20Dec2024

Industry Reviews / Latest News & Report

Comments: No Comments.

Vietnam’s total energy demand in 2023 has grown up by 9.2%, compared to 2022[1], driven by a robust average economic growth rate of 5%[2], with increased in industrial activity and urban development. As a result, coal and oil, now accounting for 47% and 25% of the country’s primary energy demand, continue to depend on fossil fuels to meet growing energy needs[3]. From 2017 to 2023, Vietnam’s greenhouse gas emissions rose by 46%, reaching 372 million tons of carbon dioxide, the highest recorded since 1900[4]. Therefore, at the 7th Central Committee Conference in 2019, the government underscored the urgent need to reduce greenhouse gases and transition to cleaner, safer energy sources, particularly by reducing coal and fossil fuel consumption and gradually shifting to LNG energy[5].

Overview of LNG energy market in Vietnam

In 2023, Vietnam officially entered the LNG market with the Thi Vai LNG Terminal, operated by PetroVietnam Gas, which received its first LNG cargo in July. As the country currently does not produce LNG domestically, Thi Vai serves as Vietnam’s first and only operational LNG import facility, helping ensure gas supply for existing customers and to-be-built power plants. Thi Vai Terminal has an annual capacity of 1 million tons per annum (MTPA) and is expected to supply the Nhon Trach 3 and 4 combined cycle power plants in 2025[6]. By 2024, LNG energy market is expected to increase even further, with the addition of the Cai Mep Terminal, has the capacity of 3 MTPA and will significantly expand Vietnam’s LNG import and processing capacity[7].

Vietnam is actively investing in expanding its LNG infrastructure, with the Power Development Plan VIII[8] (PDP8) setting a goal of approximately 22.4 gigawatts (GW) of LNG-fired power generation capacity by 2030. This would account for about 15% of the country’s total installed power capacity, positioning LNG as a critical component of the nation’s energy mix[9]. According to Wood Mackenzie, LNG demand is projected to increase by an average of 12% annually, potentially tripling by the mid-2030s[10]. Additionally, Vietnam is converting the Quang Trach thermal power station into an LNG plant[11], further promoting LNG as a foundational energy source in Vietnam’s transition.

While Vietnam initiated its first LNG imports in 2023 with the Thi Vai Terminal (1 MTPA) and plans to add the 3 MTPA Cai Mep Terminal, its capacity is still modest compared to Thailand’s 10 MTPA at Map Ta Phut and 7.5 MTPA at Nong Fab[12], as well as Singapore’s 11 MTPA SLNG Terminal[13]. This huge gap in production underscores Vietnam’s need to accelerate LNG infrastructure development to meet regional standards.

Foreign Investment and Development Projects in Vietnam’s LNG Market

As Vietnam strives to diversify its energy sources and reduce coal reliance, LNG has become a key focus for foreign corporations investing in Southeast Asia’s energy market. This influx of capital and collaborative projects highlights Vietnam as a high potential market in the LNG sector.

LNG Energy Projects in International Collaboration

| Project | Collaborator | Operation status | Partnership Type |

| Son My LNG Terminal

(LNG power plant) |

AES Corporation

(United States) |

Scheduled operation in 2027 | Collaborator with PetroVietnam Gas (PV Gas) |

| LNG terminal

(LNG power plant) |

JERA

(Japan) |

In planning | Foreign investment |

| Block B

(Gas Field) |

Mitsui & Co. Ltd

(Japan) |

Scheduled operation in 2026 | Collaborator with PVN, PVEP, PV Gas and PTTEP[14] |

Source: B&Company Complication

Additionally, Delta Offshore Energy (DEO), a Singapore-based company, has partnered with Electricity Power Trading Company (EPTC) under Vietnam Electricity (EVN) to organize international bidding for a long-term LNG supply. This process attracted more than 29 bids, highlighting growing foreign interest in Vietnam’s LNG market[15].

Vietnam’s LNG market presents a high-potential investment opportunity due to its growing energy demands adding with the Power Development Plan VIII (PDP8), has set ambitious targets for LNG market in Vietnam. Although the market is promising, competition remains relatively low compared to neighboring markets, presenting a unique advantage for early entrants who can secure a foothold before the market matures.

Government policies and supports

The Vietnamese government has taken active steps to support the development of LNG infrastructure, creating a fertile environment for both current and potential investors. With clear directives and ambitious energy plans, Vietnam is making LNG a central component of its long-term energy strategy.

Key Vietnamese Policies Promoting LNG Energy

| Decision | Issued date | Policy name | Terms on Promoting LNG Development |

| Resolution No. 55-NQ/TW | February 2020 | Orientation of Vietnam’s National Energy Development Strategy to 2030, vision to 2045 | · Focus on national energy development. Capable of importing liquefied natural gas (LNG) of about 8 billion cubic meters (m3) by 2030 and about 15 billion m3 by 2045

· Promoting the infrastructure development of the gas industry, prioritizing investment to serve the import and consumption of LNG |

| Decision No. 893/QĐ-TTg | July 2023 | National Energy Master Plan for the 2021-2030 period, and a vision toward 2050 | · Implementing the construction of LNG port warehouses and increasing LNG and CNG gas import

· Direct enterprises to intensify collaboration with domestic and international investors to develop LNG power plants and establish LNG import terminal infrastructure |

| Decision No. 500/QĐ-TTg | May 2023 | National Power Development Master Plan for the 2021-2030 period, and a vision toward 2050 | · Urgent development of LNG power plant projects; prioritizes maximum gas usage for electricity generation

· Develop LNG projects and establish LNG import infrastructure in line with appropriate scale · Expected by 2050, LNG capacity reached 25.4 GW, generating 138 billion kWh |

Source: B&Company Complication

Vietnam’s energy development plans are aligned with its commitment under the Paris Agreement in 2015, amend and supplement in 2020, where the Government have pledged to reduce greenhouse gas emission by 8% in 2030[16]. In addition, Vietnam’s Methane Emissions Reduction Action Plan targets a 30% reduction in methane emissions by 2030, compared to 2020 levels, by shifting away from coal and incorporating LNG as a cleaner alternative[17]. The Power Development Plan VIII (PDP8) and Decision No. 500/QĐ-TTg, emphasize extensive plans to construct LNG power plants and import terminals across Vietnam, with a focus on the northern and southern regions. These projects, projected to be completed by 2050, aim to position Vietnam as a regional leader in LNG energy.

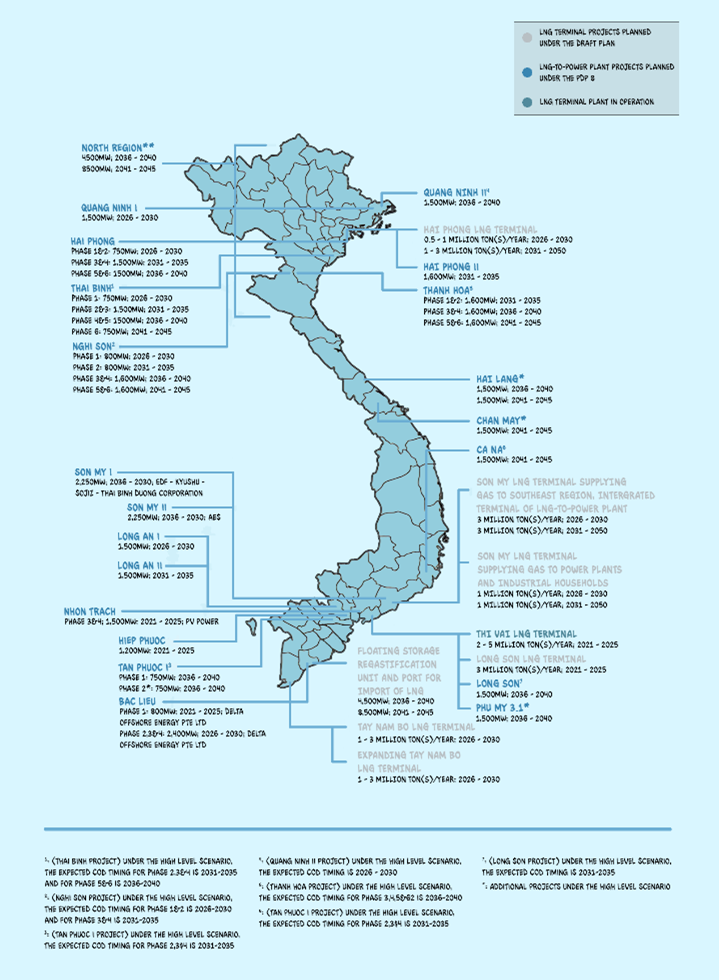

LNG Energy Development and Expansion Plan in Vietnam (2023–2050)

Source: Baker McKenzie Research

These government-backed policies and quantitative goals not only promote LNG development but also create a stable regulatory environment that attracts foreign investors to Vietnam’s rapidly growing LNG market.

Conclusion

Vietnam’s LNG market is at the forefront of the nation’s energy transition, driven by rising demand, robust government support, and strategic international investments. With initiatives like PDP8 and a focus on developing LNG infrastructure, Vietnam aims to balance its energy needs while reducing greenhouse gas emissions. The operational Thi Vai Terminal and future expansions underline the country’s commitment to cleaner energy. However, increased energy dependency on imported LNG could strain the balance of payments and foreign exchange reserves and profitability of LNG projects are more and more challenged by the development of other climate-friendly alternatives. Despite this, Vietnam’s growing LNG market offers significant potential for early investors seeking long-term opportunities in Southeast Asia’s energy landscape.

[1]Statista (2024). Vietnam Primary Energy Consumption <Assess>

[2]Statista (2024) Vietnam GDP Growth Rate from 2019 – 2029 <Assess>

[3] Statista (2023). Vietnam Energy Consumption by Type of Fuel <Assess>

[4]World Energy Institute (2023). Statistical Review of World Energy <Assess>

[5] Politburo of the Communist Party of Vietnam (2019). Strengthening Resource Management and Environmental Protection <Assess>

[6] The Investor (2024). Vietnam First LNG to Power Plant <Assess>

[7] The Reuters (2024). Vietnam’s Second LNG Terminal Begin Commissioning Tests <Assess>

[8] Prime Minister (2023). National Power Development Master Plan for the 2021-2030 period, with a vision toward 2050 <Assess>

[9] Vietnam Briefing (2024). Vietnam’s National Electricity Development Plan <Assess>

[10] Vietnam Economic Times (2024). Vietnam LNG Demand Expected to Increase by 3 times by 2030 <Assess>

[11] Vietnam Briefing (2023). Vietnam Power Development Plan 8 <Assess>

[12] The LNG Industry (2024). Room for LNG Growth in Asia <Assess>

[13] The Reuters (20214). Singapore and Japan LNG Deals <Assess>

[14] Vietnam Oil and Gas Group (“PVN”), PetroVietnam Exploration Production Corporation Limited (“PVEP”), PetroVietnam Gas Joint Stock Corporation (“PV Gas”), and PTT Exploration and Production Public Company Limited (“PTTEP”), a Thai national oil and gas company

[15] Vietnam Investment Review (2024) 4 billion USD in Investment for LNG Projects <Assess>

[16] The Socialist Republic of Vietnam (2020). National Determined Contribution Updated <Assess>

[17] The United State Department of Agriculture (2022) Vietnam National Strategy on Climate Change <Assess>

| B&Company, Inc.

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles

- All

- Agriculture

- AI

- Apparel

- Business

- Business Matching

- Energy

- Equipment & Appliances

- Exhibition

- Expand overseas

- Finance & Insurance

- Food & Beverage

- IT & Technology

- Lifestyle

- Retail & Distribution

- Seminar

- Tet