15Dec2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s fast-food market in 2025 continues to be shaped by long-established international brands. The sector grew by 7% in 2024, led by strong performance from Asian chains like Jollibee and Lotteria. Store expansion continues nationwide, while consumer behavior increasingly favors convenience, social dining, and digital ordering. Key trends include social-media-driven marketing, menu localization, and integration with delivery platforms. New entrant is expected, competition is set to intensify, pushing brands to keep innovating and adapting more.

Current situation of the fast food market

Vietnam’s fast-food market is still dominated by international players that entered the country decades ago and built strong brand familiarity. Major names include KFC from the US (entering in 1997), Lotteria from South Korea (entering in 1998), Jollibee from the Philippines (entering in 2005), and McDonald’s from the US (entering in 2014). Across these brands, core offerings typically include fried chicken, burgers, fries, rice meals, spaghetti, and beverages.

According to a report from Euromonitor International, Vietnam’s fast food market has witnessed growth, reaching 22.4 thousand billion VND in 2024. This marks an increase of 7% compared to 2023. Concerning the fried chicken sub-segment, 2024 has an increase of 6.5% from 2023, reaching 5.6 thousand billion VND. Among brands, Asian players are showing good performance and adaptation when taking up a large amount of market share. Jollibee is in the lead with 22% market share, while Lotteria follows closely with 21.5%. US brands are falling behind with KFC (13.4%) and McDonald’s (7.1%)[1]. Noticeably, this marks a shift from 2020, when Lotteria held the largest share (23.7%), followed by KFC (18.3%) and Jollibee (15.6%). By 2022 and onward, Jollibee secures its top spot[2].

Vietnam’s fried chicken market share in 2024

100% = 5.6 thousand billion VND

Source: CafeF

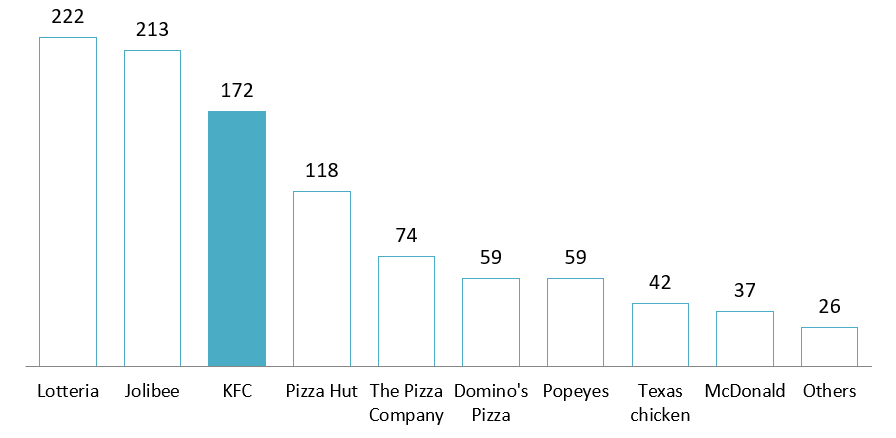

In terms of store openings, the total number of fast-food outlets nationwide reached 1,022 in 2025, an increase of nearly 12% compared to 2024. The expansion is not limited to Hanoi and Ho Chi Minh City; many new branches are opening across provinces, tapping the demand outside the two largest cities[3]. For example, Lotteria has opened new stores in Nha Trang, Quang Tri, Nam Dinh and Phu Quoc in the first 6 months of 2025[4]. Likewise, McDonald’s made its first presence in Da Lat (Lam Dong) in July 2025[5]. Leading in the number of stores is Lotteria with 222 stores nationwide, then Jollibee and KFC with 213 stores and 172 stores respectively. Other players include pizza-focused chains such as Pizza Hut (118 stores) and The Pizza Company (74).

Fast-food brands’ stores in Vietnam in 2025

Unit: stores

Source: Q&Me

Customer perception towards fast food consumption

Although fast-food chains are expanding, many Vietnamese consumers still view fast food as an occasional change-of-flavor, not a core daily meal. Fast food occupies only a small portion (around 3.5%) of the overall F&B market, which remains largely dominated by traditional dining, street food and local eateries[6]. Among fast food offerings, fried chicken is the most popular among Vietnamese customers; hamburgers or spaghetti are less well-received, mostly because of the existence of local alternatives: banh mi and noodles of all kinds [7].

There is a growing number of consumers eating fast food regularly, on a monthly or weekly basis. Consumption is higher among young people aged 18-34, living in urban areas. Eating fast food is often considered a social hangout with friends and families for students or people with young children, while adults of 22-29 years old prefer eating alone. Taste and Convenience are top criteria for choosing to eat fast food[8].

For brand awareness, KFC is perceived to be the most popular, widely used and strongly associated with good value, consistent quality and familiarity[9]. Jollibee is popular among youth (age 18–24), considered to be trendy, youthful, and offering variety, with restaurant atmosphere and menu diversity as their strengths. Lotteria is viewed favourably for food/drink quality and convenient locations. Meanwhile, McDonald’s holds a premium image: people see it as cozy, with good space/seating and a standardized, somewhat higher-end offering[10].

Fast-food market trends

Leveraging social media for marketing campaigns

Fast-food brands in Vietnam increasingly rely on social media as it has become the primary channel through which young consumers discover, evaluate, and emotionally connect with brands. Platforms like Facebook and TikTok allow brands to stimulate conversations and influence purchase decisions through short-form, trendy, and shareable content. Fried-chicken chains that actively engage audiences on social platforms, through seasonal promotions, viral challenges, or storytelling, achieve higher levels of brand mentions and positive sentiment[11].

Early in December 2025, Jollibee launches the campaign for the Christmas season: customers have opportunities for a plush reindeer when buying a food combo. The reindeer quickly becomes a “check-in” symbol for the season, stimulating user-generated content and shareable posts on social media. This results in a long waiting queue at stores, and plush scarcity across stores in Ho Chi Minh City[12].

Jollibee’s reindeer is at the center of the meal

Source: Nguoi lao dong Newspaper

Localizing menus and services

Localization has become a critical success factor for fast-food brands in Vietnam. Local consumers have distinct flavor preferences, meal habits, and price expectations that differ significantly from Western and global markets. As a result, many leading brands have already demonstrated the adaptation. Jollibee modified its seasoning and flavor profiles to better match Vietnamese preferences for slightly sweeter, more aromatic fried chicken[13]. KFC incorporates rice meals such as chicken-and-rice combos in its menu to fit Vietnamese eating habits. McDonald’s also researched a new recipe for fried chicken to fit Vietnamese preferences [14].

Integrating food delivery and e-commerce platforms

Vietnam’s food-delivery market has experienced explosive growth and is now one of the fastest-growing in Southeast Asia[15]. According to industry reports, demand continues to rise due to drivers such as increasing urbanization, busy lifestyles, the convenience of cashless payments, and aggressive promotions from delivery platforms. This rapid expansion is also fueled by shifting consumer habits after the pandemic, with many Vietnamese, especially young, urban users, seeing delivery as a default dining option rather than an occasional convenience[16].

Fast-food chains have quickly adapted to this shift by deepening their presence on delivery apps and experimenting with new digital formats to reach customers. Almost all major brands now integrate their full menus into platforms like ShopeeFood, GrabFood, and BefFood, offering app-exclusive deals to drive online sales. Beyond traditional delivery, players such as KFC are pioneering innovative approaches like selling on TikTok livestream, where influencers showcase menu items, interact with viewers in real time, and trigger instant purchase conversions[17].

Upcoming new player

Looking ahead, Vietnam’s fast-food market looks set to welcome a new entrant: Shake Shack, with its first flagship location opening in 2026. Shake Shack is a US-origin fast-casual burger chain known worldwide for serving premium-quality burgers, crispy chicken sandwiches, hand-spun milkshakes, and frozen custard desserts in a modern, New-York-style setting. The brand aims to open a total of 15 outlets nationwide by 2035[18]. This signals fresh competition for existing players and suggests that the fast-food landscape in Vietnam is still open to international growth. Shake Shack’s arrival may introduce a different fast-casual dining model and could further accelerate market modernization, diversification of offerings, and raise consumer expectations for quality, experience, and brand innovation.

Business implications

From the above analysis, several implications emerge:

| Key updates | Implications | |

| Market situation | Vietnam’s fast-food sector continues to expand steadily, with market value rising 7% | Growth opportunities in Vietnam’s fast-food market remain strong. Success increasingly depends on scale, brand strength, and operational efficiency, giving established players a competitive edge while requiring newcomers to enter more cautiously |

| Consumption frequency is increasing among urban youth aged 18–34 who prioritize convenience, taste, and social dining occasions | ||

| Asian brands strengthen their leadership, while Western giants like KFC and McDonald’s see slower relative growth | ||

| The number of fast-food outlets increased nearly 12%, driven by chains accelerating expansion not only in major cities but also in second-tier provinces. | As major cities approach saturation, regional expansion into tier-2 and tier-3 markets offers the next wave of growth, but requires thoughtful planning around supply chain, pricing, and local tastes. | |

| Market trends | Social media with viral campaigns could boost brand visibility and drive large in-store crowds. | Strong social-media engagement can significantly boost brand visibility and conversion, especially through TikTok and Facebook platforms and youth-oriented, trendy content. |

| Brands deepen adaptation to fit Vietnamese tastes. | Localization is essential and encouraged for brands to adapt flavors, pricing, and service styles to Vietnamese preferences | |

| Vietnam’s food-delivery market grows quickly, pushing fast-food chains to strengthen their presence on delivery apps and adopt new formats like TikTok livestream selling. | Digital and omnichannel have become core growth drivers, with delivery platforms, social commerce, and online promotions shaping how consumers discover and purchase fast food. | |

| New Entrant | Shake Shack will enter Vietnam in 2026, planning 15 stores by 2035. | Competition is intensified, pushing existing fast-food chains to elevate quality, store experience, and brand differentiation. |

B&Company’s synthesis

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[1] CafeF, Fast food chain war: Jollibee’s market share surpassed Lotteria’s 3 years ago, KFC dropped significantly (https://cafef.vn/dai-chien-chuoi-thuc-an-nhanh-thi-phan-jollibee-vuot-mat-lotteria-tu-3-nam-truoc-kfc-tut-doc-ro-ret-188250518223715746.chn)

[2] Dan Tri, New race in the Vietnamese fast food market (https://dantri.com.vn/kinh-doanh/cuoc-dua-moi-tren-thi-truong-thuc-an-nhanh-viet-nam-20250603213002132.htm)

[3] Q&Me, Vietnam retail store (Modern Trade) trend 2025

[4] Announcements on Facebook Fanpage Lotteria Vietnam

[5] McDonald’s

[6] Vietnam net, Fast food in Vietnam – a fierce race in the billion-dollar market (https://vietnamnet.vn/do-an-nhanh-o-viet-nam-cuoc-dua-khoc-liet-cua-thi-truong-ty-usd-2403033.html)

[7] Vietnam Investment Review, From McDonald’s closing down stores: Times are tough for fast food chain (https://baodautu.vn/tu-viec-mcdonalds-dong-bot-cua-hang-thoi-gian-kho-voi-chuoi-do-an-nhanh-d225548.html)

[8] Brands Vietnam, Coc Coc: Unlocking the fast food industry in Vietnam (https://www.brandsvietnam.com/congdong/topic/338858-coc-coc-mo-khoa-nganh-hang-do-an-nhanh-tai-viet-nam)

[9] VnExpress, KFC is the most popular fast food brand in Vietnam (https://vnexpress.net/kfc-la-thuong-hieu-thuc-an-nhanh-duoc-yeu-thich-nhat-viet-nam-4819013.html)

[10] Q&Me, Fast food popularity and brand image (https://qandme.net/en/report/fast-food-popularity-and-brand-image.html)

[11] YouNet Media, Which fried chicken brand is really igniting the community’s voice on social networks? (https://younetmedia.com/thuong-hieu-ga-ran-nao-dang-thuc-su-khoi-day-tieng-noi-cong-dong-tren-mxh/)

[12] Nguoi Lao Dong, The trend of lining up to buy fried chicken and “reindeer hunting” is causing a fever among young people during the 2025 Christmas season (https://nld.com.vn/trao-luu-xep-hang-mua-ga-ran-san-tuan-loc-gay-sot-trong-gioi-tre-mua-noel-2025-196251206155321391.htm)

[13] VnExpress, Fast food localization strategy to please Vietnamese consumers (https://vnexpress.net/chien-luoc-ban-dia-hoa-do-an-nhanh-lay-long-nguoi-tieu-dung-viet-4894920.html)

[14] CafeF, McDonald’s fried chicken – a push into the Vietnamese fast food market (https://cafef.vn/ga-ran-mcdonalds-cu-hich-vao-thi-truong-thuc-an-nhanh-viet-nam-20181116110339232.chn)

[15] Dan tri, Vietnam’s food delivery market is the fastest growing in Southeast Asia (https://dantri.com.vn/kinh-doanh/thi-truong-giao-do-an-viet-nam-tang-truong-nhanh-nhat-dong-nam-a-20250218121754626.htm)

[16] VnExpress, ShopeeFood and GrabFood hold more than 90% of the food delivery market (https://vnexpress.net/shopeefood-grabfood-nam-hon-90-thi-truong-giao-do-an-4911752.html)

[17] Brands Vietnam, Case-study: KFC – Livestream selling fried chicken (https://www.brandsvietnam.com/congdong/topic/344882-case-study-kfc-livestream-ban-ga-ran-tuong-dua-nhung-that)

[18] Shake Shack, Xin Chao Vietnam