29Oct2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s organic food market is entering a clearer stage of development in 2025, as the demand for “clean eating – green living” spreads and modern retail channels expand coverage. Along with that, the domestic certification framework approaching international standards has promoted the standardization of the supply chain from raw material areas to traceability. The increasingly active participation of domestic manufacturers, retailers’ private labels, and international partners creates a potential investment space for the coming period.

Market overview of the Vietnamese organic market

Vietnam’s organic food market is now on a double-digit growth trajectory in the next decade, thanks to the need to “eat clean – live green”, urbanization, and raising agricultural management standards. Some recently published estimates set the 2024 mark at a scale of more than 1 billion USD and forecast a sharp increase until the early 2030s, whereby the market size could reach 2.68 billion USD in 2033 with a CAGR of 11.2%[1].

In the dairy segment, Vietnamese companies have proactively pursued international standards to strengthen consumer trust in “organic/clean” labels. A notable example is Vinamilk Green Farm and Vinamilk 100% Organic, which were certified by the Clean Label Project (CLP) and announced as the first dairy products worldwide to achieve this standard[2]. Meanwhile, Japanese retailers such as AEON have expanded “Vietnamese Products Week” and their Topvalu/Topvalu Organic private labels in Vietnam and across Asian markets, thereby creating additional conditions for certified organic products to enter hypermarket systems[3].

The national standard TCVN 11041 (2017) for organic agriculture sets general requirements that help standardize the farm-to-table supply chain. According to the Netherlands government’s agricultural information portal, by the end of 2023, Vietnam’s organic farming area reached approximately 74,540 hectares, and the number of producers and processors increased to serve both domestic and export markets[4].

From September 16–19, 2025, Vietnam hosted the Organic Asia Congress in Ninh Binh, co-organized by IFOAM-Organics Asia and VOAA, bringing together policymakers, experts, and businesses across the region. The event serves as a catalyst for supply–demand matchmaking, the diffusion of organic farming practices, and elevating the profile of Vietnamese organic products in the regional marketplace[5].

8th Organic Asia Congress, Ninh Binh

Source: Vietnam Organic Agriculture Magazine

Consumer behavior towards organic foods

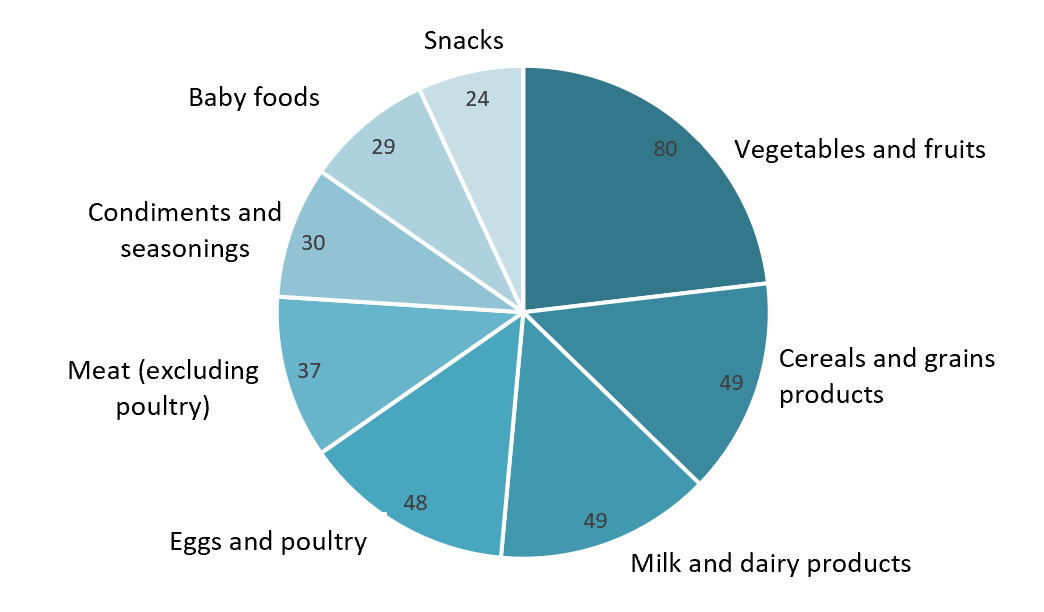

In organic food consumption preference in Vietnam, according to a survey by Statista in 2023, organic vegetables and fruits dominate at 80%. In addition, categories such as grains, dairy, eggs, and poultry also record relatively high purchase rates (around 48–49%), indicating steady demand for essential items in the daily diet.

Organic food groups favored by Vietnamese consumers in 2023

Unit: %, N= 4,649 respondents

Source: Statista

In addition, Vietnam’s food retail system continues to expand, serving as an organic category to enter everyday consumption. The USDA (2024) report noted that the modern retail channel remains dominant, as consumers’ preference for convenience drives the expansion of convenience stores and minimarts, while organic products are becoming increasingly common in supermarkets[6]. In addition, e-commerce has grown rapidly, with supermarkets launching their own delivery apps, while some online platforms, such as TikTok Shop, even sell fresh fruits via livestream. Many major retail chains have also set up dedicated shelves for organic produce, as demand remains high despite prices being 25–35% higher[7].

Leading Companies in Vietnam’s Organic Food Market

Below are 10 representative companies in Vietnam’s organic food market. The list spans large-scale producers, retailers’ private labels, and dedicated organic chains—together offering a comprehensive snapshot of today’s supply landscape.

| No | Name | Country | Year the organic line started | Organic Product Types | Organic Certification | Price Level | Website |

| 1 | Organica | Vietnam | 2011 | Vegetables, grains/dry goods, spices, eggs, etc. | EU/USDA (some SKUs), PGS | High | https://organica.vn |

| 2 | Vinamilk 100% Organic / Green Farm | Vietnam

|

2017 | Fresh milk, milk powder, yogurt | EU Organic (Control Union), CLP (Clean Label Product) | Medium | https://www.vinamilk.com.vn |

| 3 | TH True MILK Organic | Vietnam

|

2017 | Fresh milk, yogurt, butter | EU Organic | Medium | https://www.thtruemilk.vn |

| 4 | Vinamit Organic | Vietnam

|

2016 | Dried fruit snacks, seasonings, beverages | USDA, EU, JAS | Medium | https://vinamit.com.vn |

| 5 | Co.op Organic (Saigon Co.op) | Vietnam

|

2017 | Private label: rice, vegetables, seafood, seasonings | EU/USDA (by SKU) | Medium | https://www.saigonco-op.com.vn |

| 6 | Bác Tôm | Vietnam

|

2010 | Vegetables, meat & fish, regional specialties | PGS/natural farming (some certified) | Medium | https://bactom.com |

| 7 | ORFARM | Vietnam

|

2013 | Vegetables; chicken & eggs; fresh foods | Natural/EM Green; PGS (some items) | Medium | https://orfarm.com.vn |

| 8 | Quế Lâm Organic | Vietnam

|

2012 | Organic rice; organic pork | TCVN 11041/PGS | Medium | https://quelamorganic.com |

| 9 | Viễn Phú – Hoa Sữa Foods | Vietnam

|

2012 | Organic rice | USDA, EU | Medium | https://hoasuafoods.vn |

| 10 | Betrimex – Cocoxim (Organic) | Vietnam

|

2017 | Coconut water, coconut milk, coconut oil | USDA, EU, JAS | Medium | https://betrimex.com.vn |

Source: Compiled by B&Company

(1) The organic wave formed most clearly in the period 2010–2017, when most big brands announced organic lines, showing that the 2016–2017 milestone was the “turn on” time, thanks to international organic standards (EU/USDA) starting to become popular.

(2) The prices are mainly at the average level, with the exception of Organica at the High level due to selective positioning and organic product import certifications, showing that the race is shifting from “expensive-rare” to universal on a larger scale.

(3) The product portfolio ranges from fruits and vegetables to milk, rice, and coconut – this is a “daily essential” group, reinforcing the perception that organic is moving from a high-end niche to everyday consumption.

Most of the leading brands in the organic food segment in Vietnam are domestic brands. In 2024–2025, no new names emerged on a national scale; instead, existing businesses will accelerate expansion and upgrade the value chain: Organica opens more stores and pilots franchising; TH Group promotes green growth initiatives; Vinamilk/Green Farm develops a circular farm model and an innovative milk portfolio; Saigon Co.op increases the role of private labels and exports; Que Lam expands organic-circular chain linkages in many localities

Implications

The need to “eat clean – live green” is organically shifting from the high-end niche to everyday consumption, creating room for stable growth for essential categories and opening the door for retailers’ private labels, as well as domestic brands that meet international standards. Supermarket systems and organic chains are continuously expanding shelves along with the initiative of large retailers such as AEON, which has proactively sought more suppliers, created shelf space, private labels, and traceability standards for organic goods. The national standards framework (TCVN 11041) and international certifications (EU/USDA/JAS) are helping Vietnamese businesses strengthen buyer confidence, making it easier to enter modern channels and gradually approach high-value exports[8].

Besides the opportunities, there still exist some big challenges, such as: The supply chain is still fragmented, the scale of organic raw materials is still small, and standardization of quality-traceability by crop/lot requires close links between farmers, cooperatives, and businesses[9]. In addition, certification and traceability requirements are becoming increasingly strict as modern organic food retail channels expand, leading to requirements for international certification. Finally, there are limitations in cold logistics capacity and post-harvest handling. For fresh products (vegetables, fresh milk), the cold chain/packaging is required to be stable; Operating costs can easily “eat away” profit margins if scale is not reached or agreements with retailers are not optimal[10].

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[1] https://www.researchandmarkets.com/reports/6085696/vietnam-organic-food-market-size-share

[2] https://www.prnewswire.com/news-releases/vinamilk-green-farm-and-organic-milk-first-to-be-clean-label-project-certified-301732288.html

[3] https://corp.aeon.com.vn/wp-content/uploads/2025/06/FINAL-ENG_-News-Release-VN-Products-Week-in-JP-2025-1.pdf

[4] https://www.agroberichtenbuitenland.nl/actueel/nieuws/2025/04/24/as14-vietnam

[5] https://oac.ifoamasia.org/

[8] https://www.prnewswire.com/news-releases/vinamilk-green-farm-and-organic-milk-first-to-be-clean-label-project-certified-301732288.html

[9] https://www.agroberichtenbuitenland.nl/actueel/nieuws/2025/04/24/as14-vietnam

[10] https://apps.fas.usda.gov/