18Jun2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

The transfer of Japanese educational technology to Vietnam offers a significant opportunity to address the growing demand for skilled human resources from Japanese enterprises operating in the country. This initiative is driven by several key factors: Japan’s substantial investment in Vietnam, the evolving nature of industries requiring higher technical skills, and Vietnam’s commitment to educational reform and digital transformation.

Overview situation of Japanese companies in Vietnam

Vietnam has emerged as a strategic destination for Japanese enterprises due to its favorable investment climate and robust economic growth

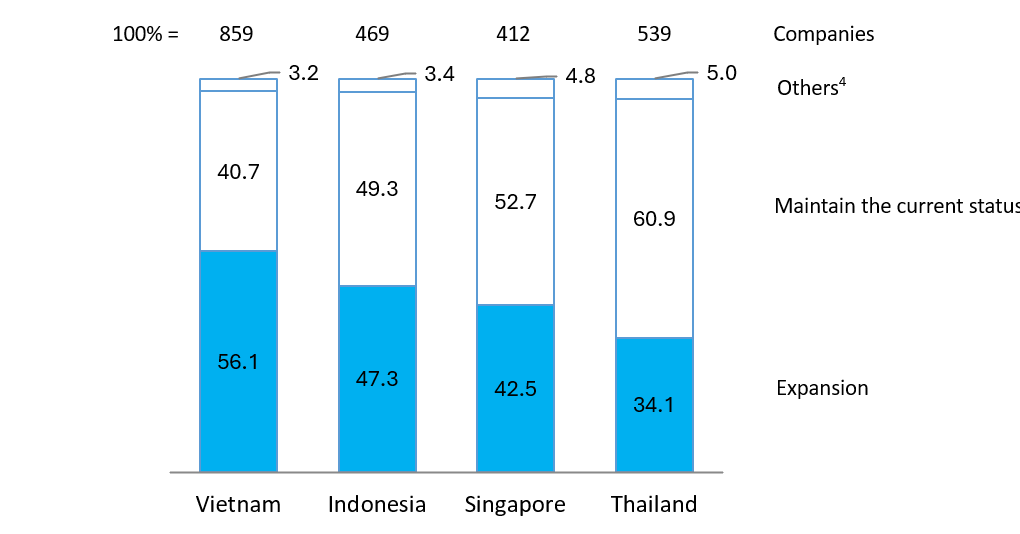

– High Investment Intent: Among the 149 countries and territories investing in Vietnam, Japan is currently the third-largest foreign investor, following South Korea and Singapore1. Besides, a survey in 2024 by the Japan External Trade Organization (JETRO) revealed that 56.1% of Japanese businesses operating abroad plan to expand their operations in Vietnam within the next 1-2 years, marking the highest rate among ASEAN countries, exceeding the regional average of 46.3%.2

– Profitability Prospects: This survey also indicated that 64.1% of companies expect to be profitable in 2024, the first time in five years this percentage has exceeded 60%.3

Direction of business development over the next 1-2 years (By major countries of ASEAN)

Unit: %

Source: Jetro

Key Investment Sectors

Japanese companies are diversifying their investments across various sectors:

– Manufacturing: According to Vietnam’s Ministry of Planning and Investment, manufacturing led Japanese FDI in 2023 with USD 23.5 billion, accounting for 64.2% of total FDI, up 39.9% year-on-year. 5

– Energy: Japan continues to be a key strategic partner for Vietnam across various sectors. In 2023 alone, newly registered FDI from Japan reached nearly 7 billion USD, making it the second-largest investor, after Singapore.6

– Real estate: In 2023, total FDI from Japan into Vietnam’s real estate sector reached nearly USD 6.57 billion, accounting for about 10% of Japan’s total FDI in this country.7

Skilled Human Resources’ demand

Japanese enterprises have a substantial and growing presence in Vietnam, with 3250 firms in 20238 across various sectors including manufacturing, construction, and finance. This significant investment has created a critical need for high-quality human resources. While Vietnam boasts an abundant labor force, there’s a recognized gap in the technical skills required by Japanese companies, particularly for high-value production and advanced technology sectors. As a result, Japanese firms in Vietnam face ongoing labor shortages, while Vietnamese workers struggle with intense job market competition. Japanese companies frequently seek skilled workers for managerial and technical roles, such as production, quality control, and machinery design. This demand for proficient labor is expected to increase further due to global value chain shifts and trade tensions.

Skills gap hinders Japanese companies in Vietnam from hiring quality workers

Source: skhcn.bacgiang.gov.vn

Skilled Human Resources supply

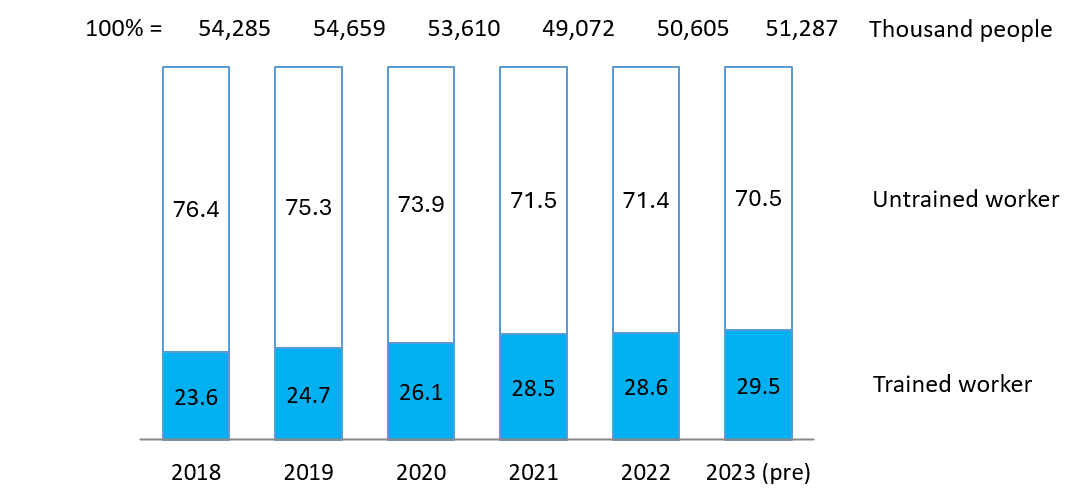

The rate of trained labor in Vietnam has shown a slight upward trend in recent years; however, the figure remains modest. According to preliminary data from the General Statistics Office (GSO), the rate of trained workers in 2023 reached 28.5%, an increase of 0.9% compared to 20229. Meanwhile, the underutilized labor rate in Vietnam in Q4 of 2024 stood at 3.8%, equivalent to about 2.0 million people10. This highlights the need for more effective training policies and programs to improve workforce quality and meet labor market demands amid economic integration and development.

The rate of trained workers in Vietnam

Unit: %

Source: GSO

Opportunities for Japanese Educational Technology Transfer

Japan possesses advanced educational technology and strong expertise in human resource development, which can be highly beneficial for Vietnam. Key aspects of Japanese educational technology and approaches that are being, or can be, transferred include:

– Vocational Training and Technical Skills: Japanese cooperation, particularly through organizations like JICA, has focused on strengthening vocational training institutes in Vietnam. This includes curriculum development, training of trainers, and providing equipment to meet Japanese standards. The “Kosen Model,” a poly-technique system emphasizing ability, mindset, and creativity, is also being introduced.11

– “Soft Skills” and Management Practices: Japanese business administration principles such as 5S (Sort, Set in order, Shine, Standardize, Sustain) and Kaizen (continuous improvement) are being transferred through business courses and hands-on training. These focus on enhancing not only technical expertise but also work ethics and organizational efficiency12

– Advanced Technology Education: Collaboration extends to cutting-edge fields like Artificial Intelligence (AI) and Information and Communication Technology (ICT). Vietnam-Japan University, for instance, has partnered with Japan’s National Institute of Information and Communications Technology (NICT) for research and technology exchange, aiming to train high-quality human resources in these areas.13

MOU Signing Ceremony between Vietnam Japan University and Japan’s National Institute of Information and Communications Technology (NICT)

Source: vju.ac.vn

– Project-Based Learning: Initiatives like “Project Design” education, as pioneered by Kanazawa Institute of Technology (KIT), are being implemented to cultivate innovation and problem-solving abilities through team-based approaches to real-world challenges14

Successful Collaborations Between Japanese and Vietnamese Educational Institutions

In the context of a shortage of high-quality human resources, the educational partnership between Japan and Vietnam plays a pivotal role in developing a skilled workforce that meets Japanese business standards. Some notable collaborations include:

| No | Collaboration cases | Started in | Details |

| 1 | Vietnam Japan University (VJU) | 2016 | A joint initiative between the Vietnamese and Japanese governments, VJU aims to become a leading institution in Asia.

· Collaborating Universities: VJU partners with several prestigious Japanese universities, including The University of Tokyo, Osaka University, Ritsumeikan University, Waseda University, and Yokohama National University15 · Programs Offered: VJU offers master’s programs in various fields such as Nanotechnology, Environmental Engineering, Public Policy, Climate Change and Development, and Global Leadership16 |

| 3 | Duy Tan University (DTU) Programs | 2017 | · DTU offers study-abroad programs in collaboration with Japanese universities with the 2+1+2 Program: Students spend 2 years at DTU, 1 year studying Japanese in Japan, and 2 years specializing in their major at a Japanese university17 |

| 4 | University of Economics Ho Chi Minh City (UEH) and AAEE | 2024 | · The Vietnam-Japan Exchange Program (VJEP), organized by UEH and the Asia Association of Education and Exchange (AAEE), provided students with academic and cultural exchange opportunities, focusing on Sustainable Development Goal #4: Quality Education18 |

| 2 | Hiroshima University and Vietnam National Innovation Center | April 2025 | · Hiroshima University and Vietnam’s NIC agreed to train semiconductor talent, with scholarships for Vietnamese students to join a program co-run with the University of Idaho, targeting young Asian professionals.

· This partnership supports Vietnam’s goal to train at least 50,000 semiconductor professionals by 2030, including 42,000 engineers, 7,500 master’s, and 500 PhDs19 |

VJEP 2024 Opening ceremony

Source: ueh.edu.vn

These collaborations not only enhance the quality of education in Vietnam but also ensure that the workforce is well-equipped to meet the standards of Japanese enterprises operating in the country

Challenges and Opportunities

There exist some challenges for Japanese investors in this sector:

– Infrastructure and Funding: While Vietnam is keen on EdTech growth, there’s a geographic disparity in access to digital education, with major cities being better served. Public schools often lack the necessary infrastructure, outdated hardware, and adequate tech facilities.20

– Policy Implementation: Although the Vietnamese government policies support EdTech and foreign investment, the lack of specific actions, consistent funding, and streamlined implementation measures can slow progress, especially in underserved regions.21

– Teacher Training: Ensuring that Vietnamese educators are equipped to deliver Japanese-standard curricula and utilize advanced educational technologies is crucial.22

However, overall, there are some opportunities for Japanese investors to develop in this field. Including:

– Government Support: The Vietnamese government is actively promoting foreign investment and collaboration in education, science, and technology. It is reflected in “Strategy to 2030 and vision to 204523” and “Decree 124/2024/ND-CP24” on encouraging international universities to establish campuses, facilitate joint programs, and prioritize frontier technologies.

– High Demand for EdTech: Vietnam’s EdTech market is booming. The EdTech market in Vietnam is forecast to grow at a CAGR of 13.5% from 2024 to 2032, thanks to the increase in the young population, high internet and smartphone penetration, as well as the willingness of families to invest in education. This is fertile ground for Japanese EdTech solutions.25

– Bilateral Relations: Vietnam and Japan’s strong ties, elevated to a “Comprehensive Strategic Partnership” in November 2023, expanding cooperation in areas such as science, technology, innovation, and development of high-quality human resources26. Additionally, Japan is a leading investor and ODA donor, demonstrating a commitment to Vietnam’s human resource development.27

The Governments of Vietnam and Japan held talks on upgrading relations to the level of “Comprehensive Strategic Partnership”

Source: baochinhphu.vn

Conclusion

The transfer of Japanese educational technology to Vietnam holds immense potential for training human resources to meet the specific needs of Japanese enterprises in the country. By leveraging Japan’s expertise in technical and vocational training, soft skills development, and advanced technology education, and with the strong support of the Vietnamese government, Vietnam can significantly upgrade its workforce capabilities. Addressing challenges related to infrastructure, policy implementation, and teacher training will be crucial for maximizing the effectiveness and reach of these educational technology transfers, ultimately fostering stronger economic ties and mutual development between the two nations.

1 https://tapchitaichinh.vn/doanh-nghiep-nhat-ban-danh-gia-cao-tiem-nang-dau-tu-tai-viet-nam.html

2 +3 https://www.jetro.go.jp/

4 Includes “Downsizing” and Withdrawal/Relocation to 3rd countries”. However, we do not show them in the chart due to the very small proportions

5 https://thesaigontimes.vn/dong-dau-tu-tu-xu-hoa-anh-dao-khoe-sac-tro-lai/

6+7 We have mentioned this issue in some previous articles of B&Company. Please refer here for more information

8 According to B&Company’s Database

9 https://www.nso.gov.vn/

10 https://www.gso.gov.vn/

11 https://www.jica.go.jp/Resource/vietnam/english/activities/activity04.html

12https://www.jica.go.jp/

13 https://vju.ac.vn/truong-dai-hoc-viet-nhat-ky-ket-hop-tac-nghien-cuu-va-trao-doi-cong-nghe-voi-vien-cong-nghe-thong-tin-va-truyen-thong-quoc-gia-nhat-ban/

14 https://www.hutech.edu.vn/english/training-news/14618817-vietnam-japan-institute-of-technology-discussed-joint-educational-programs-with-kanazawa-university

15 https://vju.ac.vn/en/collaboration/partner-university/

16 https://vju.ac.vn/en/study-at-vju/undergraduate-programs-2/

17 https://vjiet.duytan.edu.vn/du-hoc-nhat-ban/dh-duy-tan-dh-okayama-shoka-va-quy-ho-tro-du–qddqt

18 https://ueh.edu.vn/cuoc-song-ueh/tin-tuc/trao-doi-sinh-vien-giua-asia-association-of-education-and-exchange-aaee-va-dai-hoc-kinh-te-thanh-pho-ho-chi-minh-ueh-vietnam-japan-exchange-program-2024-72473

19 https://www.vietnam.vn/en/cap-hoc-bong-ban-dan-cho-sinh-vien-viet-nam-tai-nhat-ban-va-my

20 We have mentioned this issue in some previous articles of B&Company. Please refer here for more information

21 https://vm.ee/

22 https://vje.vn/index.php/journal/article/view/365/159

23 https://baochinhphu.vn/chien-luoc-phat-trien-giao-duc-den-nam-2030-tam-nhin-den-nam-2045-102250102165657226.htm

24 https://thuvienphapluat.vn/van-ban/Dau-tu/Nghi-dinh-124-2024-ND-CP-sua-doi-Nghi-dinh-86-2018-ND-CP-dau-tu-cua-nuoc-ngoai-linh-vuc-giao-duc-628112.aspx

25 https://asiafundmanagers.com/identifying-growth-opportunities-of-edtech-in-vietnam/

26 https://baochinhphu.vn/nang-cap-quan-he-viet-nam-nhat-ban-len-doi-tac-chien-luoc-toan-dien-vi-hoa-binh-va-thinh-vuong-tai-chau-a-va-tren-the-gioi-102231127202442552.htm

27 https://vir.com.vn/japanese-oda-is-massive-contribution-for-vietnam-116840.html

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |