08Aug2024

Highlight content / Industry Reviews / Latest News & Report

Comments: No Comments.

Vietnam’s Transportation Sector

According to Vietnam’s Ministry of Natural Resources and Environment (MONRE), transportation accounts for about 18% of total greenhouse gas emissions. Among them, motorcycles contribute more than 90% of carbon monoxide (CO) and volatile organic compounds (VOCs), and 60% of suspended particulate matter (SPM).[1] To meet climate change targets without hindering productivity, it is desirable to increase the adoption of electric two-wheelers in both freight and passenger transport.

Vietnam commitment in Paris Agreement about greenhouse gas emission reduction

Under the Paris Agreement, Vietnam has pledged to reduce greenhouse gas emissions by 8~25% by 2030 and achieve net zero by 2050 at the United Nations Climate Change Conference (COP26) in 2021. Although there were pros and cons, Ho Chi Minh City and Hanoi researched on plans to phase out internal combustion motorcycles and scooters by 2030.[2]

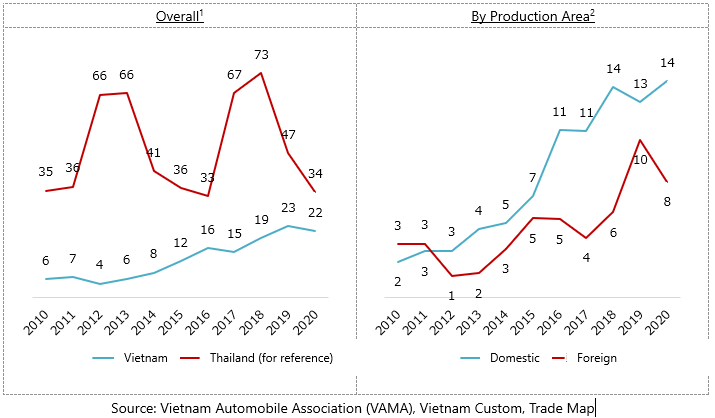

Overview of Vietnam’s motorcycle market

Vietnam is the world’s fourth-largest motorcycle market. As of 2020, there are about 58 million motorcycles for a population of about 97.6 million. Among them, electric motorcycles accounted for about 5.9 million units (about 10%), making Vietnam second only to China in Asia[3]. However, the annual sales of motorcycles have declined since 2019 due to the growing popularity of automobiles as a status symbol and government policies aimed at alleviating air pollution and traffic congestion[4].

Despite these trends, the large number of petrol-powered two-wheelers presents a significant market opportunity for electric replacements.

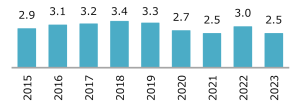

New motorcycle sales in Vietnam (million units)

Source: VAMA (Vietnam Automobile Association)

The expansion of Vietnam’s express delivery service market

Vietnam’s express delivery service market was valued at approximately USD 710 million in 2021 and is expected to reach approximately USD 4.9 billion by 2030 due to the rapid expansion of e-commerce. In addition, the increasing demand for online shopping and same-day delivery has led to a need for two-wheelers that can deliver parcels to consumers quickly and at a low price[5]. However, these costs can account for more than 50% of total transportation costs and more than 40% of total supply chain costs[6]. E-commerce operators are looking for cost-cutting strategies, such as shifting to electric vehicles (EVs), to maintain profits in an inflationary environment with soaring fuel prices.

Some companies have begun to replace gasoline vehicles with electric two-wheelers. GHN (a major logistics company) is adopting electric vehicles (Evs) for delivery. Ahamove, a delivery service company, is integrating electric two-wheelers into its fleet to reduce operating costs and environmental impact[7]. Vietnam Post is exploring the use of electric two-wheelers to improve delivery efficiency and sustainability, and is testing the performance of electric scooters for urban deliveries. These efforts coincide with the government’s push for greener modes of transportation[8]. Viettel Post, a major logistics company, has also begun to shift to electric two-wheelers, upgrading its fleet to increase delivery speeds and reduce emissions. In addition, the company is focusing on the use of technology to optimize delivery routes and increase the efficiency of its EV fleet[9]. Vinfast, a leading EV manufacturer, is partnering with various logistics companies to promote the use of electric two-wheelers in order to provide reliable and efficient EVs.

Challenges and opportunities for electric two-wheelers in Vietnam

The expansion of electric two-wheelers is both a challenge and an opportunity.

- Infrastructure: Developing infrastructure for proper charging and battery replacement requires a lot of investment and cooperation.

- Government support: There are many incentives for electric four-wheelers, but few are specific to electric two-wheelers[10].

- Environmental and economic benefits: The transition to EVs leads to lower operating costs and environmental impact.

The shift to electric two-wheelers by Vietnamese logistics companies is gaining momentum. With continued investment in infrastructure and government support, the logistics sector is poised to become more sustainable and efficient in the coming years.

This article has been published in the column “Read Vietnamese trends” of ASEAN Economic News.

FNX_Electric two-wheelers in Vietnam_2408_ENG

References

[1] Source: MONRE (Ministry of Natural Resources and Environment) “National Environmental Report on Waste Management” (2018)

[2] Source: Phap Luat (Law Newspaper), “Roadmap for Motorcycle Regulations in Hanoi and Ho Chi Minh City” (April 2022)

[3] Source: Kline + Company (U.S. market research company), “Why the Electric Two-Wheeler Market is Experiencing Rapid Growth” (July 2022)

[4] Source: Statista (German online data platform) “Motorcycle sales in Vietnam (2018~2023)” (March 2024)

[5] Source: Allied Market Research, “Opportunity Analysis of the Express Delivery Services Market (2022~2030)” (April 2022)

[6] Source: DispatchTrack, a U.S. software company, “Last-Mile Delivery Cost Breakdown,” June 2021

[7] Source: Ahamove (delivery service company) “Delivery by electric vehicle ~Future green trend~” (October 2022)

[8] Source: VNNIC (Domain Management Organization), “Introduction of electric vehicles in transportation services, new competition among transportation operators” (May 2023)

[9] Source: Viettel, a leading mobile network operator, “VTPost Hue tests delivery using electric motorcycles” (March 2023)

[10] Source: Daklak24h (official newspaper of Daklak Province) “Lack of policies to support electric motorcycles” (April 2024)

| B&Company, Inc.

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles

[/vc_column_text][/vc_column][/vc_row]

- All

- Business

- E-Commerce

- Economic

- Exhibition

- Food & Beverage

- Healthcare

- Human Resources

- Investment

- IT & Technology

- Multi-country Research

- Regulation

- Retail & Distribution

- Seminar

- Temporarily closed

- Tet

- Tourism & Hospitality