Market overview of electric motorbike in Vietnam

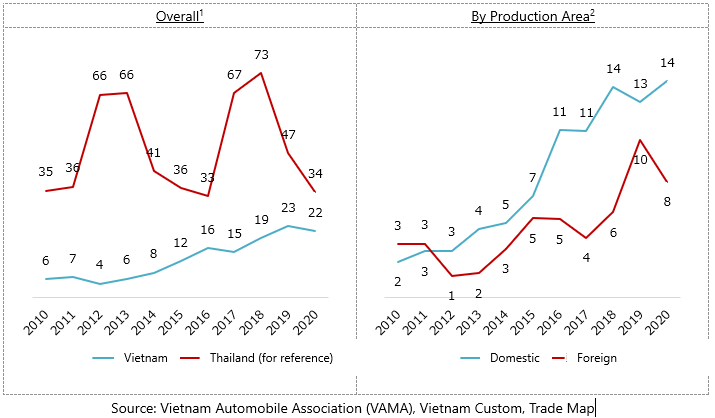

Vietnam is witnessing a significant shift from traditional gasoline-powered motorbikes to electric alternatives. The electric motorbike market in Vietnam is poised for significant growth. The Ministry of Industry and Trade reports that there are currently over 3 million electric bicycles and electric motorcycles in circulation in 2024. This has made Vietnam the largest electric motorcycle market in the ASEAN region and the second largest globally, after China.

The growth of this market is attributed to opportunities derived from the government’s encouragement and the context of Green Consumption and Transition in Vietnam. To begin with, this market is supported by a combination of favorable government policies, such as tax incentives and subsidies (E.g. Registration fee for electric cars powered by batteries at 0% for 3 years; special consumption tax on electric cars to only 1%-3%, etc.) and ongoing infrastructure improvements, particularly in the development of charging networks. Secondly, the growing popularity of “Green Consumption” which has led consumers to prioritize eco-friendly products and services, fuels the demand for electric motorbikes. Thirdly, the use of electric motorbikes will significantly contribute to achieving “Green Transition goals”, with an emphasis on reducing carbon emissions and promoting clean energy.

“Xanh SM” is one of the outstanding examples reflecting the aforementioned factors that shape the development of the electric motorbike market. It is an electric vehicle rental and booking service operated by Green and Smart Mobility Joint Stock Company (GSM). These services aim to popularize the habit of using electric vehicles to each citizen, thereby raising public awareness of the convenience, intelligence and sustainability of green vehicles.

Xanh SM. Source: GSM website

Despite some positive highlights, there are also remaining challenges. Electric motorbikes often have higher upfront costs compared to traditional gasoline-powered motorbikes, which can be a barrier for some consumers, particularly those in lower-income segments. In addition, despite the growing environmental consciousness, some consumers may still lack awareness about the benefits of electric motorbikes, requiring continued education and marketing efforts to drive adoption. Furthermore, the well-established gasoline-powered motorbike market in Vietnam may pose pressures on electric motorbike manufacturers, as they compete for market share and work to change consumer habits.

Key Players

Vietnam’s electric motorbike market is characterized by a mix of established companies and emerging startups. In which, VinFast, a subsidiary of the Vietnamese conglomerate Vingroup, has emerged as a leader in the domestic market, investing heavily in the development and manufacturing of electric motorbikes. Other notable players, such as Dat Bike, Pega, and Yadea, offer unique features and designs catering to different customer segments, contributing to the market’s diversity and competitiveness.

Vinfast and Yadea products. Source: Vinfast’s website and Yadea’s website

Japanese Investment and Collaboration

Japanese investment and collaboration play a crucial role in driving the green transition in Vietnam’s electric motorbike market. Several prominent Japanese firms have established a strong presence in Vietnam, partnering with local companies to develop and manufacture electric motorbikes. For instance, Honda, a global leader in the automotive and motorcycle industry, has been actively investing in Vietnam’s electric motorbike market, collaborating with Vietnamese partners to develop new models and expand its charging infrastructure network. Yamaha has also been collaborating with VinFast to develop and manufacture high-quality, affordable electric motorbikes, leveraging Yamaha’s technological expertise and VinFast’s local market knowledge. In addition to the private sector, The Japanese government has also provided support through initiatives like the “Japan-Vietnam Environmental Improvement Project,” aimed at promoting sustainable transportation and reducing greenhouse gas emissions in Vietnam, further cementing the importance of Japanese involvement in the market’s growth.

The Future of Vietnam’s Electric Motorbike Market

Despite these challenges, the outlook for Vietnam’s electric motorbike market remains positive. As the country continues to embrace sustainable transportation and work towards its green transition goals, the electric motorbike market is poised to play a crucial role in shaping Vietnam’s transportation landscape in the years to come. According to the Program for green energy transition and reduction of carbon and methane emissions in the transportation sector (Decision No. 876/QĐ-TTg), by 2050, 100% of road motor vehicles, construction vehicles, and machinery will transition to using electricity and green energy. In public transport, from 2030, at least 50% of vehicles will use electricity and green energy; 100% of newly invested and replaced taxis will use electricity and green energy. By 2050, 100% of buses and taxis will use electricity and green energy.

B&Company, Inc.

| B&Company, Inc.

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles