Intelligence, Vietnam Solar Energy Market – Companies & Profiles, https://www.mordorintelligence.com/industry-reports/vietnam-solar-energy-market/companies

[10] VSUN Solar, Corporate Website, https://www.vsun-solar.com/

[11] Ensun.io, Vietnam Solar Power Search and Company Database, https://ensun.io/search/solar-power/vietnam

[12] The Investor Vietnam, Vietnam to add 6,793 MW to power sources in 2025, fulfilling electricity demand, https://theinvestor.vn/vietnam-to-add-6793-mw-to-power-sources-in-2025-fulfilling-electricity-demand-d13062.html

[13] Vietnam Energy Online, Samsung inaugurates rooftop solar power project at SEV factory in Bac Ninh, https://vietnamenergy.vn/samsung-inaugurates-rooftop-solar-power-project-at-sev-factory-bac-ninh-34630.html

[14] Nardello & Co., Unlocking ASEAN’s Renewable Energy: Overcoming Foreign Ownership Barriers, https://nardelloandco.com/our-insights/article/unlocking-aseans-renewable-energy-overcoming-foreign-ownership-barriers/