03Nov2025

Highlight content / Highlight Content JP / Highlight content vi / Industry Reviews / Latest News & Report

Comments: No Comments.

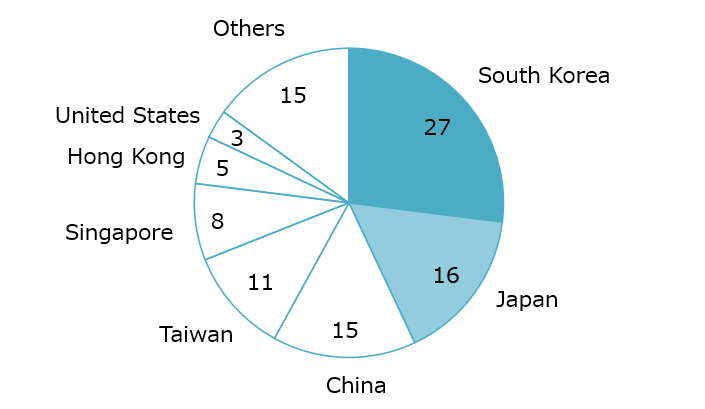

Japanese companies are becoming increasingly prominent in Vietnam. According to B&Company, there were approximately 1.08 million active companies in the country as of 2023, of which approximately 20,000 are foreign-invested (FDI) companies. While FDI companies account for only about 2% of the total, they are also a driving force behind the economy, generating 28% of the country’s total net revenue. By country, South Korean companies accounted for the largest number, with approximately 5,500 companies, followed by Japan and China.

Composition of foreign companies by country in Vietnam in 2023 (%)

Source: B&Company

Japanese companies continue to expand despite the COVID-19 pandemic, with two polarized regions

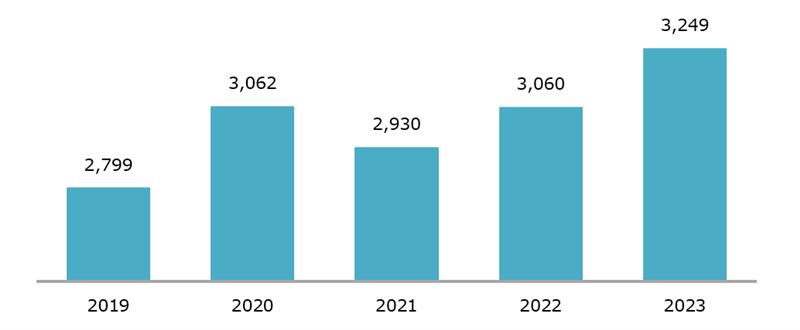

Even with the stagnation caused by the COVID-19 pandemic, the number of Japanese companies entering the country steadily increased between 2019 and 2023. Behind this is a trend in which Japanese companies, seeking to break away from their reliance on domestic demand, have repositioned Vietnam as a growth market.

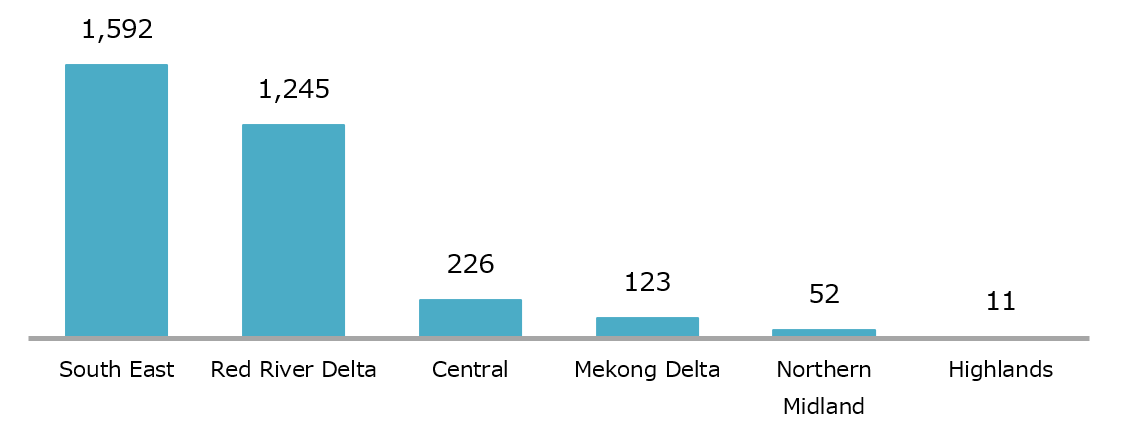

By region, expansion is concentrated in the northern provinces of Hanoi, Vinh Phuc, and Thanh Hoa, and the southern provinces of Ho Chi Minh City, Binh Duong, and Dong Nai. Both areas have well-developed transportation infrastructure and port facilities, making them highly convenient export bases. In addition to manufacturing, logistics, retail, and IT-related industries are also accumulating.

Trends in Japanese companies operating in Vietnam (companies)

Source: B&Company

Areas in Vietnam of Japanese companies in 2023 (companies)

Source: B&Company

Japan lags behind South Korea in large-scale investments and is adopting a “diversified investment” approach

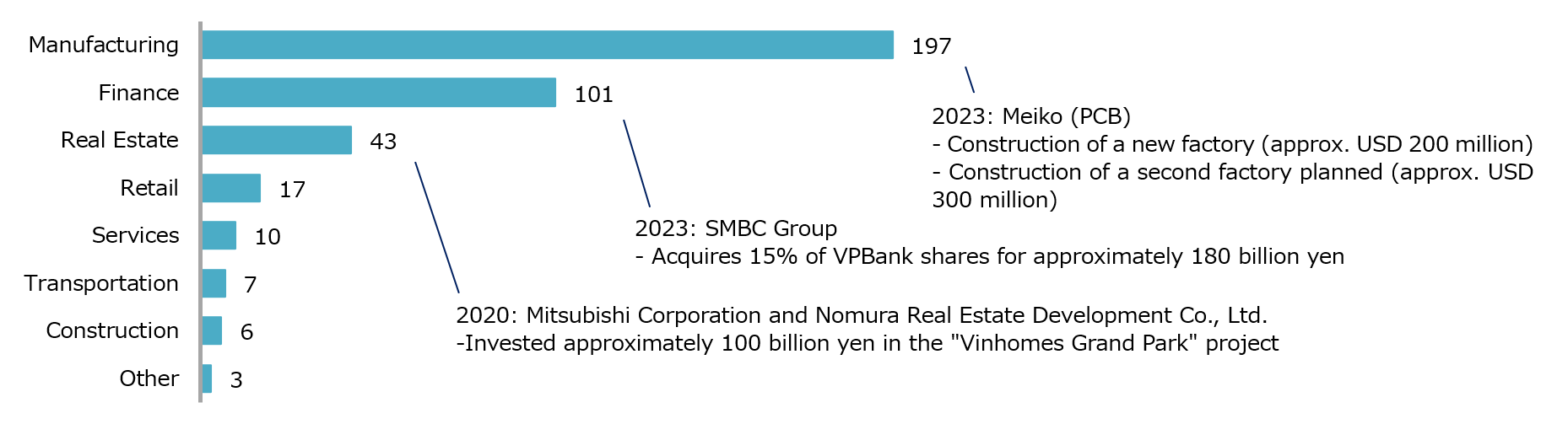

On the other hand, South Korean companies are one step ahead in terms of the scale of large-scale investment projects. Since 2005, South Korean companies have made multiple factory investments worth over USD 1 billion, mainly in the manufacturing industry. In contrast, Japanese companies’ investments tend to be more diversified and cross-sectoral, spanning manufacturing, finance, real estate, and retail.

This difference stems from differences in strategy. Japanese companies aim to diversify their investments across ASEAN, while South Korea focuses its capital on Vietnam as a “strategic core base.” This has resulted in differences in the speed at which industrial clusters are formed.

Japan → Vietnam Cumulative investment amount (10 billion yen: 2005-2023)

Source: B&Company

New trends: Japan-Vietnam cooperation deepens in semiconductors, renewable energy, and digital transformation

The economic partnership between Japan and Vietnam is growing stronger every year. With a government-to-government cooperation framework as a backdrop, Japanese companies are expected to accelerate their activities in new fields such as semiconductors, digital transformation (DX), and renewable energy.

For Japanese companies, Vietnam is no longer simply a “low-cost manufacturing base.” Its importance as a strategic base for developing next-generation industries is increasing. As the restructuring of the regional supply chain progresses, the role of Japanese companies is at a turning point, shifting from quantity to quality.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |