27Oct2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Hotpot has matured from a celebratory, family-style meal into a scalable restaurant format with replicable kitchen workflows, strong per-party checks, and reliable weekend/evening peaks. In Vietnam, rapid mall development, a youthful population, and a cultural preference for communal dining have created fertile ground for chains to expand via franchising or partnership models. As consumer demand for consistent quality and experiential dining rises, the hotpot segment is emerging as one of the most promising formats for sustainable growth in the country’s F&B market.

Market overview in Vietnam

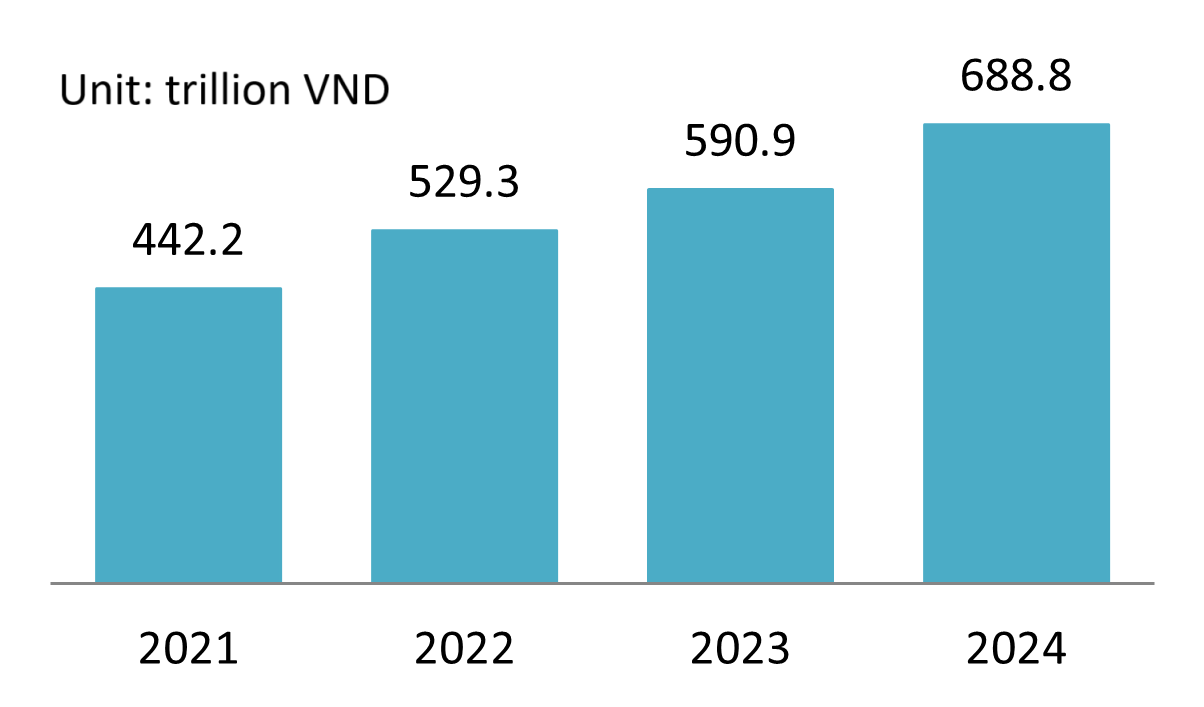

Vietnam’s food and beverage (F&B) industry has grown strongly in recent years, reflecting higher consumer spending and a shift toward organized dining. Total sector revenue rose from VND 442.2 trillion in 2021 to an estimated VND 688.8 trillion in 2024[1], representing a solid 16% compound annual growth rate. The sharp rebound in 2022 marked post-pandemic recovery, steady gains in 2023 reflected spending normalization, and the projected 2024 surge highlights renewed momentum from tourism, new mall openings, and digital dining channels.

Vietnam F&B Revenue 2021-2024

Source: IPOS

This growth is driven by Vietnam’s expanding middle class[2], rising disposable income[3], and strong urbanization[4]. Consumers are increasingly moving from street food toward branded restaurants that offer consistency, hygiene, and modern service[5]. As a result, both domestic and international chains are accelerating expansion through franchising, which enables faster scale and quality control[6].

Within this trend, the hotpot segment stands out as one of the most scalable categories. Hotpot’s communal, shareable nature aligns with Vietnamese dining culture, while its standardized equipment and central kitchen model make it ideal for replication[7]. Brands like Golden Gate’s Kichi-Kichi and Manwah and international players such as Haidilao show that hotpot franchising is set to remain a leading growth driver in Vietnam’s F&B landscape[8].

Main players

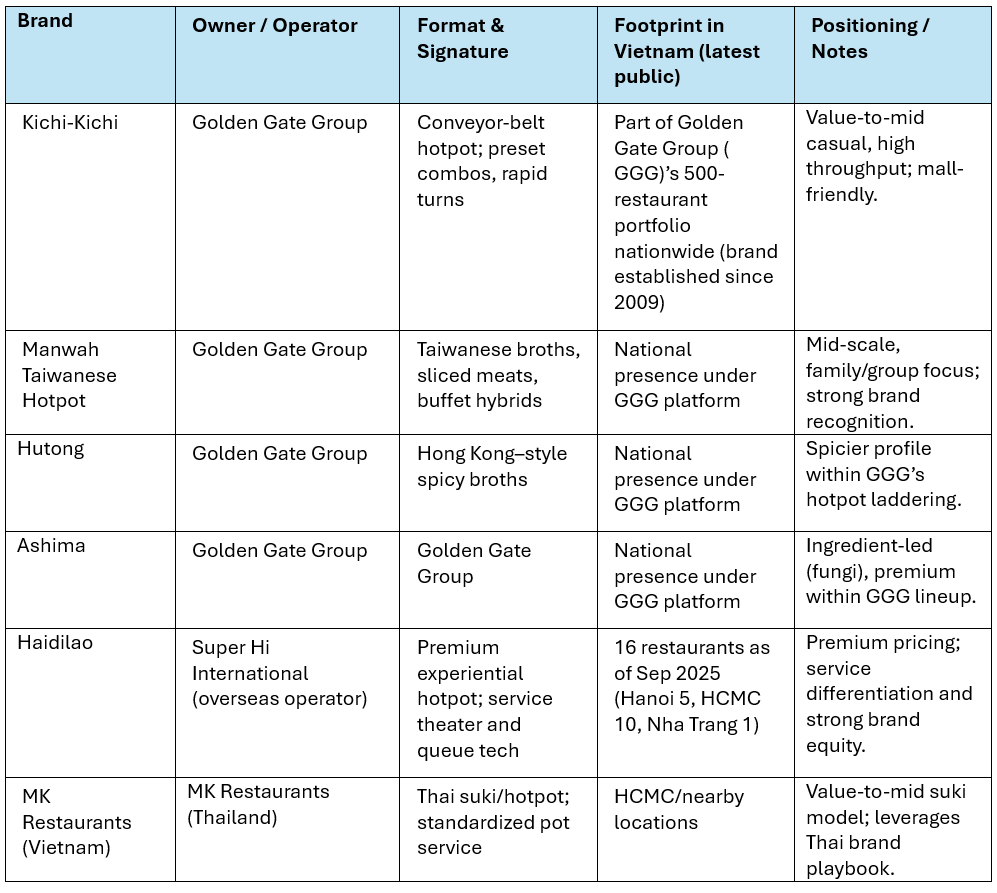

The Vietnamese hotpot market is currently influenced by a combination of strong local operators and well-established international brands, each catering to different customer groups and offering various dining experiences. Local groups have leveraged their deep understanding of consumer preferences and supply chain networks to dominate the mid-range market, while foreign players have introduced premium experiences that elevate service standards and diversify consumer choices. The table below highlights several main players driving the growth and professionalization of Vietnam’s hotpot franchise segment.

Table 1. Vietnam Hotpot Main Players

Source: B&Company synthesis

Opportunities and challenges for investors

Opportunities

Hotpot is an ideal concept for franchising because its operations can be standardized and replicated easily across multiple locations[9]. The format relies on consistent equipment such as induction or electric pots and on broth bases that can be prepared in bulk at central kitchens under strict quality control[10]. Ingredient preparation is also highly organized with a limited and well-defined product list, making it easier to train staff and maintain uniformity across outlets[11]. The model fits naturally within Vietnam’s expanding network of malls and mixed-use developments, where group dining, family gatherings, and entertainment traffic from cinemas and shopping centers provide a steady customer base[12]. With thoughtful menu design, restaurants can enhance revenue through split pots that allow multiple broth choices, along with upselling premium meats, mushrooms, desserts, and beverages[13]. Buffet or semi-buffet service systems also improve efficiency and table turnover, especially on weekends and peak hours[14]. The strong presence of large domestic groups such as Golden Gate Group (GGG) further supports franchising potential, as their centralized supply chains, logistics networks, and training programs help new franchisees lower operational risks, achieve faster scalability, and ensure consistent quality and brand standards across the market[15].

Challenges

Initial investment costs for a hotpot restaurant are usually higher than those of a standard fast-casual format because the setup requires proper ventilation, strong electrical capacity, fire safety systems[16], and high-quality mall-standard interiors. Staffing needs are also considerable, as employees are responsible for sauce stations, broth refills, and attentive table service[17].

In such an open and social dining environment, any lapse in service quality is quickly noticed by customers. Ingredient prices for items like beef, seafood[18], and specialty mushrooms can fluctuate, affecting profit margins if there is no large-scale purchasing or flexible pricing plan. Competition is becoming more intense as premium brands such as Haidilao raise customer expectations and domestic chains compete for the best locations, driving up rent and marketing costs. In addition, economic slowdowns can still influence business results, as seen in 2023 when several large restaurant groups adjusted their staffing numbers. This situation shows why investors should maintain sufficient cash reserves and adopt flexible labor strategies to remain resilient.

Haidilao Vietnam

Source: Haidilao Vietnam

Suggestions for investors

Investors interested in Vietnam’s hotpot franchise market should begin by defining their business model and target segment. Choosing between a value buffet, conveyor-style casual format, or premium experiential restaurant will determine the required investment, restaurant layout, and staffing scale[19]. Conveyor concepts focus on efficiency and quick table turnover, while premium experiences need larger spaces and more intensive staff training. It is important to finalize the restaurant’s design, electrical capacity, and ventilation systems before signing a lease to ensure cost efficiency.

Location remains one of the most important factors for success. Hotpot is a social and occasion-driven meal, with demand peaking on weekends and holidays. Positioning in shopping malls or mixed-use developments with strong entertainment anchors such as cinemas or supermarkets helps maintain consistent foot traffic. When negotiating rent, investors should seek favorable terms such as rent-free periods or performance-based payments during the early phase of operation.

Partnering with a reputable franchisor can reduce operational risks and shorten the learning curve. Established platforms provide centralized supply chains, training programs, and verified suppliers that help franchisees maintain consistent quality and efficiency. Investors should focus on creating menus that are profitable, not overly complex. Offering a few broth choices, premium meat and mushroom upgrades, and appealing set menus can boost revenue while keeping kitchen operations simple and efficient.

Good service is key to building brand loyalty. Hotpot dining depends on attentive, timely service, such as refilling broth and maintaining sauce stations. Clear service procedures and staff incentives based on customer satisfaction can help ensure consistency and quality. Investors should also plan finances carefully, allocating an additional 10 to 15 percent of the investment for technical adjustments and keeping enough cash reserves to manage fluctuations in ingredient prices or temporary slowdowns. Choosing the right partnership structure is also crucial. For new market entrants, a joint venture can offer a balance of resources and local expertise, while more established businesses may benefit from a master franchise model for faster expansion across multiple cities.

Conclusion

The hotpot market in Vietnam is well-suited for franchising, with standardized back-of-house operations, repeatable mise en place, and a communal dining experience that appeals to groups and fills restaurants during peak hours. Domestic platforms have established successful models, while international brands like Haidilao have set higher service standards and expanded the market at the premium level. For investors, success depends more on operational discipline than novelty, focusing on streamlined menus, strong supply chains, efficient service, and realistic return expectations. Those who select a clear business model, rely on reliable platform support, and tailor their locations and staffing to meet weekend demand are likely to achieve sustainable unit economics and successful multi-city expansion as Vietnam’s retail network grows.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[1] https://ipos.vn/bao-cao-nganh-fnb-2024/

[2] https://www.vietnam-briefing.com/news/understanding-vietnams-middle-class-size-spending-patterns-and-opportunities-for-businesses.html/

[3] https://retailasia.com/videos/vietnams-middle-class-eyes-higher-disposable-income-2027

[4] https://www.mordorintelligence.com/industry-reports/vietnam-food-service-market

[5] https://news.tuoitre.vn/vietnams-fb-market-sees-foreign-players-thrive-amid-domestic-chains-challenges-103250907140934146.htm

[6] https://b-company.jp/vietnams-fb-franchising-industry-from-expansion-to-consolidation/

[7] https://fmsfranchiseasia.com/franchise-market-in-vietnam/

[8] https://daibieunhandan.vn/vuot-mat-golden-gate-chuoi-lau-haidilao-tai-viet-nam-do-nu-giam-doc-9x-dieu-hanh-co-doanh-thu-hang-nghin-ty-moi-nam-10370083.html

[9] https://www.researchgate.net

[10] https://supy.io/blog/why-central-kitchens-in-restaurants-are-the-key-to-consistent-quality/

[11] https://www.tryotter.com/resource/wiki/what-is-a-hot-pot-restaurant

[12] https://dpointernational.com/food-industry-news/hotpots-bbqs-dining-are-the-new-craze-in-vietnam/

[13] https://www.marketreportanalytics.com/reports/hot-pot-with-food-246034

[14] https://hanoitimes.vn/vietnam-fb-industry-in-2024-continues-growth-with-new-trends-326464.html

[15] https://cafef.vn/van-hanh-gan-400-nha-hang-chu-chuoi-gogi-manwah-moi-ngay-bo-tui-hon-18-ty-dong-doanh-thu-188250401111234097.chn

[16] https://vietnamlawmagazine.vn/law-sets-out-more-fire-safety-requirements-for-residential-commercial-buildings-73553.html

[17] https://www1.hkexnews.hk/

[18] https://vietfishmagazine.com/fisheries/predicted-seafood-price-surge-by-late-2024-trends-and-opportunities-for-farmers.html