234 月2025

最新消息及报道 / 越南简报

评论: 没有评论.

概述

越南正在发展成为区域创新中心。凭借年轻的人口结构、快速增长的中产阶级以及亲商政策,越南为外国投资者提供了肥沃的土壤,尤其是在三个潜力巨大的行业:信息技术与人工智能 (AI)、可再生能源以及医疗保健。

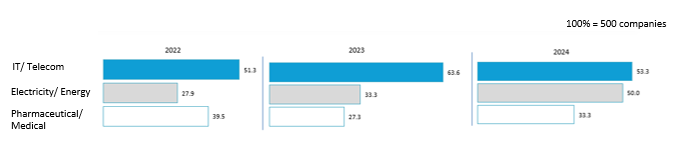

根据越南报告对高增长潜力行业的调查结果1 在2022年至2024年三年间500家FAST500企业的参与下,信息技术、制药与医疗保健、电力/能源成为持续获得最高且最稳定支持率的三大行业。

从FAST500 Business角度看最具潜力的行业

单位:%

来源: 越南报告

越南部分新兴产业介绍

- 信息技术与人工智能

碳当前形势

越南信息通信技术 (ICT) 行业正经历着指数级增长。据越南信息通信部的数据,预计到 2024 年,越南 ICT 行业的总收入将达到 4,244 万亿越南盾(相当于 1,659 亿美元),比 2023 年增长 13.21 万亿越南盾。在其子行业中,软件外包业务蓬勃发展,FPT、VNG、TMA Solutions 和 MoMo 等领先公司正在该地区拓展业务。

每年约有 5 万名 ICT 毕业生进入劳动力市场,但该行业仍面临高达 40 万名专业人才短缺,无法满足市场需求2.

越南年轻工人积极将人工智能应用于工作

来源: 越南信息和通信技术展览会

越南也是一个开放且具有前瞻性的市场,积极采用人工智能 (AI) 来提高生产力。越南工人能够快速采用科技,紧跟全球发展步伐。关键指标包括:

– 70% 在工作中使用了人工智能工具3.

– 54% 报告 AI 提升生产力和创意生成4.

– 90% 表示希望将尽可能多的工作委托给 AI,以减轻他们的工作量5.

发展展望

– 据信息通信部称,越南信息通信技术行业的目标是到 2025 年实现 1700 亿美元的收入,占全国 GDP 的 12% 以上。

– 2023 年人工智能市场价值约为 $5.471 亿美元,预计到 2032 年将达到 $20.6 亿美元,在此期间复合年增长率 (CAGR) 为 15.8%6.

– 受数字服务和智能技术日益增长的需求推动,越南有望成为区域人工智能创新中心。

值得注意的国内人工智能初创公司包括 ZaloAI、Trusting Social、VinAI、Utop 和 RADA,它们正在引领越南的创新竞赛。

政府激励措施

越南政府认识到信息通信技术和人工智能的巨大潜力,出台了多项重要政策以加速发展。第127/QD-TTg号决定——《国家人工智能战略(2021-2030)》包括:

– 为人工智能初创企业提供长达 4 年的免税期。

– 为国际研发合作提供配套补助。

– 公私合作发展人工智能大学和技术园区。

政府还将社会保障、医疗记录和教育平台等公共服务数字化,创造了巨大的 B2G(企业对政府)机会。

重点投资案例

Nvidia 与 FPT 在河内举行签约仪式

来源: 越南快运

– Hana Micron(韩国)计划到 2026 年投资约 9.3 亿美元扩大其在越南的芯片封装业务。

– 谷歌正在考虑在胡志明市附近建立一个大型数据中心,这是美国科技公司在越南的首次重大投资。7.

– FPT x NVIDIA:联合投资2亿美元打造越南首个“AI工厂”。

– 国内人工智能初创公司 VinAI 已融资 5000 万美元,将人工智能应用于零售、物流和安全领域。

- 可再生能源与绿色基础设施

当前形势

– 电力需求不断增长:受快速工业化和城市化推动,预计到 2025 年越南的电力需求将增加 12%-13%。

– 截至 2023 年底,可再生能源占越南总装机容量的 27%8太阳能和风能项目正在蓬勃发展;然而,基础设施的限制正在减缓它们的进展。

可再生能源和绿色基础设施: 越南未来发展的新方向

来源: hdll.vn

发展展望

越南政府正在投资国家电网的现代化和扩建,以满足日益增长的需求并有效整合可再生能源。

– 该国的目标是到 2030 年实现 30.4 吉瓦太阳能发电量和 6 吉瓦海上风电发电量9.

– 由于快速的城市化和工业增长,可再生能源需求不断上升。

政府政策

– 第80/2024/NĐ-CP号法令授权实施直接购电协议(DPPA),以支持能源多元化,减少对化石燃料的依赖,并加强能源安全。这体现了越南致力于打破电力行业垄断的努力。

– 上网电价 (FIT) 的修订,特别是通过促进对可再生能源行业的补贴,增强了长期投资者对风能、太阳能和生物质能项目的信心,这些项目在越南仍未得到充分开发

重点投资案例

– 2021年底,印度阿达尼集团在越南投资了两个可再生能源项目,包括由阿达尼福明风电有限公司运营的位于宁顺省顺南县福明乡的27.3兆瓦风电项目;以及同样位于宁顺省的50兆瓦太阳能发电项目。

– PNE AG(德国)早在2019年就提出了在越南投资$46亿越南盾的海上风电项目。经过六年的开发,该项目最近取得了一些积极进展

- 2025年3月5日,日本驻越南大使伊藤直树确认,日本国际合作银行(JBIC)和日本企业将共同在越南投资包括风力发电厂在内的14个项目,总资本额达200亿美元

- 医疗保健与医疗创新

当前形势

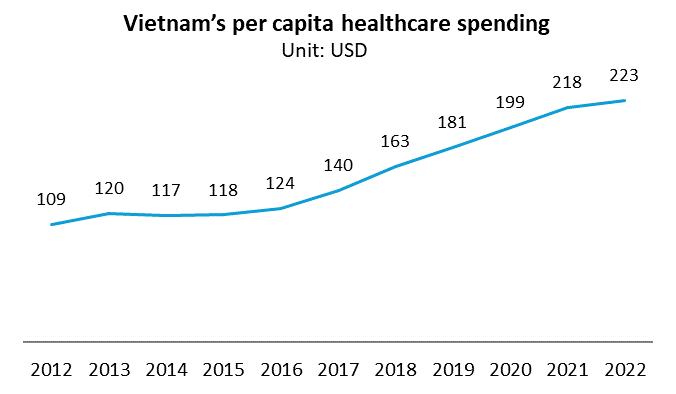

– 2017 年至 2022 年期间,越南的医疗保健总支出从 161 亿美元增至 220 亿美元。此外,越南的医疗保健支出占 GDP 的百分比从 2016 年的 4.52% 增至 2022 年的约 6.5%10.

– 卫生部统计数据显示,过去十年,越南人均医疗保健支出年均增长11%。人均年就诊次数从2010年的1.89次增加到2020年的2.95次。然而,这一数字仍然远低于该地区其他国家,例如泰国(3.5次/年)和中国(4.9次/年)。因此,未来几年医疗保健服务仍具有巨大的增长空间。

来源: 统计局

发展展望

– 2026年医疗器械市场规模将达到1421亿美元11.

– 2020年,卫生部启动了1000个远程医疗站点,连接30多家主要医院,支持复杂病例的会诊和治疗

政府政策

2024年《医疗检查和治疗法》简化了外商直接投资程序:

– 不要求外国投资者与公立医院合作。

– 100% 允许外资拥有诊所和医院。

– 减税、免除进口关税以及加快许可审批时间。

重点投资案例

– 汤姆森医疗以143.81亿塔卡收购了FV医院。

– 富士越南公司与公立医院合作推出了人工智能辅助诊断系统。

– 西门子健康、通用电气医疗和美敦力继续扩大业务范围。

结论:越南新兴产业已准备好迎接全球投资

越南不再是一个前沿市场,而是寻求亚洲可持续、高增长机会的外国投资者的战略中心。

从人工智能驱动的 IT 解决方案和尖端半导体到清洁能源和数字医疗保健,每个行业都提供了由强有力的政策框架支持的可扩展机会。

对于外国投资者来说,越南呈现出年轻活力、政策驱动进步和尚未开发的细分市场的罕见组合。

2 BC 综合网上文章

3 https://www.cisco.com/c/dam/m/en_us/solutions/ai/readiness-index/2024-m11/documents/cisco-ai-readiness-index-vn.pdf

4 https://vneconomy.vn/techconnect/con-duong-tro-thanh-quoc-gia-dan-dau-khu-vuc-ve-ai.htm

5 https://ictvietnam.vn/tac-dong-cua-ai-den-cach-lam-viec-tai-viet-nam-57322.html

6 https://vneconomy.vn/viet-nam-nguoc-chieu-con-khat-nhan-luc-cong-nghe-tai-dong-nama.htm

9 BC 综合网上文章

10 https://kirincapital.vn/wp-content/uploads/2023/03/Bao-cao-nganh-thang-02.2023-Nganh-cham-soc-suc-khoe.pdf

*如果您想引用本文中的任何信息,请注明来源以及原始文章的链接,以尊重版权。

| B&Company

自 2008 年以来,日本第一家专门从事越南市场研究的公司。我们提供广泛的服务,包括行业报告、行业访谈、消费者调查、商业配对。此外,我们最近还开发了一个包含越南 900,000 多家公司的数据库,可用于搜索合作伙伴和分析市场。 如果您有任何疑问,请随时与我们联系。 信息@b-company.jp + (84) 28 3910 3913 |