Vietnam’s baby products market is experiencing significant growth, driven by rising disposable incomes, urbanization, and increasing parental awareness about child health and safety. Additionally, young families in urban areas are investing more in premium and high-quality baby products, reflecting changing consumer priorities.

Baby Products Market Overview in Vietnam

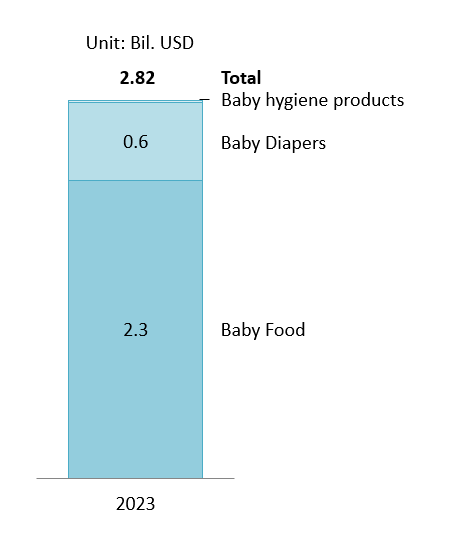

Vietnam’s baby products [1] market is experiencing dynamic growth across categories such as baby food, diapers, hygiene products, apparel, toys, and nursery furniture. The baby food sector alone was valued at 2.3 billion USD in 2023[2]. Additionally, diapers and baby hygiene products also saw growth, gaining a total of 557 million USD[3] and 15 million USD[4] respectively.

Vietnam’s Featured Baby Products (2023)

Source: B&Company Complication

Vietnam’s economics steadily recovered after the Covid-19 pandemic, leading to a growth in disposable incomes, especially in urban areas as their monthly salary in 2023 increased by 11% compared with 2018[5]. The urbanization rate in Vietnam is also quite high at 42% by 2023[6]. These have driven demand for premium and organic baby products as parents prioritize health and safety for their children, aligning with global trends toward sustainable and health-conscious consumption despite their relatively high prices.

Baby Products Displayed in Stores

Source: B&Company Complication

However, despite the growth in Vietnam’s baby products market, the number of children aged 0-5 has shown a clear downward trend. From 2019 to 2023, the population of Vietnamese children under five decreased by 10% and is projected to continue declining over the next five years[7]. This decline signals that Vietnam’s baby products market may be approaching a saturation point, posing potential challenges for future growth.

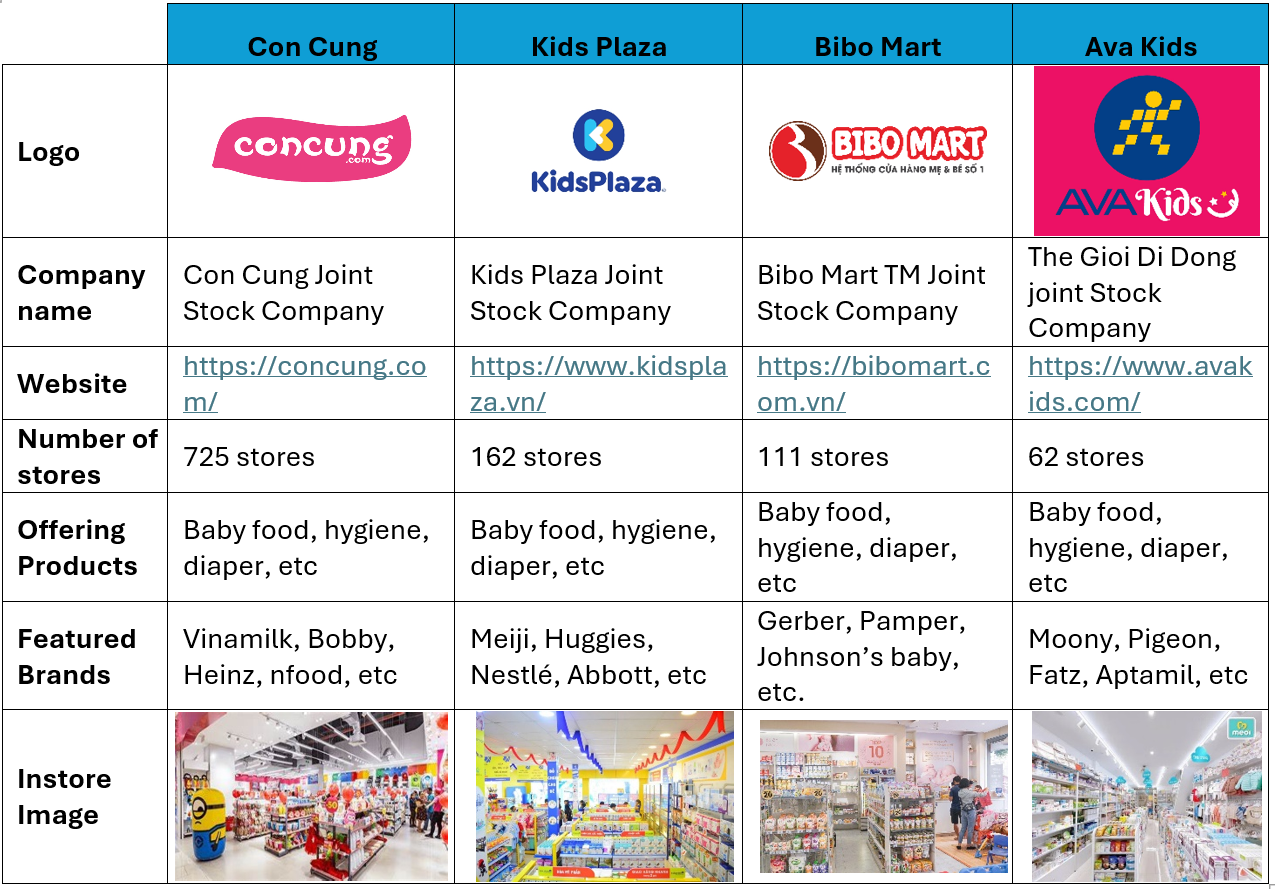

Main Players in Baby Products Segment

Most baby products in Vietnam come from international markets, offering a diverse range of types and categories. Notably, brands from Japan and the United States have become highly familiar and widely preferred by Vietnamese consumers, with prominent names like Abbott, Johnson & Johnson, Bobby, and Meiji. Among domestic players, Vinamilk stands out as the Vietnamese brand capable of competing with these international giants. In the baby food segment alone, Vinamilk holds an impressive 20%[8] market share, ranking second only to Abbott. Interestingly, the price difference between domestic and foreign brands is not significant. However, international brands often leverage economies of scale to offer more affordable and diverse product options compared to their local counterparts.

When it comes to retail, Con Cung, Bibo Mart, and Kids Plaza dominate the Vietnamese market, with a strong presence primarily in major cities like Hanoi and Ho Chi Minh City. While most retailers remain concentrated in urban areas, Con Cung has leveraged substantial resources and foreign investment to establish branches across all provinces in Vietnam. This widespread reach has given Con Cung a significant competitive advantage, making it challenging for other retailers to match its scale and presence.

Some Popular Baby Product Retailers

Source: B&Company Complication

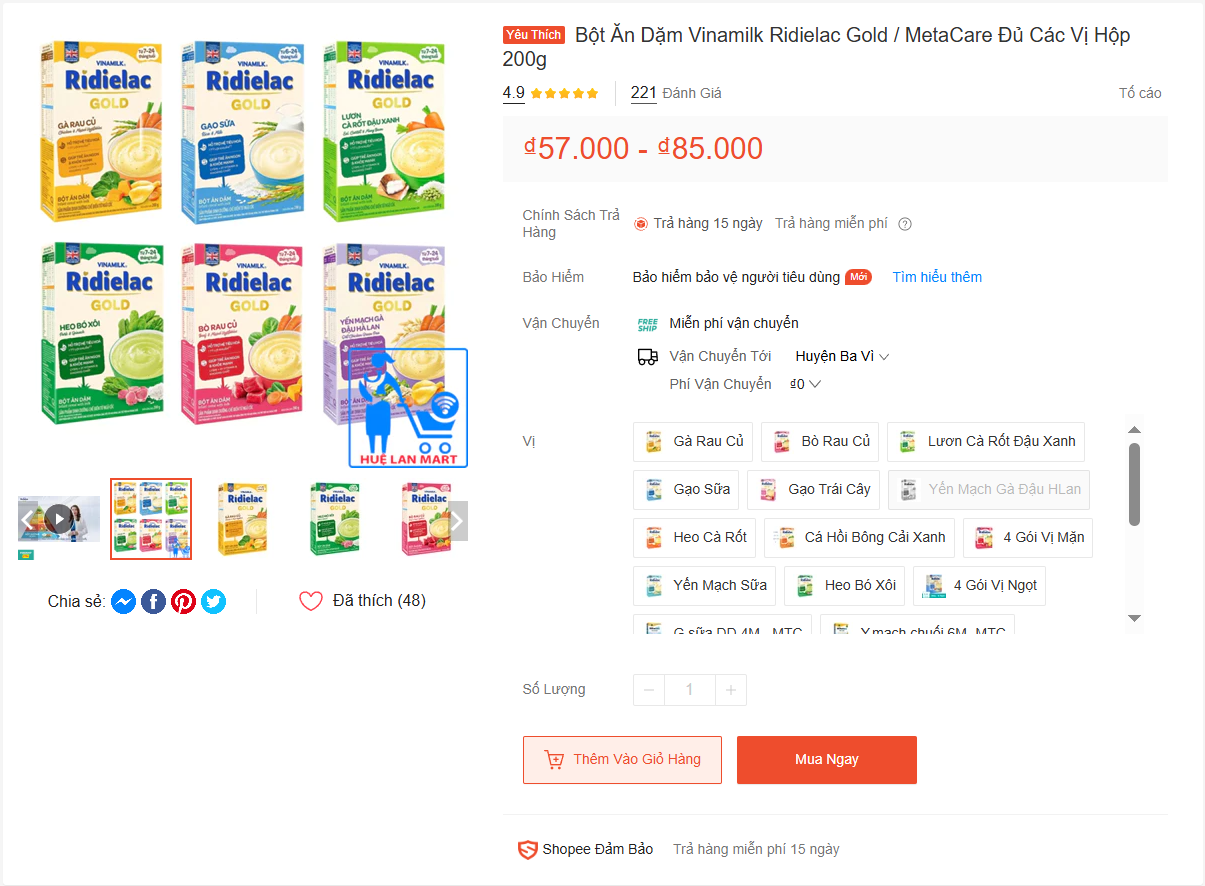

Not only retailer stores, the rise of e-commerce platforms like Shopee, Lazada, and Tiki has further transformed the market, making it easier for parents across Vietnam to access a wide variety of products. This digital revolution has also opened opportunities for smaller, niche brands or retailers that target specific consumer needs, such as organic or hypoallergenic products.

Example of Baby Products on Shopee (E-Commerce Platform)

Source: Shopee E-Commerce Platform

Opportunities And Challenges for the Market

As urbanization accelerates and disposable incomes rise, the demand for high-quality, safe, and sustainable products is set to grow. The baby food market is expected to have a CAGR of 7% in the next 5 years, from 2023 – 2028[9]. Niche markets, such as hypoallergenic skincare or baby food inspired by local flavors, also hold significant potential. Additionally, the growing popularity of e-commerce presents another avenue for growth, allowing brands to reach a broader audience at relatively low costs. International investments are on the rise, with foreign companies increasingly recognizing Vietnam as a high-potential market for baby products

Despite its rapid growth, the market faces several challenges. (i) Price sensitivity remains a significant concern, particularly among middle-income families who prioritize affordability over premium options. (ii) The existence of counterfeit products poses another thread, with baby food and formula are the most common on the market, undermining consumer trust and creating safety risks for children[10]. (iii) Additionally, the market already has many competitors with variety of products and some of them became well-known and familiar brands to Vietnamese people.

Therefore, to address these challenges, companies that focus on affordability while maintaining quality are likely to capture a significant share of the market. Baby product retailers such as Con Cung, Bibo Mart and Kids Plaza have set their branches all over the region, hence foreign investors might want to consider collaborate with domestic retailer to drive further growth, raising brand awareness and bringing new product offerings. Moreover, the emphasis on organic, eco-friendly or unique flavor products is expected to dominate future consumer preferences, shaping the direction of the industry in the coming years.

Conclusion

Vietnam’s baby products market stands out as a dynamic and evolving sector, fueled by rising disposable incomes, urbanization, and evolving consumer preferences toward premium and sustainable childcare products. While challenges such as price sensitivity, counterfeit goods, and economic disparities persist, the opportunities are equally compelling. The increasing popularity of e-commerce, niche product categories, and collaborations with established local retailers offer avenues for innovation and expansion. Companies that prioritize quality, affordability, and sustainability will be well-positioned to thrive in this dynamic and promising market.

[1] The report will cover baby food, diaper and hygiene products

[2] Statista (2023). Baby Food Market Revenue by Country <Assess>

[3] Statista (2023) Revenue of the Baby Diapers Market by Country <Assess>

[4] Statista (2023) Baby Hygiene Revenue in Vietnam <Assess>

[5] Statista (2023) Vietnam Monthly Average Income <Assess>

[6] Statista (2023) Urbanization Rate in Vietnam <Assess>

[7]United Nation Data Portal (2023). Vietnam Population by Age <Assess>

[8] Euro Monitor International (2023). Vietnam Baby Food Market Report

[9] Euro Monitor International (2023). Vietnam Baby Food Market Report

[10] Vietnam’s Children Papers (2024). Counterfeit Baby Food and Formula on Rampant <Assess>

| B&Company, Inc.

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles