19Jun2025

Highlight content / Industry Reviews / Latest News & Report

Comments: No Comments.

Vietnam is known as one of the most TV-loving countries in Southeast Asia, and its viewing style is beginning to change dramatically. In the past, terrestrial TV programs were the norm, but in recent years, VOD (video on demand) centered on smart TVs has been on the rise. As the content supply structure becomes more globalized, we explore the possibilities and challenges of content originating from Japan.

Smart TVs play a key role in the rapid expansion of viewing time

According to a survey conducted by Kantar in four cities, Hanoi, Da Nang, Ho Chi Minh City, and Can Tho, the percentage of people who answered that they “watched video content such as TV, VOD, and live streaming the previous day” jumped from 71% in the first quarter of 2020 to 85% in the second quarter of 2021. The average viewing time also expanded from 82 minutes to 112 minutes.

Changes can also be seen in viewing devices. Smart TVs are the most popular at 66%, followed by smartphones (61%) and laptops (53%) [1]. This shows that while the traditional style of “watching TV with family in the living room” remains the same, viewing devices and program content are shifting to “smart TV + on-demand type.”

Largest in Southeast Asia in terms of GDP ratio, still has ample room for growth

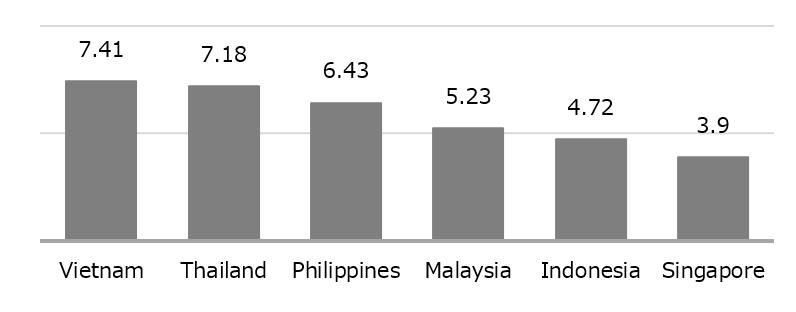

[Figure 1] VOD market size per GDP (1/100%, 2023)

(For comparison: Japan 15.4, US 25.4, UK 24.6)

Vietnam’s VOD market is expected to reach approximately USD 320 million in 2023, growing by approximately 60% to USD 490 million in 2028. What is noteworthy is not the absolute size of the market, but the fact that VOD spending as a percentage of GDP is the highest in Southeast Asia.

YouTube maintains a top position amid fierce competition between local and foreign companies

[Figure 2] Vietnam’s major VOD players

| Company name | Nationality | Year of entry into Vietnam | Sales Share (2022) |

| YouTube | US | 2005 | 37% |

| FPT Play | Vietnam | 2013 | 11% |

| Netflix | US | 2016 | 11% |

| VTVGo | Vietnam | 2015 | 11% |

| iQIYI | China | 2020 | 8% |

| POPS | Vietnam | 2008 | 6% |

| others | – | – | 16% |

|

(100%=272 million USD) |

|||

The VOD market is a battleground between global giants and local Vietnamese companies. In terms of market share in 2022, the US’s YouTube will lead the way with a 37% market share. Overseas players such as Netflix (11%) and China’s iQIYI (8%) also have a strong presence.

Meanwhile, local companies FPT Play (11 %), VTVGo (11 %), and POPS (6 %) also ranked highly, highlighting the mixed structure unique to the Vietnamese market. FPT is a private IT company, VTVGo is a national broadcasting station, and POPS is a local media company, so each has a diverse parent organization. For traditional TV stations, entering the VOD field is a strategic shift that will determine their survival.

Japanese content is niche, and anime is the breakthrough

So, what kind of content is viewed on VOD? While movies and dramas from the US and South Korea are extremely popular, Japanese video works, apart from anime, remain a niche presence. The reality is that the current viewing demographic is limited to so-called “Japan lovers.” However, there is a way out. Children’s anime is doing well, with “Doraemon” ranking highly in the box office at cinemas almost every year and established as a staple on VOD. In recent years, the broadcast of dramas and movies aimed at the public has been gradually increasing, and expectations are high for cross-genre development in the future.

Diversifying viewing environments: A test for Japan

Vietnam’s VOD market continues to expand, and it is a rare market where a strong TV viewing culture and digital transformation coexist. In the future, there is room to increase awareness and establish Japanese content through content translation and subtitling, optimization of recommendation algorithms, and other measures. South Korea has already achieved success in “cultural exports” through dramas, and if Japan is to achieve a similar goal, it is urgent to develop pillars other than anime. Success in a pro-Japanese country like Vietnam could become a touchstone for spreading the ripple effects throughout Asia.

[1] Source: Market Report IO ” Vietnam Streaming Report and Prediction 2020-2025: Viet Nam ” (March 2022)

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |