04Nov2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Once overshadowed by precious metals like gold and silver, aluminum is now increasingly recognized as a critical resource in the modern economy. It plays a pivotal role in various industries, from packaging and automotive manufacturing to electric cables and machinery. Furthermore, aluminum is essential in supporting global energy transition, powering technologies like solar panels, wind turbines, electric vehicles, and transmission cables. Its versatility is attributed to its unique properties, including high strength, low weight, recyclability, and superior electrical and thermal conductivity.

However, both the global and Vietnamese aluminum sectors are facing challenges due to disruptions in global supply chains, resulting in fluctuations in both supply and prices. This article examines Vietnam’s emerging role in the global aluminum supply chain amidst these challenges, while also highlighting the opportunities and risks for foreign investors in the sector

Global Supply Chain Disruptions and Their Impact

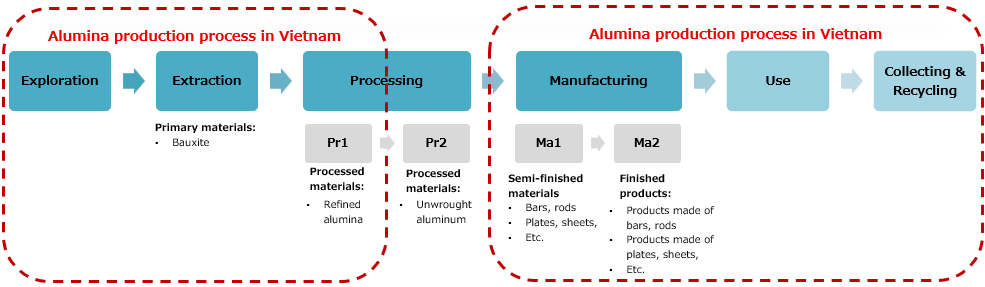

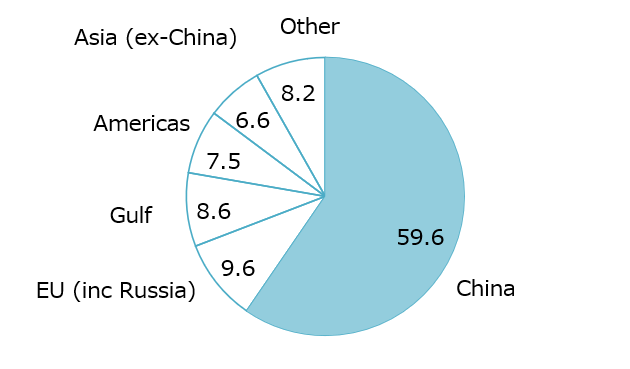

World’s primary aluminum production in July 2024

Unit: %, 100% = 6.194 million tonnes

Source: Al Circle1

Over the past decade, the global primary aluminum industry has experienced significant changes, particularly with China emerging as a dominant production hub. By mid-2024, China is estimated to account for nearly 60% of global smelting capacity, up from just under 15% in 20002.

However, China’s output is constrained by a government-imposed cap of 45 million tons per year, introduced in 2017 to address overcapacity and environmental concerns. In recent months of 2025, China’s aluminum production has been running at around 44 to 44.5 million tons annually, leaving little room for further growth3.

Combined with this quota, the supply situation has been exacerbated by the shutdown of numerous aluminum smelters in Europe, primarily due to skyrocketing energy costs, a consequence of the ongoing Russia-Ukraine conflict. Additionally, supply constraints have been worsened by Guinea, one of the world’s top bauxite suppliers, suspending its exports and nationalizing its mining operations4. While countries like India and Indonesia have increased production, their efforts have not been sufficient to close the growing supply gap.

As a result, the London Metal Exchange (LME) benchmark price for aluminum has risen by approximately 17% since April 2025, surpassing $2,700 per ton5.

Looking ahead, the aluminum market will likely continue to face price volatility, driven by geopolitical factors, regulatory changes, and environmental challenges. Market analysts predict that prices could continue to climb, potentially exceeding $3,000 per ton by 2026. Furthermore, the global shift towards sustainability and a growing emphasis on recycled aluminum are expected to transform the supply chain dynamics. The adoption of green technologies and the global push for carbon reduction will likely fuel demand for more sustainable aluminum products, particularly those made from recycled materials.

Vietnam’s Role in the Global Supply Chain and Market Size

The Vietnam Aluminum Market is positioned for steady growth in the coming years, even amidst global disruptions. It is projected to reach USD 4.53 billion by 2025 and is expected to grow to USD 7.30 billion by 2030, with a compound annual growth rate (CAGR) of over 10% from 2025 to 20306. This growth is primarily driven by strong demand for semi-finished aluminum products, which are widely used in industries such as construction, automotive, and electronics. The growth is further supported by Vietnam’s vast bauxite reserves, which are the third largest in the world, following Guinea and Australia, alongside the country’s continuous efforts to enhance its bauxite extraction and alumina production capacities.

Value chain of aluminum

Source: EC Raw Materials System Analysis7, Vietnam Aluminum Association8

Despite these promising projections, Vietnam’s ability to produce unwrought aluminum (raw aluminum) remains limited. While the government is making substantial investments in electricity infrastructure and advanced refinery technology, both crucial for boosting domestic raw aluminum production, the country still heavily relies on imports to meet its demand for downstream production and processing. This highlights a gap in Vietnam’s capacity to process raw materials domestically and underscores the need for further development in its aluminum production capabilities.

Foreign Investment and Opportunities in Vietnam’s Aluminum Market

Foreign contractors and foreign direct investment (FDI) have played and continue to play a pivotal role in Vietnam’s aluminum sector. In the upstream segment, Vietnam currently hosts two alumina refineries operated by Vinacomin: one in Tân Rai, Bảo Lộc, Lâm Đồng, and another in Nhân Cơ, Gia Nghĩa, Đắk Nông, with a combined design capacity of 1.3 million tons per year. Both facilities employ the Bayer process, supplied by the Chinese contractor Chalienco9. In the downstream segment, as of 2023, there are over 80 aluminum extrusion and fabrication plants serving both domestic and export markets. Approximately 35% of these downstream manufacturers are FDI companies9. These foreign investors contribute not only capital and technology but also global market access, helping to raise the overall competitiveness of Vietnam’s aluminum sector.

The entry of foreign investors into Vietnam’s aluminum industry is expected to accelerate further, driven by the ongoing global supply chain realignment. International corporations seeking alternatives to China are increasingly looking to Vietnam, which offers strategic advantages in both raw material availability and geopolitical location. This trend presents opportunities for Vietnam to attract additional FDI into both semi-finished and value-added aluminum production. Furthermore, the country is actively promoting the adoption of aluminum recycling technologies, which reduce reliance on imported raw materials, help stabilize production costs, and facilitate more accurate risk management and forecasting. Alongside this, the push toward green production and the integration of advanced technologies, including AI-driven automation and quality control systems, provides additional avenues for domestic and foreign companies to enhance operational efficiency and strengthen their global market position.

Despite these positive developments, Vietnamese aluminum manufacturers face several challenges. Many upstream and downstream facilities are operating below capacity, ranging from 40% to 70%, reflecting underutilization amid a global economy that has yet to fully recover. Trade defense measures and other protective policies from importing countries also pose risks to exports, limiting market access for Vietnamese aluminum products. In addition, the issue of “origin washing,” where some foreign producers exploit Vietnamese-origin labeling for their exports, undermines the credibility of Vietnam’s aluminum sector and introduces significant legal and reputational risks.

In response to these challenges, Vietnam is actively transforming its aluminum industry through modernization and technological upgrades. Investments in recycling, automation, and AI-based quality control aim to reduce dependency on imported raw materials, improve cost efficiency, and enhance resilience against market volatility. By embracing sustainable and technologically advanced production practices, both local and FDI aluminum manufacturers in Vietnam can strengthen their competitiveness and secure a more prominent position within the regional and global aluminum value chain10.

Conclusion

In conclusion, Vietnam’s aluminum industry stands at a pivotal moment, poised to expand its role in the global supply chain despite ongoing disruptions and market volatility. The country’s abundant bauxite reserves, growing domestic demand, and active efforts to enhance extraction and production capacities provide a strong foundation for future growth. Foreign investment has been and will continue to be a critical driver, bringing technology, capital, and access to international markets, while fostering competitiveness across the value chain. At the same time, challenges such as limited unwrought aluminum production, underutilized capacity, trade barriers, and risks related to origin labeling require careful management. By investing in sustainable practices, recycling, and advanced technologies—including automation and AI-based quality control—Vietnam can reduce reliance on imports, stabilize production, and position itself as a more resilient and competitive player in the regional and global aluminum market.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

1 https://www.alcircle.com/news/world-primary-aluminium-production-reaches-new-high-in-july24-registering-an-annual-growth-of-2-4-111756

2 https://www.cmgroup.net/industries/primary-aluminium/

3 https://safety4sea.com/intermodal-chinas-aluminium-powerhouse-is-approaching-a-hard-ceiling/

4 https://discoveryalert.com.au/news/guinea-bauxite-nationalization-impacts-aluminum-supply-2025/

5 https://www.aluminium-journal.com/what-does-2025-hold-for-aluminium-prices-and-the-market

6 https://www.mordorintelligence.com/industry-reports/vietnam-aluminium-market

7 https://www.researchgate.net (Material flow analysis of aluminum, copper, and iron in the EU-28)

8 https://wtocenter.vn/ (Aluminum overview and development strategies for the aluminum sector in Vietnam)

9 https://cvdvn.net/2024/08/11/cong-nghe-phan-nhom-4-ky/

10 https://theleader.vn/cong-thuc-moi-cho-dong-co-phat-trien-cua-nganh-nhom-d39495.html