31Jul2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s F&B franchise market is growing rapidly while facing increased competition and consolidation. Success depends on digital adaptation and brand relevance, especially among Gen Z consumers. Franchising continues to polarize between global chains and compact, low-cost models, highlighting the need for innovation and operational excellence.

Vietnam’s F&B Market Grows Strong in 2023

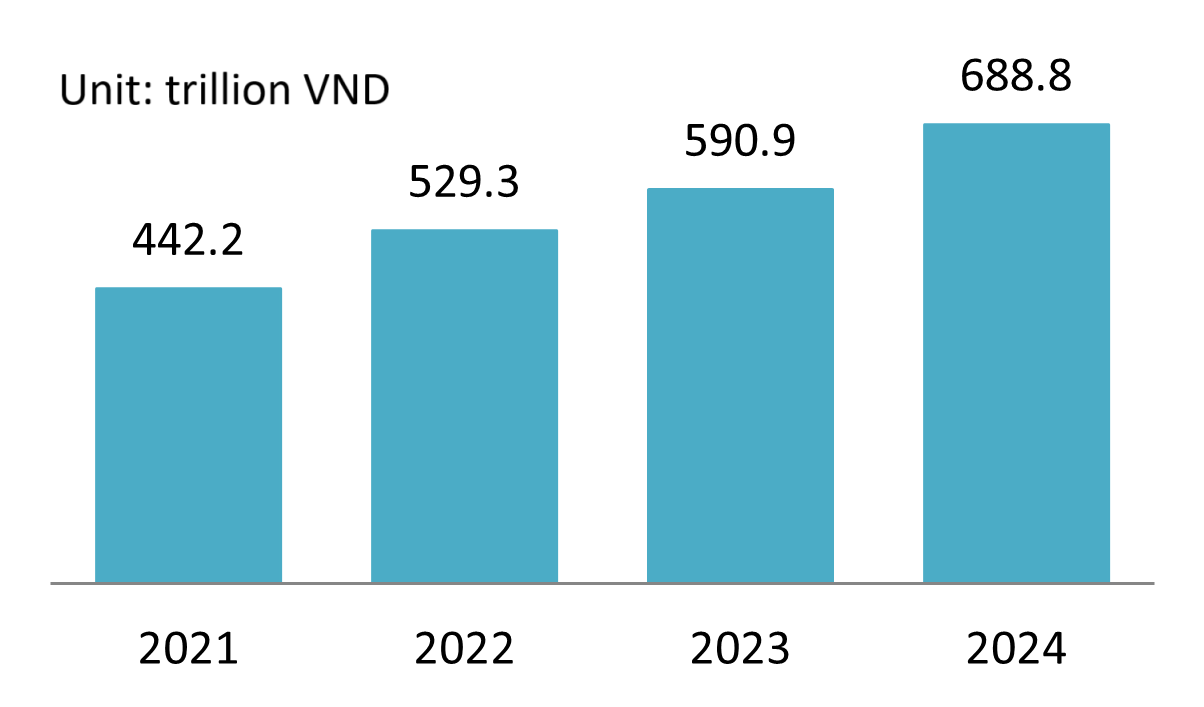

In 2024, Vietnam’s food and beverage (F&B) industry grew rapidly, surpassing VND 688.8 trillion in market size [1]. This strong momentum is driven by several structural advantages: a steadily expanding economy, rising disposable income, and shifting consumer behavior. As food and beverages remain a major household expense, a young, urban population increasingly seeks out modern dining experiences. Combined with the recovery of international tourism, these factors are fueling the rise of fast-casual dining, delivery-first models, and innovative beverage chains across the country.

Vietnam F&B Revenue 2021-2024

Source: iPOS

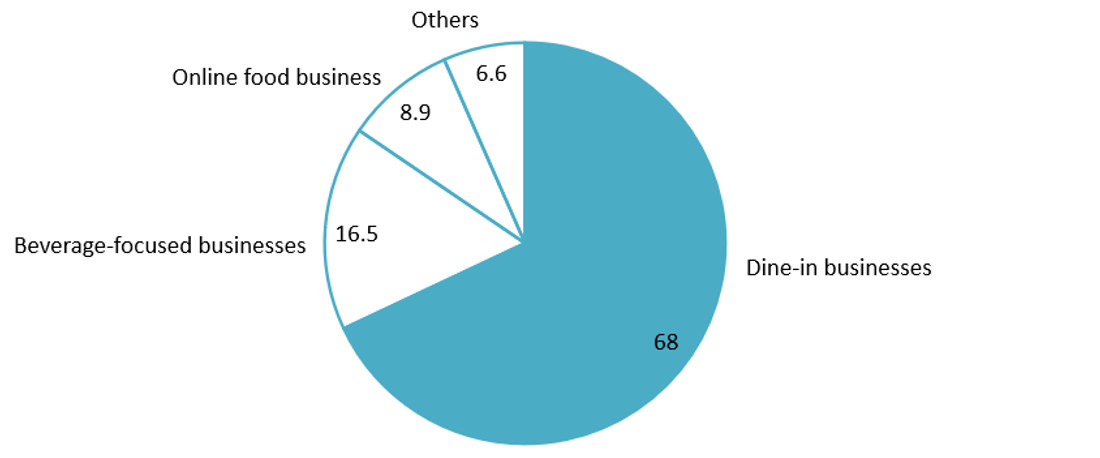

Although sales channels in Vietnam’s F&B industry are becoming increasingly diverse, dine-in experiences remain dominant, accounting for over 68% of total industry revenue. In contrast, emerging channels such as online food delivery and beverage-focused businesses contribute only around 8.9% and 16.5% respectively—highlighting that consumer behavior still favors physical space, in-person service, and on-site dining experiences [1].

Vietnam F&B revenue structure in 2023 (%)

100% = 590.9 trillion VND

Despite strong double-digit growth, Vietnam’s F&B market is undergoing intense consolidation, with 30,000 outlets closing in early 2024 alone [2]. This signals a maturing industry where competition is fierce and consumer expectations are rising. In this context, franchising is emerging as a smart growth strategy—offering proven systems for brands to scale and lower-risk entry points for investors.

Reflecting this strategic shift, Vietnam’s F&B franchise sector recorded a robust growth in 2024—outpacing the other franchising industry. The number of foreign franchise brands was led by the F&B sector, growing from 41 brands in 2014 to 178 brands in 2024 [3]. This upward momentum is driven by both established and emerging players. Market leaders like Highlands Coffee, Lotteria, Trung Nguyên Legend, and Cộng Cà Phê are accelerating their expansion through franchising, while niche brands such as Phở Thìn and Gong Cha are also scaling up—indicating growing investor interest and a more diversified franchise ecosystem.

However, rapid growth also brings structural risks. According to Nielsen IQ, only 30% of fast-growing franchises maintain stable performance, while 25% face downsizing or closure [4]. Common challenges include overcrowded urban markets like Hanoi and Ho Chi Minh City, inconsistent service quality—especially among smaller chains—and difficulty aligning staff with brand culture. These pressures signal the need for stronger operational systems and long-term franchise planning

Chains vs. Independents

While independent F&B stores dominate in terms of sheer numbers, they are growing more slowly and facing increasing competitive pressure. In contrast, franchise chains are steadily gaining market value share thanks to professional operations, strong branding, and scalable business models. The table below highlights the key differences between the two:

| Criteria | Independent Outlets | Franchise Chains |

| Core Traits | Street food, family-run, informal | Systemized, professional, prime locations |

| Pricing Power | Market-driven, limited | Stronger, brand-based |

| Operations | Manual, informal | Optimized, cost-efficient |

| Marketing | Local, low-budget | National scale, well-funded |

| Financial Resources | Limited, self-funded | Backed by corporates/investors |

| Scalability | Slow, inconsistent | Fast, standardized |

Vietnam’s F&B Franchise Landscape: Between Growth and Shakeout

Vietnam’s F&B franchise sector is expanding rapidly, but not evenly. While independent outlets still account for the majority in terms of numbers, franchise chains—both local and international—are gaining value share thanks to stronger branding, standardized operations, and better scalability. This shift marks a structural transition as the market matures and competitive pressures intensify.

Franchise activity now spans diverse formats—from fast food and pizza to milk tea, Vietnamese casual dining, and kiosk-style concepts. Global brands like McDonald’s, KFC, Pizza Hut, Gong Cha, and Mixue dominate standardized categories with brand equity and operational consistency. Meanwhile, hotpot and BBQ chains such as King BBQ, Dookki, and Thai Express are capitalizing on experiential dining to attract younger, urban consumers [5].

On the local side, Vietnamese brands are asserting themselves in culturally rooted segments. Highlands Coffee leads the coffee market with over 700 stores, while Trung Nguyên’s E-Coffee model enables wide reach. Groups like Golden Gate and Goldsun Food dominate Vietnamese cuisine and hotpot formats, while street food-inspired kiosks such as Bánh Mì Má Hải offer low-cost, scalable entry points for franchise investors [6].

These shifts are further shaped by four key trends:

– Saturation in coffee and tea, where storytelling and niche positioning drive differentiation.

– Health and wellness demand, pushing clean-label, organic, and low-calorie menus.

– Compact models, meeting urban demand with cost-effective kiosks and delivery-first setups.

– Digitalization, which has become a non-negotiable backbone for growth—covering POS, CRM, logistics, and brand communication.

As the market moves from rapid expansion to selective survival, success hinges on more than just brand appeal. Franchises that align strong operations, tech infrastructure, market fit, and agility will lead. Whether investing in a global powerhouse like KFC or a local favorite like Bánh Mì Má Hải, long-term success depends on strategic alignment, execution excellence, and adaptability.

Strategic Outlook: Choose Smart, Operate Smarter

Vietnam’s F&B market is shifting from easy growth to selective survival. Opportunities are still abundant, but so is the pressure to stand out. As consumption habits evolve and digital ecosystems mature, only franchises with robust operations, adaptive models, and clear differentiation will thrive.

Investors must look beyond brand popularity. They must evaluate operational systems, tech infrastructure, market positioning, and customer alignment. Whether it’s a global player like KFC or a local brand like Bánh Mì Má Hải, the formula for long-term success lies in readiness, relevance, and resilience.

Conclusion

Vietnam’s F&B franchise sector is entering a new phase of selective growth. While market potential remains strong, success now hinges on operational excellence, digital agility, and sharp brand positioning. The rise of both global giants and local innovators underscores a fast-maturing ecosystem—one where only the most adaptable models can thrive. For investors and operators alike, strategic clarity and execution will define who leads in this increasingly competitive landscape.

[1] iPOS and Nestle, F&B industry report 2024 <Access>

[2] Vietnam Investment Review, 30,000 F&B outlets shut down in first six months of 2024 <Access>

[3] B&Company, Franchising spreads in Vietnam’s food and beverage market, but Japanese presence remains limited <Access>

[4] The 2024 Franchise Boom with Bitter Lessons – Is There Still a Chance for Business Owners in 2025? <Access>

[5] FMS Asia, The Franchise Market in Vietnam: A Booming Industry in 2025 <Access>

[6] Vietnambiz, Comparing the potential of two culinary ‘kings’, Golden Gate and Goldsun Food <Access>

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |