18Jul2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

The notable growth of electric motorcycles

Vietnam, with nearly 75 million registered motorcycles, is one of the largest two-wheeler markets globally. Motorcycles are vital for the economy and daily life, with manufacturers like Honda and Yamaha investing in local production. From 2019 to 2023, 3 to 4.7 million motorcycles were produced annually.

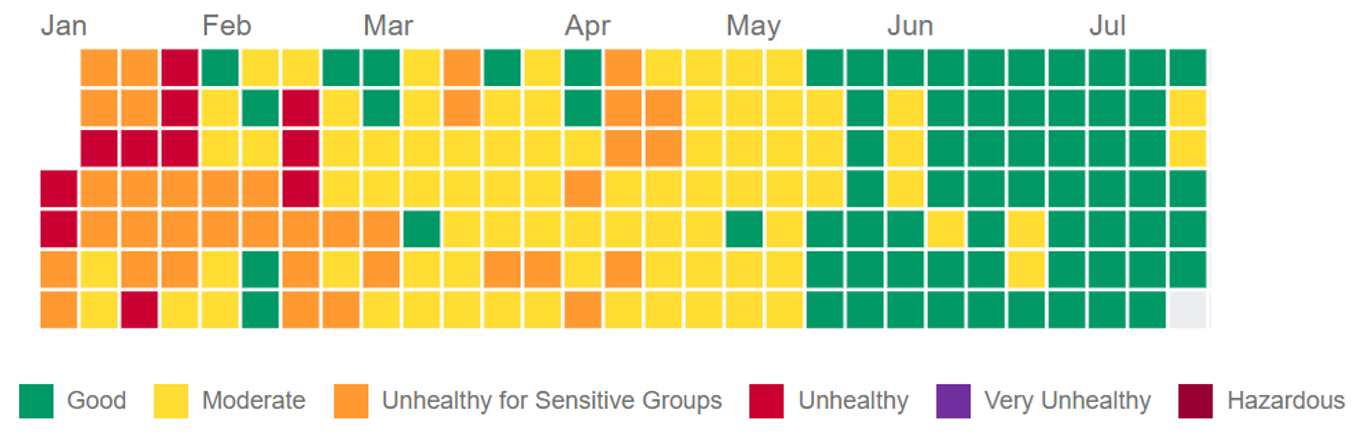

However, the increasing number of vehicles, particularly those failing to meet emission standards, has worsened air quality in major cities like Hanoi. Following data from B&Company, from the beginning of 2025 to July 18, 2025, Ha Noi has only 34% of days having good air quality, this situation creates an opportunity for electric vehicles as a cleaner alternative. Therefore, restrictions on gasoline vehicles are necessary to address the pollution issue.

Air quality of Hanoi from Jan 1 to Jul 18/ 2025

Source: B&Company Airdata360

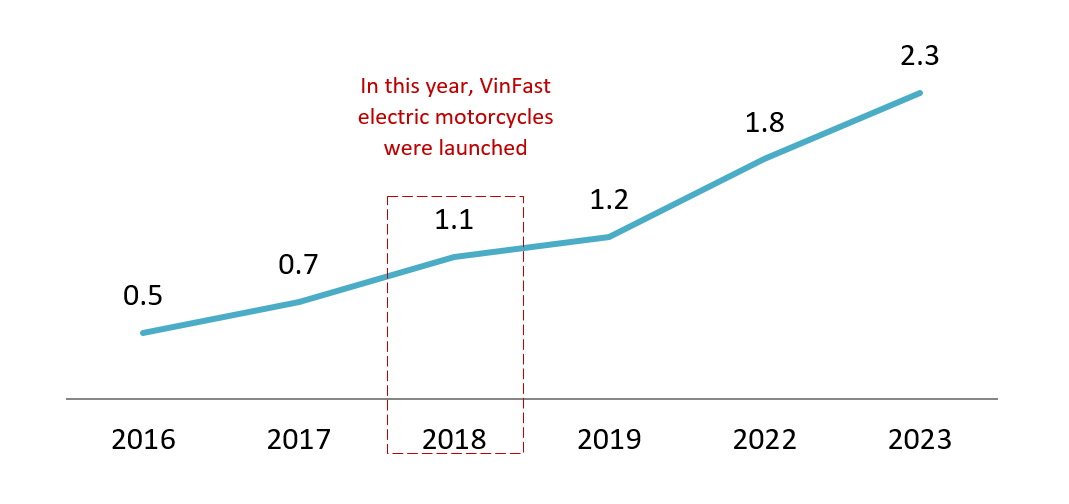

This impending restriction acts as a powerful catalyst for a rapidly emerging alternative. While the gasoline motorcycle market remains dominant for now, a clear shift in consumer preference is underway, driven by environmental awareness. The number of registered electric motorcycles has steadily increased since 2016, rising from 0.5 million units to 2.3 million units in 2023, with a CAGR of 24.3%. VinFast, Pega, and Yadea are currently the leading electric motorcycle brands in Vietnam [3].

Number of total registered E2W in Vietnam from 2016 to 2023[11] (Unit: Million units)

Source: GIZ

Vietnam’s Bold Policy Shift, Paving the Way for Electric Motorcycles

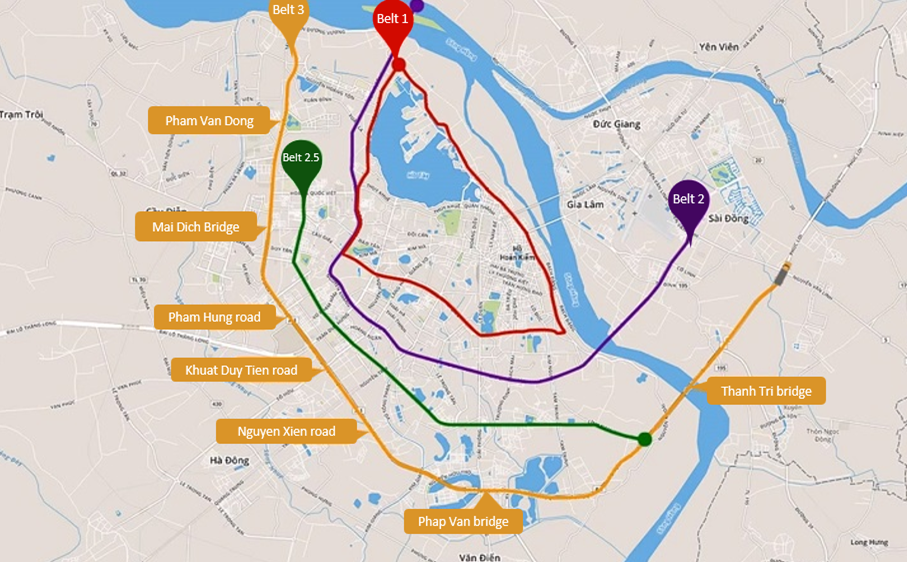

For years, discussions on restricting private motorcycles in Vietnam’s major cities remained at the proposal stage. However, the situation has changed with the government’s firm directives, turning these ideas into a clear roadmap with non-negotiable deadlines. On July 12, 2025, Prime Minister Pham Minh Chinh signed Directive No. 20/CT-TTg to address environmental pollution urgently [4]. This marks a mandatory policy shift, ushering in a new era for urban transportation in Vietnam. The roadmap reflects strong political determination. Phase 1, starting from July 1, 2026, will see the complete cessation of fossil fuel-powered motorcycles in the inner core of Hanoi, within Belt 1, directly targeting the heart of the capital. Phase 2, from January 1, 2028, will expand the ban on gasoline motorcycles to Belt 2, and will also begin restricting fossil fuel-powered cars within both Belt 1 and Belt 2. By Phase 3, starting in 2030, the restriction will extend further to Belt 3, creating a significantly larger central area where personal emission-producing vehicles are nearly absent.

Hanoi belt map

Source: Google Maps

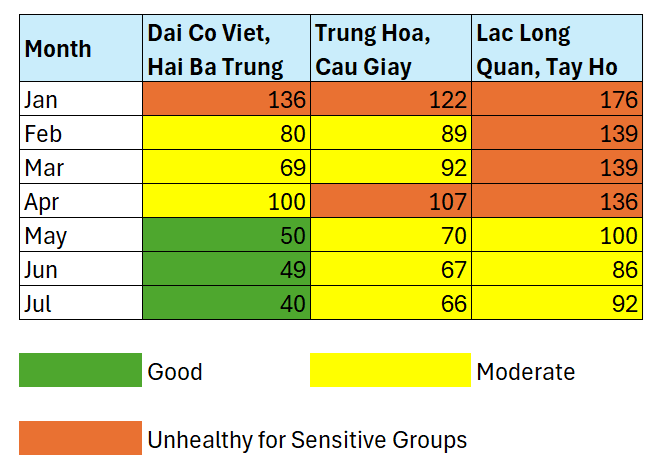

Air quality in some areas of the Beltway 1 in Hanoi, according to AQI index in 2025

Source: B&Company Airdata360

Unlike the strong measures in Hanoi, Ho Chi Minh City is reviewing proposals to limit high-emission vehicles in pollution-prone areas. The Department of Construction has sent a document requesting feedback from relevant departments on raising emission standards and establishing emission control zones. Agencies such as the Department of Agriculture, the Department of Finance, and the Institute for Development Research will also propose solutions for controlling emissions and developing infrastructure for green transportation. HCMC plans to pilot emissions control in areas like Can Gio, Con Dao, and the city center. A Green Transition Credit Fund will also be established to reinvest in green transport infrastructure and support citizens in transitioning to electric vehicles, particularly technology drivers [2].

Challenges in Transitioning

Insufficient Infrastructure, Especially in Public Transportation

Despite efforts to build public transportation systems like metro trains in HCMC, elevated trains in Hanoi, electric buses, and charging stations, the infrastructure remains insufficient, posing a major challenge for the government. While these projects are steps in the right direction, they are still in the early stages, and the existing infrastructure does not fully support the rapid transition needed for green transportation. The slow pace of implementation, coupled with the rapid increase in urban population and vehicle numbers, puts immense pressure on the government to build a more comprehensive and timely infrastructure plan. VinFast is tackling this by building a 150,000-point network, a strategic move that provides a strong competitive advantage. However, this private-led approach sparks debate over its potential to create a proprietary system. Such a network could become a major barrier for other EV manufacturers, thereby limiting market competition and consumer options. This raises the question not only of whether this infrastructure should be a state-funded public utility, but more fundamentally, whether the push for EV adoption is driven by public interest or private profit.

Consumer psychology on costs and the burden of old vehicles

Consumer psychology presents significant barriers to the adoption of electric vehicles, including “range anxiety,” where people fear running out of battery, despite most daily trips being short. Many consumers also lack understanding of electric vehicle technology, maintenance costs, battery lifespan, and operation, causing hesitation. Additionally, the higher initial cost of electric motorcycles compared to gasoline bikes overshadows long-term savings, further deterring potential buyers.

| Used gasoline motorbike | New gasoline motorbike | New electric motorbike | |||

| Cheapest | Mid-range | Standard | High-end | Basic | Standard |

| 5 – 10M | 10 – 20 M | 30 – 50 M | Over 50 m | 18 – 25M | 25 – 40 M |

Source: B&Company compilation

The issue of millions of existing gasoline motorcycles also poses a major challenge, with no national buyback, recycling, or subsidy program in place. This creates logistical, economic, and environmental problems, and could burden low-income workers who depend on inexpensive, old gasoline bikes. Without proper support for transitioning, this policy could increase social inequality. Moreover, safety concerns, such as the risk of fires from substandard electric vehicles, have already caused incidents in major cities.

Gaps in Policy and Support

While the ban has been firmly raised, the support mechanism remains unclear and is still under development. The government has tasked Hanoi with issuing policies to encourage and support the public in transitioning to electric vehicles, but these policies are not yet fully developed or widely implemented. Vietnam currently lacks a unified national policy framework, including direct subsidies for consumers, adequate incentives for manufacturers, and a clear strategy for battery disposal and recycling, all of which are essential for sustainable development.

Although some positive policies, like exempting electric cars from registration fees, have been introduced, they have not yet been applied comprehensively to the electric motorcycle segment, which is far more important in daily transportation for the Vietnamese. To elaborate on Hanoi’s policy, recent proposals suggest a financial incentive of up to 4 million VND for residents who turn in old, non-compliant motorcycles for new electric ones. While this marks an official effort to encourage the transition, the amount is negligible when set against the 25-40 million VND price tag of a standard electric motorcycle. A subsidy of this scale is considered more symbolic than substantive, proving insufficient as a primary motivator to attract a broad base of consumers.

Opportunities

A potential ban on internal combustion engine motorcycles in major cities is seen as the main catalyst, ready to reshape Vietnam’s entire two-wheeler industry. This groundbreaking shift will open a new market, creating an urgent demand for professional electric vehicle maintenance and repair services. The market will face a shortage of skilled workers in electric drive system diagnostics, battery management, and software handling, presenting a significant opportunity for training institutions and high-tech service centers.

Simultaneously, the development of a supporting ecosystem plays a critical role. Key investment opportunities include building a dense network of charging and battery swapping stations to address user concerns about range. Additionally, the supply chain for spare parts, components, and an efficient battery recycling industry will thrive. This is not just a vehicle replacement, but the creation of an entirely new service and technology economy.

Conclusion

The potential for electric motorcycles in Vietnam is enormous, with the government’s gasoline vehicle ban acting as a key catalyst. In the next 2-3 years, this shift is expected to revolutionize the two-wheeler industry. Despite challenges in infrastructure, costs, and policies, the combination of strong political will and innovative business strategies, such as those from VinFast, is driving significant growth. In the next 2-5 years, electric motorcycles may dominate urban transportation, creating a predictable demand wave and accelerating large-scale adoption.

[1] Lao Động, Emission Standards for Millions of Motorbikes Expected to Be Issued in July <Access>

[2] Lao Động, HCMC Seeks Public Feedback on Limiting Fuel Vehicles in High Pollution Areas <Access>

[3] VnEconomy, Motorcycle Output Remains High Despite Imminent 2030 Restriction Deadline <Access>

[4] Government News, Directive on Electricity Saving Issued by the Government <Access>

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |