17Feb2025

Industry Reviews / Latest News & Report

Comments: No Comments.

Overview of Vietnam’s paint and coating market

The paint and coating industry in Vietnam is a dynamic, domestically-driven market that serves a wide range of sectors, including construction, wood manufacturing, and industrial production. These products not only enhance aesthetics but also provide critical protective benefits, particularly in the steel and shipbuilding industries, where they safeguard materials against deterioration caused by environmental factors.

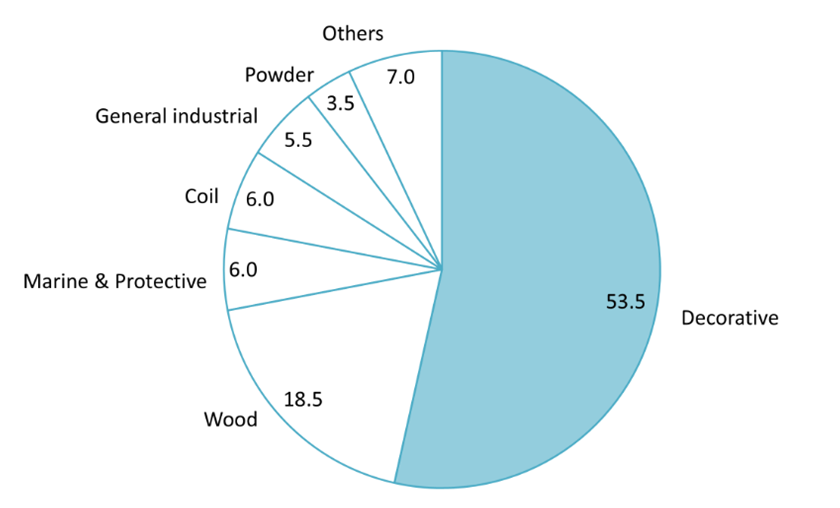

The Vietnam Paint and Ink Association (VPIA) reported that the industry’s production value was 1,559 million USD as of 2023, corresponding with a domestic output volume of 454 million liters. The decorative segment has led the market, accounting for 53.5% of the total domestic supply volume, followed by wood paints and coatings, which represented 20% of the market share in 2023[1].

Vietnam’s paint and coating production output by category in 2023 (Unit: %)

100%= 454 million litters

Source: Vietnam Paint and Ink Association (VPIA)

The majority of domestic production is consumed locally, and the export of paints and coatings only accounted for 6% of the supply value in 2023[2]. While the local manufacturing capacity has been able to meet the demand of general paints and coatings in the country, the Ministry of Industry and Trade (MoIT) noted that Vietnam is still required to import some high-tech products from neighboring countries[3].

However, the sector has faced significant setbacks in recent years, with 2023 marking its lowest performance and the second consecutive year of decline in two decades[4]. Output volume and value fell by 21% and 19%, respectively, from 2022 to 2023. Decorative products and wood paints saw year-over-year output declines of 23% and 29%, while powder coating production dropped by 25% over the same period.

The fluctuation of the paint and coating market in Vietnam can largely be attributed to trends and demands within its key customer industries, as the majority of its output supports domestic manufacturing sectors. For instance, Savills’ report highlighted a 10-year low in new residential housing supply in 2023[5] reflecting declining domestic demand for decorative paints. Similarly, the Vietnam Timber and Forest Product Association (VIFOREST) reported a 22.5% drop in wood product and furniture exports from 2022 to 2023[6], corresponding to the fluctuation in output demand for wood paints and coatings. Additionally, certain industrial manufacturing sectors experienced declines in their Index of Industrial Production (IIP) scores in 2023[7] compared to the previous year, further illustrating the market’s sensitivity to broader economic shifts.

Market Concentration and Competitive Landscape in Vietnam’s Paint and Coating Industry

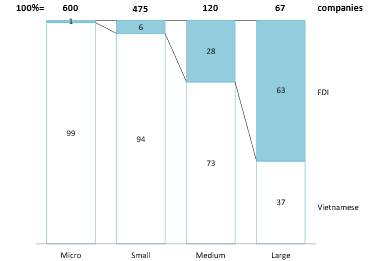

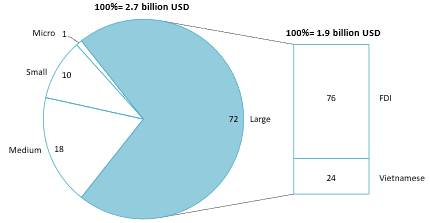

The domestic paint and coating market is concentrated among industry leaders and is characterized by fierce competition between Vietnamese and FDI companies. According to B&Company’s enterprise database, in 2022, the industry posted a total revenue of around 2.7 billion USD with over 1,200 companies. However, large foreign-invested companies contributed the majority of the total revenue of the industry with 55%[8]. Furthermore, 67 large companies made up 71% of the market’s revenue, highlighting the concentrated nature of the market.

Vietnam’s paint and coating industry by company type in 2022 (Unit: %)

Source: Vietnam’s Enterprise Database, B&Company’s synthesis

Vietnam’s paint and coating industry by revenue contribution in 2022 (Unit: %)

Source: Vietnam’s Enterprise Database, B&Company’s synthesis

FDI companies hold a dominant share of the market as only 107 companies account for over 60% of the market revenue[9]. These companies made up two-thirds of large operations domestically with industry leaders such as Akzo Nobel Vietnam Ltd., Jotun Vietnam Co., Ltd., 4 Orages Co., Ltd., and Nippon Paint (Vietnam) Co., Ltd.

Overseas brands have thrived locally by leveraging product quality to dominate multiple market segments. These companies lead the high-end industrial and protective coatings sectors, while their decorative products offer advanced features that local manufacturers cannot match[10]. Nippon Paint, a Japanese representative in the market, has succeeded with a broad portfolio across all segments. The company provides premium industrial, marine, and protective coatings, alongside durable architectural paints with added technologies like waterproofing, dust, crack, and heat resistance[11].

Nippon Paint (Vietnam) Co., Ltd.’s third manufacturing plant in Vinh Phuc, Vietnam

Source: Nippon Paint (Vietnam)

On the other hand, Vietnamese brands focus on affordability for the mid-range and lower market segments. Some have invested in advanced technologies to enhance product quality and compete with foreign brands. The Vietnamese brand Kova Paint has become one of the industry leaders by offering high-tech paints and coatings incorporated with technological advancements[12]. Overall, local manufacturers are able to maintain steady growth despite the market domination of overseas brands[13].

Opportunities for future growth of Vietnam’s Paint and Coating market

Despite fierce competition and recent market volatility, Vietnam’s paint and coating market remains promising with growth potential.

The customer industries of paints and coatings have shown signs of recovery recently. The government is working to address challenges in real estate and construction while boosting residential housing supply[14]. The industrial manufacturing sector has rebounded strongly in 2024, with the IIP increasing by 10% compared to the previous year[15]. Exports of wood products and furniture rose by over 20% in the first nine months of 2024[16], signaling a promising year for wood coatings. The paint and coating market is rapidly evolving and presents multiple growing potentials for both domestic and foreign companies and opportunities to expand their catalog to other market segments to fully capture the market growth.

The government recognizes the paint and coating industry’s importance and has implemented policies to foster growth. Decision No. 726/QD-TTg creates a favorable business environment by addressing market challenges and encouraging investment in high-value, sustainable paints[17]. The decision prioritizes high-tech production while promoting the domestic supply of input materials to reduce the reliance on imports. These policies create growth potential for both domestic producers and foreign companies who aim to invest in local manufacturing.

Rising concerns about environmental and health issues are driving future growth in the industry. Demand for Low-Volatile Organic Compound (VOC) solvent-borne and water-borne paints is increasing due to the harmful effects of VOCs like formaldehyde on consumer health.[18]. Similarly, powder coatings and water-borne paints are alternatives for solvent-borne products in the industrial sector to reduce their environmental impacts. Industry leaders, such as Nippon Paint (Vietnam), have actively invested in expanding their production capability for these alternatives, signifying an industry-wide shift in demand.

Conclusion

In conclusion, the paint and coating market in Vietnam is at its turning point. Despite fierce competition and challenges in the sector, recent recovery signals present opportunities for growth. Vietnam has been focused on creating a favorable landscape and supporting the domestic market by addressing current market gaps and leveraging government support. By active investment and renovation, expansion in product offerings, and shifting toward sustainability, companies can benefit from the recovery of the market and see economic results.

[1] Construction News (2024). Vietnam Paints and Printing Ink Association’s 2024 Annual Conference <Assess>

[2] In 2023, Vietnam’s domestic supply of paints and coatings was valued at 1,559 million USD, while exported value was 99 million USD (Souce: ITC Trademap).

[3] VIB Online (2021). Strategic Development Report for Vietnam’s Chemical Industry Until 2030, Vision to 2040 from the MoIT <Assess>

[4] Construction News (2024). Vietnam Paints and Printing Ink Association’s 2024 Annual Conference <Assess>

[5] Savills (2024). Vietnam Real Estates Market Report Q4/2023 <Assess>

[6] VIFOREST (2024). Export and Import Trends of Vietnam’s Timber Industry in 2023 and Projections for 2024 <Assess>

[7] GSO (2023). Vietnam’s Index of Industrial Production in December 2023 <Assess>

[8] According to Vietnam’s Enterprise Database, large FDI companies posted a total revenue of 1.46 6 billion USD, which was around 54.6% of the industry’s total revenue in 2022.

[9] According to Vietnam’s Enterprise Database, FDI companies recorded a total revenue of 1.6 billion USD, which was around 61.2% of the industry’s total revenue in 2022.

[10] Vietnam Economic News (2024). Forecast of Strong Growth in the Paint Industry Market <Assess>

[11] Nippon Paint Vietnam (2022). Capability Profile <Assess>

[12] Kova Paint. Nano technology from rice husk <Assess>

[13] Vietnam Economic News (2024). Forecast of Strong Growth in the Paint Industry Market <Assess>

[14] MOC (2023). 2023 Summary Report <Assess>

[15] GSO (2024). Vietnam’s Index of industrial production in November, 2024 <Assess>

[16] Numbers & Events Magazine – GSO (2024). Wood Export Targeting 14.2 Billion USD Goal <Assess>

[17] TVPL (2022). Decision 726/QĐ-TTg 2022 approving Vietnam’s Chemical Industry development strategy by 2030 with a vision towards 2040 <Assess>

[18] Journal of Construction (2022). Controlling VOC emissions from construction material products in Vietnam <Assess>

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |