30Dec2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s food processing sector is growing quickly as manufacturers expand capacity, improve hygiene standards, and prepare for stricter export requirements. Alongside this growth, factories are under increasing pressure to strengthen surface sanitation; the need for on-site water-based disinfection solutions for food surfaces, equipment, and processing areas is becoming increasingly important. This shift creates a clear growth opportunity for modern water disinfection machines that support safer, more standardized sanitation practices across the industry.

Market overview of the Food processing industry

Vietnam is one of Asia’s fastest-growing food processing hubs. The sector contributes over 19% of total manufacturing output 2024[1] and continues to expand as consumer demand rises and foreign investors deepen their presence. Food manufacturing revenue increased from USD 53.2 billion in 2021 to USD 67.5 billion in 2023 (up 27%), reflecting a sustained expansion of the sector. This trend indicates a strong demand recovery post-pandemic and expanding production capacity across the industry.

Revenue of companies in Vietnam’s Food Manufacturing sector (2017 – 2023)

Unit: billion USD

Source: B&Company Enterprise Database

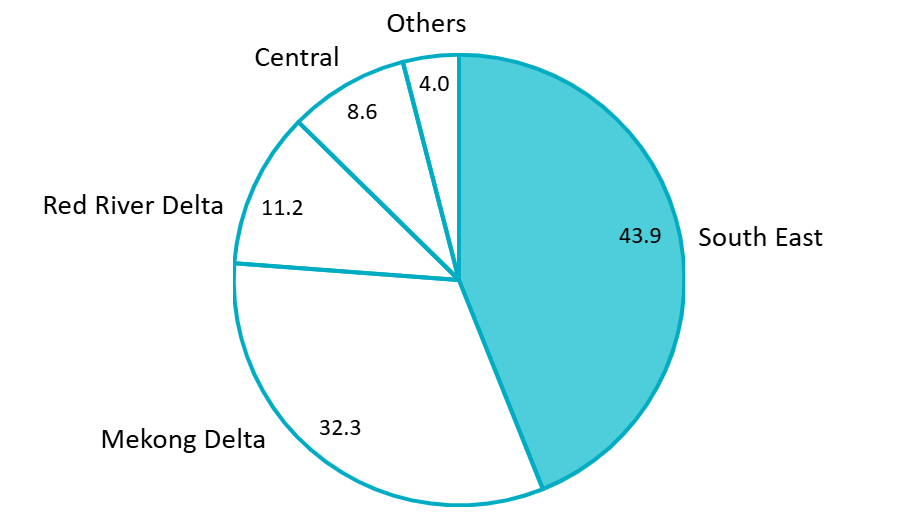

Vietnam’s food-manufacturing revenue is heavily concentrated in the Southeast and Mekong Delta, accounting for 43.9% and 32.3% of total revenue in 2023, which far outperforms all other regions due to its strong agricultural and seafood base. The Red River Delta and Central regions follow at much lower levels, reflecting moderate processing capacity. Meanwhile, the Northern midlands and Highlands contribute very little (4% combined), showing that large-scale food processing remains predominantly a Southern-driven industry.

Vietnam’s revenue of the Food Manufacturing sector by region in 2023

100% = 67.5 billion USD

Source: B&Company Enterprise Database

As factories, cold-storage facilities, central kitchens, and restaurant chains scale up, they are under stronger pressure from both local regulators and export customers to deploy HACCP and ISO 22000-style food safety systems, which explicitly emphasize hygienic design and effective disinfection of water, equipment, and surfaces[2].

Water disinfection machine application and market trend

As different user groups face distinct sanitation needs, from surface cleaning to raw material washing and equipment sterilization, the market naturally divides into several application areas rather than a single unified segment. As a result, Vietnam’s water disinfection machine landscape can be viewed across four primary application clusters, each with its own adoption drivers and technology priorities.

Foodservice, HORECA (Hotel – Restaurant – Catering), and Institutional kitchens

This is the most active segment, driven by the rapid expansion of restaurants, hotels, central kitchens, and school catering units. Operators increasingly require a consistent, auditable sanitation process, especially for washing vegetables, sanitizing kitchenware, and disinfecting food-contact surfaces. Water disinfection machines such as hypochlorous acid (HOCl) generators or electrolyzed water systems are widely adopted because they reduce chemical handling, offer mild yet effective sterilization, and improve hygiene compliance.

Food and beverage processing plants

Adoption in this segment is growing steadily, although more strongly among medium and large manufacturers, particularly those exporting seafood, frozen fruits, beverages, or ready-to-eat foods. These factories are required to meet HACCP, ISO 22000, and international buyer standards, which demand reliable sanitation systems for raw materials, equipment surfaces, and water used in washing or CIP processes. As a result, water disinfection machines are increasingly viewed as a safer, residue-free alternative to conventional chlorine dosing.

Healthcare, public buildings, and commercial facilities

During and after COVID-19, many hospitals, clinics, government offices, and public buildings invested in HOCl-based disinfection systems and ozone/UV modules for surface and air sanitation. This segment continues to maintain demand, especially for mild, people-safe disinfectant water suitable for entrances, common areas, or handwashing stations.

Agriculture, aquaculture, and cold-chain logistics

Although still emerging, several farms, packhouses, and cold-storage facilities use water disinfection machines to sanitize fruits, vegetables, seafood, tools, and cold-room surfaces. These applications remain niche but are expected to expand as Vietnam strengthens its agricultural export quality standards.

Adoption in the Food Processing Sector

Within Vietnam’s hygiene landscape, the food processing sector stands out as one of the most demanding and fast-evolving areas. As production volumes grow and export requirements tighten, factories are under greater pressure to control contamination risks throughout their operations. This environment is driving increased attention toward modern water-based disinfection solutions.

However, the adoption of water disinfection machines is still limited. The main barrier is low technical awareness of advanced sanitation equipment and reliance on outdated post-harvest technologies. Many processors, especially SMEs, which account for 93% of Vietnam’s total active businesses[3], are familiar with traditional chlorine cleaning but have a limited understanding of newer technologies like HOCl, electrolyzed water, or ozone-water systems, how they work, and how they improve food safety outcomes.

Besides, as adoption gradually increases among the more capable players, the market is beginning to form clearer technology preferences. Recently, Vietnamese food processors mainly use four types of water disinfection machines.

Electrolyzed water generators (neutral NaOCl/Anolyte)

These systems electrolyze a dilute salt solution to produce highly active sodium hypochlorite with a neutral pH of 7.0-7.5. The disinfectant water has strong antimicrobial properties, low odor, and minimal residue. In food factories, it is used for washing vegetables, fruits, and seafood; sanitizing knives, cutting boards, conveyors, and tanks; and fogging or spraying in preparation rooms or cold rooms.

Hypochlorous acid (HOCl) generators – soft acidic water

Systems like OSG P3 create low-concentration HOCl for surface and full-body disinfection, promoted as safer than ozone gas, anolyte, or traditional chlorine solutions. In the food processing context, HOCl is increasingly positioned, by both global and emerging local suppliers as a solution for washing raw materials and sanitizing production lines, with advantages such as low corrosion, low odor, and very low chemical residue.

Ozone-water and UV disinfection integrated into water-treatment lines

Ozone generators and UV modules are used to disinfect water in filtration-RO-UV/ozone systems. These units act as the final “disinfection module” to ensure microbiologically safe process water in beverage, seafood, and general food-processing plants.

Chlorination systems and traditional chemicals

Chlorine dosing remains common, especially in smaller factories, due to its low cost. However, both in Vietnam and globally, the market is gradually shifting toward safer, low-residue solutions such as electrolyzed water, HOCl, ozone, and UV technologies.

Overall, Vietnam’s food processing sector is gradually transitioning from traditional chemical sanitizers toward more advanced, low-residue water disinfection machine technologies. As regulatory pressure and export requirements intensify, these modern disinfection technologies are expected to become standard across more Vietnamese factories.

Key manufacturers

Vietnam’s market for water-disinfection machines is shaped by a combination of Korean and Japanese brands like NaOClean and OSG, alongside an expanding group of Vietnamese manufacturers such as Dr.Ozone, Ecomax, Rama, and UVGREEN. Foreign brands lead the premium segment with stable HOCl and electrolyzed-water technology, often targeted at food factories and high-hygiene environments. Local brands focus more on ozone and UV solutions, offering cost-effective products for small and medium users. Across the market, demand is rising due to stronger hygiene standards in food processing, food service, and households. Overall, the trend is moving toward safe, low-residue, on-site disinfectant technologies rather than traditional chemicals.

B&Company’s synthesis

Market Outlook for Water Disinfection Machines in Vietnam

Key Opportunities

Vietnam’s food processing industry is expected to remain one of the fastest-growing manufacturing segments over the next five years, supported by strong domestic consumption, expanding export demand, and continued foreign investment. As processors scale up and modernize, hygiene control will become an increasingly critical operational priority. This creates sustained demand for water disinfection machines, especially systems that ensure microbial safety and meet export-grade standards. The shift from chemical-based methods to UV, ozone, and integrated sterilization and drying systems is likely to accelerate as consumer expectations and regulatory enforcement strengthen.

Central kitchens, catering units, fresh-cut vegetable processors, cafés, and convenience chains are growing rapidly. These users favor compact, easy-to-maintain water disinfection machines for daily surface and ingredient sanitation. The technology is still emerging, with no single dominant brand. High-quality foreign brands have strong differentiation potential, especially if offering local training, after-sales service and demonstration units.

Key Challenges

Although hygiene standards have improved, many Vietnamese food processors, especially SMEs, still have limited knowledge of electrolyzed water (HOCl/NaOCl neutral), ozone-water systems, or UV-based disinfection. Buyers often confuse water disinfection machines with simple ozone “detox” devices or household sterilizers. This lack of clarity slows adoption and requires significant investment in training, demonstrations, and technical explanations to help customers understand safety, efficacy, and proper use.

Small and medium food-processing facilities, fresh-cut vegetable workshops, and local catering units operate with tight margins. They often perceive advanced disinfection systems as high-cost compared to traditional chlorine powder or liquid disinfectants. Even when long-term operating costs are lower, the initial CAPEX barrier remains a challenge. Without financing options, leasing, or government support, purchasing decisions are delayed or avoided.

Vietnam has general food safety regulations, but there are no dedicated national standards governing HOCl generators, neutral electrolyzed-water systems, or ozone-water machines for food processing. As a result, factories sometimes hesitate due to uncertainty about compliance, certification, or auditing requirements. The absence of official Vietnamese standards also makes it harder for suppliers to market scientific claims or prove superiority compared to chlorine.

Conclusion

In the near term, adoption will be highest in export-oriented factories, seafood, fruits and vegetables, beverages, and ready-to-eat processed foods, where compliance with HACCP, BRCGS, and ISO 22000 drives investment in more advanced and traceable disinfection technologies. Southern Vietnam, with its dense concentration of processors and industrial parks, is expected to lead market demand.

Although the market remains fragmented with international OEMs dominating the high end and domestic suppliers serving SMEs, there is a clear opportunity for differentiated, robust, and easy-maintenance machines. Overall, Vietnam offers a strong growth outlook, with rising multi-tier demand and significant room for innovative systems, particularly where integrated sterilization, drying efficiency, and user-friendly maintenance are decisive purchasing factors.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[1] https://vietnamnews.vn/economy/1687540/vn-s-food-processing-industry-struggles-to-improve-quality-and-value-chain-integration.html

[2] https://nifc.gov.vn/en/qms-certification-general-introduction/food-safety-management-system-certification-post1663.html

[3] https://vietnamnet.vn/en/vn-s-food-processing-industry-struggles-to-improve-quality-2345414.html