28Oct2024

Industry Reviews / Latest News & Report

Comments: 1 Comment.

Overview of the cinema industry in Vietnam

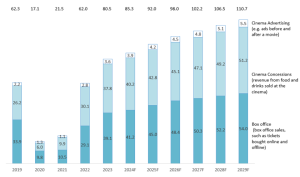

Despite the heavy impact of the COVID-19 pandemic on all service sectors in Vietnam, the cinema industry has shown significant recovery and growth post-pandemic. According to Statista, the total revenue of the cinema industry in 2023 increased by over 30% compared to pre-pandemic levels (2019), rising from 62.3 million USD to 80.5 million USD. The revenue is expected to continue growing over the next five years (2024-2029) at a CAGR of around 4.9% and could reach $110.7 million USD by 2029.

Revenue of cinema in Vietnam (2019-2024F)

Unit: million USD

Source: [1]

Cinema-going remains a popular form of entertainment as it appeals to various demographics and maintains reasonable costs. Movie tickets cost an average of 45,000 VND depending on the theater, time slot and seat type. Some theaters offer discounts for children, students and seniors.[2] in Vietnam has rapidly expanded, nearly tripling from 79 complexes in 2014 to 212 in 2023.[3]

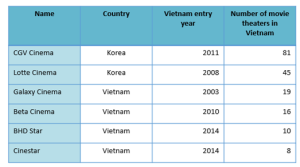

The Vietnamese cinema market is dominated by two South Korean brands: CGV Cinema (45% of cinema number) and Lotte Cinema (26% of cinema number).[4] The remaining market share is held by Vietnamese brands such as Galaxy Cinema, BHD Star, and Beta Cinemas, with a big difference in number compared to 2 top brands.

- – CGV Cinema: Part of CJ Group (South Korea), CGV is one of the world’s top five cinema chains and is the largest cinema chain in Vietnam. CGV utilizes advanced cinema technologies like SCREENX, IMAX[5], etc. In addition to screening films, CGV Vietnam organizes various activities supporting film creativity and community initiatives through their movie projects.[6]

- – Lotte Cinema: Established in 2008 with their complex in Ho Chi Minh City, Lotte Cinema has since expanded across northern, central, and southern Vietnam, operating nearly 50 complexes. Lotte Cinema applies various technologies in screening including SCREENX, IMAX and their exclusive Superplex technology with a brighter and wider screen than usual. Currently, Lotte Cinema is the second largest cinema chain in Vietnam.[7] [8]

- – Galaxy Cinema: This brand belongs to Galaxy Studio (Thien Ngan Film JSC) – a Vietnamese company with 20 years of experience in film distribution and cinema management. In 2023, Galaxy Studio launched a modern cinema called Galaxy Sala in Ho Chi Minh City. This was the first cinema in Vietnam having IMAX Laser screen with an upgrade in brightness and 4K display resolution. Galaxy Sala also offering luxury dinning space[9] and themed screening rooms.[10]

- – Beta Cinema: By selecting suitable locations and optimizing space and costs, Beta Cinema maintains reasonable ticket prices, targeting customers such as students and individuals with average income. Most of Beta cinemas are invested and established by Beta Media, ¼ of the remaining complexes are developed through a flexible franchising model.[11]

List of major movie theater in Vietnam (Feb 2024)

Source: [12]

Opportunities and Case studies

Diverse content offerings

To meet the demands of today’s younger generations, such as Gen Z and Gen Alpha, and to enhance competitiveness, cinemas need to diversify their content beyond movies. Even though CGV is the market leader, CJ CGV is concerned that maintaining the top position would be challenging if they only show movies. Therefore, CGV has launched a new production and distribution division – ICECON[13]. ICECON operates with four main categories:

- – Stage: screening concerts of domestic and international artists

- – Play: screening sports and e-sports matches

- – Channel: adapting content from other platforms, such as reality TV shows and interactive games, into theater screenings

- – Library: offering a new type of knowledge experience through exhibitions and workshops

In 2023, through ICECON, CGV sold tickets for the screening of the documentary ‘Taylor Swift: The Eras Tour,’ selling out 13,000 tickets within the first hour. This year, CGV continues to screen documentaries of concerts by Korean and Vietnamese artists, as well as e-sports tournaments, and related merchandise. These activities can increase cinema revenues across all three segments: box office, advertising, and concessions.

Collaboration between local brands and foreign investors

As mentioned, the Vietnamese cinema market is mainly held by two South Korean brands: CGV Cinema and Lotte Cinema. However, Vietnamese brands such as Galaxy Cinema and Beta Cinema are making effort to find the way in improving cinema quality and increasing the scale of operations.

- – In early August 2024, AEON Entertainment (Japan) and Beta Media announced a joint venture, planning to invest 5,000 billion VND in 50 cinema complexes by 2035. This partnership aims to develop and operate 50 high-end cinema complexes under the AEON Beta Cinema brand, with the first opening planned for 2025.[14]

- – In March 2024, Galaxy Studio (Galaxy Cinema) and Samsung signed a strategic partnership aimed at enhancing the movie-watching experience through specialized display solutions and pioneering technology products. As soon as customers enter the cinema, they will see the information about popular and new films in Samsung’s LED and LCD screen. Additionally, customers can easily buy ticket at ticket-selling kiosks or enjoy movies on vivid screens.[15]

Key Considerations for Investors

Understand competitors to enhance competitiveness

Foreign investors should thoroughly research the market and the successful business models of other brands to determine an appropriate strategy when entering the market. Specifically, investors can study and refer to Beta Cinema’s cost optimization and franchising model or the partnership with other companies, like Galaxy Cinema, to enhance service quality and competitiveness.

Comply with relevant regulations/policies

Investors planning to produce and distribute films, including operating cinemas in Vietnam, need to refer to specific regulations set by the Vietnamese government in this field.

- – Law on Cinematography 2022, which came into effects from January 1, 2023, in replacement of Law on Cinematography 2006: This law governs cinema activities; the rights, obligations, and responsibilities of organizations and individuals participating in cinema activities; and state management of cinema

- – Decree No. 131/2022/ND-CP: Detailing certain provisions of the Cinema Law

- – Decree No. 38/2021/ND-CP: Including administrative penalties in the fields of culture and advertising

Law 2022 has amended 32 articles and added 18 new regulations compared to the old law, with some noteworthy changes that benefit investors in film production and distribution.

- – Chapter 2, Article 13: Instead of having to submit the whole script, film crews are now only required a summarized script and the detailed script of scenes set in Vietnam, in Vietnamese.

- – Chapter 3: “Film distribution services” have been removed from the list of conditional business lines.

- – Article 38: Entities permitted to organize film festivals are broadened to not limited to state agencies but also Vietnamese private organizations and agencies, international organizations, foreign organizations, diplomatic missions, and foreign facilities of culture, with certain criteria.

- – Article 41: Foreign organizations producing films using Vietnamese scenes are entitled to tax incentives as prescribed by law.[16]

Conclusion

The cinema market is expected to continue growing over the next five years, with increasing revenue and user demand. However, competition and pressure on new investors are also intensifying. Therefore, investors should consider new approaches, such as diversifying content offerings and collaborating with established brands. Moreover, they need to have a thorough understanding of the market, competitors’ business models, and relevant regulations and policies to be well-prepared when entering the Vietnamese market.

——

[1] Statista (August 2024). Revenue in the Cinema market. <Assess>

[2] VNPAY, Cinema ticket price. <Assess>

[3] Dai Doan Ket (2023) – The Central Committee of the Vietnam Fatherland Front. It is still a challenge to determind the future of cinema industry. <Assess>

[4] Vietnam News Agency (2024). Vietnam cinema market’s players enter a race to redistribute market share. <Assess>

[5] ScreenX improving the cinema experience with a screen three times larger than a regular one with three different viewing angles. IMAX is a technology that uses a curved screen and two projectors, with sound effects that envelop the entire theater.

[7] Lottemart website <Assess>

[8] VNPAY. What is the feature of Superlex, how to get the ticket. <Assess>

[9] This is a luxury restaurant/lounge where customers can enjoy various food and drinks (includes alcohol drinks such as cocktail, wine) while waiting for the show.

[10] Dien tu ung dung (2023). Galaxy Sala sets new standards for a modern and superior cinema <Assess>

[11] Beta Cinema website <Assess>

[12] Cinematone: a website launched in 2018, specializing in synthesizing and providing information about cinema from official sources of film producers and reliable newspaper, magazines. <Assess>

[14] Vietnam News Agency (2024). Vietnam cinema market’s players enter a race to redistribute market share. <Assess>

[15] Galaxycine (2024). Galaxy studio and Samsung sign a strategic parnership. <Assess>

[16] National Assembly (2022). Noteworthy changes in Law on Cinematography 2022. <Assess>

| B&Company, Inc.

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles

- All

- E-Commerce

- Economic

- Food & Beverage

- Healthcare

- Human Resources

- Investment

- IT & Technology

- Logistics & Transportation

- Regulation

- Retail & Distribution

- Seminar

- Temporarily closed

- Tourism & Hospitality

- White Book

Related article

1 Comment

Comments are closed.

Vietnam's Hidden Gems: Filming Locations for Global Productions | Blog